Stress testing a bank is like giving a car a check-up before a long trip. You check the brakes, tire pressure, and oil level not because something has already broken, but to make sure the car can handle the road even under tough conditions. It is the same with banks. A stress test examines how a financial institution would behave if the economy took an unexpected turn, for example, if the hryvnia sharply devalued, unemployment rose, demand for loans dropped, or clients began withdrawing deposits en masse.

The National Bank of Ukraine does not wait for a crisis to “put out the fire” – it assesses banks’ financial resilience in advance. The evaluation includes an analysis of their operations, financial indicators, and asset quality. For the largest banks, stress testing is also conducted. This is one of the tools for assessing stability, allowing regulators to model how a bank would function in a hypothetical crisis and determine whether it has enough capital to avoid insolvency. This makes it possible to identify weaknesses early, prevent defaults, avoid panic, and protect depositors from losses.

In Ukraine, the practice of stress testing emerged after the 2008-2009 financial crisis and gradually became a key tool of banking supervision. At first, these were isolated initiatives, but starting in 2015 – under the pressure of crisis and as part of cooperation with the IMF – the practice became more structured and integrated into the banking oversight process. Stress testing is not carried out every year and is not mandatory for all banks. However, it is required for banks deemed systemically important, as their activities significantly impact the stability of the entire banking system, given their substantial holdings of deposits, loans, and public trust. At present, the NBU recognizes 16 banks as systemically important; together, they account for over 90% of net assets and nearly 90% of household deposits.

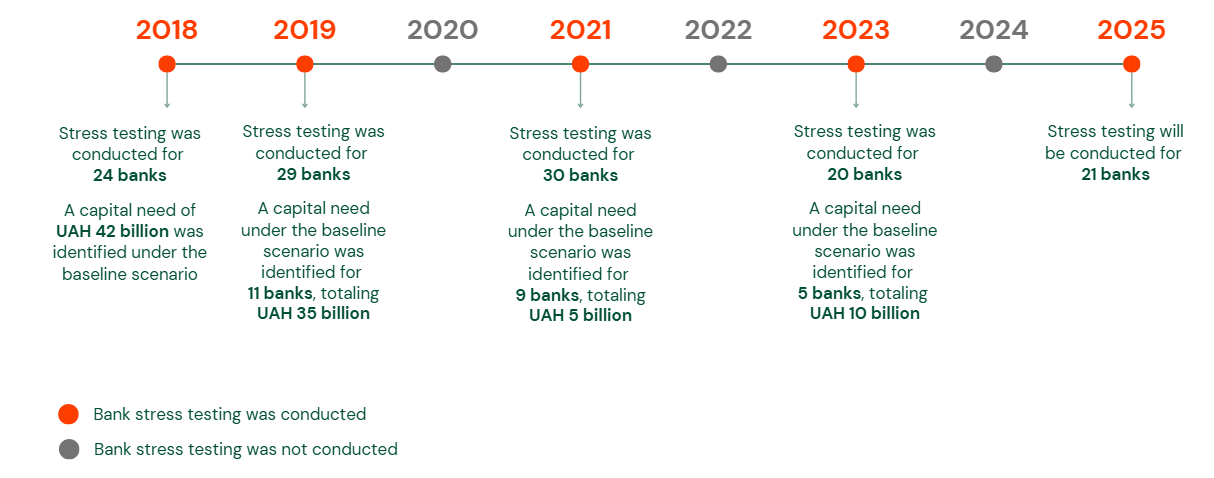

Regular annual testing was introduced in 2018, after which the results became available to the general public. Since then, the approaches to stress testing have been continuously refined to reflect the realities of the pandemic and the full-scale war.

In 2025, 21 banks will undergo stress testing (together, they account for over 90% of the entire banking system’s assets). Among them are PrivatBank, Oschadbank, Raiffeisen Bank, Ukreximbank, Ukrgasbank, PUMB, Universal Bank, and other well-known institutions (see Figure 1). Undergoing a stress test is not a punishment for a bank, but rather preparation for a possible crisis. If a bank fails the adverse scenario, it does not shut down. It simply needs to develop an action plan – how to restore capital, restructure risks, or adjust its lending approach.

Figure 1. Commercial banks in Ukraine undergoing stress testing in 2025

This year’s testing is special: for the first time since 2021, the NBU is returning to the use of an “adverse scenario” – that is, a simulation of a severe economic crisis. Such a scenario is not a forecast. It is a hypothetical but realistic crisis. For example, it envisions a GDP decline of 3,1% in 2025, a hryvnia depreciation against the U.S. dollar of 25.6% over the next three years, and an acceleration of inflation. In 2023, due to the war, stress tests were softer and based only on the NBU’s official economic forecast (the baseline scenario). In 2024, no assessment was conducted, as the results of the previous stress testing remained relevant.

Figure 2. Timeline of bank stress testing in Ukraine since 2018

Although stress testing became widespread after the 2007-2008 global financial crisis, the approach has deeper historical roots. The idea of checking banks’ resilience to hypothetical economic shocks began taking shape back in the 1990s. Elements of stress testing first appeared in IMF and central bank reports following the banking crises in Latin America and Asia in 1997-1998. For example, as early as 1998, the Bank of England used risk modeling when analyzing systemic stability, though such methods largely remained internal analytical tools. It was only after the collapse of Lehman Brothers in the United States in 2008 that stress testing became a mainstream tool for restoring trust in banks.

In 2009, the U.S. Federal Reserve was the first to launch a large-scale public stress testing program – the Supervisory Capital Assessment Program (SCAP) – for the country’s 19 largest banks. As a result, 10 banks were required to raise USD 75 billion in capital. Today, the Fed conducts stress testing annually for some of the largest banks. For example, in 2025, the 22 largest banks in the country, including JPMorgan Chase, Citigroup, and Bank of America, underwent testing. In the baseline scenario, the stress test envisioned unemployment rising to 10 percent, a 33% drop in the commercial real estate market, and a 33% fall in housing prices. Under such a scenario, total banking sector losses would amount to USD 550 billion – yet all 22 banks would remain resilient.

In the European Union, the first large-scale stress testing exercise was coordinated by the European Banking Authority (EBA) in 2011. The EBA now conducts it every two years in cooperation with the European Central Bank (ECB). The most recent round, completed in 2023, covered 70 banks from 16 EU countries, collectively holding 75% of the eurozone’s banking assets. The adverse scenario envisioned a 6% drop in EU GDP over three years, inflation rising to 19.9 percent, a 29% decline in the commercial real estate market, and a 21% fall in housing prices. The results showed that under such a scenario, despite projected total losses of EUR 496 billion, 67 EU banks would remain adequately capitalized, while three banks in the sample would fail to meet mandatory capital requirements.

Figure 3. Geographical distribution of banks included in the 2023 stress testing

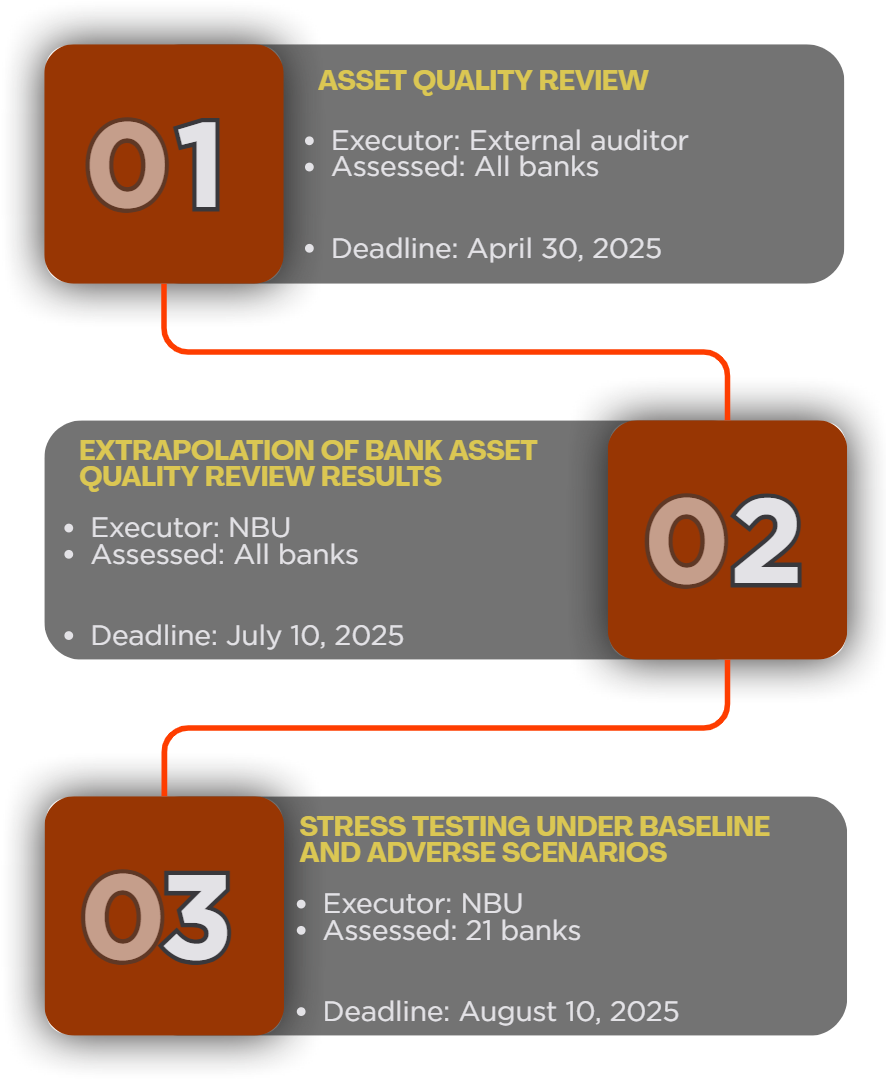

The resilience check of Ukrainian banks in 2025 takes place in several stages. In the first stage, the work is carried out not by the National Bank itself, but by an independent auditor. The auditor assesses the quality of the bank’s assets (primarily issued loans) and verifies how justified the bank’s assumption is that these funds will be repaid (in doing so, the auditor reviews not all loans, but a specific sample of loans in each bank). All commercial banks (60 as of August 1, 2025) are required to undergo this review.

Figure 4. Timeline for resilience assessment in 2025

Source: Concept of 2025 Resilience Assessment of Banks, Decision of the NBU Board “On the Approval of the Technical Specifications for Conducting the Assessment of the Resilience of Banks and the Banking System of Ukraine in 2025,” No. 452-rsh dated December 26, 2024

In the second stage – also undertaken by all banks – the results of the asset review conducted by the independent auditor are scaled to the bank’s entire loan portfolio. Thus, if the auditor’s sample of the bank’s loans reveals systemic issues (for example, errors in collateral valuation or overstated asset values), these findings are applied to the bank’s entire loan book. This is known as extrapolation. After that, the NBU, using the adjusted data from the extrapolation, calculates key indicators: how much capital the bank has and how well it meets requirements. These are the so-called capital adequacy ratios, which reflect the strength buffer: the larger it is, the better protected the bank is against financial losses. At this stage, it becomes clear whether the bank requires recapitalization under current conditions.

The resilience assessment using only the first two stages (under the NBU’s approved Technical Specifications for Conducting the Assessment of the Resilience of Banks and the Banking System of Ukraine in 2025) covers 40 commercial banks that will not undergo stress testing. For the remaining 21 banks, which hold the majority of depositors’ funds and lending volumes, a third stage of resilience assessment is planned – namely, the stress test itself (meaning that for these banks, the 2025 resilience assessment will be conducted in three stages).

At the stress testing stage, the selected banks undergo a simulation of operations under two scenarios: the baseline and the adverse. The baseline scenario corresponds to the NBU’s forecast, while the adverse scenario assumes a significant deterioration in conditions. For each scenario, the bank’s financial position is modeled three years ahead, projecting its profits, losses, and remaining capital. These calculations determine whether the bank will have sufficient resources to meet the standards and how much capital it would need to feel secure even in difficult times.

The stress testing results are not a verdict, they are a plan of action. A bank either confirms its resilience or receives a clear signal: there are weaknesses that need to be addressed. If the assessment shows that the bank’s capital would be insufficient in a crisis, the bank will be required to submit a capitalization or restructuring program to the NBU. This document explains exactly what steps the bank will take to strengthen its financial position. There are various ways to do this, for example, attracting additional funds from shareholders, adjusting lending policies, optimizing expenses, or partially limiting dividend payments. The key goal is to reach a capital level that will allow the bank to remain resilient even under challenging conditions. The NBU monitors how the bank implements the agreed plan. If progress is insufficient, the regulator may apply enforcement measures – for instance, restricting the payment of dividends or the distribution of capital, limiting or suspending certain operations (such as prohibiting unsecured lending), or imposing a fine.

It is important to understand that if a bank fails a stress test, it is a signal that, in a crisis, it would need additional capital or a change in its business model. For the regulator, it is a tool for strengthening the entire banking system before anything serious happens.

Such checks are essential for everyone who deals with money: from small businesses to Ukraine’s international partners. For businesses, it is an indication of how reliable the bank looks where the company’s funds are held or through which payments are processed. For investors, stress testing is an important signal of the NBU’s institutional capacity and its oversight of the banking system as a whole. And for ordinary Ukrainians, stress testing provides a source of information for assessing the reliability of the banking system.

At the same time, it is worth understanding that stress testing is not a guarantee, it is a tool for preventive assessment. This tool can reveal a bank’s weak spots and give it time to address them. However, even after successfully passing a stress test, a bank may still encounter problems if reality turns out to be harsher than the modeled scenario. In addition, certain risks may remain outside the scope of testing – for example, risks related to the structure of the client base or the specifics of the bank’s business model. Therefore, a stress test is a significant step toward improving the system’s reliability, but not an absolute safeguard.

Photo: depositphotos.com/ua

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations