Recently, the head of the Verkhovna Rada Banking Committee Serhiy Rybalka wrote a column on the deplorable results of the bank purge conducted by the National Bank, which led to a reduction in the number of bank branches in Ukraine. Rybalka believes that this makes banking services less accessible to the population.

For its analysis, VoxCheck used the most consequential quote from the text and found signs of manipulation in it:

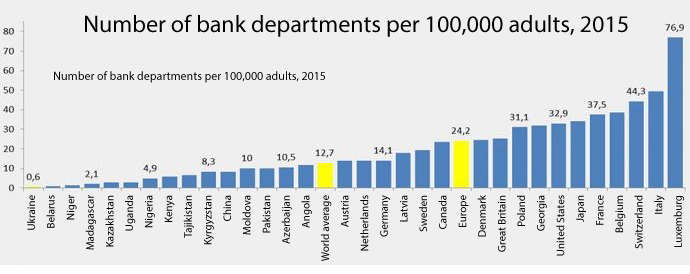

“Within three years, the network of bank branches shrunk from 19,300 at the beginning of 2014 to 10,300 at the beginning of 2017. This resulted in a deterioration of the most important indicator of banking services accessibility – the number of bank branches per 100,000 persons. Ukraine is ranked lowest on this indicator by the World Bank. All developed countries producing a high GDP have a multi-branch banking network; and the quantity indicator of bank departments per 100,000 adults is above the world average (12.7). The situation just continues to deteriorate. In the first quarter of 2017 alone, 321 bank branches were closed down. Lower competition is yet another result of the NBU’s actions (aimed at purging the banking sector – note by VoxCheck).

Most of the data quoted by Serhiy Rybalka is correct. The only incorrect statistics concern the decrease in the number of bank departments in the 1st quarter of 2017: the right figure is 305, not 321. Besides, the World Bank’s methodology itself, which in this case makes use of IMF data, is debatable. Calculation of the total number of bank departments in Ukraine based on the WB’s indicator (0.6 departments per 100,000 adults) and on the fact that there were 34,900,000 adults (aged 18+) in Ukraine in 2015 results in there being only 209 bank departments in Ukraine. If 321 departments had already been closed down in 2017, as claimed by the MP, the number of departments would have become negative.

In reality, how many bank branches per 100,000 persons are there in Ukraine? According to NBU data, there were 15,082 branches in Ukraine in 2015. This amounts to 43.2 branches per 100,000 persons, not 0.6; the actual figure is nearly twice the European average. Remarkably, the situation was much the same in 2013, according to the Independent Association of Ukrainian Banks.

Anyway, MP Rybalka presents an incomplete picture of trends in the banking sector. This is what the manipulation consists of. The MP fails to mention at least three other factors behind the decrease in the number of branches:

- The decrease in the number of actual departments on account of high maintenance cost and switch to online banking. “Traditional branches are no longer necessary,” PwC analysts say in their report Retail Banking 2020 Evolution or Revolution? (page11). “Given their high-fixed cost, branches will need to become dramatically more productive, or significantly less costly.” In heavily banked markets such as the US, according to the PwC forecast, there will be at least 20% fewer branches by 2020 and that trend will continue to accelerate.

- The war in the East and annexation of the Crimea, where Ukrainian banks lost more than 1,000 branches.

- The decrease in the number of “live” banks on account of the global economic crisis that began back in 2009.

At the same time, against the backdrop of the rapid spread of electronic services, there has been an upsurge in the discussion of the impact of the number of banking branches on bank services accessibility which was mentioned by the MP. For example, the study Do Bank Branches Still Matter? The Effect of Closings on Local Economic Outcomes (Nguyen, 2014) demonstrates that the closing of branches has an adverse effect on small business crediting in the affected regions. Another study (Talavera, Tho Pham, 2016) shows that in reality the number of banking branches is not the best indicator of credit accessibility. Therefore, the dependence between the number of branches and the accessibility of banking services is a subject for debate. VoxUkraine’s article Deenergized Networks (Ostapchuk, 2016) reveals a relationship between internetization of society, higher public welfare, and the decrease in the number of branches.

At any rate, the decrease in the number of branches in Ukraine does not necessarily result from the National Bank’s actions, even though the banks did lose more than 4,500 branches as a consequence of the market purge. On the whole, the decrease in the number of branches does not inevitably lead to a negative outcome.

Update. After the publication of this article, VoxCheck found Ukrainian Postal Service (Ukrposhta) data indicating that bank services are accessible to 65% of the Ukrainian population, while the network of banking branches is available in a mere 6% of the populated localities. That is, 35% of the population of Ukraine face the problem of banking services accessibility.

Main photo: depositphotos.com / 3dfoto

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations