VoxUkraine has been regularly calculating the pace of economic reforms in Ukraine. Quarterly reviews show a “bird’s eye panorama” of what has happened in the previous three months. We present another quarterly review of reforms: for the second quarter of 2018. Links to the previous reviews: 2017-Q2, 2017-Q3, 2017-Q4, 2018-Q1.

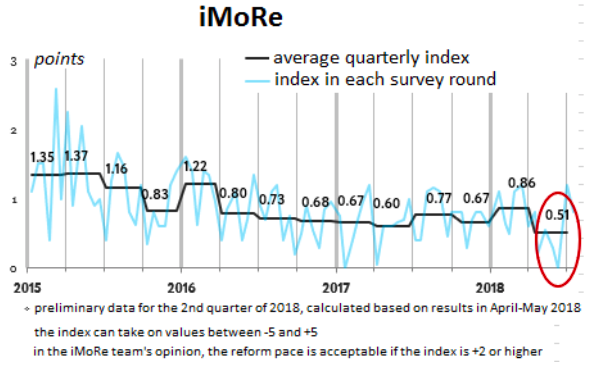

The second quarter of 2018 was marked by a considerable slowdown of reforms; the average value of Reform Index went down to +0.5 points, the lowest level since the beginning of 2015. In the preceding quarter, the Reform Index value was +0.9 (within a range from -5.0 to +5.0).

Diagram 1.

Briefly: Trends

In the 2nd quarter, 17 normative acts of a reformist nature (according to the experts) were adopted. The average Reform Index score of these laws and resolutions was +1.3 points (in the preceding quarter, 19 normative acts were passed; their average score was +1.5).

In the quarter under review, two important laws were adopted: “On the High Anti-Corruption Court” and “On Currency and Currency Transactions”; nevertheless, the quarter’s score is low. There were but a few other reformist “steps” and they had little impact, receiving a low Reform Index score.

Reform initiators

Most important changes. The laws “On the High Anti-Corruption Court” (Reform Index# 87) and “On Currency and Currency Transactions” (Reform Index# 88), each of which received +5.0 points from the experts, were initiated by the President. (5.0 was the sum of points for two aspects of each law; hence the potential maximum was +10.0 points).

It should be added, however, that the law on the Anti-Corruption Court was adopted within the framework of cooperation with international financial organizations. Pursuant to the Ukraine-IMF memorandum, the law should have been submitted to the Verkhovna Rada before April and approved before mid-June 2017. The passing of the law was delayed for a long time, until that procrastination began to endanger Ukraine’s cooperation with the IMF.

While the law on currency and currency transactions was submitted to the Parliament by the President, it had been drafted by the NBU, which at present is not entitled to propose legislative initiatives.

The most productive entity. The National Bank issued 7 resolutions that were subject to Reform Index assessment in the 2nd (Reform Index#82, 84, 87, 88). The average score of the NBU’s resolutions was +0.9 points. In the preceding quarter, it issued 3 resolutions and their average score was +1.3.

Anti-reformer. In the second quarter, the Cabinet of Ministers implemented an anti-reform, issuing a resolution on a list of services of general economic interest. Enterprises providing such services will be entitled to receive state support without securing approval from the Antimonopoly Committee (Reform Index#86). There is, however, a positive aspect to that list: it was created and presented in a single document and a range of services specified in it can be provided on a commercial basis without state support.

The Government also initiated 6 progressive changes to the legislation (average score: +0.6 points). In particular, the use of stamps at retail trade enterprises selling alcoholic beverages and oil products was cancelled (Reform Index#82); the procedure for granting subsidies (Reform Index#84) as well as that for consideration of complaints in connection with state registration of enterprises (Reform Index#83) were altered. In the preceding quarter, 13 normative acts initiated by the Government were adopted; their average score was +1.3 points.

Unproductive Rada. Only one reformist law initiated by the MPs was passed. It pertains to the decentralization sphere, establishing the rules for voluntary accession of territorial communities to cities of oblast subordination (Reform Index#84). In the previous quarter, 10 normative acts initiated by MPs were passed; their average score was +1.8 points.

Only one reformist law initiated by the MPs was passed. It pertains to the decentralization sphere, establishing the rules for voluntary accession of territorial communities to cities of oblast subordination. In the previous quarter, 10 normative acts initiated by MPs were passed; their average score was +1.8 points.

TOP-3 reform directions in the second quarter

The banking sector

The construction of a stable and transparent banking system requires the introduction of modern risk-oriented approaches in bank management as well as in supervision of bank activities. To that end, NBU strategy provides for the banks’ transfer to FINREP/COREP standards and a unified digital accounting standard as well as harmonization of prudential requirements for banks with the EU legislative provisions and Basel Committee recommendations. All these international standards and recommendations are aimed at enhancing the financial strength of the banks and the banking system as a whole as well as at increasing their risk management capacity.

The National Bank has been introducing these standards in a gradual manner. In particular, new rules for evaluating a bank’s risk management system were enacted in the quarter under review. The changes pertain to the format of banks’ risk management accounting in the sphere of financial monitoring, the reporting frequencies, and the auditing procedure.

There will be a change in the approaches to bank audit planning, in keeping with the European Banking Authority’s Guidelines on Common Procedures and Methodologies for the Supervisory Review and Evaluation Process (SREP). From now on, the frequency of the regulator’s inspection visits will depend on the size of a bank and the risks it faces.

The activities of the banks will become more transparent. Due to the introduction of international standards, the banks will annually compile and publish their management reports. These reports must contain information characterizing the bank’s financial situation, the results of its operations, and the prospects for its development as well as the main risks and uncertainties that might jeopardize its viability in the future.

The activities of the banks will become more transparent. Due to the introduction of international standards, the banks will annually compile and publish their management reports. These reports must contain information characterizing the bank’s financial situation, the results of its operations, and the prospects for its development as well as the main risks and uncertainties that might jeopardize its viability in the future.

Business and currency regulation

The Law “On Currency and Currency Transactions” is one of the key reform events of the 2nd quarter of 2018. According to Reform Index experts’ estimates, this law essentially improves the regulatory environment for doing business.

The European Union’s currency regulation regime is based on the EU’s principles for regulating capital flows specified in the European Community’s Council Directive 88/361/EEC of June 24, 1988. Under the EU-Ukraine Association Agreement, Ukraine committed itself to implementing these principles in its legislation.

Ukraine’s previous currency regulation regime was at odds with these principles. It was cumbersome and complicated and created barriers to doing business in Ukraine and to attracting foreign investment. It was based on Cabinet of Ministers Decree dating back to 1993 “On the System of Currency Regulation and Currency Control” and was adjusted every now and then through amendments to the legislation that did not alter its underlying principles.

The Law “On Currency and Currency Transactions” No. 2473-VIII of June 21, 2018, creates conditions for building a currency regulation system based on the European principles, currency market liberalization, and Ukraine’s integration in the world financial markets.

It defines the philosophy behind currency regulation. However, the implementation of its principles will depend on the NBU. The National Bank will establish or lift restrictions on foreign exchange operations or capital flows, determine the limits on foreign economic operations, regulate the issuance of permits for currency transactions, etc. It will also determine whether banks will be able to offer currency transfers between accounts to their clients, open hryvnia accounts for non-residents, buy foreign securities, or provide loans to companies from other countries.

The law also cancels a number of archaic norms. In particular, the abolished norms include those requiring mandatory monitoring of small-scale export-import operations (the current limit set by the law on financial monitoring is 150,000 UAH); this frees the banking sector from excessive bureaucratic load. The penalties for exceeding contract completion dates for export-import operations have been essentially alleviated, thus reducing opportunities for corruption.

In particular, the abolished norms include those requiring mandatory monitoring of small-scale export-import operations (the current limit set by the law on financial monitoring is 150,000 UAH); this frees the banking sector from excessive bureaucratic load. The penalties for exceeding contract completion dates for export-import operations have been essentially alleviated, thus reducing opportunities for corruption.

Combating corruption

Reforms in the anti-corruption sphere consist of two key components: reduction of corruption opportunities and creation of an effective system of punishment for acts of corruption.

Essential game rule changes aimed at reducing opportunities for corruption were taking place in 2015-2016. In particular this included the implementation of the public e-procurement system ProZorro, the simplification of a number of regulatory and authorization procedures, the launching of electronic services and the opening of registers.

The authorities began to build an efficient system of punishment for acts of corruption at the end of 2014, when laws were adopted on the creation of the National Anti-Corruption Bureau (NABU) and the Specialized Anti-Corruption Prosecutor’s Office (SAP). This provided opportunities for investigating cases against top corrupt officials and for presenting these cases in courts. However, corruption-related cases often “get stuck” in courts.

The judicial reform, which provides for a change of the judicial system and a renewal of the courts, is a lengthy process. Therefore, to ensure fair consideration of corruption-related cases at present, without waiting for the completion of the reform of the entire judicial system, a High Anti-Corruption Court has to be created.

The law “On the Judiciary and the Status of Judges”, which was approved in June 2016, set out the key principles for its formation. However, the creation of the High Anti-Corruption Court required a separate law, one which would define the key principles for the formation of the court’s composition and for its operation. After a heated debate on issues related to competitive selection of judges, a compromise version of the law was adopted.

Law No. 2447-VIII of June 7, 2018, regulates the most problematic issues: unrealistic requirements regarding candidate judges have been removed; the key role of international experts and their participation in the judges selection process have been enshrined; the court’s jurisdiction has been narrowed to top corruption cases investigated by NABU; and the judges have been provided with guarantees of financial independence and personal security.

A number of controversial provisions remained in the document, allowing some corruption suspects to avoid their cases being heard by the Appellate Chamber of the High Anti-Corruption Court; this caused an uproar in civil society. However, in August these problems were resolved through amendments to the law on the judiciary and the status of judges.

At the end of June the President signed the law on the creation of the Anti-Corruption Court, enabling the launching of the judges selection process. The court will be formed within the next 12 months; its operation can start once 35 judges have been appointed.

The adoption of the laws on the Anti-Corruption Court has actually completed, in legislative terms, the creation of the country’s anti-corruption structure: NABU – Anti-Corruption Prosecutor’s Office – Anti-Corruption Court. In the words of Giorgi Vashadze, advisor to the President of Ukraine, this will be a precedent for the entire region, including Georgia, Moldova and other post-Soviet states.

Conclusions

The laws on currency translations and on the Anti-Corruption Court create new opportunities for the development of the country’s economy. However, the results will depend on whether these laws are effectively enforced.

After some recovery in the 1st quarter of 2018, Reform Index continues to indicate a trend for a reform slowdown. In the near future, the index may go further down on account of the start of the election campaign.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations