Ukraine did not have an independent central bank in its first 23 years. The National Bank of Ukraine was an active player in the process of Ukrainian hyperinflation in the beginning of the 1990s, which greatly exceeded that of other Eastern European countries. Even up until 2015, the National Bank was helping the Cabinet of the Ministers hide the real budget deficit, which became one of the reasons for complete imbalances in government budgets and the resulting devaluation of the hryvna (uah).

The material is a part of the special project “Bad decisions: how to build the poorest country in Europe”

On the 20th of March, 1991, the Parliament of the Ukrainian SSR accepted the law on banks and banking activity, which defined the rules of the banking system for the next 8 years – including after independence. This law is important because it particularly defines the role of the central bank [the future National bank of Ukraine].

According to research, the more independent a central bank is (i.e. ability of management to make politically independent decisions), the more effective it can be in fighting inflation. This is why there is a correlation between independent central banks and future GDP increases. In Ukraine, the independence of the National Bank of Ukraine, which became the legal successor of USSR central bank, was never even a consideration.

Everything was completely controversial according to the new Law. In Article 14 of the new law, it was determined that, “The National Bank, through the banking system, organizes and fulfils cash execution of the state budget of the republic. On the decision of the Parliament of Ukrainian SSR, the National Bank may provide the credit for the Ministry of Finances of Ukrainian SSR on general conditions”.

Thus, this law subjected the central bank of Ukraine to the Ministry of Finances and the Parliament. That subjugation in particular became one of the main causes of hyperinflation in the beginning of the 1990s. This hyperinflation had a destructive influence not only on the economy of the young country, but also on the well being of its citizens and the psychological security of many Ukrainians.

What exactly happened?

At the time of the separation of the Soviet Union, an economic crisis was rapidly developing, leaving tens of thousands of governmental enterprises with no governmental orders and broken delivery chains. Producing and selling goods during this time became very problematic. Incomes decreased enormously and there was no money to pay for raw materials, salaries for employees and taxes for the government. In the ensuing chaos, there were large scale payment and budget crises within the country.

Leonid Kravchuk, the first President of Ukraine, alongside the first Parliament of an independent Ukraine were trying to solve the problem, taking the sources from governmental budget and the National Bank of Ukraine. Their first move was to get the Ministry of Finances to provide subsidies from the government’s budget to government enterprises (mostly from agrarian and energy (gas and coal) sectors). In 1992, the volume of subsidies reached 8.1% of GDP. By the following year in 1993, it was at 10.8% of GDP – writes Anders Aslund, the famous American explorer of post-soviet transformation, in his book “Ukraine: what went wrong and how to fix it”.

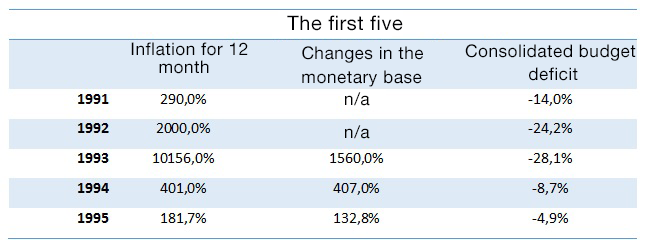

A blistering increase in the budget deficit was a direct consequence of the President and Parliaments politically motivated intervention in the markets. In 1991, the budget deficit was equal to 14% of GDP. And although the forecast for the following year, 1992, was set at no more than 2%, it increased enormously to 29%. The National Bank was obliged to cover the deficit.

Secondly, the National Bank had to provide credits with very low interest rates to the different sectors of the economy.

In 1992 net gross credits provided to the enterprises were worth no less than 65% of GDP, while in 1993, it dropped to 47%, writes A. Uslund. For example, during the summer of 1993, The President Leonid Kravchuk signed an order to provide unlimited lines of credit for agricultural enterprises. Even though hyperinflation already existed in Ukraine, the interest rates for these credits were equal to only 30%.

Printing money was also occurring because of the regular increases in minimum salary rates at the time. Those salary increases were designed to protect Ukrainian citizens from the collapsing economy. However the Parliament, by its own decision and contradictory to active protests by the Cabinet of Ministers, had been regularly increasing the social standards without taking into account the inability of the government budget to meet the increases.

For example, in October 1994, the Parliament of Ukraine decided to increase the minimum salary rate. However, with hyperinflation and a drastic budget deficit causing harm to the economy already, both the President and the Cabinet of Ministers were against it. “Increasing of the minimum salary rate in Ukraine, which is currently being discussed at the session of the Parliament, can “blow up” the situation in the country” – Leonid Kuchma, the President of Ukraine. Quote taken from “Zerkalo Nedeli” newspaper.. “After each increase of the minimum salary level during the past several months, the real salary level continues to decrease. We have seen this several times already just this year”, Victor Pinzenyk, First Vice-Premier-Minister explained, and added fuel to the flame of the developing hyperinflation and permanent devaluation of coupon-karbovanets. In November 1990, with the collapse of the Soviet planned economy, the Ukrainian SSR introduced one-time coupons (karbovanets), which were distributed to Ukrainian residents. The coupons were needed in addition to Soviet rubles in order to buy groceries and living essentials.

“Up to 5 trillion Karbovanets were added to the monetary market in Ukraine. This is the result of emission, which has been provided during the II and III quarters of the year and is going to be conducted in the IV as well according to the decision of the Parliament”.

Neighbourhood inflation

Was the situation in Ukraine unique? The method of additional money printing to cover deficit was used by almost all of the countries of former USSR. But the problematic difference of Ukraine is the scale of the deficit, and the resulting monetary emission which caused hyperinflation. “During the first year after the removal of controls on prices, the prices increased up to 7 times in Poland, up to 26 times in Russia and more than 100 times in Ukraine” – states an IMF report dedicated to post-soviet countries. Hyperinflation in Ukraine reached 2,730% in 1992 and 10,155% in 1993.

Accordingly hyperinflation was the main reason of industry collapse, it destroyed economic life and demoralized society, Uslund writes.

The countries which built independent central banks were able to come back to economic stability faster. For example, Poland passed a law in 1989 creating an independent central bank whose main task was “strengthening the Polish currency”. In Czechoslovakia, a similar step was taken in 1990. “Countries like Bulgaria, Romania, Russia and Ukraine, which were not able to create independent central banks, had to go through a second round of stabilization” IMF report says.

Path to freedom

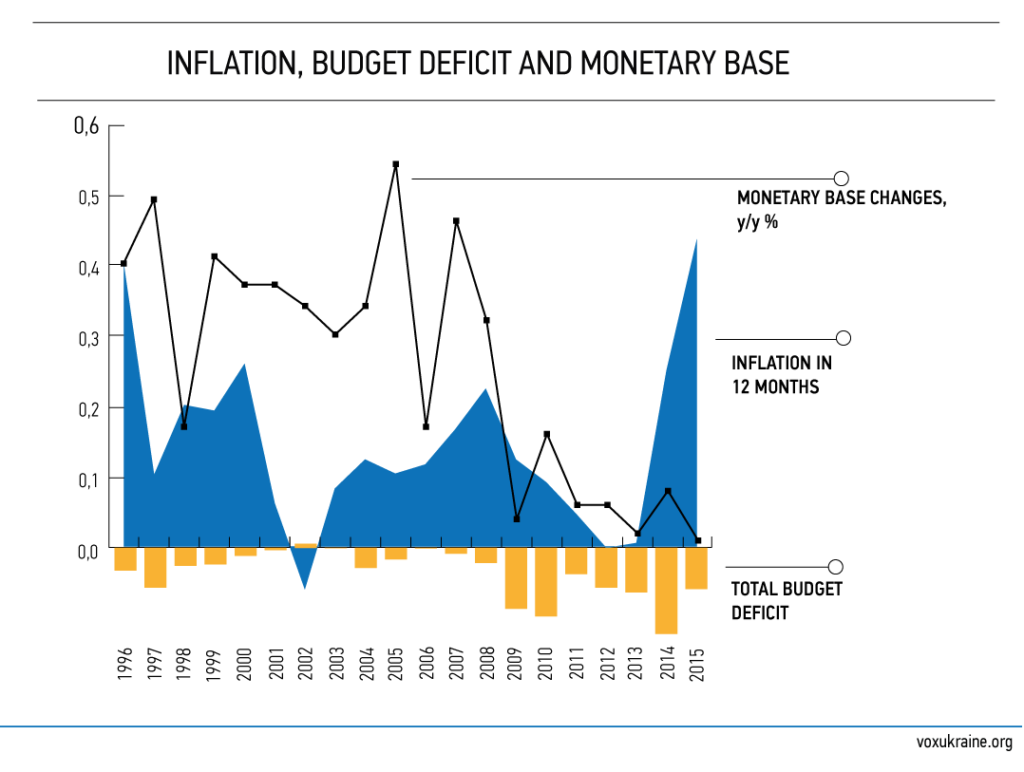

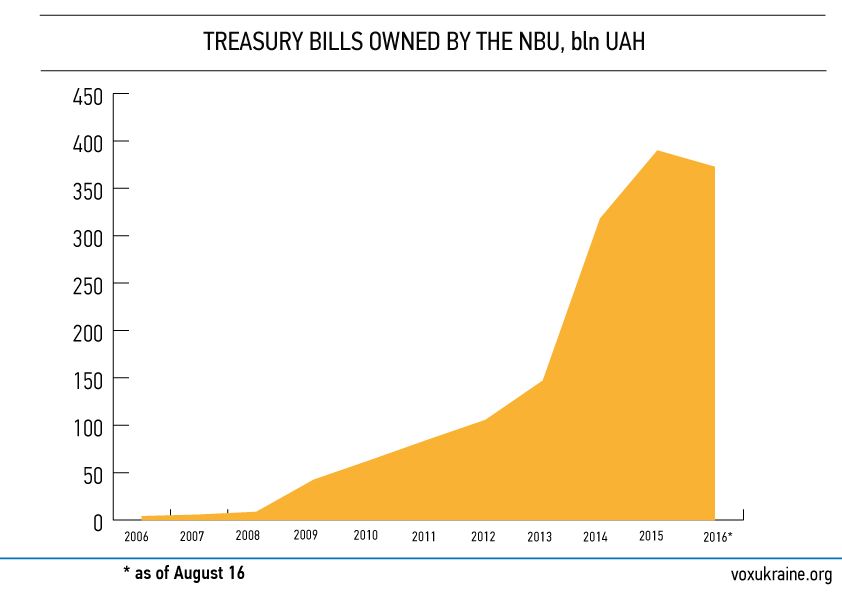

The path to independence for Ukraine’s central bank was long. The efforts to fix the situation and strengthen the independence of the National Bank started as far back as the 1990s. For example, In Memorandum on economic politics in 1995 (in partnership with the IMF) it is mentioned that the government gave parliament a draft of the law on the central bank, which proposed increases in the autonomy of the regulator. But it took 4 years to see any progress before the law “On National Bank of Ukraine” was finally passed in 1999. However, the law didn’t become a panacea from political interference into the work of the National Bank of Ukraine. In reality, from the time of the financial crisis in 2008-2009, and during the entire period of President Yanukovich’s governance from 2010-2013 up to the first year of the Revolution of Honour, the National Bank of Ukraine was being led by the cabinet of Ministers It was even covering part of the government’s budget deficit via monetary emission (buying state obligations). Statistics speak volumes and from 2008 until 2014, the volume of domestic government loans in the National Bank’s portfolio increased up to 60 times (from 5,6 mlrd UAH till 318,1 mlrd UAH).

In 2015, after Parliament accepted changes to the law on the National Bank, the decreasing volume of monetary emissions became one of the key reasons for macroeconomic stabilization in Ukraine.

With participation of: Lubomyr Humaniv, Anna Gusak.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations