What financial system can facilitate Ukraine’s post-war recovery and development? A new report provides a clear answer: an effective, competitive and widely trusted financial system that lives up to recognised standards of integrity, is compliant with the EU accession process, and assumes a recognised role in Europe’s banking and capital market unions. The team of authors, which combines leading Ukrainian economists with experts from CEPR’s Research Policy Network on European financial architecture, stress that a well-designed financial sector – the whole of banks, capital markets, insurance, mortgages, financial regulation and supervision – can play a catalytic role in Ukraine’s reconstruction. Preparing for EU accession can help to steer that process and build confidence among investors and the public, at home and in the international community.

Discussions about the post-war reconstruction of Ukraine inevitably start with observing the huge physical damage inflicted in the course of the Russian invasion, and the consequent need for the rebuilding of hospitals, housing, schools, and other essential infrastructure. But this tragedy also gives Ukraine an opportunity to build back better, to modernise the country along many dimensions, and to be ready to withstand possible further Russian aggression and become an important element of the NATO security system (Becker et al. 2023, Gorodnichenko and Rashkovan 2022, Gorodnichenko et al. 2023).

To this end, ravaged by war as it is, Ukraine will need massive support from its allies. The key policy question is how to ensure first, that resources become available in sufficient volume, and second, that they go to the best uses and foster sustainable development of the country. As we argue in a new report (Carletti et al. 2024), both aspects are deeply dependent on the existence of a widely trusted and visibly effective financial system. The emerging financial system in Ukraine is supposed to function well at two levels: channelling investible funds; and establishing good governance by screening and monitoring projects across the country.

In thinking about Ukraine’s future, there is a clear precedent in the provision of large-scale aid from the US to Europe after WWII. The European Recovery Program or Marshall Plan of 1947 is often held up as the ‘gold standard’ for the economic reconstruction of areas in the wake of political, military, or economic devastation because it stood at the beginning of an era of unprecedented growth coupled with political stability. To be clear, the Marshall Plan was not just about the transfer of money, but rather about institutional reforms such as establishing deep connections linking national economies to their neighbours and to the world, and helping to create an effective financial system domestically.

In the three-quarters of a century since the launch of the Marshall Plan, the world has accumulated a rich experience of reconstruction and development efforts. History is littered with failed attempts to impose designs and manage domestic processes, but also impressive examples of collaborations that have fuelled rapid recovery. The successes point to the need for strong recipient country ownership of donor coordination and application of core governance standards along with environmental, social and procurement standards. Ukraine’s reconstruction and modernisation offer rich opportunities to put these lessons to use and ensure that the country’s transition to an advanced European economy goes as quickly and smoothly as possible.

Consistent with this view, German Chancellor Olaf Scholz declared at the June 2022 G7 summit at Schloss Elmau, Germany, that there was a consensus that a new Marshall Plan was needed. In a similar spirit, the G7’s first major international conference on the “Recovery, Reconstruction and Modernisation of Ukraine” in October 2022 underscored the role that institutions play in governing and coordinating recovery and reconstruction, as well as the need to establish a recovery framework that emphasises cross-border linkages and a deepening relationship of Ukraine with the EU, with membership as one stage in that process (G7 Germany 2022).

These aspirations will require large investment. Funds will partly be drawn in from public sources, national and international. Some foreign public capital will come from international institutions and sources such as the European Bank for Reconstruction and Development (EBRD), the European Investment Bank (EIB), and the World Bank. But a large part of the required funds will have to be mobilised from private sources abroad. Furthermore, such a mobilisation will not be possible without mobilising domestic savings.

This report makes a series of proposals on reforms and policies necessary to achieve these goals. We stress that a well-designed financial sector – the whole of banks, capital markets, insurance, mortgages, financial regulation, and supervision – can play a catalytic role in Ukraine’s reconstruction and development. We also show how preparing for EU accession can help to steer that process and build confidence among investors and the public.

What financial system can facilitate recovery and development? The answer is clear to us: an effective, competitive, widely trusted financial system, living up to recognised standards of integrity, compliant with the EU accession process, and assuming a recognised role in Europe’s banking and capital market unions.

What strategic steps are necessary to deliver this longer-term vision?

Principle #1: Ukraine’s institutional framework for banking and financial markets should be aligned with that of the euro area and the EU’s Banking Union, in particular with regard to financial legislation and supervisory practice

To access global capital and to converge with the rest of Europe, Ukraine has to integrate its financial system into European markets and institutions. This does not mean that Ukraine should copy everything from the euro area’s regulatory framework right away. But to integrate fully into the euro area’s banking and capital markets and thus tap into vast resources and experiences, Ukraine will need to adopt the euro area playbook.

For example, on its transition to EU accession, Ukraine could and should sign a formal agreement with the EU’s Single Supervisory Mechanism to help align supervisory standards and practices with those commonly applied inside the EU.

In a similar spirit, aligning enforcement for transparency and reporting (e.g. the International Financial Reporting Standards, the International Sustainability Standards Board, and the European Securities and Markets Authority) should facilitate more the access, at least for large Ukrainian firms, to capital markets outside the country (e.g. Frankfurt, London, Paris, and Warsaw), thereby unlocking potentially significant investments and strengthening their governance.

The same logic suggests that the resilience and international recognition of the mortgage lending market in Ukraine can be supported by introducing collateral rules in line with international practice, for example limiting the ratio of loan-to value and debt-to-income service, and strengthening the role of covered bonds and specialised lending institutions, such as savings and loans associations.

Finally, by making the institutional framework compatible with the EU, Ukraine should facilitate the entry of foreign banks and other financial firms, thus deepening domestic capital markets further and boosting competition.

Principle #2: Financial sector effectiveness can be significantly improved by creating recognised and catalytic institutions that are capable of coordinating international donors and investors, as well as integrating foreign capital markets and domestic financial institutions

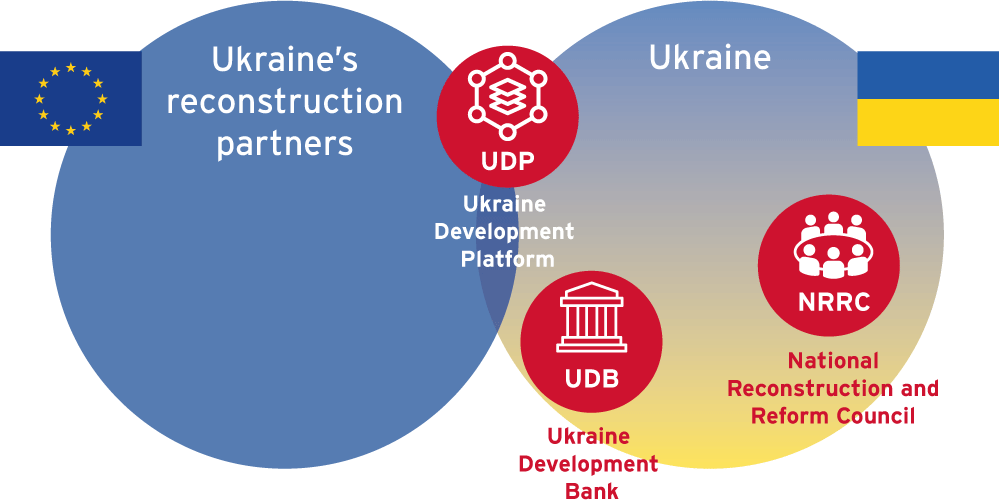

We suggest establishing three institutions, partly based on existing institutions, in order to strengthen and widen Ukrainian ownership of the reconstruction and reform process.

First, a National Reconstruction and Reform Council (NRRC) should be established that develops and communicates a broadly shared vision for reconstruction, strives for agreement on the reform agenda and monitors its implementation.

Second, a Ukraine Development Bank (UDB) could leverage the capacity of existing banks in the country’s reconstruction and ambition to build back better. The UDB would raise capital in the markets to finance programmes (e.g. machinery, energy, housing) by entering into co-financing deals with existing banks, thereby leveraging their ability to invest. Moreover, the UDB would lend to sub-sovereign entities carrying out infrastructure projects (roads, rails, reconstruction). The UDB is envisioned as an institution co-owned by national and multilateral development banks, to ensure world- class practices as well as access to cheaper capital in international markets.

Third, a Ukraine Development Platform (UDP) would be a multilateral venture, with strong Ukraine ownership, that is dedicated to strategic planning and donor coordination relating to the reconstruction effort during and after the war. The government would put projects on the platform for multilateral and bilateral development banks to explore how they could collaborate. The UDP would also promote core standards to be applied to projects and encourage development institutions to come together in financing individual projects.

Together, the UDB and the UDP should be capable of facilitating Ukrainian banks’ access to international capital flows, while the NRRC would help to ensure a broad consensus within Ukrainian society for the reform agenda.

Figure 1. Proposed architecture: new institutions for financing recovery

Principle #3: Reforms of the financial sector should seek to resolve post-war legacies and deliver a market-based allocation of capital

There is a clear need to recapitalise banks and compensate for losses caused by war- related non-performing loans. To the same end, war insurance and various public–private partnerships are needed to de-risk investment and credit in a country that is likely to continue to live in the shadow of potential Russian aggression.

To support the achievement of a market-based allocation of capital, the government should privatise state-owned banks by selling stakes to investors and other banks, aiming for a diverse and competitive, (largely) privately owned domestic banking landscape, with somewhat limited roles for institutions remaining under state ownership.

Principle #4: Financial development should be supported by broader reforms of corporate governance, the rule of law, pension systems, etc. – and by a favourable macroeconomic environment

Over the last decade, Ukraine has made great strides in strengthening its macroeconomic framework and banking sector, but these achievements must now be supplemented by wider governance reforms. In a nutshell, reforms of the financial sector are unlikely to yield sustainable benefits if the rest of the country suffers from corruption, if households have few incentives to save, if investors cannot protect their projects from expropriation, if markets are closed to competition and if oligarchs control much of the economy.

Because broader reforms are essential for EU accession, we can hope that the determination of Ukraine to join should provide a sufficiently strong institutional anchor that motivates them.

Principle #5: Faith in the long-term success of Ukraine

We would like to flag the final key ingredient: faith. We see the prospect of Ukraine as a free, democratic and prosperous country and a full EU member as a faith-breeding promise in the sense of Gerschenkron (1962). We hope that others share our faith in the long-term success of Ukraine, not only for the sake of the brave Ukrainians who defend their homes and freedoms but also for anybody who believes in the free world.

References

- Becker, T, B Eichengreen, Y Gorodnichenko, S Guriev, S Johnson, T Mylovanov, M Obstfeld, K Rogoff, I Sologoub and B Weder Di Mauro (2023), Post-war Macroeconomic Framework for Ukraine, CEPR Press.

- Carletti, E, Y Gorodnichenko, H James, J-P Krahnen, V Rashkovan, A Rodnyansky and I Sologoub (2024), Ukraine’s Reconstruction: Policy Options for Building an Effective Financial Architecture, CEPR Press.

- G7 Germany (2022), International Expert Conference on the Recovery, Reconstruction and Modernisation of Ukraine, Conference Report.

- Gerschenkron, A (1962), Economic Backwardness in Historical Perspective: A Book Of Essays, Belknap Press of Harvard University Press.

- Gorodnichenko, Y, and V Rashkovan (eds) (2023), Supporting Ukraine: More critical than ever, CEPR Press.

- Gorodnichenko, Y, I Sologoub and B Weder Di Mauro (eds) (2022), Rebuilding Ukraine: Principles and Policies, CEPR Press.

Authors: Elena Carletti, Yuriy Gorodnichenko, Harold James, Jan-Pieter Krahnen, Vladyslav Rashkovan, Alexander Rodnyansky, Ilona Sologoub

Firstly published at CEPR

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations