In recent days, the National Bank of Ukraine (NBU) and its head Valeria Hontareva were sharply criticized in the parliament and press. Corruption, incompetence, and mismanagement of the economy were some of the charges. Obviously, known instances of corruption should be filed with proper authorities for further examination. Accusations of incompetence and mismanagement of the economy are harder to prove but an educated discussion of what has been accomplished by the NBU team and what could have been done differently is entirely possible. In this brief review, we provide an assessment of what we think was key in the evolution of the NBU and the Ukrainian economy since 2014.

New Monetary Regime

For years, the National Bank of Ukraine maintained a fixed exchange rate as a policy regime. We have argued on multiple occasions that this was a terrible policy choice for Ukraine. The volatile commodity prices and irresponsible fiscal policy that Ukraine experienced under this regime create enormous macroeconomic risks under the fixed exchange rate regime. Indeed, repeated currency and banking crises in Ukraine are the disastrous results of that policy. After many failed attempts to move away from the fixed exchange rate, the NBU with Hontareva’s team at helm finally made significant progress in changing its policy to inflation targeting. The experience of other countries provides strong evidence that countries with inflation targeting achieve both lower inflation rates and greater macroeconomic stability. While the fruits of this change may be not so obvious to the public right now, it will be clear in the next few years how important this change is.

The main suggested alternative for inflation targeting is a fixed exchange rate regime. Its advocates often cite success stories of East-Asian economies which used this regime. But the advocates ignore the fact that these economies went through a devastating crisis in the late 1990s. Since then South Korea, Thailand, Philippines and Indonesia, all prominent victims of the crisis, switched their monetary regime to inflation targeting.

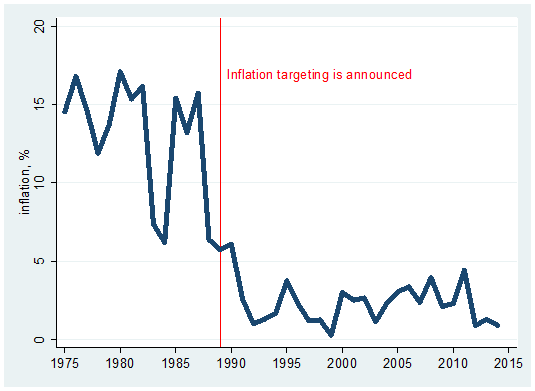

The earliest adopter of inflation targeting was New Zealand. In 1989, after decades of high and volatile inflation the country decided to set 0-2 per cent inflation as the medium term goal. The Reserve Bank of New Zealand gained the necessary independence to pursue this goal. At the beginning there was no credibility for the target but the bank was able to lower the inflation from an average of 9.3% in 1987-1989 to a mere 1.6% on average in 1991-1993.

Figure 1. Inflation in New Zealand

Similar to Ukraine, New Zealand has a high share of raw commodities exports and industrial goods imports, meaning a heavy dependence on world prices, but this is not a barrier for inflation targeting per se. Indeed, many countries with inflation targeting and dependence on commodity prices fared well in terms of low inflation and stable macroeconomic development despite volatile global conditions.

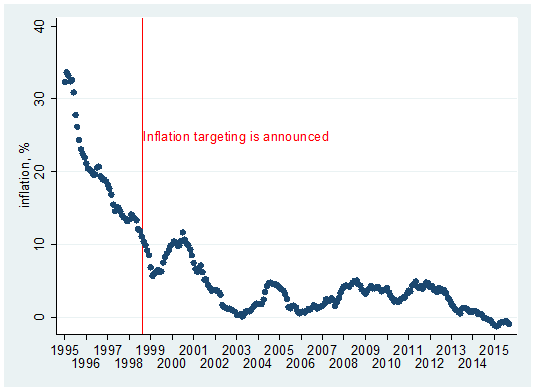

Among Ukrainian neighbours, the most prominent example of shifting to inflation targeting is Poland. After having high and volatile inflation during the 1990s, the National Bank of Poland (which became more independent in 1997) decided to shift to inflation targeting in September 1998. Before that a mix of policies have been used, such as crawling exchange rate peg, targeting monetary aggregates and short term interest rates. None of these previous regimes really worked. The shift to inflation targeting led to lower average annual inflation: from 20.9% in 1995-1997 to 7.6% in 1999-2001, and finally to approximately 2.1% in 2002-2015 with very small fluctuations around the target. The inflation remained low despite the booming years before the 2007-2008 Global Financial Crisis, which contrasted sharply with Ukraine, where the inflow of foreign currency led to both unsterilized interventions to keep the nominal UAH/USD exchange rate fixed, and high inflation which averaged 9.9% in 2003-2007.

Figure 2. Inflation in Poland

Large depreciation of the hryvnia

Critics of the NBU suggest that the current management team is responsible for the massive depreciation of the hryvnia in 2014-2015 which pushed many Ukrainians into poverty. To assess the fairness of this claim, we should understand i) why the depreciation happened and ii) what alternatives were available to the NBU.

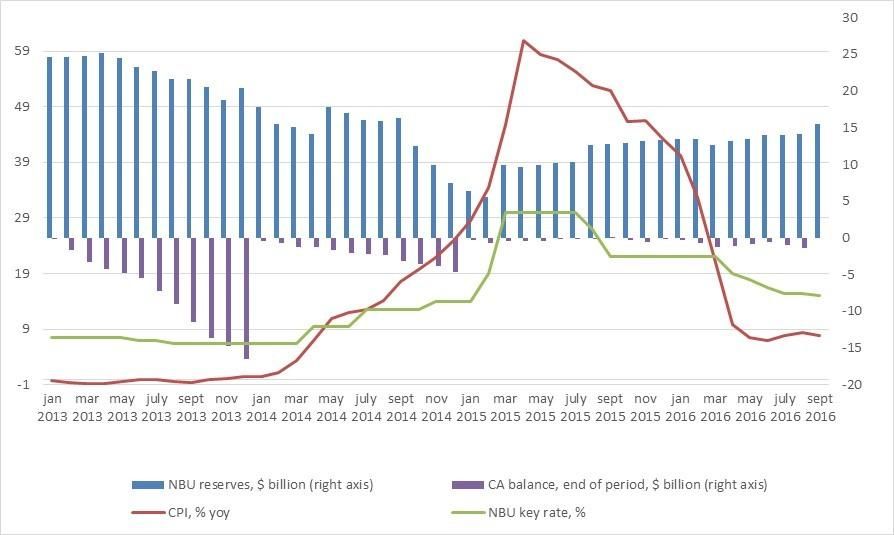

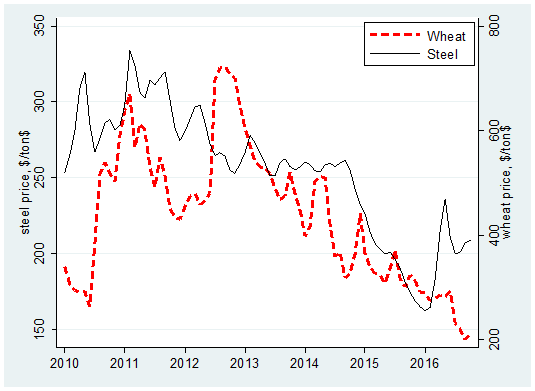

For the first point, one can simply examine the dynamics of the current account before the Maidan in 2014. Because Ukraine had a fixed exchange rate, ran relatively high inflation, and was hit with a negative price shock for its main exports (see Figure 4), the hryvnia was becoming increasingly overvalued. That is, Ukrainian goods were becoming less and less competitive in foreign and domestic markets. As a result of the fixed exchange rate, imports grew a lot relative to exports and the country was running an enormous current account deficit: nearly 9% of GDP in 2013 (see Figure 3). A deficit of this scale portends a terrible imbalance in the economy. Furthermore, the situation was turning increasingly bad because in its attempts to defend the currency the previous management of the NBU depleted foreign reserves from the peak of USD 38.2 bn as of end-August 2011 to USD 15.5 bn as of end-February 2014 (flight of Yanukovych) and futile attempts to defend the hryvnia further depleted reserves to a mere USD 5.6 bn as of end-February 2015 (see diagram below). The economy plunged into recession since the third quarter of 2012 (measured as two consecutive quarters of shrinking real GDP). Later the recession deepened because the country was hit by military conflict with Russia-backed separatists and lost a portion of its exports. In these circumstances, a run on the hryvnia was all but assured. The hryvnia was destined for a large depreciation. Ukraine was like the Titanic heading for disaster, and to claim that a last-minute action by the captain could turn the ship one minute before the hit is hypocritical. Thus, the question is not whether depreciation should have happened but how large depreciation should have been to adjust the imbalance.

Figure 3. Macroeconomic time series for Ukraine

Figure 4. Global сommodity prices

For the second point, let’s go back in time to the beginning of 2015. The current account deficit shrinks to 3.4% of GDP, but remained in the red. There is a run on the currency and banks. Foreign reserves are critically low. The government or the NBU cannot borrow funds in international markets to defend the currency. The fiscal deficit widened to whopping 10% of GDP in 2014 . The economy shrank by 17 percent in the first quarter of 2015. Effectively, there are no resources to defend the hryvnia.

The three realistic options are a) let the hryvnia float, b) try to limit capital outflows by raising interest rates, and c) impose tight currency controls (which could cover a broad spectrum of administrative restrictions including bank holidays, suspended trading, etc.). Neither of these options is easy for the public to swallow. However, option a) is better than options c) and b) because option a) (floating exchange rate for hryvnia) can remove the overvaluation of the currency and thus start re-balancing of the economy. In contrast, option c) can limit the panic but it does not solve the long-term need for current account re-balancing. Experience of other countries with a currency run suggests that option b) could require raising interest rates to very high levels (more than 100%), which is very costly for households and businesses. In addition, option b) only postpones re-balancing.

The NBU chose option a) and eventually combined it with options c) and b). Perhaps capital controls could have been introduced earlier (to avoid the hysteria of February 2015) and the NBU had to decide on floating the currency earlier and thus avoid burning scarce reserves defending it with the intervention. But, overall, given the limited menu of what could have been done, the NBU did the only possible thing: with reserves close to zero (USD 6.4 bn as of end-January 2015 with average monthly outflow of USD 2.5 bn in the last quarter) the hryvnia had to be allowed to depreciate. How deep should the depreciation have been? The only logical answer is the point where supply meets demand. The market found its equilibrium at 25 hryvnia per USD.

Disinflation through high interest rates

After the devaluation of the hryvnia and a hike in energy tariffs, inflation shot up which brought very unpleasant memories of the 1990s hyperinflation. To curb currency devaluation and inflation, the central bank raised interest rates (see previous section) thus making credit very costly and probably pushing economy further into recession. The critics of the NBU suggest that this aggressive response to inflation was unwarranted. Is this fair? Again, we need to examine the conditions in which the central bank operated and choices at its disposal.

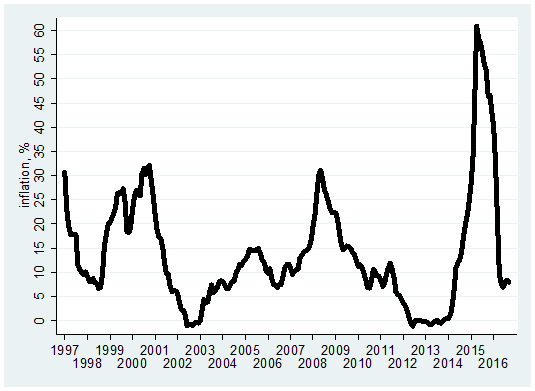

Figure 5. Inflation rate (CPI, year on year) in Ukraine

The mandate of the NBU is to ensure the stability of the national currency, i.e. stable purchasing power of the hryvnia (it does not mean a fixed exchange rate!). The Law on the NBU clearly states that the central bank’s main priority is price stability defined as steadily low inflation in the medium-term. NBU’s other activities are subordinated to this low inflation priority. 60% inflation recorded in April 2015 is clearly inconsistent with the stability of the hryvnia. So the NBU had to take steps to reduce inflation (i.e., implement disinflationary measures).

What could have been done? The basic macroeconomic theory is clear. First, the central bank can influence inflation expectations so that households and businesses do not panic in the face of a temporarily high inflation. Second, the central bank has to generate “slack” in the economy, that is, a situation where resources are underutilized. This means a recession. Of course, the first option is the easiest but this requires enormous credibility for a central bank. After multiple crises and the Yanukovych team at the helm of the NBU, the central bank in Ukraine could hardly use this as a workable solution. So the only feasible path was to raise interest rates dramatically. This is a costly measure and, obviously, nobody wants to use a “weapon” like this unless the situation is desperate. But the alternatives would be even costlier. The hyperinflation and economic collapse in Ukraine during the early 1990s is a grim reminder of what can happen if inflation is not in check.

The NBU was not the first or last to take this route and what we saw in Ukraine is not unprecedented. For example, the U.S. Federal Reserve System under Paul Volcker could reduce inflation only after interest rates were raised to sky-high levels, which plunged the U.S. economy into one of the worst post-WWII recessions. Yet, that policy brought low and stable inflation and subsequent economic prosperity to the U.S.

Removal of “zombie” banks

Banking crises often leave deep scars: it could take years for economies to recover. In part, these painfully slow recoveries stem from so called “zombie” banks. These banks appear solvent on paper but the market value of their portfolios can be such that these banks have negative net worth. For such a bank, it is nearly impossible to attract capital, resume lending, and rebuild trust. If these banks are allowed to stay afloat, they can drag the economy. For example, economic research shows that zombie banks likely contributed to the stagnation in Japan in the 1990s (after the financial crisis in Japan) and other countries (e.g., the Eurozone after the Global Financial Crisis). In Ukraine the problem was exacerbated by widespread related-party lending by the banks and lax external controls.

Unfortunately, liquidating “zombie” banks is not easy in the best of times — banks are highly leveraged and extremely interconnected so that removing a bank can trigger a wave of bankruptcies — and it becomes a huge challenge in times of crisis. There is no simple solution. One option could be to sell problematic banks to healthy banks. This was however nearly impossible in a systemic crisis like Ukraine’s had because there was virtually no domestic bank that was truly healthy. Expecting a foreign bank to step into this mess and save the day was just a hopeful dream. Foreign-owned banks were looking for an exit!

Another option is to require banks to raise more capital from private markets. Experience from similar crises in other countries suggests that doing so could have been hard to accomplish and could have worsened the economic conditions. If the private markets cannot provide capital, one can use government funds to inject capital into banks so that they can improve their balance sheets over time. This option was difficult to implement because the government had no resources, and printing money would defeat the efforts of the NBU to bring inflation down. At a later stage when the IMF gave resources to Ukraine, this could have been done but the scale of the problem was so large the initial support from the IMF was too small to make it work. In summary, in the spur of the moment, solutions other than liquidation were hardly on the table. The NBU had to do perhaps the costliest option (liquidation), which is not conducive for building short-run trust in the banking sector (it can fuel bank runs as depositors may fear possible liquidations) and for restoring lending quickly (banks have to hold large reserves).

So, are the critics right in blaming the NBU for doing costly liquidations of banks? They would have been right if the NBU had more options in its arsenal but unfortunately this was not the case.

Tackling related-party lending

The financial model of a typical business group in Ukraine was to set up a bank, collect deposits, and use these deposits to credit its own business. Such a model of banking makes the financial system highly vulnerable. Indeed, banking is about diversification of risks and Ukraine’s business model is the opposite of diversification: the risks are concentrated! After the NBU enforced disclosure of ultimate ownership of banks in Ukraine (which was an extremely important policy change!) it became clear that the scale of related-party lending is enormous — it reached 80% at some banks. Forcing banks to restructure their credit portfolios and minimize related-party lending is costly, which is another point raised by critics of the NBU.

Was the cost justified? A healthy recovery of the Ukrainian economy can be only achieved with a healthy banking sector. Related-party lending is problematic at many levels and thus a prudent policy is to reduce it to acceptable levels (below 20% within the next 3 years with following further reduction up to complete elimination of this practice). The NBU offered non-compliant banks to develop restructuring plans so that the banks can gradually resolve this issue. This seems to be a reasonable compromise.The NBU also strengthened supervision of the banks to ensure that related lending does not happen in the future.

Supporting Banks with Refinancing

During the 2014-2015 banking crisis, the NBU provided large amounts of liquidity to banks (so called “refinancing”). Some of the banks did not survive and thus resources given by the NBU to these banks cost taxpayers money. As of mid-October 2016, the net amount of refinancing stood at UAH 74 billion, of them UAH 44 billion was “locked” in non-viable banks sent into receivership. Critics suggest that refinancing was a massive waste of resources and an example of large-scale corruption. Because we are not aware of documented and court-tried instances of corruption under the new NBU management, we focus on whether refinancing was necessary and/or desirable. If there has been any mis-management, we support investigations into these cases. However, here we discuss not individual cases on which we are unable to provide a judgement presently, but a general approach.

The theory and practice of central banking is clear: in times of crisis, the central bank should be a lender of last resort. Liquidity (“refinance”) should be given to solvent but illiquid banks. This ensures stability of the banking system and hence broader economy. Thus there should really be no question about whether the NBU had to provide resources to banks in a situation like the one Ukraine had in 2014-2015. It was vital to support the banks.

A more challenging aspect of this is how to determine which bank is solvent. In a raging panic, it is hard for an outsider to establish the value of assets held by a bank. Given related-party lending and zombie banking in Ukraine, this task is even more complex. In these conditions, how can one guarantee that a bank that receives refinancing from the NBU is not going bust the moment it receives money? With the limited liability of banks, the central bank can recover little from bankrupt financial institutions. So the bankers do not have “skin in the game”, that is, they do not have a personal responsibility for the unpaid debts of the banks they run. In an economy with a strong rule of law, it is the threat of criminal punishment that keeps bankers compliant (defrauding the central bank is a criminal offense). If the law is “flexible”, this safety net is not effective. The solution of the NBU was to break the precedence of limited liability and require personal guarantees from the owners of the banks. That is, if a bank goes under, the owner has to pay from his personal pocket to honor the loan from the NBU. This unusual condition set by the NBU was meant to provide extra insurance that refinancing is used appropriately and that the taxpayers can recover the money in case a bank fails.

Was this a perfect solution? It is too early to tell (the NBU is suing owners of the failed banks). Was it worth a try? Given the desperate conditions, this solution looked like a viable option. In any case, it is not unusual that even the best central banks lose money while acting as lenders of last resort. For example, the U.S. Federal Reserve System lost billions of dollars on some of its decisions to support troubled financial institutions in the recent crisis.

Capital controls

Critics of the NBU claim that capital controls were not necessary or that capital controls were too tight and should have been lifted by now. Our discussion above makes clear that Ukraine’s banking system was in great peril: a run on the hryvnia and banks, limited access to foreign markets, limited capacity of the government to inject resources, depleted foreign reserves, massive capital flight, shrinking economy. The state of panic was so pervasive that even healthy banks were in deep trouble.

Experience of other countries suggests that trying to stop a panic of this scale with conventional, market-based tools is likely ineffective. On the other hand, administrative measures such as capital controls can tame chaos. It is fairly common for regulators to shut down markets if the situation becomes uncontrollable. For example, the New Deal of U.S. President Franklin Roosevelt included banking holidays as a means to calm down fears of households and businesses. More recently, a banking panic in Cyprus was stopped only after Cyprus’s central bank introduced capital controls and limits on ATM withdrawals. Greece had to implement similar measures to keep the banking sector running. In 2004, Ukraine temporarily banned early deposit withdrawals and imposed limits on cash withdrawals to contain panic during the first Maidan. Thus, introducing capital controls (together with letting the currency to float and hiking interest rates) was a sensible policy for Ukraine. In fact, capital controls perhaps should have been introduced earlier to avoid (or at least reduce) wild gyrations of the hryvnia in February 2015.

Should the NBU lift all capital controls now? If history is any guide, a successful transition from capital control to free flows of capital means a gradual approach. For example, Cyprus had capital controls for two years with a gradual phase out of the controls. This is exactly what the NBU has been doing: gradually untighten the screws of the controls. Given the fragile state of the Ukrainian economy, the risks of lifting all controls too early outweigh the benefits. Indeed, does anyone expect a massive inflow of foreign capital into Ukraine in the near future? On the other hand, is it likely that we may see another panic in Ukraine? The answers are clear.

Summary

The National Bank of Ukraine faced some of the toughest possible challenges in 2014-2015. There was no easy solution to the problems that had accumulated over many years. The menu of options was very limited. The “medicine” had to be painful. Blaming the Hontareva team for administering a bitter “pill” is not fair. Perhaps some details of what the NBU did during the crisis could have been better (e.g. let the hryvnia float and impose capital controls earlier) and some critique may be justified. But more importantly, the critics offer no feasible alternative strategies for handling the crisis. The course taken by the NBU was a reasonable policy given the circumstances.

By: Tymofiy Mylovanov (PhD, University of Pittsburgh), Yuriy Gorodnichenko (PhD, University of California Berkeley), Oleksandr Zholud (senior economist, International Center for Policy Studies), Olena Bilan (chief economist, Dragon Capital), VoxUkraine editorial board members

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations