Financial data is no longer the banks’ exclusive domain. In the age of open banking, you decide who gets access to your information — and that changes everything.

Imagine you want to take out a loan or start managing your spending more effectively. Instead of collecting paperwork yourself, you simply open an app and grant it access to your bank account history. With your permission, a potential lender can instantly view your regular income and expenses to assess your creditworthiness. Or a financial app might analyze your transactions and offer personalized advice — pointing out where you’re overspending, how you could save more, and what to watch out for. All of this happens with just a few taps, no paperwork, no trips to the bank.

This is the new financial reality already operating in dozens of countries — and starting August 1, 2025, it will launch in Ukraine. It is called open banking: a concept that gives bank customers the right to independently share their financial data with those they trust — other banks, fintech companies, or personal finance services. Using secure digital interfaces known as APIs, a customer can, with a single click, allow a third-party service — like a fintech startup — to analyze their financial behavior and offer tailored services, from saving advice to loans on better terms. The result is a more transparent financial market.

Until recently, banking data was closed. It belonged to the bank where the customer held their account. The bank had a monopoly on information about the customer’s financial behavior—deposits, spending, missed payments, regular income, and even streaming subscriptions. Open banking changes that. At the center is no longer the bank but the customer — who decides who gets access to their data and when. This opens the door to a new wave of competition and innovation in the financial sector. New players, including fintech companies, gain the ability to compete with major banks — and customers get more options to choose from.

Article Summary: Babina, T., Bahaj, S. A., Buchak, G., De Marco, F., Foulis, A. K., Gornall, W., Mazzola, F., & Yu, T. (2024). Customer Data Access and Fintech Entry: Early Evidence from Open Banking (Working Paper No. 32089). National Bureau of Economic Research.

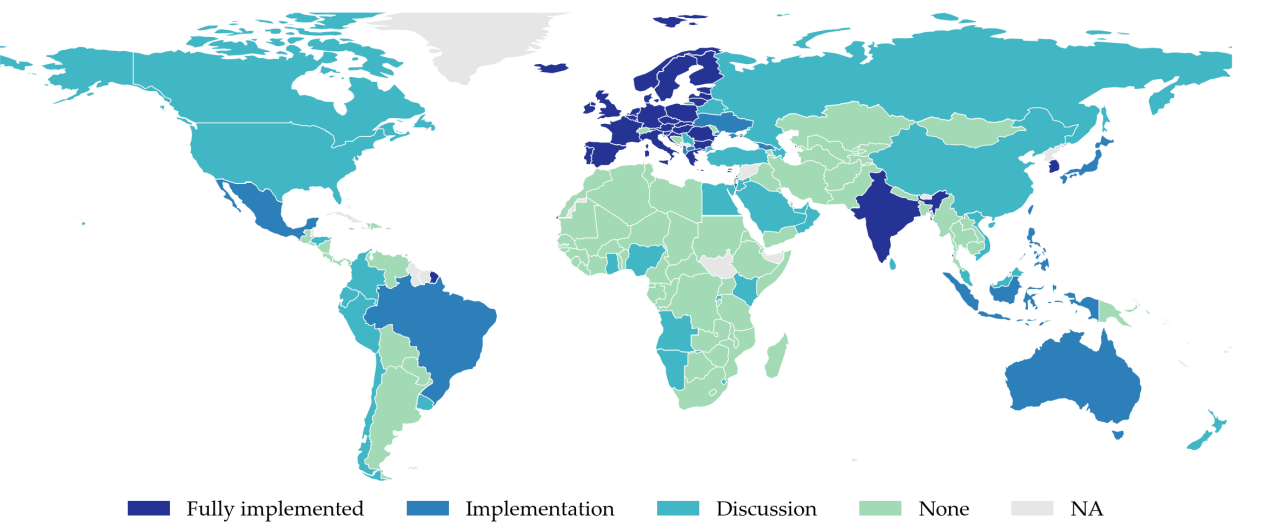

A study published in January 2024 by a team of international economists — including Vox Ukraine contributor Tania Babina from Columbia Business School — under the auspices of the U.S. National Bureau of Economic Research shows that open banking already substantially changes the rules of the game. The authors analyzed the experience of 168 countries, covering over 99% of global GDP and 98% of the world’s population. They found that by the end of 2021, 80 of them — about 43% — already had government-led initiatives to open banking data, while 49 had moved beyond discussion to full implementation of key open banking policy elements.

Figure 1. Open banking policy implementation status across countries as of 2021

Source: Babina, T., Bahaj, S. A., Buchak, G., De Marco, F., Foulis, A. K., Gornall, W., Mazzola, F., & Yu, T. (2024). Customer Data Access and Fintech Entry: Early Evidence from Open Banking (Working Paper No. 32089). National Bureau of Economic Research.

Research Methodology

In their study, the researchers combine a global analysis with an in-depth examination of specific cases. They studied 168 countries to assess the impact of open banking on fintech development, investment, and consumer behavior. In addition, they conducted a detailed case study of the United Kingdom — a pioneer of open banking — using unique microdata from the 2020 Financial Lives Survey, which covers more than 16,000 respondents. This combination of macro- and micro-level approaches allowed them to identify both global patterns and nuanced social effects of open banking at the household and business levels.

Who stands to benefit most from open banking — and who risks being left out of the new financial ecosystem? Economists suggest distinguishing between two scenarios for how open banking is used:

- First, when data is used to improve the customer experience of financial services — for example, through personalized advice, better product selection, or comparisons.

- Second, when data is applied to assess credit risk.

In the first scenario, everyone benefits: competition stimulates innovation, and consumers get access to better-quality products. In the second scenario, the advantage goes mainly to those who appear «reliable» in the eyes of the system. Those who share «unfavorable» data — or refuse to share data at all — may automatically be flagged as «high risk» and end up receiving worse loan conditions or being denied credit altogether.

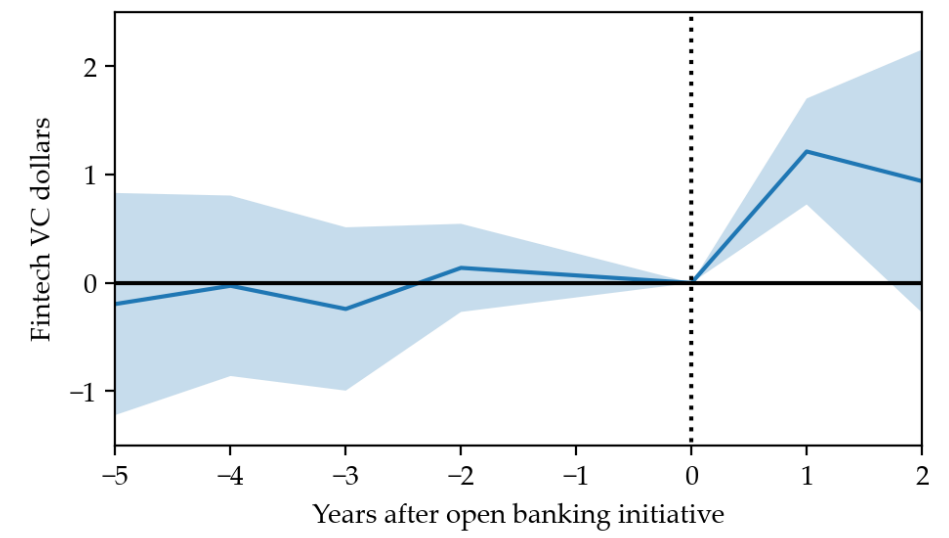

One of the first outcomes of implementing open banking has been a surge in innovation. The research shows that after open banking is introduced, the number of fintech investment deals rises by roughly a third, while the total investment volume doubles. In monetary terms, that means tens of millions of dollars in additional funding each year for every country that implements open banking. Moreover, the growth is not limited to investments in lending services — it also includes financial advice, account management, and payments.

Figure 2. Impact of open banking initiatives on venture investment in the fintech sector

Before the launch of open banking, investment in the fintech sector was relatively stable — or even slightly declining. However, there was a noticeable increase immediately after open banking was introduced: in the first year, investment volumes rose sharply. Growth slowed somewhat in the second year, but investment levels remained higher than before the launch. When people are not afraid to share their data with fintech companies, open banking functions more effectively — and investment in the sector grows more rapidly.

The United Kingdom was one of the first countries to implement open banking back in 2018. Its experience shows how quickly consumer behavior can change. According to the UK financial regulator, by 2020, 13% of the population was using at least one open banking application. Of these, 8.6% used services for financial planning — such as apps for managing expenses or saving — and 5.5% used them to access credit. Interestingly, these two groups barely overlapped: only about 13% of users of financial planning services also used open banking for borrowing.

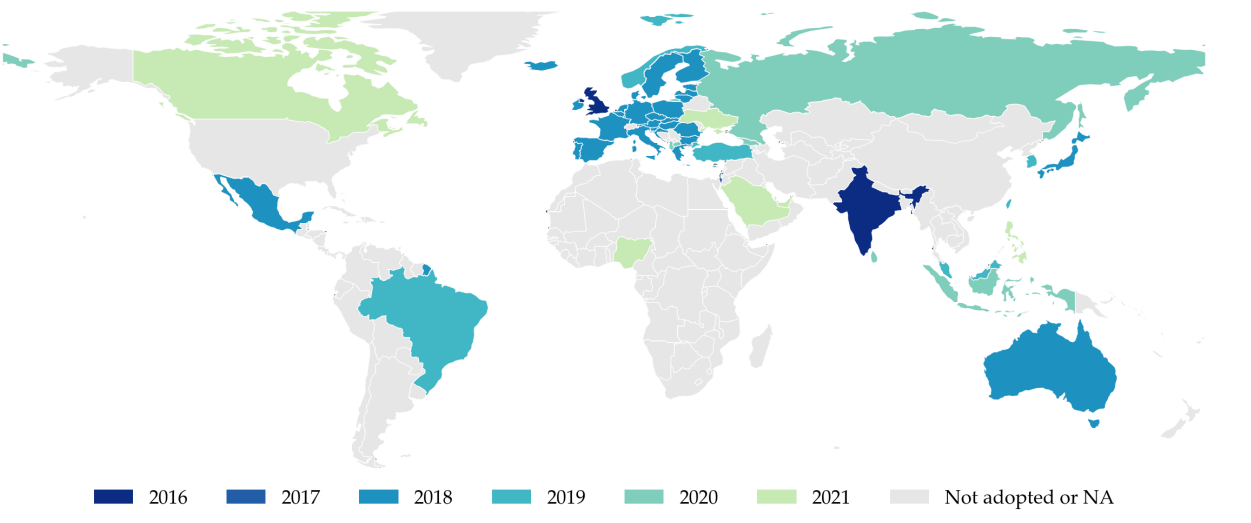

Figure 3. Timeline of open banking adoption worldwide

Source: Babina, T., Bahaj, S. A., Buchak, G., De Marco, F., Foulis, A. K., Gornall, W., Mazzola, F., & Yu, T. (2024). Customer Data Access and Fintech Entry: Early Evidence from Open Banking (Working Paper No. 32089). National Bureau of Economic Research. https://doi.org/10.3386/w32089

The analysis also found that those who use open banking for financial planning tend to demonstrate higher levels of financial literacy, while those who use it for borrowing have better access to credit — including lower interest rates. Notably, open banking users are more likely to be employed. They also include many who have previously faced difficulties paying bills or missed loan payments.

The Open Banking Impact Report (October 2021) shows that most users report improvements in financial planning and decision-making. Many say these services help them better control spending, stick to a budget, and find more advantageous financial offers.

Specifically, 76% of users noted that open banking services helped them increase their savings and build a financial cushion. In addition, 62% reported a reduction in unnecessary spending, and 55% said they were able to avoid extra fees.

Another important dimension is small business. In the UK, where open banking also applies to legal entities, businesses with annual turnover of up to £25 million gained the ability to share their financial data with new lenders. The result was a noticeable increase in loans issued by non-bank financial institutions. Businesses with an existing credit history were able to obtain new loans more easily — and often on better terms. In contrast, companies without such a track record, or those with lower levels of trust in fintech, were much less likely to share their data. As a result, they remained outside the view of new lenders and continued to rely on their existing banks.

Researchers caution that open banking is not a silver bullet but a tool. Its impact on financial access, competition, and inclusion depends largely on how it is implemented. Equally important is how much trust society places in the systems that process and protect data.

For Ukraine, which is preparing to implement open banking, this is a chance to open the market to new players, simplify access to credit, and give a boost to the country’s fintech sector. At the same time, it is essential to address technological security in advance — not only the reliability of the channels through which financial data will be transmitted but also the certification of fintech services, monitoring of access, and clear delineation of responsibility among banks, providers, and regulators. Equally critical is informing the public: people need to understand what open banking is, what data they are sharing, and how it may affect their financial opportunities. Without this, even the best digital solutions may fail to take root. Open banking does not work in a vacuum — it works where there is trust.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations