One advantage Ukraine have over previous countries which have gone through inflation targeting regime is a pre-existing set of surveys that measure the inflation expectations of different agents in the economy. This will enable the NBU to track in realtime the success of its communications strategy and the extent to which the regime change is affecting the economic expectations of Ukrainians.

We study survey data of inflation and exchange rate expectations in Ukraine. These data are available for households, firms and professional forecasters. We document some unique properties of these data as well as some limitations and discuss the longer run prospects for inflation expectations in Ukraine given the National Bank of Ukraine’s desire to adopt an inflation target in the future.

Introduction

In April 2015, the head of the National Bank of Ukraine announced that the Ukrainian central bank would in the future adopt an inflation targeting regime, aiming to stabilize the inflation rate around 5%. Inflation targeting regimes have long been viewed as being a successful way of stabilizing inflation, ever since New Zealand successfully brought down its inflation rate after adopting such a regime in 1990. By identifying a clear and visible target for the central bank, inflation targeting can help a central bank build credibility and anchor inflation expectations, thereby ultimately stabilizing both inflation and economic activity (Walsh 2011). How smoothly should we expect this process to go? How anchored are expectations likely to get? These are the questions that we consider in this paper.

Unlike most central banks, the National Bank of Ukraine has access to survey data on the inflation and exchange rate expectations of households, firms, and professional forecasters [1]. This allows us to study, in much more detail than would be the case in almost any other country, the current expectations of different types of Ukrainian agents prior to the adoption of the inflation target. We review the current state of these surveys and discuss some of their limitations, in the hope that they may be addressed before any policy changes are enacted. This would enable policy makers to track expectations in a much more careful way during their planned policy regime change.

For example, the size and coverage of both the household and firm surveys are excellent, much larger in fact than comparable surveys in the U.S. and elsewhere. But the design of the questions about inflation and exchange rate expectations could be improved as they ask respondents to pick from preset list of bins. Since these bins are sometimes too large or evolve too slowly, much unnecessary noise can be introduced into the survey. In addition, the surveys do not ask about expectations of inflation at longer horizons (which are particularly useful when thinking about credibility), perceptions of recent inflation (which are useful when thinking about communication or inattention), or uncertainty around forecasts (which can also help assess credibility, communications strategies and general uncertainty).

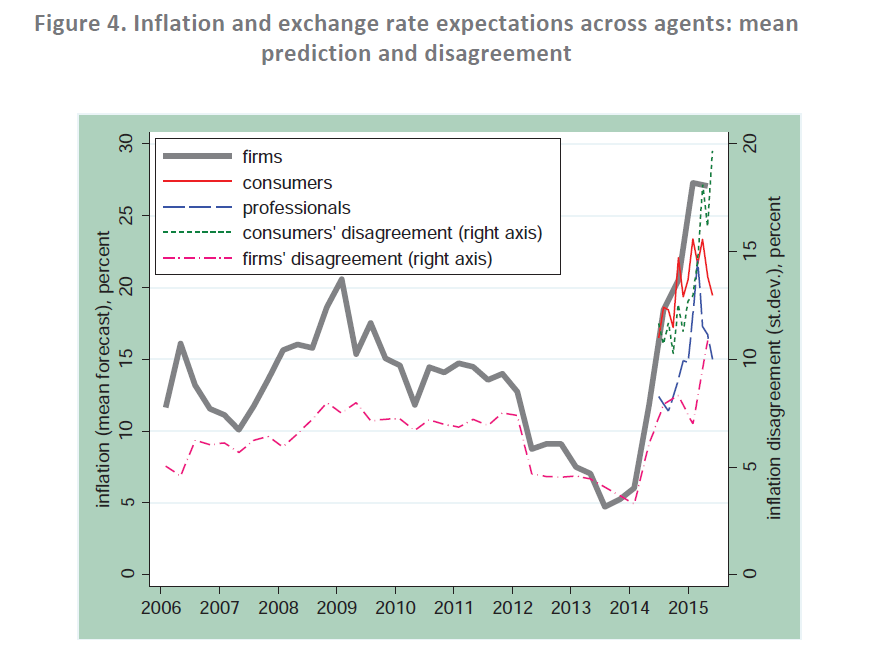

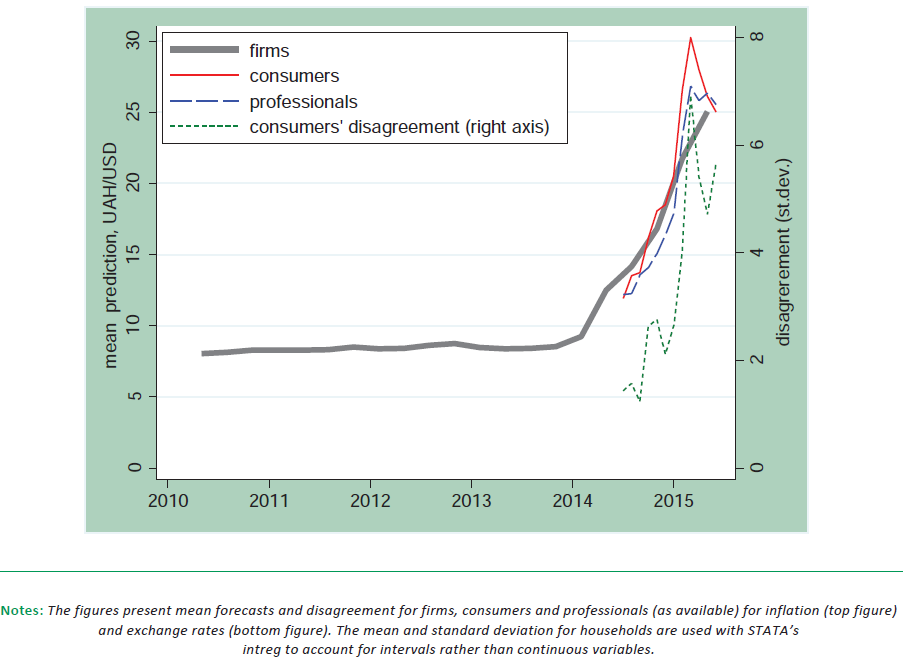

Despite these limitations, the surveys also provide some unique features, such as household expectations of exchange rates or an extended time series of firms’ expectations of both inflation and exchange rates. As in other countries, we find that both households and firms disagree much more about inflation than professional forecasters, and as in Mankiw, Reis and Wolfers (2003), this disagreement rises with the level of inflation. A similar result holds for exchange rates. Both household and firm expectations of exchange rates follow the exchange rate closely, as do firms’ expectations of inflation, much more so than those of professionals. In these respects, the properties of Ukrainian agents’ expectations mirror those found in other countries, even those with a long history of stable inflation such as the U.S. or New Zealand.

However, along several other metrics, Ukrainian expectations differ from what we observe in countries which have already been under inflation targeting regimes for an extended period, and these differences point toward some unique challenges potentially facing Ukrainian policymakers. One such challenge is the geographic/political divide of the country. Whereas expectations differ little by age, gender, education, or income, the one key predictor of individual expectations is region of origin: individuals from the West of Ukraine expect much lower inflation and a stronger hryvna than do individuals from the East and South. One possibility is that this reflects current economic disparities in the two regions, and that expectations will converge over time as political and economic conditions settle. Another possibility, however, is that, individuals in the two regions who receive the same news draw different inferences about the economic implications. This would imply that expectations might remain heterogeneous for a much longer period of time, thereby making policymakers’ attempts at stabilization more difficult. Unfortunately, current data does not permit us to distinguish between these two possibilities.

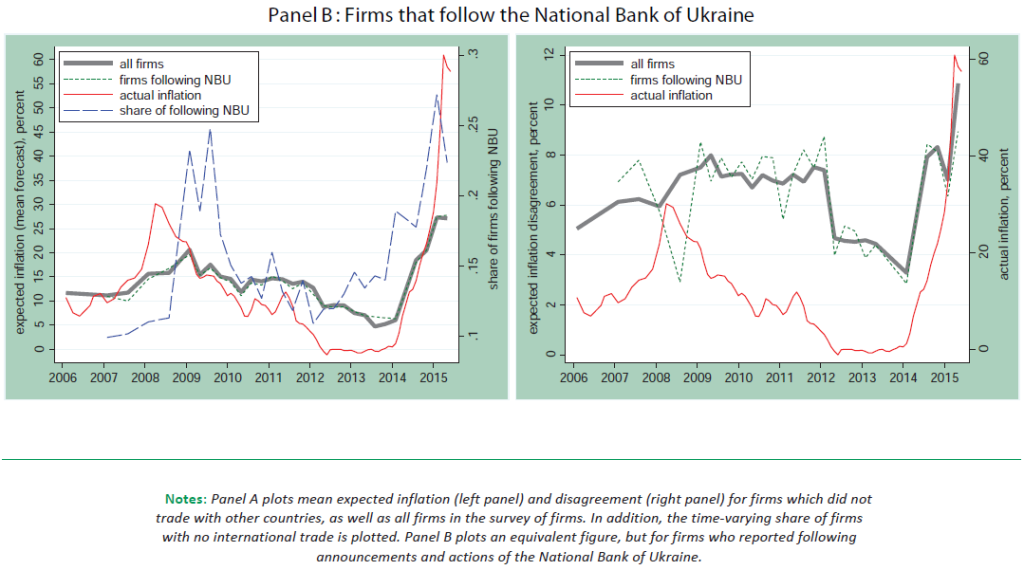

Another unique element of the firm survey is that firms were asked whether they followed the announcements and actions of the National Bank of Ukraine. This allows us to measure the share of firms over time which explicitly tracked the communications of the central bank and compare their expectations to those of other firms. Consistent with what one might expect, the share of firms tracking the actions of the central bank rises sharply in times of crisis (particularly when the value of the hryvnia falls). However, we find no difference between the inflation expectations of firms who track the announcements and actions of the central bank and those who do not, either in terms of the mean of the forecast or in terms of the disagreement across agents. This suggests either that the communications of the central bank were of poor quality and did not lead agents to revise their expectations or that, more likely, there is a significant credibility gap that causes agents to fail their revise their forecasts in light of the information from the central bank. In contrast, Coibion et al. (2015) find that firms in New Zealand which are provided information about the central bank’s inflation target revise their inflation forecasts by large amounts, consistent with the Reserve Bank of New Zealand (RBNZ) having a lot of credibility. We interpret this difference as indicating that the National Bank of Ukraine has a long road ahead in building the kind of credibility that the RBNZ now has.

A third unusual dimension of these surveys is that they track agents’ expectations of exchange rates, including for households and firms. A surprising result is that, especially for households, there is a strong positive correlation between the evolution over time of their expectations of inflation and exchange rates. While some correlation might be expected from the pass-through of exchange rates into prices, the strength of the correlation is much too high to be explained by this channel. A more likely channel is the use of the exchange rate as a simple proxy by households of broader price movements in the economy, much as households in the U.S. do with gasoline prices (Coibion and Gorodnichenko 2015). Consistent with this conjecture, we find that there is no difference in the inflation or exchange rate expectations of firms which do not trade with other countries and those which do. This suggests that the exchange rate is widely used as this type of signal, otherwise firms which trade extensively would track exchange rates more and would then have different inflation expectations through the pass-through channel. One potential advantage of this signaling role of exchange rates for Ukrainian policy makers is that, unlike gasoline prices, the exchange rate is at least somewhat under their influence, so attempts to stabilize the exchange rate could have an unusually large positive externality through stable inflation expectations.

A broader lesson from the history of official inflation targeting countries like New Zealand and unofficial ones like the U.S., however, is that even after two decades of low and relatively stable inflation, household and firm inflation expectations remain difficult to anchor. In both countries, households display significant disagreement about both short run and long run inflation, and firms in New Zealand display at least as much disagreement as households. Mean forecasts of each have been persistently above actual levels of inflation over the last decade, as have been people’s perceptions of inflation. This suggests that the road to anchoring expectations in Ukraine is likely to be a long one as well.

The paper is organized as follows. Section 2 describes the three surveys of expectations available for Ukraine and discusses their strengths and limitations. Section 3 studies the properties of inflation and exchange rate expectations in Ukraine. Section 4 assesses the prospects for anchoring expectations in Ukraine given the experiences in New Zealand, the U.S. and Poland. Section 5 concludes.

Data

The National Bank of Ukraine has measures of inflation expectations for several types of agents: consumers (households), firms, and professional forecasters. In this section, we review the sources of this information and discuss the pros and cons of the available surveys.

A. Consumers

Every month, GfK Ukraine, a consultancy, surveys approximately 1,000 consumers about their demographics, current economic conditions, financial choices, shopping experience, political preferences and other aspects of their lives. The sample is nationally representative but it does not have a panel component.

Since 2000, this survey has had a module devoted to eliciting consumers’ expectations of future inflation and the UAH/USD exchange rate, a key measure of the hryvnia’s purchasing power for many households in Ukraine. Unfortunately, questions eliciting this information are not consistent over time. Between 2000 and 2014, the question about future inflation was qualitative [2]. Consumers could choose one of the following six options in response to “how will the prices of basic consumer products and services change in the next 1-2 months?”: 1) prices will grow faster than now; 2) prices will grow at the same rate as now; 3) prices will grow slower than now; 4) prices will be at the current level; 5) prices will fall; or 6) do not know. In a similar spirit, possible responses to “how do you think the exchange rate of USD to UAH will change in 3 months?” were: 1) USD will get considerably cheaper; 2) USD will get somewhat cheaper; 3) USD/UAH exchange rate will not change; 4) USD will get somewhat more expensive; 5) USD will get considerably more expensive; or 6) do not know. This wording of questions is similar to the wording in surveys implemented in other countries (e.g., Poland). With additional assumptions, one can obtain quantitative predictions from these questions.

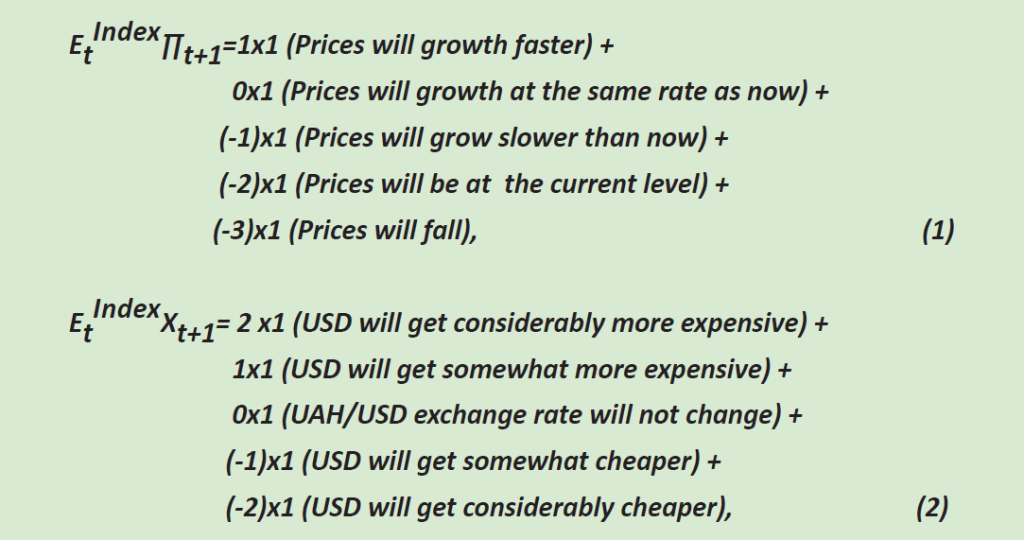

For this early part of the data, we construct an index of inflation and exchange rate expectations as follows where 1 (statement) is an indicator function equal to one if the statement is true and zero otherwise. The indices are equal to zero if a consumer predicts no change in the rate of inflation or the level of the UAH/USD exchange rate. Positive values of the indices are consistent with inflationary/depreciation expectations. Because the time series of the indices are noisy, we use a 3-month moving average (centered) of the raw series for our analyses.

In July 2014, GfK introduced a new set of questions designed to yield quantitative measures of expected inflation and exchange rate. These questions also changed the horizon from 1-3 months in the previous measures to a one-year ahead horizon, which is comparable to equivalent surveys in other countries. Specifically, consumers are asked to pick from a set of inflation brackets running at five percent increments: inflation over the next twelve months will be a) less than zero (“prices will fall”), b) between 0 and 5 percent, c) between 5 and 10 percent, etc. Until inflation in Ukraine accelerated in 2015, the maximum bracket was “inflation will be more than 30%”. In 2015, additional brackets (also with 5 percent increments) were introduced with the maximum bracket being “inflation will be more than 50%”. The question about the expected exchange rate had a similar structure although brackets were more detailed, running in increments of 0.5 UAH in 2014 and early 2015 and increments of 1 UAH after March 2015.

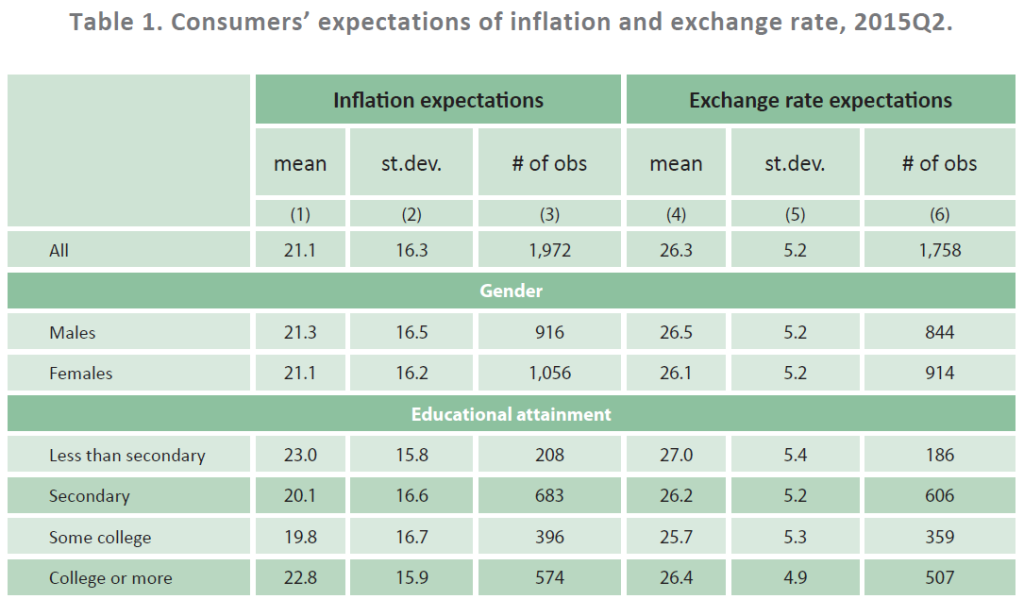

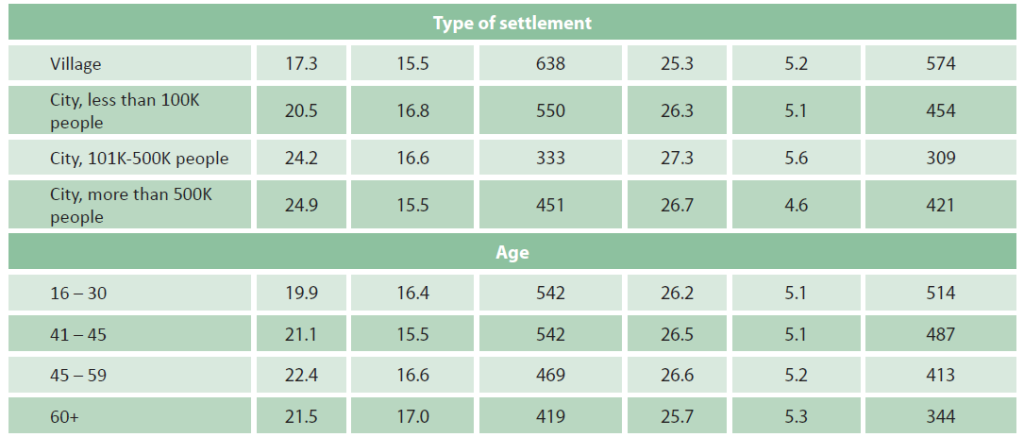

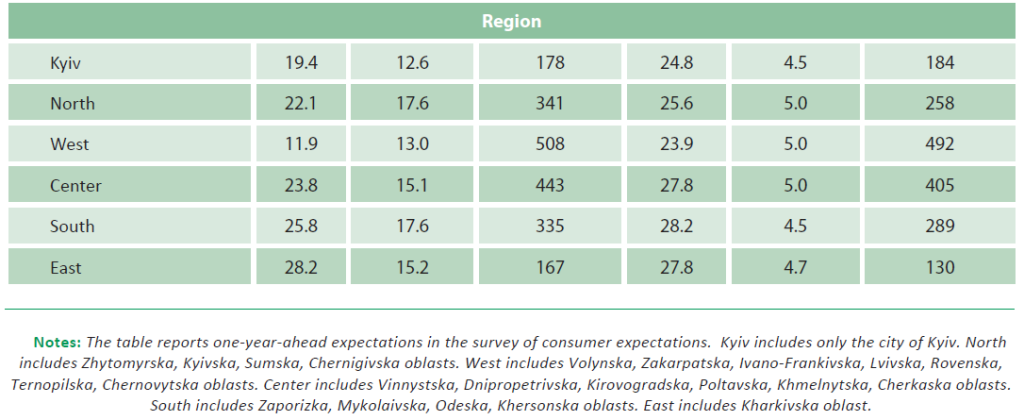

Table 1 provides descriptive statistics for the second quarter of 2015. On average, consumers predicted high inflation (21.1%) but they also strongly disagreed about the magnitude (standard deviation of 16.3%). Likewise, consumers expected a strong dollar (26.3 UAH/USD) and exhibited strong unanimity in this prediction (standard deviation of 5.2 UAH). There is little visible difference across men and women as well as across people with different educational attainment, income or age.

The one striking form of heterogeneity in beliefs is across regions. People living in West Ukraine expected inflation to be only 12% on average and expected a stronger hryvna than the rest of the population. In contrast, those living in the South and the East expected a much higher rate of inflation than the rest of population (26% and 28% respectively) and a weaker hryvna. These regional differences in beliefs could stem from the different economic conditions there at the time, due in particular to the political and military turbulence in the South and East. In this case, one might expect these regional differences in beliefs to fade over time when the political situation stabilizes. Less optimistically, these differences could reflect deeper divides which lead individuals to react differently to the same economic news. This form of heterogeneity in beliefs would likely be much more long lived than one based only on current economic conditions. Further, it could pose a real quandary for monetary policy makers, since news which might be interpreted as stabilizing by one group could be interpreted as destabilizing by another. Unfortunately, the available data do not permit us at this stage to differentiate between these hypotheses, but trying to do so should likely be a priority for future work.

B. Firms

The survey of firms’ expectations—conducted by regional offices of the NBU—is quarterly with a sample size of approximately 1,000 firms covering different sectors, sizes, and regions. Survey forms and responses are distributed and collected via phone, email, fax, or mail. Survey forms are filled out by general managers, chief accountants, or chief financial officers. The selection of firms into the survey is based on a stratified random sampling. The sampling frame is based on the registry of businesses as well as more informal sources such as “yellow-pages”. The survey has a panel component (we do not have access to micro-level data).

The survey collects one-year expectations for inflation since 2006 and for the exchange rate since 2010. Similar to recent waves of the consumer survey, the questions are structured in such a way that managers of firms can pick a bracket for future inflation (in 5 percent increments) or the exchange rate (in 2 UAH increments for recent waves). Also similar to the survey of consumers, recent surveys of firms augmented the list of brackets to accommodate higher inflation and exchange rate depreciation expectations. For example, the early part of the survey had a top bracket of “inflation will be more than 25%”, while more recently it has had a top bracket of “inflation will be more than 45%.”

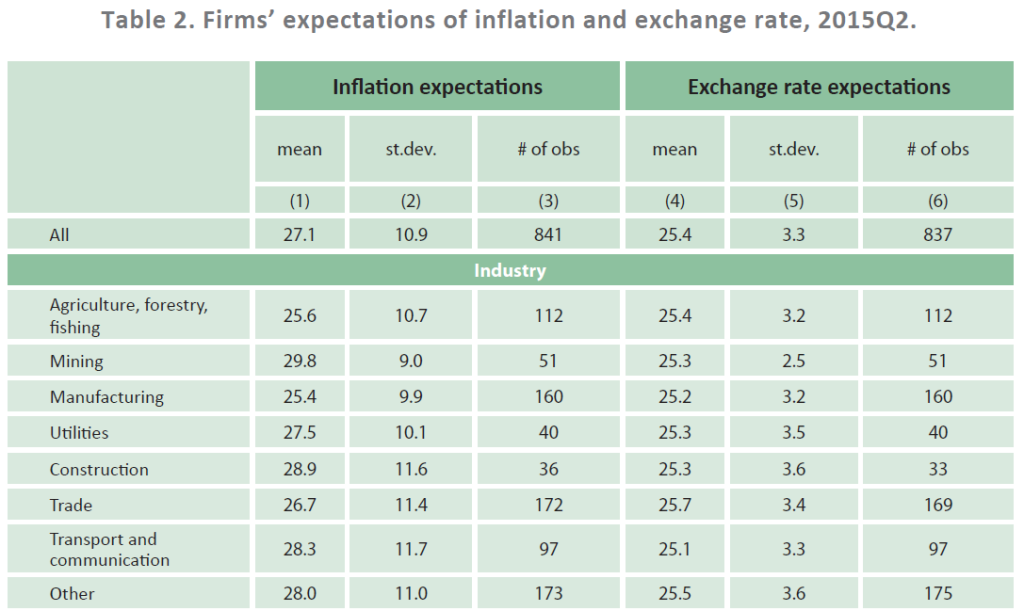

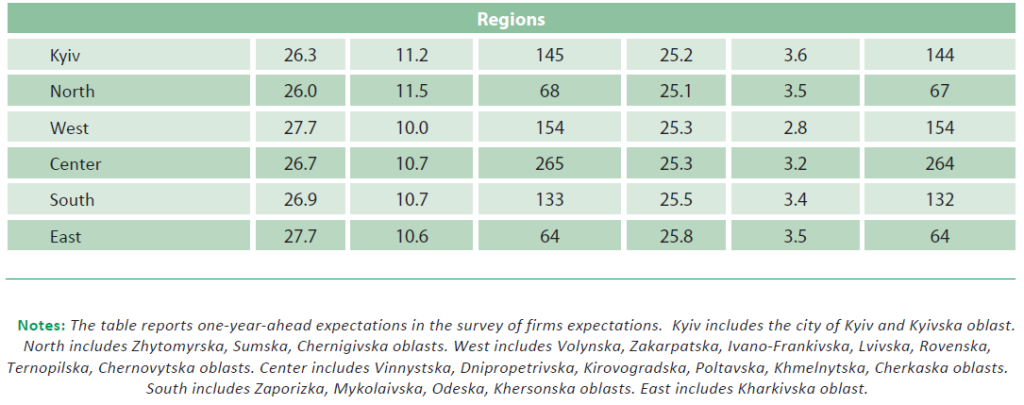

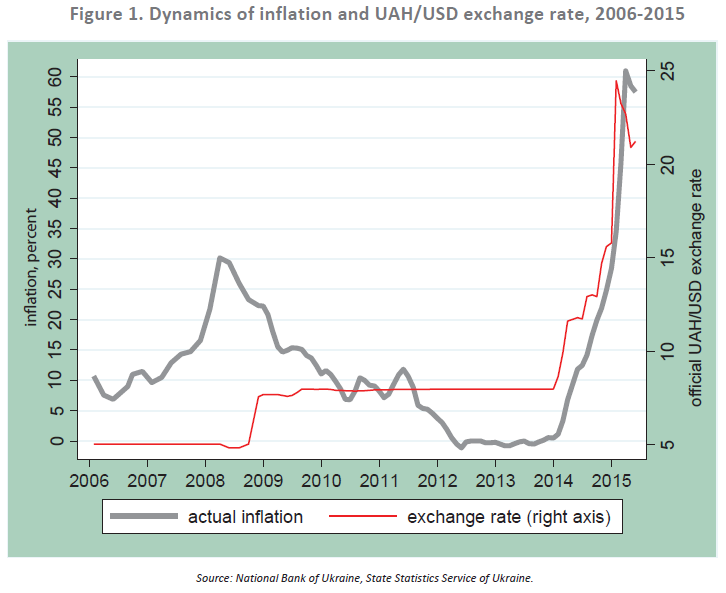

Table 2 provides descriptive statistics for the most recent wave of the survey (2015Q2). Relative to consumers, firms expect higher inflation (27% vs. 21%) and about the same level of the UAH/USD exchange rate (25.4 UAH/USD vs 26 UAH/USD) [3]. Similar to households, firms strongly disagree in their predictions about future inflation (standard deviation of 10.9%.) and the exchange rate (standard deviation of 3.3 UAH) but the level of disagreement is lower than the level of disagreement for consumers. These expectations are broadly similar across industries, firm sizes, or exposure to international trade. In contrast to results for households, there is no evidence that firms in different regions of the country have different inflation or exchange rate expectations. Interestingly firms that follow the actions of the NBU have similar expectations to firms that do not follow. These patterns suggest that firms pay significant attention to inflation statistics and track the exchange rate closely.

Because this firm survey has a large cross-section, represents the entire distribution of Ukrainian firms, and is quantitative in nature, it represents an unusual source of data for a central bank. For example, no such comparable data exists in the U.S., U.K., Euro-Zone, Canada, or Japan. While these countries have other surveys of firms available, these are generally either qualitative in nature or limited to very large firms. Only Sweden, to the best of our knowledge, has a similarly long-running, quantitative and representative survey of firms’ inflation expectations.

C. Professional forecasters

In July 2014, the NBU started to survey financial analysts in major financial firms about their expectations of inflation and the exchange rate. The size of the sample is smaller: at most 17 respondents. However, this size is similar to comparable surveys of professional forecasters in other countries. For example, the number of responses in the Survey of Professional Forecasters (SPF) run by the Federal Reserve Bank of Philadelphia varies between 9 and 53 respondents with the mean equal to 34. In contrast to other surveys, the respondents are asked to report numeric forecasts rather than pick a bracket. In addition, the survey collects 3-year-ahead predictions for inflation and the exchange rate.

D. International perspective on the surveys

The surveys in Ukraine have a number of advantages over foreign analogues. First, the surveys have large sample sizes relative to similar surveys in other countries. For example, the Michigan Survey of Consumers (MSC) in the U.S. surveys 500 people in a given month while the GfK survey in Ukraine has approximately 1,000 respondents. Second, the survey of firms collects more information about firms’ expectations and demographics than counterparts in other countries. For example, the Livingston survey in the U.S. provides only limited information about the type of forecaster (e.g., non-financial vs. financial firm). Third, recent waves of consumer and firm surveys have quantitative information, while comparable surveys in other countries often can provide only qualitative information. For example, the Conference Board Survey in the U.S. asks firms to report if prices are going to increase, decrease, or stay the same.

However, the design of the surveys could still be improved along several dimensions. First, expectation questions are offered only in brackets. While some brackets are detailed (there are over 20 brackets for the exchange rate question), others are too coarse (brackets for inflation have 5% increments). As a result, some information is lost relative to the case when respondents can report a numeric value for their expectations. Because the brackets are granular (especially for inflation), the survey may fail to fully capture changes in the distribution of beliefs. In addition, in times of rapidly changing economic conditions, brackets may easily get outdated, yielding lumps in the top/bottom brackets. Finally, changes in the sizes of brackets could make the data not directly comparable over time if the introduction of new brackets changes respondents’ perceptions about the possible ranges of outcomes.

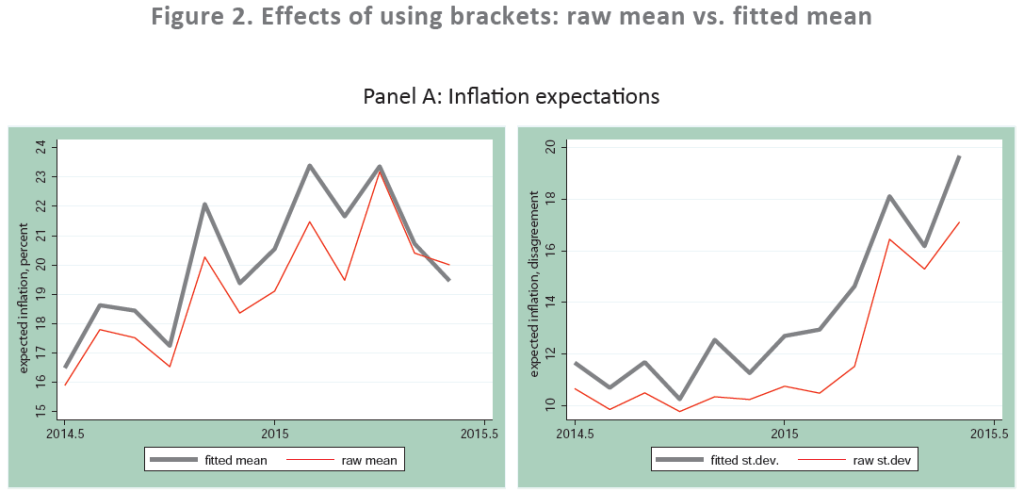

Some of these concerns can be addressed by fitting a normal distribution to the distribution across brackets (a type of censored regression, see Cameron and Trivedi 2010). Figure 2 shows that fitting a censored regression to estimate the mean and standard deviation on the distribution of responses across brackets tends to yield higher inflation expectations and more disagreement about these expectations. At the same time, the difference between the raw and fitted (regressionbased) mean and standard deviation is smaller for the exchange rate because the question on exchange rate expectations has more and finer brackets [4]. In any case, allowing consumers to provide “continuous” responses would be likely to provide more information at little additional cost.

Second, the surveys do not ask respondents to report probability distributions. As a result, the central bank cannot establish ex ante uncertainty in forecasts and, thus, it is harder to assess whether expectations are anchored [5]. Recent developments in survey design (e.g., Manski 2004) suggest simple procedures to elicit the subjective uncertainty (probability distribution) of expectations. For example, in addition to asking for point one-year-ahead predictions for inflation, the Survey of Consumer Expectations (SCE) run by the Federal Reserve Bank of New York asks consumers to assign probabilities to several bins of possible inflation realizations. Given that the current surveys of households and firms already provide bins to respondents in asking about their expectations of inflation and exchange rates, it would be simple to allow respondents to assign probabilities to these bins rather than just picking one.

Third, the surveys do not ask agents to report their perceptions of inflation (nowcasts or backcasts). While workhorse models in macroeconomics routinely assume full-information rational expectation (FIRE) so that agents are aware of past and current inflation, survey evidence for other countries (e.g., Coibion et al. 2015, Coibion and Gorodnichenko 2012, 2015) suggests that perceived inflation may deviate considerably from actual inflation. Because individuals’ perceptions of past inflation are a very strong predictor of their expectations of future inflation, understanding the dynamics of inflation expectations will ultimately be difficult without also gathering information on consumers’ and firms’ nowcasts and backcasts of inflation.

Fourth, the success of inflation targeting and related policy regimes is often measured by how sensitive long-term inflation forecasts are to macroeconomic shocks. Intuitively, if the central bank is credible at delivering, for instance, 5 percent inflation, then current economic conditions should have little bearing on inflation 5-10 years into the future. Currently, only the survey of professional forecasters collects information about 3-year-ahead inflation expectations [6].

Finally, the surveys do not have a usable panel structure so that it is difficult to assess how agents revise their beliefs about current and future inflation. This is an important limitation because, without a panel component, one cannot establish why agents have high or low inflation expectations. These expectations may be consistent with e.g. strong ex ante priors (which may be hardly affected by policy), lack of information (which may be addressed by enhanced communication policies), or responses to agent-specific or aggregate shocks (which may be influenced by standard macroeconomic tools of a central bank). To distinguish between these alternative explanations, one should observe the evolution of agents’ beliefs. For example, the MSC interviews about a third of respondents 6 months after the first interview and thus creates a rotating panel. The SCE follows consumers monthly up to a year.

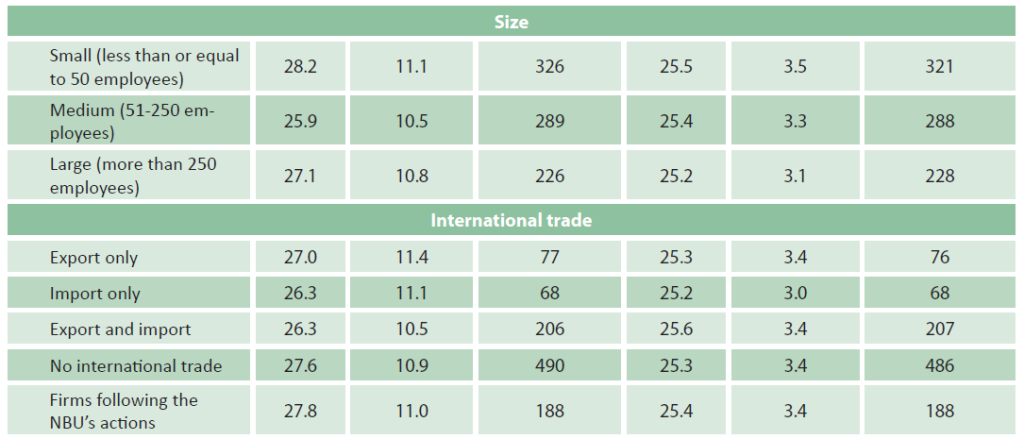

Properties of expectations

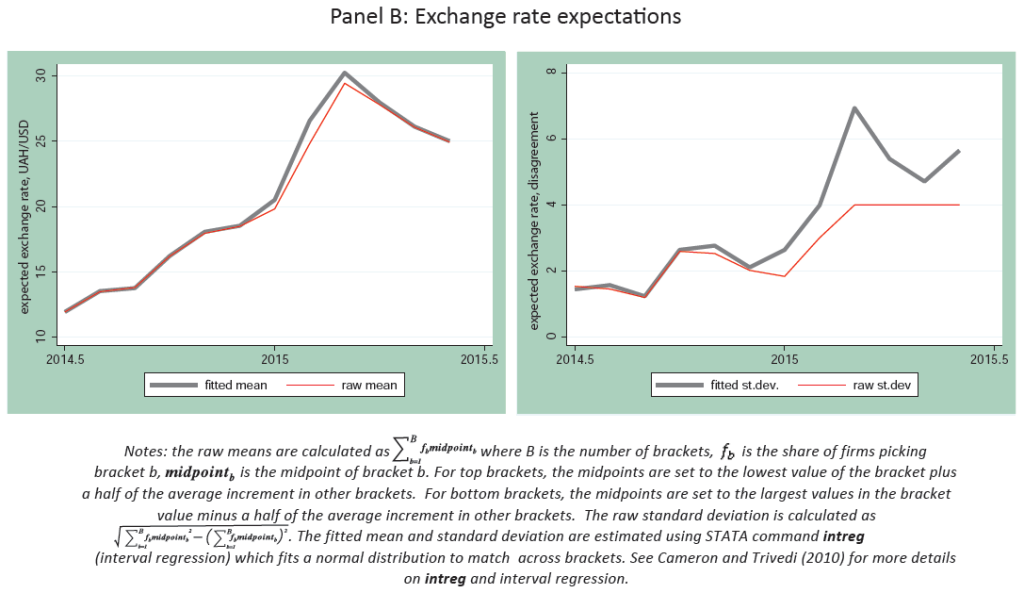

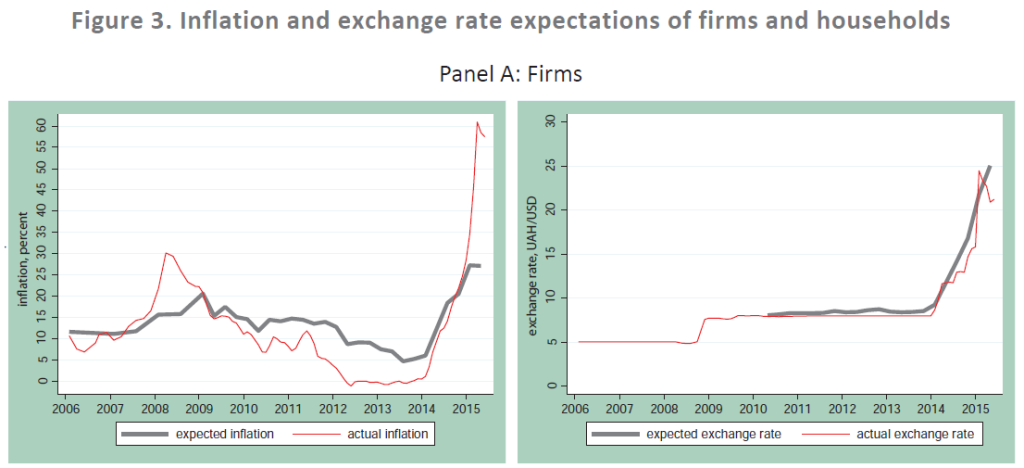

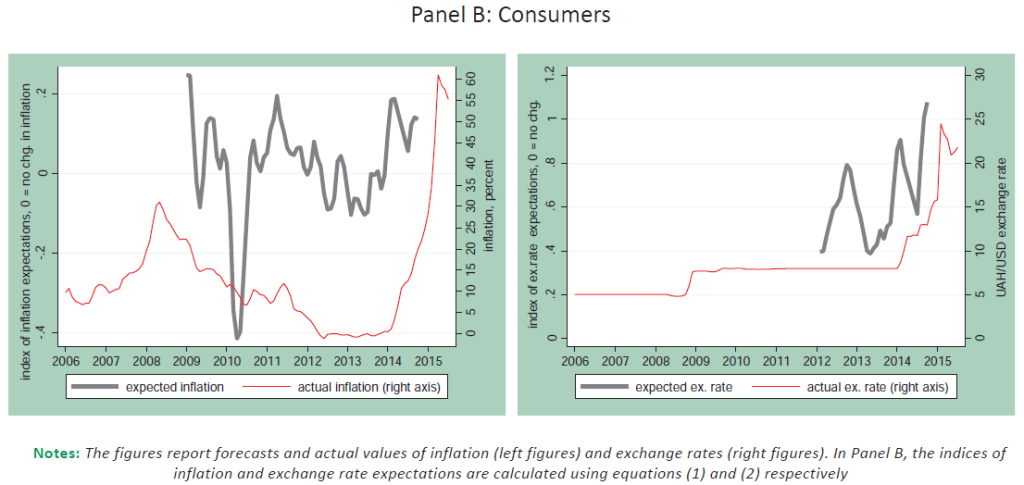

Figure 3 shows the dynamics of the actual inflation rate and the UAH/USD exchange rate versus the expectations of firms (mean forecast) and consumers (mean value of the index). The expectations are highly correlated with the actual series. For example, the correlation between inflation expectations of firms and actual inflation is 0.86. For the exchange rate, the correlation is even higher: 0.95. While these magnitudes may appear striking, they are similar to what one can observe for other countries. For example, the correlation between actual inflation and consumer expectations over 1998-2015 (a stable period of inflation) in New Zealand is about 0.77, while the correlation in the U.S. is 0.47 over 1998-2015 (a stable period of inflation in the U.S.) and 0.9 over 1978-2015 (this period includes high and volatile inflation in the later 1970s and early 1980s as well as the Volcker disinflation).

The indices of expectations for Ukrainian households are less strongly correlated (0.34 and 0.54 for inflation and exchange rate respectively). The reduced magnitudes of the correlations likely reflect noise in the indices rather than a genuine unresponsiveness of consumer expectations to fluctuations in inflation and the exchange rate. Indeed, when we compare the dynamics of mean oneyear-ahead expectations across agents in Figure 4 (over the period for which we have a direct quantitative measure of household forecasts rather than an index), we find that they track each other closely. An acceleration of inflation in late 2104 and early 2015 translated into increased inflation expectations and the pattern is similar for exchange rate expectations. As we discuss below, this similarity of expectations across different types of agents in times of high inflation is observed in other countries as well but one may predict that expectations may diverge as inflation in Ukraine subsides.

The available time series are too short to do formal tests of rationality. Indeed, Croushore (2010) documents that departures of survey expectations from rational expectations over short periods of time can be frequent even when they appear rational over longer periods. However, one can note two observations. First, firms’ expectations of inflation—the longest time series of expectations available to us—have an average error of approximately zero. Second, the expectations were lagging actual inflation and exchange rate dynamics in late 2014 – early 2015, the time of large movements in these variables, which is similar to how expectations behave in similar situations in other countries, as emphasized in Coibion and Gorodnichenko (2012).

Firms’ and consumers’ disagreement about the future course of inflation and exchange rate is strongly positively correlated with the actual series [7]. For example, between mid-2013 when inflation expectations were at the lowest level and mid-2015 when they peaked, the standard deviation of firms’ forecasts more than doubled. The positive correlation between disagreement among agents in their inflation expectations and the level of inflation has also been documented in the U.S. by Mankiw, Reis and Wolfers (2003) for households and professional forecasters. While disagreement is not equivalent to uncertainty, elevated and rising disagreement is consistent with poorly anchored inflation expectations.

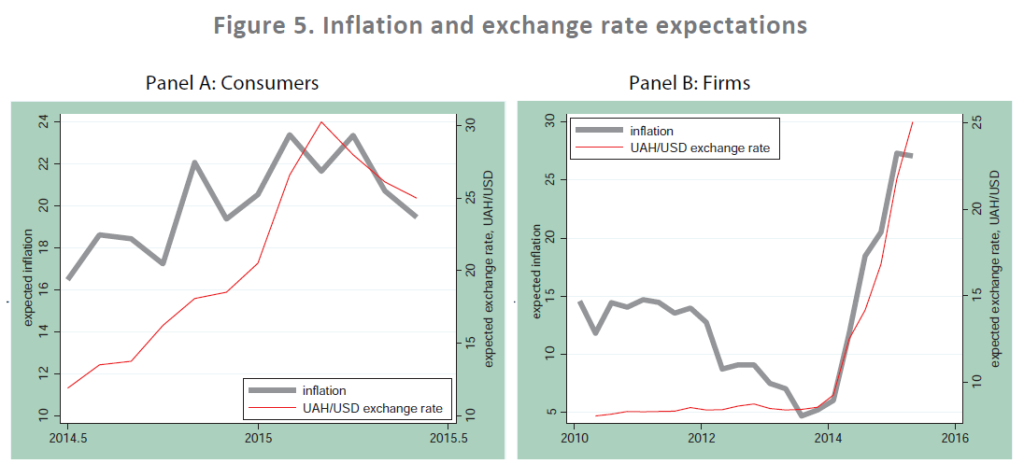

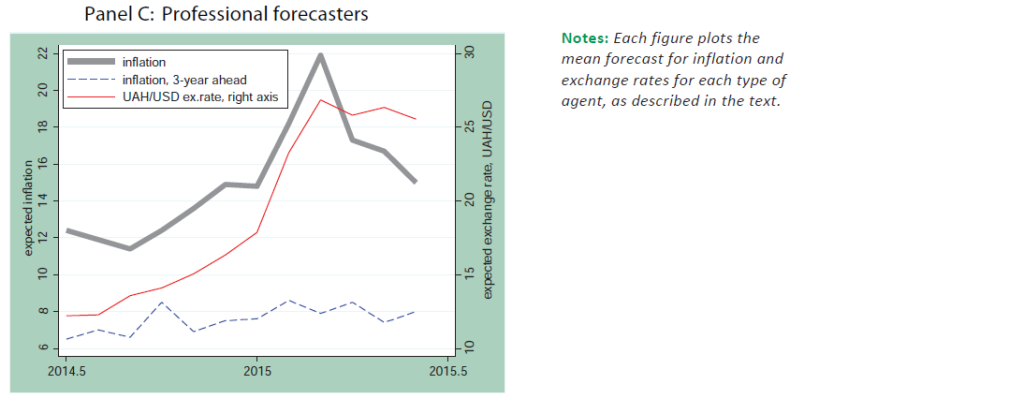

Figure 5 shows that inflation and exchange rate expectations are tightly connected. The massive depreciation of the hryvnia in 2015 led to a sharp rise in the inflation expectations across all types of agents. Obviously, some of this tight relationship can be accounted by the pass-through from exchange rate expectations. However, there could be other channels. For instance, in countries with chronically high inflation, economic agents could routinely use exchange rates as a sufficient statistic summarizing the stance of monetary and fiscal policies as well as other macroeconomic conditions to infer the rate of inflation. As a result, inflation expectations could be sensitive to exchange rate fluctuations above and beyond what is justified by pass-through. Coibion and Gorodnichenko (2015) document a similar mechanism in the U.S. where American households use gasoline prices to infer the aggregate inflation rate and their expectations exhibit a disproportionately strong sensitivity to movements in commodity prices (e.g., the price of gasoline and food).

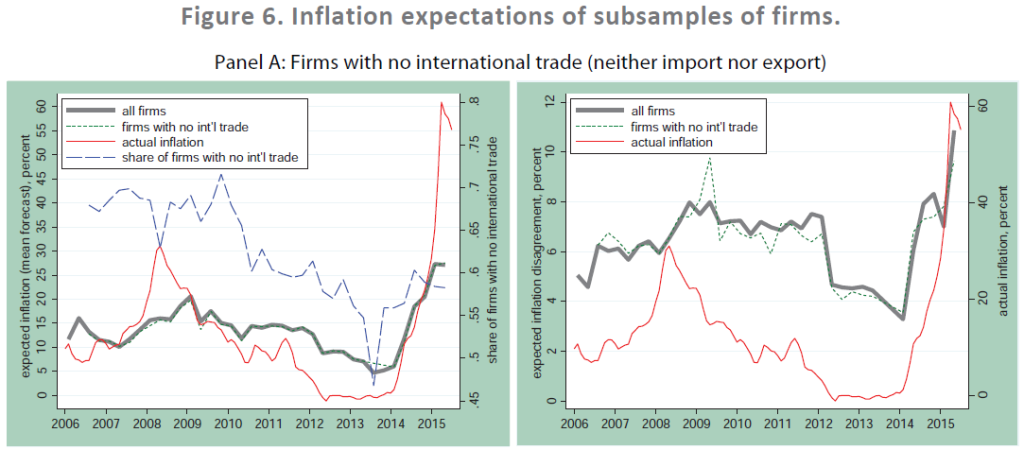

To assess this conjecture, we plot in Panel A of Figure 6 the mean inflation expectations and disagreement about inflation of firms which did not engage in any trade with other countries, along with the expectations of all firms. If the pass-through explanation was the correct one, one would expect firms which engage in trade with other countries to devote more time and resources to forecasting the exchange rate than others. As a result, they would tend to form different exchange rate forecasts which, through the pass-through channel would lead to different inflation forecasts. But as documented in Panel A of Figure 6, there is no visible difference in the inflation forecasts of firms which trade and those which do not, either in terms of their mean forecasts or in terms of their disagreement. This suggests that the exchange rate is treated as an informative signal about the economy and inflation by all firms in the economy.

While households and firms both display strong correlations between their inflation and exchange rate forecasts, the 3-year ahead inflation predicted by professional forecasters has been much less sensitive to recent exchange rate volatility. This pattern is certainly an encouraging sign for Ukrainian monetary policymakers, although the level of their expected inflation has been higher than the 5-percent inflation target (with acceptable deviations within one percentage point) declared by the NBU (NBU 2015). This difference may reflect several factors. First, the NBU plans to gradually disinflate toward the target and during this stage the bands around the target may be wider. Perhaps the 8% inflation rate predicted by professional forecasters will be in the upper part of the admissible range for inflation. Second, the central bank may be not credible in the eyes of professional forecasters. Unfortunately, the available data again does not permit us to differentiate these two explanations. One would need additional information about uncertainty in inflation forecasts as well as expectations of inflation at longer horizons.

Another unique property of the firm survey is that firms were asked to report if they follow the actions and announcements of the NBU. Panel B of Figure 6 shows that the share of firms following the NBU commoves strongly with crises and the level of inflation. For example, just before the start of the Global Financial Crisis in 2008, approximately 10 percent of firms followed the NBU. In the heat of the crisis, the share jumped to 25 percent. The share fell again close to 10 percent by the end of 2012 and it started to climb up again as the Ukrainian economy slid into recession in 2013 and, as inflation peaked in 2015, the share jumped to over 25 percent. Strikingly, the level of expectations or disagreement is very similar across “non-followers” and “followers”. One possible interpretation of this pattern is that it reflects poor communications on the part of the NBU: their announcements fail to provide enough information to affect agents’ expectations. Another interpretation is that this reflects a credibility gap: while agents want to know what the central bank is saying, they are skeptical about its ability to affect inflation over short horizons, so their expectations are unchanged relative to those of other agents.

The absence of a difference in beliefs for agents who receive news from the NBU is in sharp contrast to other evidence from inflation targeting countries where central bank credibility is high. For example, in New Zealand, when firm managers are presented with information about the central bank’s inflation target, this leads to large revisions in their inflation forecasts, especially if they were initially uncertain about future inflation (Coibion, Gorodnichenko and Kumar (2015)). This is indicative of the work that lies ahead for the NBU in building its credibility, a task that is likely to take years.

Future dynamics of expectations

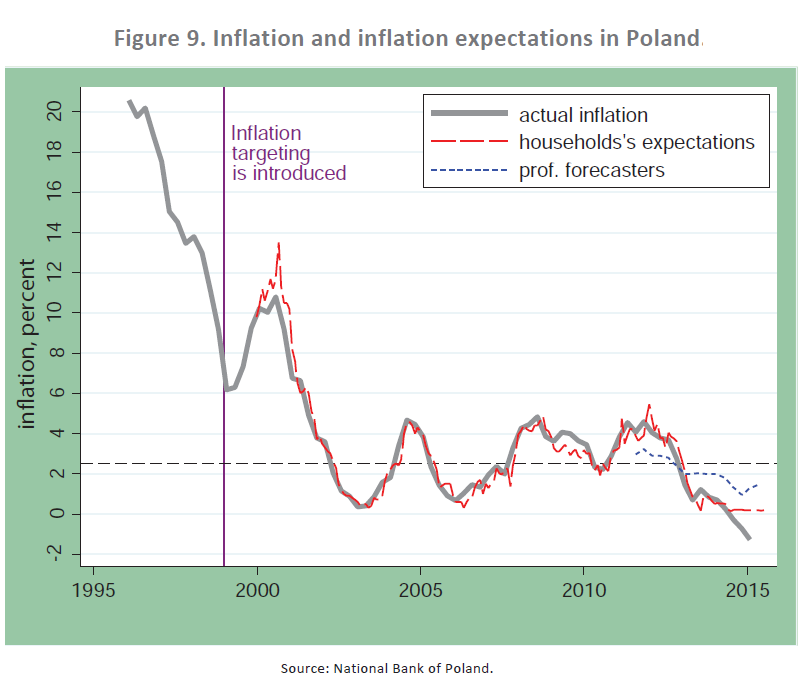

Because Ukraine’s macroeconomic history is rather short, we will use international experience to predict the future behavior of inflation expectations. Specifically, we will focus on the U.S.A., New Zealand, and Poland, countries that went through significant disinflations and adopted some form of inflation targeting. The longest, high-quality series of inflation expectations are available for the U.S. New Zealand, the pioneer of inflation targeting, is interesting because it is a small open economy dependent on commodity prices —which is similar to Ukraine—and with a long history of low and stable inflation, an outcome of its inflation targeting regime. Finally, we analyze Poland because in many ways, the Ukrainian authorities treat Poland—also a transition economy—as a role model. Apart from the Polish economy showing enviable economic development and modernization, the Polish central bank successfully implemented inflation targeting and brought inflation down from over 30 percent per year to 2-3 percent per year.

—which is similar to Ukraine—and with a long history of low and stable inflation, an outcome of its inflation targeting regime. Finally, we analyze Poland because in many ways, the Ukrainian authorities treat Poland—also a transition economy—as a role model. Apart from the Polish economy showing enviable economic development and modernization, the Polish central bank successfully implemented inflation targeting and brought inflation down from over 30 percent per year to 2-3 percent per year.

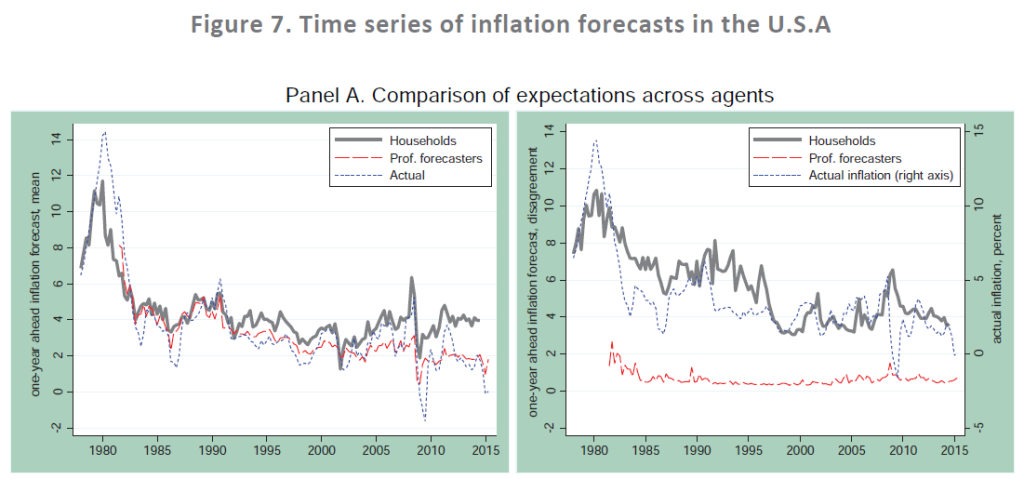

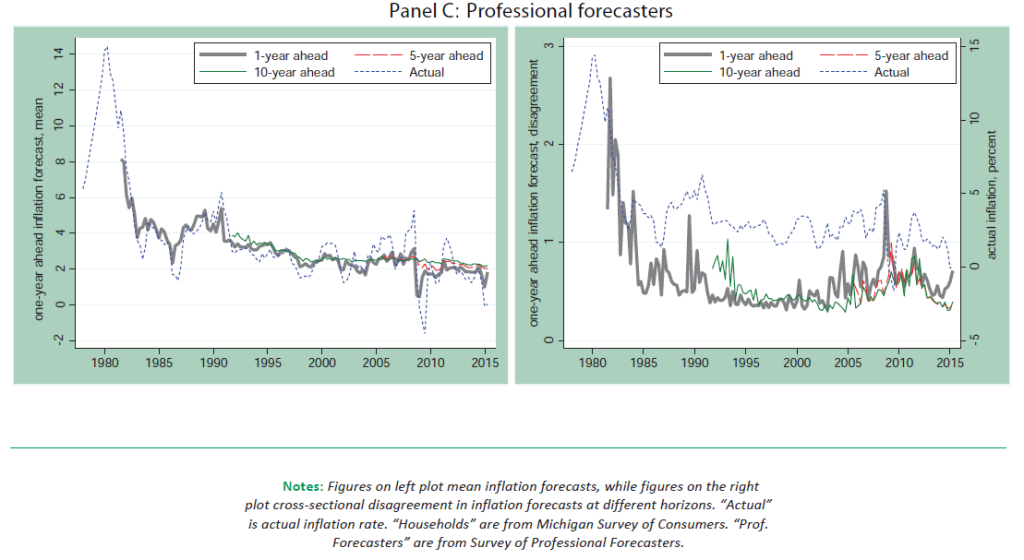

Panel A of Figure 7 shows the dynamics of one-year-ahead inflation expectations and actual inflation since the late 1970s for the U.S. Note that in the early part of the sample, expectations of households and professional forecasters [8] tracked each other closely but a significant divergence began in the early 2000. As discussed in Coibion and Gorodnichenko (2015), this divergence was driven by rising prices of gasoline and other goods readily visible to households. In other words, households assign a weight to gasoline prices, food prices, and house prices that is higher than what is assigned by statistical agencies and, consequently, professional forecasters. This pattern suggests that even after the Volcker disinflation of the early 1980s and the de facto inflation targeting regime in place since the 1990s, consumers in the U.S. still do not have completely anchored expectations. In contrast, expectations of professional forecasters [9] are stabilized at the 2-percent inflation target declared by the Federal Reserve System. There are several other manifestations of the divide in anchoring of inflation expectations.

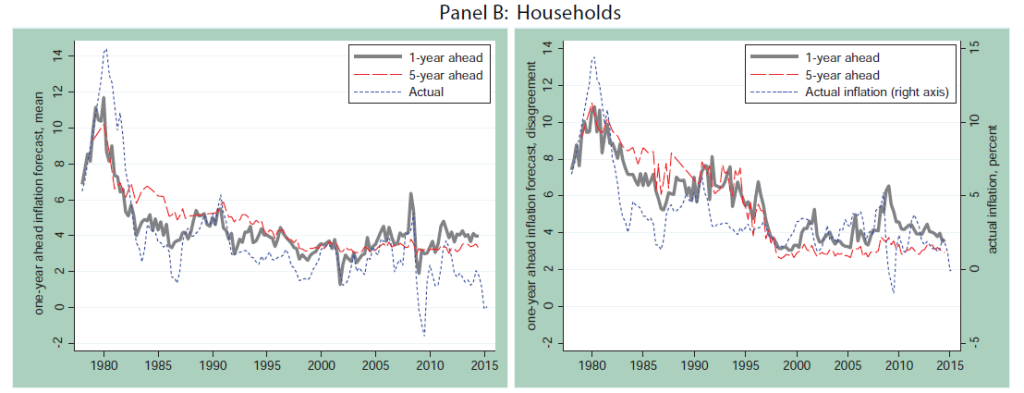

First, disagreement about future inflation is much higher for households than for professional forecasters: the standard deviations of beliefs in the cross-section of households and professional forecasters are about 4 percentage points and 0.5 percentage points respectively. The disagreement of households declines little with the forecasting horizon, while it falls in the case of professional forecasters (see Panels B and C of Figure 7). However, the Volcker disinflation shrank the disagreement of households from 10 percentage points in 1980 to 4 percentage points in 2000s and 2010s.

Second, while the 5-year-ahead inflation expectations of households are less than their 1-year-ahead inflation expectations on average, the mean 5-year-ahead forecast is still well above the official target and it tends to co-move with the short-term inflation forecast (Panel B of Figure 7). On the other hand, the 5- and 10-year ahead inflation predictions of professional forecaster are nearly fixed at the official inflation target (Panel C of Figure 7).

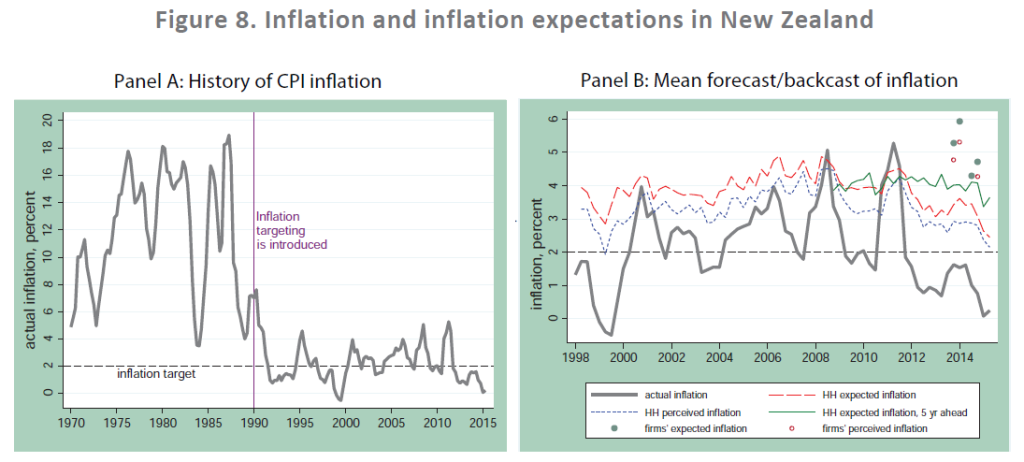

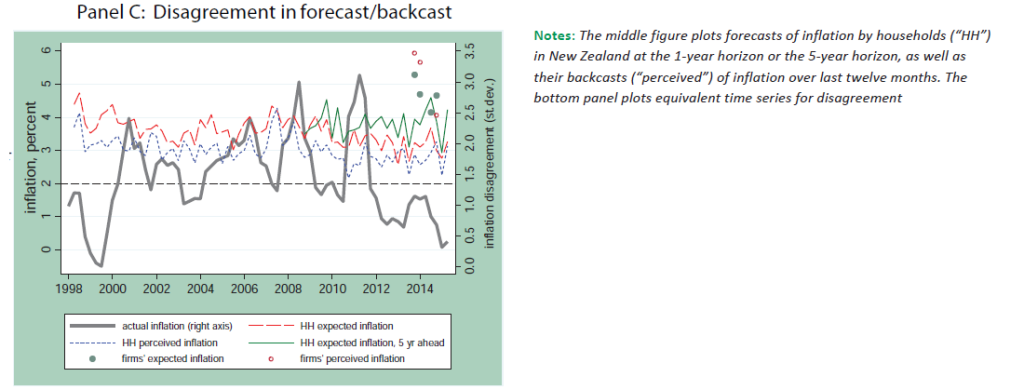

We observe similar patterns in New Zealand. In the 1970s and 1980s, New Zealand experienced high and volatile inflation but after adopting inflation targeting in 1990, the Reserve Bank of New Zealand was able to reduce and stabilize inflation at 2 percent (Panel A of Figure 8). Unfortunately, we do not have expectations series going back to the pre-adoption period. However, in contrast to the U.S. data, we have information about both households’ and firms’ expectations of future inflation as well as their perceptions of past inflation. Panel B of Figure 8 shows that between 1999 and 2015 inflation expectations as well as perceptions of inflation were stable over time. On the other hand, the average level of inflation expectations was close to 4 percent, considerably above the official target of two percent. At the same time, expectations of professional forecasters (not shown) have remained very close to two percent and exhibit little sensitivity to cyclical fluctuations. Note that firms’ expectations and perceptions—taken from Coibion et al. (2015)—are even higher than expectations of households.

Similar to the U.S., there is little disagreement across professional forecasters about future inflation (the standard deviation of the cross-sectional distribution is 0.2 percentage points; see Coibion et al. 2015) but households and firms have a much higher level of disagreement: the standard deviation of the cross-sectional distribution is close to 4-5 percentage points, which is similar to the level observed in the U.S. now. Results are similar when we examine long-term (5-year-ahead) expectations for inflation. Strikingly, the level of disagreement about past inflation is similar, indicating that informational frictions are likely to play an important role in the incentives and costs to collect and process information. It appears as if there is a limit to how far central banks can go in anchoring the expectations of firms and households.

Finally, we find that, similar to the U.S., inflation expectations in Poland tracked actual inflation closely as the level of inflation converged toward the official target. However, the stunning degree to which inflation expectations track actual inflation reflects the limitations of the survey design in Poland. Specifically, the survey asks respondents to report their inflation in a format similar to the one GfK survey in Ukraine used to have before July 2014. As a result, the point predictions of inflation are based on additional assumptions: the agency implementing the survey fits a distribution of beliefs to match the observed distribution of survey responses so that the central tendency of inflation expectations is largely imputed. Because many people pick “prices will grow at the same rate as now”, the implied mean of inflation expectations is very close to actual inflation. Not surprisingly, households’ expectations are well below the official target in recent quarters, while professional forecasters predict that inflation will be close to the target.

The history of these three countries allows us to draw several conclusions. First, the level of expectations follows actual inflation. It is therefore unlikely that the NBU will be able to anchor expectations before it disinflates and stabilizes inflation.

In other words, the NBU will have to earn credibility by delivering on its promises. Because disinflation is often associated with tight monetary policy, an economic contraction may be inevitable.

Second, while the NBU should be able to anchor the inflation expectations of professional forecasters, financial markets and the like, it may be unable to anchor inflation expectations of households and firms. The experience of the U.S. and New Zealand suggests that, even decades into inflation targeting regimes and with very credible central banks, household and firm expectations do not appear anchored in the way that professionals’ are. One explanation is that as inflation falls and stabilizes, many economic agents have reduced incentives to track inflation and other macroeconomic variables. A similar outcome in Ukraine is likely if disinflation is successful.

Third, inflation expectations of firms and households are often sensitive to movements in inflation “proxies”, such as gasoline prices in the U.S. Given the history of inflation in Ukraine, economic agents there put a disproportionately large weight on changes in the UAH/USD exchange rate to infer the rate of inflation. Because the exchange rate, unlike gasoline prices, is partly under the influence of the central bank, it may be possible to achieve a more rapid anchoring of expectations by using monetary policy tools to manage this proxy variable. Of course, directly stabilizing the exchange rate would contradict the inflation targeting regime, and the past experience of Ukraine clearly suggests that by fixing the exchange rate the NBU had to accept high and volatile inflation. Thus, policymakers should aim to find a balance between using the exchange rate to manage expectations and to hit the inflation target.

a disproportionately large weight on changes in the UAH/USD exchange rate to infer the rate of inflation. Because the exchange rate, unlike gasoline prices, is partly under the influence of the central bank, it may be possible to achieve a more rapid anchoring of expectations by using monetary policy tools to manage this proxy variable. Of course, directly stabilizing the exchange rate would contradict the inflation targeting regime, and the past experience of Ukraine clearly suggests that by fixing the exchange rate the NBU had to accept high and volatile inflation. Thus, policymakers should aim to find a balance between using the exchange rate to manage expectations and to hit the inflation target.

In summary, one may anticipate that a successful disinflation by the NBU will bring down inflation expectations in the future, albeit with some delay. Likewise, the disagreement in expectations—which may be interpreted as a measure of uncertainty about inflation—will decline. It is likely that households/firms’ expectations may diverge from those of professional forecasters. One may also predict that long-term inflation expectations of professionals will stabilize at the official inflation target of 5 percent.

Concluding remarks

As the National Bank of Ukraine prepares its future conversion to an inflation targeting regime, it must come to terms with many profound challenges, including a high rate of inflation, economic weakness and political instability. But one advantage it will have over previous countries which have gone through this experience is a pre-existing set of surveys that measure the inflation expectations of different agents in the economy. This will enable the NBU to track in realtime the success of its communications strategy and the extent to which the regime change is affecting the economic expectations of Ukrainians. While the surveys are not completely ideal in their current forms, it would take only small changes and additions to bring them to the frontier of this type of survey, and such changes could reap many benefits to policymakers. For example, they could provide measures of long-run inflation expectations for households and firms, measure the uncertainty in these agents’ forecasts, and track these agents’ perceptions of recent inflation dynamics. Each of these would be enormously useful for a central bank in the midst of a disinflationary effort.

But even without these changes, the surveys have already proven informative. For example, they have revealed striking differences and similarities in the inflation and exchange rate expectations of Ukrainian households and firms. They have also revealed a surprisingly strong correlation between expectations of exchange rate changes and expectations of inflation over time, supporting the notion that Ukrainians use the exchange rate as a key signal of overall price movements in the economy. This suggests that even under an inflation targeting regime, policymakers may want to try to limit fluctuations in the hryvna to avoid excess volatility in the inflation expectations of households and firms in Ukraine.

Unfortunately, the lesson from other inflation targeting countries is that the battle to anchor expectations is a long one, even when inflation rates have been brought down and held down for many years. Twenty-five years after adopting inflating targeting in New Zealand, households and firms there still forecast inflation well above the target, as do households in the U.S. This process may be even more challenging for Ukraine that has a history of recent hyperinflation. Thus, Ukrainian policymakers will likely need to be patient and not expect immediate results, at least when it comes to inflation expectations.

The article was initially published on Visnyk of National Bank of Ukraine

Notes

[1] Most central banks have access to some survey measures of inflation expectations. However, very few banks have measures of inflation expectations for households, firms, and professional forecaster at the same time.

[2] For exchange rate expectations, we have access to data starting in 2006.

[3] In part, this difference is observed because of the different timing of the survey. The survey of consumers is pooled across three months of 2015Q2, while the survey of firms is conducted in the middle of the quarter.

[4] In the rest of the paper, we use raw moments.

[5] If expectations are well anchored, forecast uncertainty should be minimal as agents should assign low probabilities to extreme variations in inflation or other relevant macroeconomic aggregates, especially at longer horizons.

[6] Recently, the NBU added a question about expected 3-year-ahead inflation to the firm survey. Unfortunately, this question is asked only once a year and the horizon is short relative to the 5-to-10 year standard.

[7] Some variation in our measure of disagreement is due to the fact that the survey questions elicit inflation expectations in brackets which are revised over time in terms of coverage of possible inflation values as well as the size of brackets.

[8] Unfortunately, there is no survey of firms’ inflation expectations in the U.S.

[9] Expectations of financial markets are similar to expectations of professional forecasters in the U.S.

References

1.Cameron, A. C., and P. K. Trivedi. (2010), Microeconometrics Using Stata. Rev. ed. College Station, TX: Stata Press.

2.Coibion, Olivier, and Yuriy Gorodnichenko. (2012). “What can survey forecasts tell us about informational rigidities?” Journal of Political Economy 120, 116 – 159

3.Coibion, Olivier, and Yuriy Gorodnichenko. (2015). “Information Rigidity and the Expectations Formation Process: A Simple Framework and New Facts”, American Economic Review 105 (8), 2644 – 2678.

4.Coibion, Olivier, and Yuriy Gorodnichenko. (2015). “Is The Phillips Curve Alive and Well After All? Inflation Expectations and the Missing Disinflation”, American Economic Journal – Macroeconomics 7, 197 – 232.

5.Coibion, Olivier, Yuriy Gorodnichenko, and Saten Kumar. (2015). “How Do Firms Form Their Expectations? New Survey Evidence”, NBER Working Paper No. 21092.

6.Croushore, Dean. (2010). “An Evaluation of Inflation Forecasts from Surveys Using Real-Time Data”. B.E. Journal of Macroeconomics 10 (1), 1 – 30.

7.Mankiw, N. Gregory, Ricardo Reis, and Justin Wolfers. (2003). “Disagreement about Inflation Expectations”. NBER Macroeconomics Annual 2003, Cambridge, MIT Press, 18: 209 – 248, 2004.

8.Manski, Charles F. (2004). “Measuring Expectations”, Econometrica 72 (5), 1329 – 1376.

9.National Bank of Ukraine (NBU). (2015). “When will price stability be ensured in Ukraine?”

10.Walsh, Carl E. (2011). “The Future of Inflation Targeting”, The Economic Record 87, 23 – 36.

Central Bank Week

How Ukraine’s Central Bank Wrecked the Country’s Nascent Economic Recovery in 2011 and Why It Should Not Do It Again(Andrei Kirilenko, Professor of the Practice of Finance at the MIT Sloan School of Management, Visiting Professor of Finance at the Imperial College Business School)

De-Dollarization of a Dollarized Economy (Egor Perelygin, Head of Department of Strategic Planning, MBA)

Tax Reform in the Light of Macroeconomic Stability: the NBU Perspective (Dmytro Sologoub, Deputy Governor at National Bank of Ukraine, and Serhiy Nikolaichuk, Director of monetary policy and economic analysis department at NBU)

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations