There is no doubt that Ukraine needs to return to the flexible exchange rate. However, today it is not clear how exactly (when and under what conditions) this will happen. In any case, this will not be a cakewalk. In this article, we discuss complex challenges on the return path to the floating exchange rate regime.

Several months ago, the National Bank of Ukraine (NBU) published the Strategy for easing FX restrictions, transition to greater exchange rate flexibility, and return to inflation targeting. Adoption of this document is foreseen by the current IMF program with Ukraine. It also sends an important signal to society that at least a partial return of the foreign exchange market to market principles may occur even during wartime. However, return to a flexible exchange rate is one of the most sensitive issues for the National Bank in the short run.

The problem is not only that the return to a flexible exchange rate entails other steps, such as relaxing capital controls, normalizing operational design of the monetary policy, and restoring inflation targeting. The thing is that the transition to a floating exchange rate regime is both strategically and technically complicated.

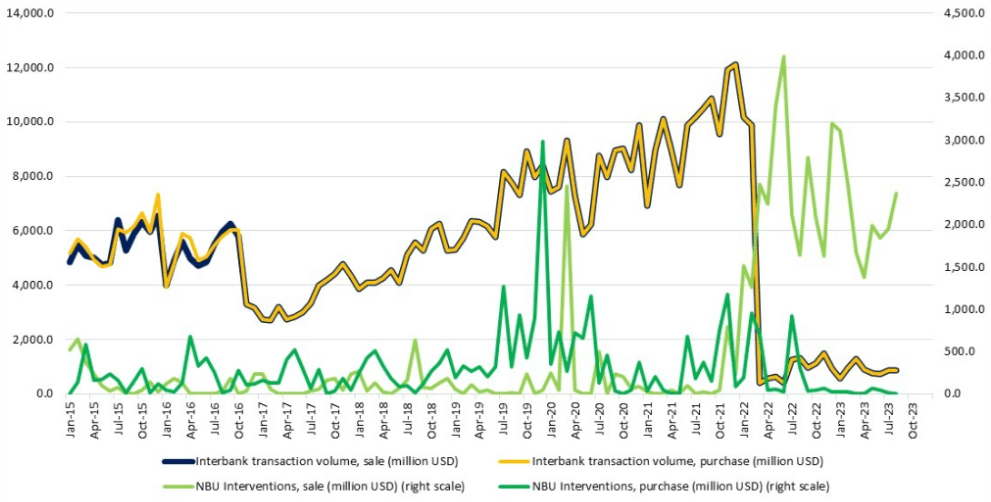

One of the major difficulties stems from the change in the composition of the interbank FX market (Figure 1). Trade volume (excluding NBU interventions) steadily increased after introduction of flexible exchange rate and transition to inflation targeting in 2015. This was expected since most studies on the issue unanimously say that floating exchange rates increase market volumes and promote market deepening through more active involvement of economic agents. However, the situation has changed with the onset of the full-scale invasion. Trade volumes of the interbank foreign exchange market have significantly decreased, while the volumes of NBU interventions have grown radically.

Figure 1. Dynamics of the interbank foreign exchange market and NBU interventions

Source: NBU data.

Therefore, the NBU faces a significant challenge. While today’s situation somewhat resembles that of 2015, the experience of transitioning to a new monetary regime under complex economic and geopolitical conditions cannot be exactly replicated today. This, of course, does not mean that the NBU should be paralyzed by fear of the unknown. However, it does mean that a detailed analysis of the challenges associated with exchange rate regime shift is necessary.

First, the transition to a flexible exchange rate regime mainly aims to allow market forces to bring the exchange rate to an equilibrium value. In other words, a floating exchange rate has to correct significant imbalances in the economy. The war has fundamentally restructured Ukraine’s balance of payments. A substantial trade deficit cannot be attributed to a wrong exchange rate or overheated demand in the traditional sense. The cause of the trade deficit is export restrictions due to port blockades and other logistical challenges accompanied by significant international aid inflows. The reconstruction of the country will also be supported by substantial official inflows, which means that trade deficit will continue to affect the composition of the current account balance for some time. On the other hand, these new structural factors make it necessary to determine the exchange rate by market forces so that FX rate does not exacerbate the destructive consequences of wartime shock.

Second, the transition to a flexible exchange rate, if it is not a free fall, typically implies its market correction towards an equilibrium trajectory defined by the central bank as optimal. Usually this entails assessing the degree of exchange rate deviation from the path associated with price stability and macroeconomic stability. However, in the current circumstances, applying the usual methods of macroeconomic estimation of exchange rate trajectory is problematic. For instance, the fundamental equilibrium exchange rate approach requires using an economic model to estimate the exchange rate value which would drive the economy to a steady state. But structural breaks and sovereign risks due to the war make such an estimate highly uncertain, if at all possible. The real effective exchange rate approach focuses on the difference in inflation levels between Ukraine and its trading partners. However, it does not take into account that export restrictions have non-economic aspects, and thus the trade deficit is not solely due to loss of price competitiveness that a downward exchange rate movement can correct. Estimation based on uncovered interest rate parity (the exchange rate trajectory is determined based on the difference between interest rates and a premium in the relevant currency) also may not yield the desired result. This is because capital controls are in place, and Ukraine’s sovereign risks are of non-economic nature.

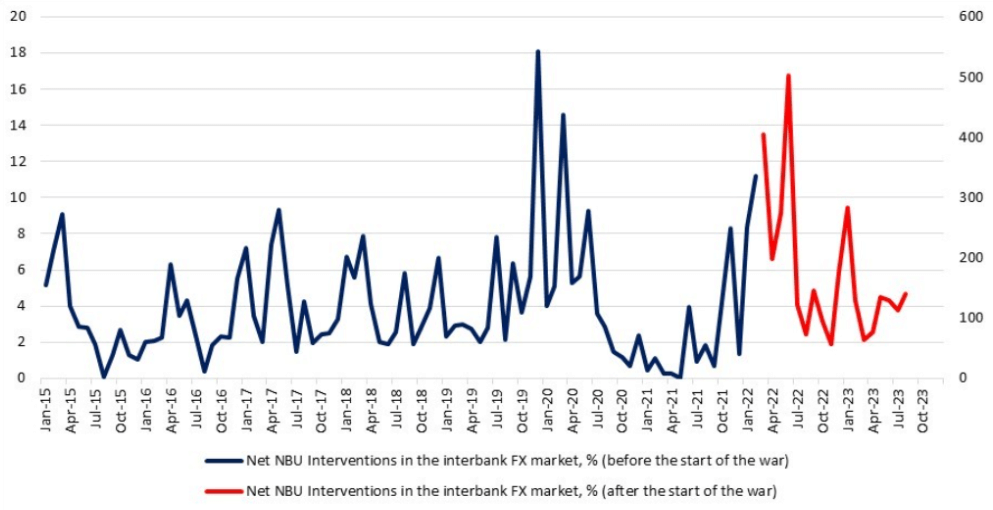

Third, a more flexible Hryvnia exchange rate poses the question of how to match operations of market agents with significant volumes of official transactions (e.g., when Naftogaz enters the market to buy currency or when the government sells currency obtained as a grant or loan, which significantly affects the market exchange rate). Taking into account the current role of FX interventions (see Figures 1 and 2), this issue is far from straightforward. For instance, the net interventions suggest that the exchange rate should be adjusted downward. On the other hand, an increase in FX reserves due to official inflows does not rule out exchange rate strengthening. Moreover, a larger volume of interventions aimed at strengthening the exchange rate (i.e., selling currency) can help absorb excess Hryvnia liquidity.

The transition to a floating exchange rate raises questions about which specific component of the balance of payments will likely be addressed by a potential correction. With significant military procurements, a downward exchange rate correction will increase budget expenditures. Given the limited logistical export capacity, a lower exchange rate may not revive exports. On the other hand, a downward exchange rate correction can limit the volume of Hryvnia transactions abroad, reducing the outflow of currency from the country (possibly leading to a decrease in unproductive expenditures on new cars). However, a significant trade balance adjustment would occur with such a depreciation of the exchange rate that may not be compatible with either price or financial stability.

There are also long-term considerations. Ukraine’s economy has experienced an extreme negative productivity shock, so Hryvnia depreciation after switching to a floating exchange rate seems natural. On the other hand, with significant imports of equipment and high labor mobility (in view of the EU accession), one can hardly expect that the economy will grow only because of incentives for commodities exporters. Aligning the exchange rate trajectory with private sector investments and the corresponding productivity increase is much more important. However, the answer to this question lies in the realm of a floating exchange rate rather than abstract considerations. In other words, only a flexible exchange rate will allow to address this issue.

Figure 2. Ratio of net NBU interventions to interbank foreign exchange market turnover

Source: NBU data.

Fourth, the depth and liquidity of the market will remain an obstacle for balancing supply and demand on the interbank foreign exchange market for quite some time. Therefore, even after introducing a flexible exchange rate and removing capital controls, capital flows will increase very gradually (as they did after introducing a floating exchange rate in 2015). As shown in Figure 2, since 2015, the ratio of net NBU interventions to the market turnover was close to 5% and only occasionally exceeded 10-15%. In other words, the NBU did not dominate the market but rather fine-tuned it. Things have changed with the onset of the war. Today the volume of net interventions significantly exceeds the market turnover. This raises questions about the parameters of the NBU reaction function to the market situation.

Moreover, interventions are likely to be less transparent than what market participants were used to before the war. Therefore, the volume of NBU interventions and the market conditions under which the NBU intervenes into the market may for some time correspond more to some artificial rather than an economic algorithm. Hence, market participants may have natural questions about the transparency of interventions. Given the wartime circumstances, the issue of constructive ambiguity during the return to flexibility will become ever more complex and will require a qualitative upgrade of the NBU communication process.

However, these challenges should not deter actions that ensure better adaptation of Ukraine’s economy to shocks and prevent getting used (again) to a fixed exchange rate, which only creates an illusion of stability and contributes to the accumulation of hidden risks. Nevertheless, initial steps toward restoring flexibility and flexibility itself will be a new experience for both the NBU and market participants. Therefore, during the transition to a flexible exchange rate all stakeholders will need to contribute to mutual trust: the National Bank will need to continuously communicate with society, and market participants will need to consider the impact of their actions on other players and macroeconomic variables.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations