In July 2015, Ukraine joined the European Commission’s (EC) initiative, which creates a prospect of integration for the Ukrainian Gas Transportation System (GTS) to the unified European regional network. The European Union moves are obvious – to intensify energy security, and diversify blue flame gas sources and routes of supply. Will Ukraine use this advantage and become part of the European regional network?

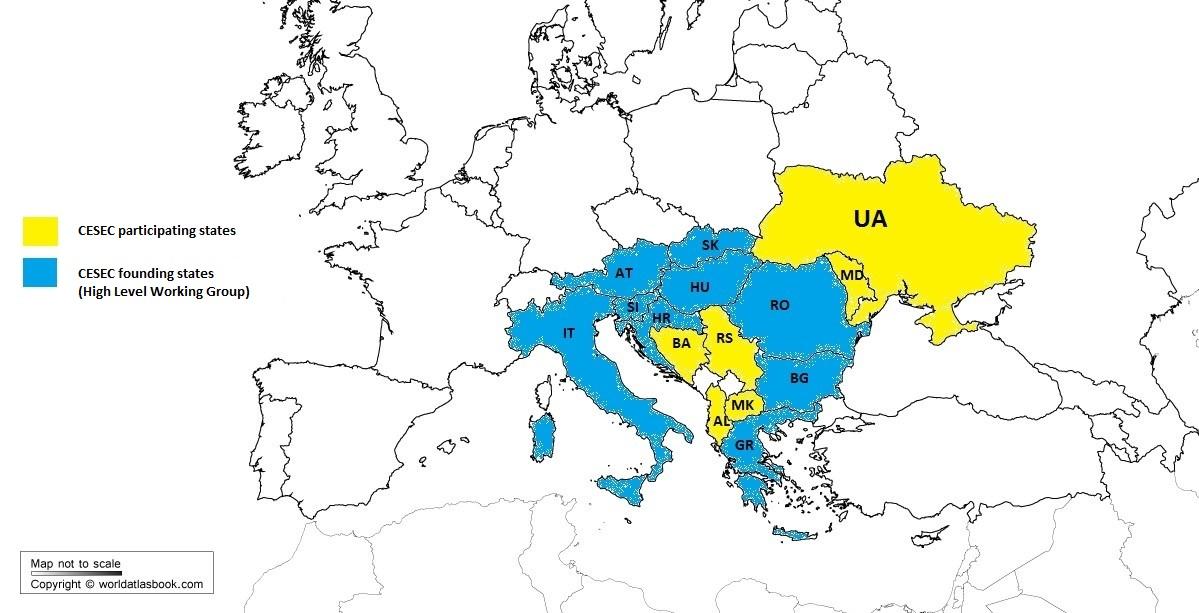

In February 2015, the EC launched the Central and South Eastern Europe Gas Connectivity Initiative (CESEC). Austria, Bulgaria, Croatia, Greece, Hungary, Italy, Romania, Slovakia and Slovenia and the EU set up a High Level Working Group (Working group).

During the Working group II meeting (July 10, 2015) CESEC was joined by the six Energy Community Contracting Parties: Ukraine, Republic of Moldova, Serbia, FYROM, Albania and Bosnia and Herzegovina, having signed a Memorandum of Understanding. The Memorandum signatories expressed their readiness to sustain the necessary political commitment to oversee the full and timely implementation of the CESEC Action Plan, which includes the following elements:

- Selection of a limited number of key projects benefitting the CESEC region.

- Identifying and addressing project-specific challenges.

- Financing aspects, including the role of the European Investment Bank and the European Bank for Reconstruction and Development.

- Addressing market integration challenges.

The Energy Community Secretariat (EC Secretariat) was invited together with the Agency for the Cooperation of Energy Regulators (ACER) and the EC to closely monitor the implementation of the Action Plan. The Secretariat supports the Contracting Parties in their implementation of the Action Plan.

During the regular Working group meeting in Budapest (8-9 September, 2016), the CESEC Action Plan was upgraded to the CESEC Action Plan 2.0. It includes an updated list of specific actions for EU Member States and Energy Community Contracting Parties and outlines further regional work to improve the functioning of gas markets by improving trading arrangements, enabling market entry and – where appropriate – optimizing cross-border transmission tariffs.

Yet, in February 7, 2017, EC Secretariat has published the Fifth Monitoring Report (Report) incorporates a new list of concrete actions, based on the revised CESEC Action Plan indicating the progress made by the Energy Community Contracting Parties participating in CESEC.

The evaluation was followed by 4 key benchmarks:

- Ensuring transparent and non-discriminatory third party access (TPA) (this standard is applicable in the EU, in the Energy Community Contracting Parties – on the stage of legislative drafting/implementation):

- Establish capacity allocation mechanisms and congestion management rules allowing TPA in forward and reverse flow.

As it is mentioned in the Report, all these provisions are indicated in the Ukrainian Gas Transmission System Code (GTS Code), adopted in November, 2015. However, full implementation of the Code has yet to be exercised for all internal entry and exit points.

- Establish market- based balancing mechanisms.

Different balancing regimes – on a daily basis for interconnection points and on a monthly basis for all internal entry and exit points may distort the market. Disproportional financial guaranties required for balancing services may constitute a barrier for market participants. The National Regulatority Authority (NEURC) has to develop new amendments to the GTS Code to change those financial guaranties. UkrTransGas, UTG (Ukrainian Transmission System Operator, TSO) contracted consultancy support to develop and implement daily balancing regimes.

“According to Chapter VIII of the GTS Code network users shall provide at least the financial equivalent to 20% of their monthly supplies (VIII.3) and at least the monthly cost of natural gas transportation services (VIII.2) as a financial guarantee. While this is a barrier on the entrance of small new market players, it might be sensible given that currently imbalances are only settled on a monthly basis and also in order to prevent traders from entering that only intend to game the system”.

Respectively, it leads to a captive market.

- Develop transparent and non-discriminatory tariff rules that do not distort trade across borders.

The entry-exit transmission tariff methodology was adopted in November 2015 and implemented beginning in January 2016 for cross-border points, while tariffs for internal entry and exit points have been calculated according to the old (volume based) methodology.

Status of implementation – “no progress”, means that the majority of actions are achieved, but there is a lack of implementation.

- Ensuring free flow of gas and provision of a competitive framework:

- Optimize actual capacity use in both directions, including backhaul (virtual reverse).

Ukraine maintains a dialogue on reversibility with Poland, Slovakia, Hungary and Romania. Bidirectional flow has been established at certain interconnection points. Final agreements for all interconnection points depend also on the progress achieved by the relevant EU Member States, which is still pending.

Status – “progress on track”.

- Ensure publication of transparency requirements of Regulation (EC) 715/2009 on ENTSOG transparency platform.

Ukrtransgaz publishes regularly capacity related information at ENTSOG (European Network of Transmission System Operators for Gas) transparency platform for all cross-border points and data on storages at Gas Infrastructure Europe.

Status – “accomplished”.

- Infrastructure related measures:

- Adopt interconnection agreements.

The transmission system operator Ukrtransgaz has concluded interconnection agreements with the Polish and Slovakian operators for pipelines where physical reverse flows take place and with the Hungarian operator for all interconnection points. An interconnection agreement was signed also with Romania on one interconnection point out of four. Discussions to conclude interconnection agreements for all interconnection points continue with Slovakia, Poland, Romania and Moldova. The CESEC Action Plan 2.0 set a deadline of 1 January 2018 for finalizing interconnection agreements.

Status – “progress on track”.

- Provide a cross-border cost allocation mechanism in line with Regulation (EU) 347/2013

Implementation of Regulation (EU) 347/2013 was expected by January 2017. The deadline has not been met, and there is no information whether any preparatory activities in Ukraine have started.

Status – “no progress”.

- Ensure there is a harmonised framework of operation of interconnected systems of EU Member States and Energy Community Contracting Parties.

The implementation of Regulation (EU) 703/2015 on Interoperability and Data Exchange Rules was discussed and agreed upon by transmission system operators and regulatory authorities of the Energy Community Contracting Parties and neighboring EU Member States in 2016. Further steps towards its implementation depend on the relevant PHLG Procedural Act (procedural regulatory act of the Energy Community Permanent High Level Group), expected in 2017.

Status – “pending”.

- TSO unbundling:

- Unbundle and certify the transmission system operator in line with the Third Energy Package.

In July 2016, the Cabinet of Ministers of Ukraine approved a Plan for Restructuring of National Joint Stock Company Naftogaz of Ukraine, which has been amended in November 2016 when a new transmission system operator, Main Pipelines of Ukraine (MGU), was established. The detailed Action Plan defines further activities and a working group chaired by the Vice Prime Minister has been tasked to streamline its execution.

The regulatory authority adopted certification rules in April 2016.

Status – “progress on track”.

As it is summarized in the Report, within the 4 benchmarks, Ukraine has fulfilled 2 of them. That is a positive development. Such observations are helpful indeed as external monitoring always serves as a stimulus to action.

There are enough professionals, experts and managers in Ukraine to intensify integrity and transparency in the Ukrainian GTS and the energy market as a whole. The primary issue is that there are too many barriers that isolate current reformers from new and fresh “energies”.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations