The environmental tax policy is significantly different in developed countries and in countries with transition economies. We discuss such economic instruments like Ecological tax and compare two countries with different levels of ecological policy Sweden and Ukraine, to prove the feasibility and necessity to take action to prevent emergencies and not to eliminate their effects. We offer not to forget the principle of fairness of taxation and take into account the priority of the development of forestry for carbon uptake.

It is possible that environmental problems seem untimely for Ukraine because there occurs a radical restructuring of the state and consciousness. But if we want to build a new, beautiful and healthy society in a free country, the environmental problems should not be forgotten.

In 2006 Nicholas Stern[1] has prepared Review of the Economics of Climate Change by order of United Kingdom Ministry of Finance. In this review, he explained the economic and environmental costs of climate change, and proved the need for a carbon tax.

As the European experience testified, environmental taxes are regarded as an effective economic tool for the improvement of the environment. From data of Eurostat[2], in 2011, revenues from Environmental Taxes in the EU-27 accounted for 2.39 % of GDP. Revenues from Environmental Tax in Ukraine accounted 0.09 % GDP in 2012.

As a rule, in the developed countries is greater emphasis on the harmonization of relations between humans and the environment. In countries with transition economies, environmental policy is in a state of transition from complete disregard and then to search for solutions of environmental problems.

We compare the environmental policy in Sweden and Ukraine, because we want to illustrate the possibility of a positive effect of intellectual tax policy. We believe that the Swedish experience can be used to some extent in Ukraine, but subject to tax management transparency and cooperation at all levels of state and local authorities. Moreover, should take into account the priority of the development of forestry, because forests play a main role in the absorption of carbon dioxide.

Dependence on fossil energy sources and high prices on fuel needs to be reviewed of energy policy. But Energy Strategy of Ukraine[3] aims to increase the share of domestic fossil fuels to 91.8% in the energy balance of the country until 2030. Therefore, natural question arises of motivation of enterprises and the public to find alternative energy sources. The tools of motivation could be the taxes, tax benefits and tariffs. The increase of tax rate will stimulate enterprises and population to change the attitude toward fossil energy sources, as for the expensive instruments for receiving own income.

The discussions about introduction of Carbon Tax are conducted in Ukraine over the past decade. Pre-conditions of its introduction were first revealed in Ukrainian scientific literature in papers by O.Veklych (2008)[4] and O.Maslyukivska(2009)[5]. At result in 2011 Ukraine introduced an Environmental Tax and a Carbon Tax in Tax Code[6]. The rate of Carbon Tax was set at 0,25 UAN/t CO2.

Swedish legislation plays an important role in-process in relation to defence of environment. The Environmental Code[7] has been in force since 1 January 1999. Through the environmental acts and their application the principles of precaution, polluters-pay and substitution have got a practical meaning within Swedish legislation and have been important tools in the environmental protection work. Swedish Carbon Tax is one of the highest in the world and was $ 109 per ton of CO2 in 2011. The main tax burden falls on ordinary citizens because the tax included in the cost of energy for households. But at the same time in Sweden the most advanced health care system and social welfare.

The CO2 tax is the major form of energy taxation in Sweden and has been successively increased since 1991. Over time focus was on gradually increasing CO2 tax rate. And according to a study by the Swedish Ministry of the Environment and Natural Resources (1995)[8], the carbon tax made influenced onto energy consumption patterns. Some plants owners, who have shifted their energy sources from fuel oil to biofuels, claim that the carbon tax was a decisive factor into their shift. In the six months after the carbon tax was also reduced for industry in 1993, heavy fuel oil consumption rose by about 20 % compared to the same period of the previous year. The preferential rate for industry also led some facilities to sell their biobased by-products to heating plants, which were taxed at the full rate and thus eager to use biofuels.

Energy policy[9] in Sweden has been approved by the Parliament in 2009. The main priorities were phased reduction of fossil fuels in heating to 2020 and the replacements of vehicle stock onto free from fossil fuels cars. Moreover, parliament decided to gradually limit CO2 tax exemptions for energy intensive industries and others between 2011 and 2015 outside the EU-ETS. Climate Roadmap 2050 for Sweden implies a significant reduction in domestic emissions; contributions from an increased net of carbon uptake in forests and fields and purchasing allowances on the international markets.

We compared the CO2 emissions and carbon uptake by forests in order to more clearly show the difference in the ongoing Environmental Policy in Ukraine and Sweden.

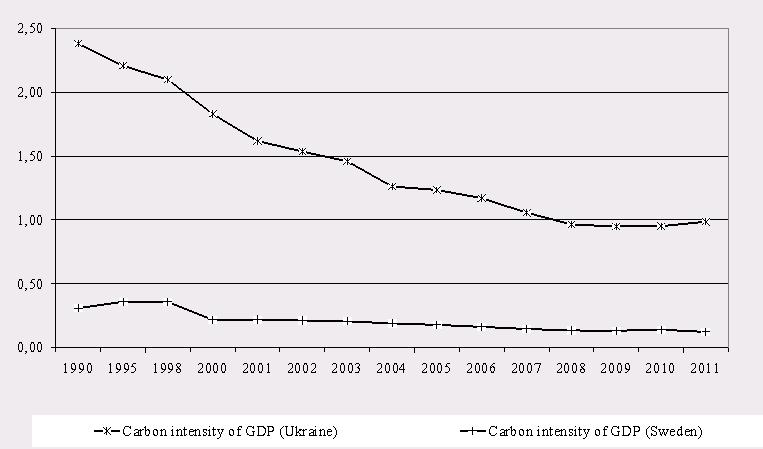

The comparison of Carbon dioxide Emissions and GDP shows that over the past 10 years CO2 emissions in Ukraine decreased. But anyway, Ukrainian emissions of CO2[10] are exceeding Swedish more than 6 times. And GDP was 3.4 times lower than in Sweden in 2011. At the same time, there is stability and a slow decline in Swedish CO2 emissions in dynamics.

Fig. 1. Comparison of CO2 Emissions and GDP in Ukraine and Sweden

Total Carbon dioxide emissions in Sweden[11], expressed in carbon dioxide equivalents, decreased by about 5.4 million tonnes compared to 2000 and have fallen by about 4.7 % or approximately 2.4 million tonnes between 1990 and 2010.

In Sweden GDP [2]growth averaged around 3.8% over the period 2002-2011, except 2008 and 2009, when growth fell by -1.4% and -12.2% respectively. GDP increased by around 19.4 % in 2010. Despite economic growth of around 50% between 1990 and 2007, Carbon dioxide emissions have been able to reduce. Between 1990 and 2010 Sweden cut its carbon emissions by 7 %, largely exceeding the target set by the Kyoto Protocol, while enjoying economic growth of 44 % in fixed prices. Sweden is one of few highly developed countries of the world, which managed to shorten Carbon dioxide Emissions. It can be hypothesized that emission levels will continue to drop as a result of the increase in the overall tax rate and the reintroduction of the 50 % industry rate. Overall, the Swedish Environmental Tax demonstrates the ability of an eco-taxation system to reduce Carbon dioxide Emissions.

Ukrainian Carbon dioxide Emissions decreased by 413.5 million tonnes in 2011 as compared with 1990 and made 42.5 % emissions of 1990. It is necessary to mark that the fall-off of Carbon dioxide Emissions happened not as a result of careful attitude toward environment, but because of disintegration of economy at the beginning of the 90s. Over the past ten years dynamics of Carbon dioxide emissions shows relative stability of their volume. There was an insignificant decline in 2009 on 18,6 million tonnes as compared with 2000. But it is related to the cutback of economic activity as a result of crisis in 2008. This tendency is very well seen on a diagram.

As result Ukraine has carbon intensity of GDP (PPC) in 7.5 times higher than in Sweden in 2011 (Fig. 2).

Fig. 2. Сarbon intensity of GDP in Sweden and in Ukraine

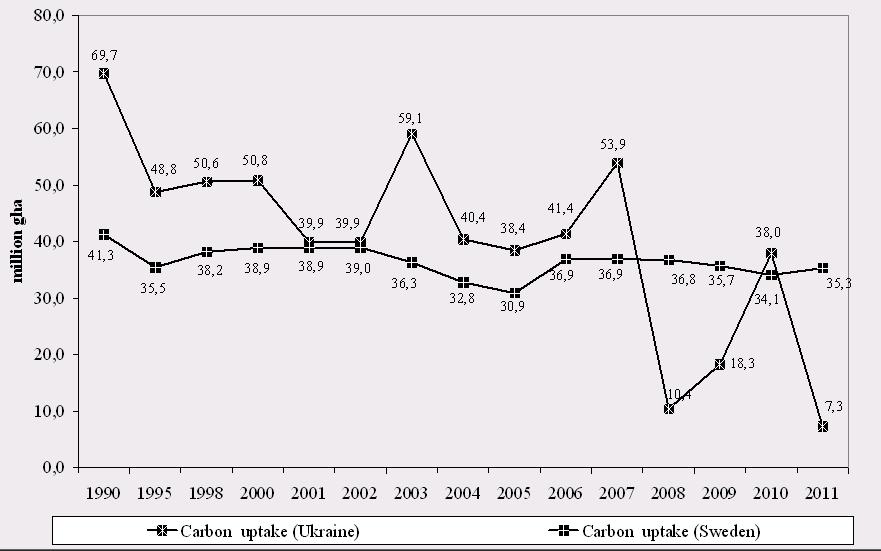

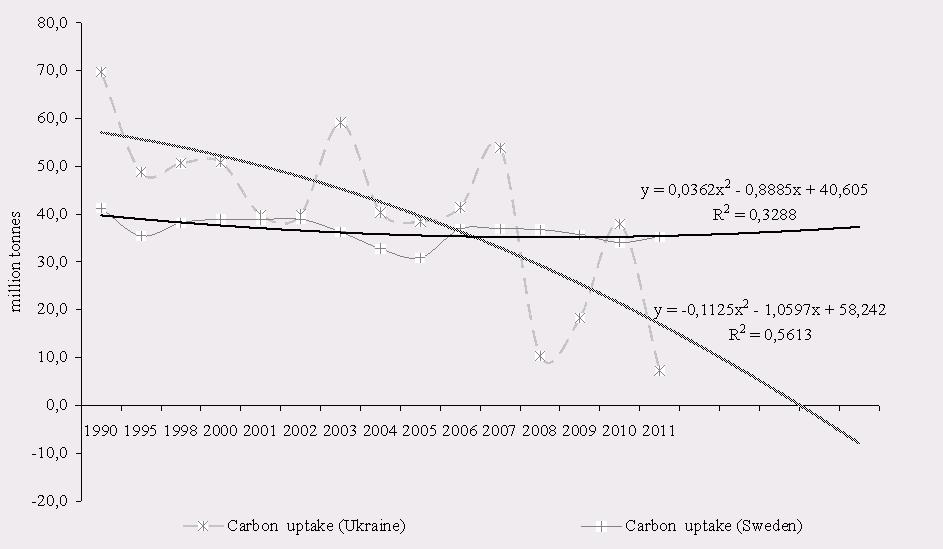

CO2 emissions are largely dependent on Carbon uptake by forest. For greater clarity, we compared the dynamics of CO2 absorption in Ukraine and in Sweden (Fig. 3). Over the past 10 years Carbon uptake in Ukraine do not have clear tendency, but we can say that it would decline than grow. At the same time, we can see stability Carbon uptake in Sweden in dynamics.

Fig. 3. Comparison of the Сarbon uptake in Sweden and Ukraine

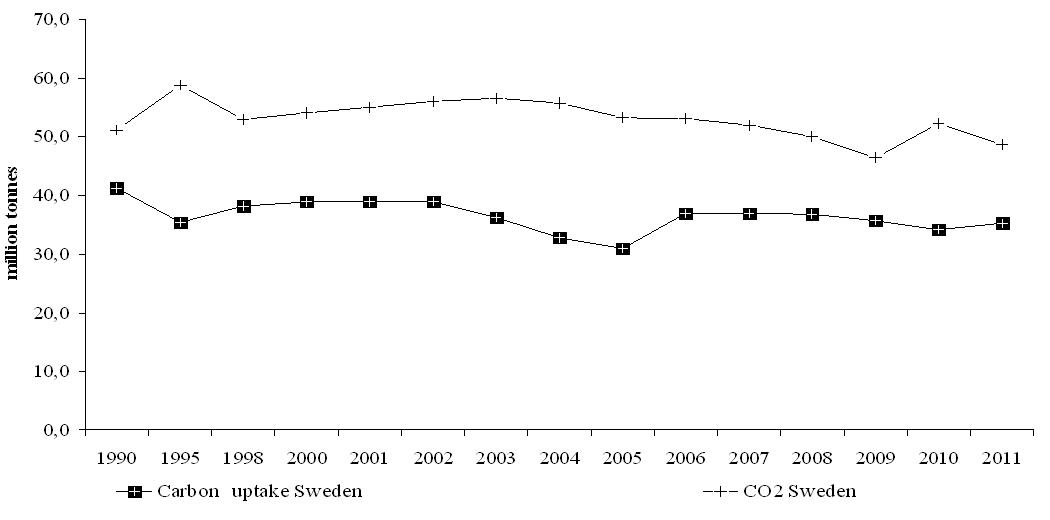

Steady state of the dynamics of carbon uptake and CO2 emissions in Sweden is confirmation harmonized environmental policy in the state and sustainable of forestry.

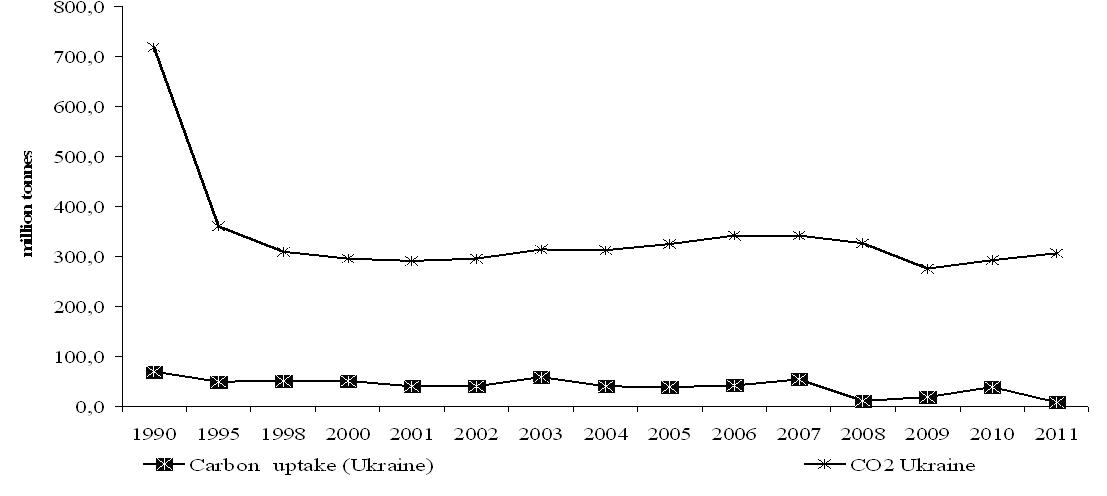

The studies show that there is no steady trend in dynamic of the Carbon uptake over the past years in Ukraine. Its changes were in the range of 10.5 % to 84.8 % of the 1990 level. Therefore, one of the directions of environmental policy for developing countries is to introduce an effective mechanism for development of forestry. Moreover, we can see on Fig. 4 that Carbon Emissions is higher than uptake in 0.7 times in Sweden, whereas in Ukraine it’s in 44.5 times greater. The level of emissions and absorption of carbon dioxide is almost completely corresponding to each other in Sweden. That is Sweden forests can absorb almost all emissions that been produced. The Ukrainian emissions had been reduced are slower than uptake in five-year term. This demonstrates the need to pay more attention to the development of forestry and an increase the area of evergreen trees.

Fig. 4. Comparison of the Сarbon uptake and CO2 emission in Sweden and in Ukraine

Fig. 5. Forecast of Ukrainian and Swedish Carbon uptake

Based on the analysis we built a graphic forecast of carbon uptake and CO2 emission, and its indicate the decline both in Ukraine and in Sweden the next five years (Fig. 5). Forecast for Sweden illustrates the almost invisible slow decline carbon uptake in five-year term. In Ukraine there is sharp change in it. But on average, we can state slowing down carbon uptake. Forecast illustrates a more sharp decline in the absorption in the five-year term than in Sweden.

Thus, it can be assumed that a rational use of wood resources and low carbon economy leads to the fact that the level of absorption and release of carbon dioxide is almost completely matched each other. Unfortunately, in Ukraine the situation is far from ideal, and therefore the question of deforestation should be one of the urgent tasks of environmental policy. Funds for forestry development can be get by the introduction of high carbon tax rates and redistribution of the tax for reforestation.

But at the same time we should not forget the principle of fairness of taxation. For example recommended in the case of raising taxes on gasoline, fuel oil and other combustible fuel should take into account the need to compensate the tax for poor people. This can be achieved by returning the value of the volume of fuel that is used on average during the month by the average consumer. Thus, much of the burden will fall on the wealthy citizens. At the same time as for the introduction of environmental taxes for businesses cautioned that should be remembered that the rate is too low are ineffective as well too high a leads to leak of capital and production abroad, because it leads to a rise in price of exports. As, we have listed the options of tax policy, the types of carbon tax, the tax base and categories of taxpayers in the table.

But at the same time we should not forget the principle of fairness of taxation. For example, Charles Krauthammer[12] recommended in the case of raising taxes on gasoline, fuel oil and other combustible fuel should take into account the need to compensate the tax for poor people. This can be achieved by returning the value of the volume of fuel that is used on average during the month by the average consumer. Thus, much of the burden will fall on the wealthy citizens. At the same time as for the introduction of environmental taxes for businesses Don Fullerton, Andrew Leicester, Stephen Smith[13] cautioned that should be remembered that the rate is too low are ineffective as well too high a leads to leak of capital and production abroad, because it leads to a rise in price of exports. Therefor, we have listed the options of tax policy, the types of carbon tax, the tax base and categories of taxpayers in the table 1.

Table 1. Types of carbon tax policy, tax base and categories of taxpayers

| Types of carbon tax | Tax base | Tax breaks | Preferential category | Categories of taxpayers | |

| A tax on carbon emissions from stationary sources | The volume of CO2 emissions | Adjustment on factor of carbon sequestration in region | No preferential categories, but the tax is reduced by increasing the absorption | All companies that produce emissions | |

| Tax on fuel oil for transport | The volume of fuel (with purchase) | Returns the value of the cost of average amount of fuel used per month by average user in the region | Unemployed, poor, privileged categories of the population, budgetary institutions | The middle class and above, individuals and legal entities, organizations and institutions | |

| Tax on fossil fuels (coal, oil, firewood) for households | The volume of fuel (with purchase) | Subsidies to households | Unemployed, poor, privileged categories of the population | The middle class and above | |

So, Environmental Tax must become the main fiscal lever to decrease the burden on the environment. Appropriately, the introduction of ecological tax for the use and damage of natural resources will lead in the certain increase in the cost of products. However, it will be compensated by updating of natural environment and liquidation of unhealthy for man chemical contamination of foods and other dangerous changes of environment.

The Ukrainian legislation and environmental tax policy need future improvement, especially if to take into attention the requirements of European Union and fight for climate stabilizing. The ways to reduce CO2 emissions are the increase Carbon Tax rate and develop forestry, because forests are the natural sinks of carbon dioxide. With effective tax management one can reducing both pollution and the costs of the tax system.

“Special Prize” of the third round of MindSketch, monthly competition of essays conducted by the policy analysis platform VoxUkraine

Notes

[1] Stern N. Review on the economics of climate change.

[2] Eurostat 2012. Environmental tax revenues – % of GDP.

[3] Energy Strategy of Ukraine till 2030

[4] Veklych О.О., Maslyukivska О.P. 2008. “Estimating the fiscal tax potential for carbon dioxide provided that base and tax rate are changed.” Finances of Ukraine. 6. 63-69.

[5] Maslyukivska O. P. “European Experience of eco-tax reform in the industry, forecasts for Ukraine” Scientific Bulletin of the Uzhgorod University. 2009. – Economy Series, Special Issue 28-1, 164-170.

[6] Tax Code of Ukraine. 2011.

[7] The Swedish Environmental Code. 1999

[8] National Center for Environmental Economics

[9] Energy Policies of IEA Countries. The United States. 2014 Review

[10] National Cadastre of antropogenic emissions from sources and absorption of greenhouse gases absorbers in Ukraine in 1990-2012.

[11] National Inventory Report 2012 Sweden.

[12] Krauthammer Charles (2015) Raise the gas tax. A lot. The Washington post.

[13] Don Fullerton, Andrew Leicester, Stephen Smith. “Environmental Taxes ” Dimensions of Tax Design. Ed. Institute for Fiscal Studies (IFS). Oxford: Oxford University Press, 2010. (DOI): 10.3386/w14197

14. European Commission. 2011. Taxation trends in the European Union. Data for the EU Member States Iceland and Norway. Luxembourg: Office for official Publications of the European Union.

15. World Data Bank. 2014. World Development Indicators.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations