There are numerous compelling reasons to oppose the unprovoked armed invasion of a democracy by a dictatorship. Russia’s violation of Ukraine’s sovereignty is akin to the German and Japanese invasions of their neighbours in the 1930s that ultimately led to WWII. Like those 1930s aggressors, Russia is engaging in widespread indiscriminate bombings and massacres. As a result, any Russian success puts democracies everywhere at risk. The invasion of Ukraine has also seriously disrupted the global economy, contributing to the largest inflation surge in 40 years and threatening widespread recession.

In this column, we focus on the risks posed by the Russian invasion to the complex web of arrangements that comprise our global financial system. Financial stability is a public good that rests on confidence in the global security framework. At the most basic level, households and businesses have an incentive to run out of any jurisdiction that is perceived as vulnerable to an attack of any kind.

As we all know, finance supports real economic activity. It gives us the ability to shift resources over time, to channel savings where the benefits are greatest, and to allocate risk to those best able to bear it. Doing this efficiently requires an elaborate infrastructure built on institutions and markets, as well as widely accepted rules that establish trust. A well-functioning financial system is necessary to support global trade and investment. Yet, the financial system is vulnerable precisely because it has so many positive spillovers: no jurisdiction can secure all the benefits, so no one has an incentive to make all the costly investments that are necessary to protect it.

By violating the most fundamental international norms, military aggression like Russia’s can trigger an immediate loss of trust in financial instruments, markets, and institutions. When people lose trust in finance, we know what happens. They run. If the problem is with a single bank, it is possible to contain the damage. But when the threat extends to a country or a region of the world, large swaths of the financial system can fall victim to a loss of trust.

This creates an obvious connection between the conflict in the Ukraine and global financial stability. Starting with its nearby neighbours, a Russian victory poses an immediate security threat to countries in eastern and central Europe. This, in turn, creates a risk of runs that would damage that region’s financial system.

But would the impact of a Russian victory on finance stop there? The danger is that investors’ concerns will soon spread to include the countries of Western Europe. A Russian victory could also intensify worries about a potential invasion of Taiwan by China, fuelling security concerns elsewhere in Asia and the Pacific. While we are cautious about relying on domino theories, history teaches us that a loss of confidence can occur very quickly and can spread far beyond the locus of any military conflict.

Consider, for example, the experience of the US at the onset of the WWI. The isolationist nation was famously distant from the conflict ‘over there’. Nevertheless, to quote from William Silber’s brilliant 2007 book, “[t]he Great War threatened the United States with financial disaster” (Silber 2007). To counter that threat, the New York Stock Exchange (NYSE) closed for more than four months from 31 July 1914 to 12 December 1914. (Keep in mind that the US did not enter the war until April 1917, nearly three years later.)

Why did then-Secretary of the Treasury William Gibbs McAdoo work to shut down the NYSE? With Europe needing to fund the war, the United States faced a potential ‘sudden stop’ of finance from abroad in the form of a fire sale of US securities by Europeans (Cecchetti and Schoenholtz 2018a). As Silber explains, unrestrained outflows of the gold proceeds from these sales could even endanger the US ability to repay foreign debts. By temporarily stemming the ‘run’ on Wall Street, the US bought time for an expansion of agricultural exports that helped balance European capital flight when the NYSE reopened. (The US merchandise trade surplus surged from just over 1% of GNP in 1914 to more than 5% of GNP in 1917.)

Could a comparable scenario play out today? If governments come to expect a Russian victory, would they rush to rearm? Might authorities in countries that feel threatened sell liquid assets held in distant foreign lands and use the proceeds to buy weapons? If so, the impact could be widespread and immediate.

To see it, we need look no further than the US Treasury market – the worlds’ most liquid securities market that sets the risk-free benchmark for dollar instruments and in which foreign official entities are among the largest participants. Indeed, we recently witnessed a disruptive foreign dash for cash at the onset of the pandemic panic in March 2020. Recognising that a dysfunctional Treasury market would spread financial chaos globally, the Federal Reserve intervened massively to steady the market.

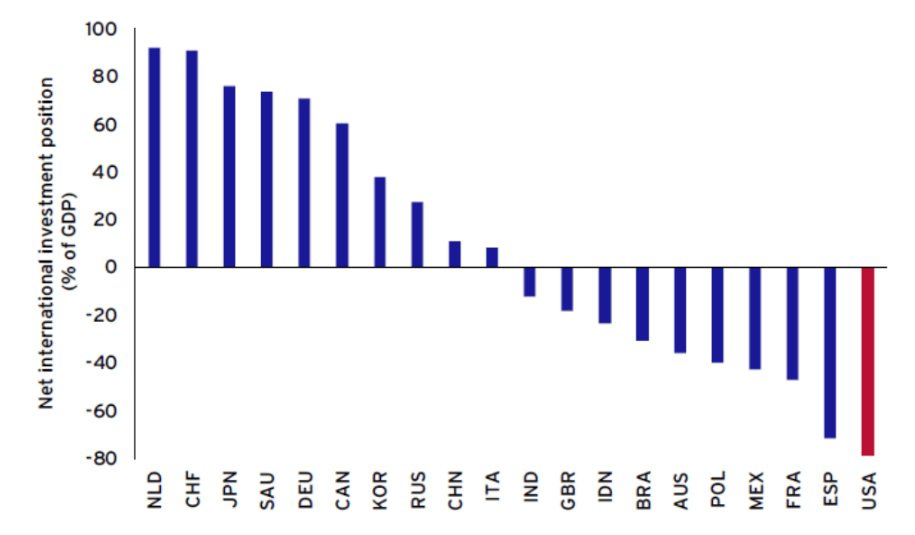

One way to assess the spillover risks that might come from a rush to rearm is to look at cross-border holdings of assets. The net international investment position (NIIP) of a country is a way to summarise its external balance sheet: the NIIP is the excess of assets held abroad by domestic residents over their liabilities to foreigners. For the world’s 20 largest economies, Figure 1 ranks the NIIP (as a percent of GDP) from the largest surplus to the largest deficit. Those with big NIIP deficits (on the right) are probably at greater risk, as are those with highly liquid assets that are widely held.

Unsurprisingly, the US (red bar) tops both these vulnerability rankings. Its NIIP shortfall is nearly $17 trillion. Of that, more than $7 trillion is in US Treasury securities. And, of that total, more than $4 trillion is held by official entities. To be sure, the Federal Reserve has well-developed facilities to provide dollars rapidly to foreign central banks both through long-established swap lines and through the newer foreign and international monetary authorities (FIMA) repo facility. Many central banks have similar arrangements. Nevertheless, it is impossible to know whether these facilities, together with policymakers’ discretionary actions, would prove sufficient to stabilize global financial markets in the event of sudden, vast cross-border capital flows.

FIGURE 1 NET INTERNATIONAL INVESTMENT POSITION, 2021 (PERCENT OF GDP)

Source: Milesi-Ferretti (2022).

To conclude, there are numerous channels through which a successful Russian invasion of Ukraine puts global financial stability at risk. We have discussed just two: the loss of trust in a range of countries that could trigger widespread runs; and sudden pressures to rearm that could fuel fire sales even in the safest, most liquid financial markets. Unfortunately, these are not the only possibilities. There are plenty of other nightmare scenarios. For example, we can envision an escalated fear of cyberattacks (Cecchetti and Schoenholtz 2018b) that weakens confidence in the central clearing parties (Cecchetti and Schoenholtz 2017) that are vital to global payments.

The bottom line is clear: it is imperative to help Ukraine expel the invaders. Any Russian success not only threatens democracy everywhere, but also undermines global financial stability as well. By fuelling the fragmentation of the world into security zones and increasing the focus on national defence, the attack on Ukraine threatens the international economic integration over the past 50 years that the global financial system made possible, and that still benefits billions of people.

References

Balke, N and R J Gordon (1986), “Appendix B: Historical Data” in R J Gordon (ed.), The American Business Cycle: Continuity and Change, University of Chicago Press for NBER.

Barone, A C, A Copeland, C Kavoussi, F Keane, and S Searls (2022), “The Global Dash for Cash in March 2020,” Liberty Street Economics, 12 July.

Cecchetti, S G and K L Schoenholtz (2017), “Resolution Regimes for Central Clearing Parties,” www.moneyandbanking.com, 9 October.

Cecchetti, S G and K L Schoenholtz (2018a), Sudden Stops: A Primer on Balance-of-Payments Crises,” www.moneyandbanking.com, 25 June.

Cecchetti, S G and K L Schoenholtz (2018b), “Cyber Instability,” www.moneyandbanking. com, 16 July.

Milesi-Ferretti, G M (2020), “The external wealth of nations database,” The Hutchins Center on Fiscal and Monetary Policy at Brookings, 15 December.

Silber, W L (2007) When Washington Shut Down Wall Street: The Great Financial Crisis of 1914 and the Origins of America’s Monetary Supremacy, Princeton University Press.

Vissing-Jorgenson, A (2021), “The Treasury Market in Spring 2020 and the Response of the Federal Reserve,” NBER Working Paper No. 29128. United States Department of Commerce (1975), Historical Statistics of the United States, Colonial Times to 1970, US Government Printing Office.

United States Department of the Treasury, Board of Governors of the Federal Reserve System, Federal Reserve Bank of New York, US Securities and Exchange Commission, and US Commodity Futures Trading Commission (2021), Recent Disruptions and Potential Reforms in the U.S. Treasury Market: A Staff Progress Report, 8 November.

#helpUkraine_helptheWorld

This publication is a part of a collection of essays initiated by the National Bank of Ukraine. Famous economists, political scientists and historians, experts recognized in the world, volunteered to share their thoughts and arguments on why helping Ukraine is helping the world. The complete book of essays can be found via the link.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations