Horizontal mergers, like horizontal agreements, are generally considered the most likely of their kind to harm competition, because they by definition remove an actual or potential competitor from a market.

Horizontal mergers, like horizontal agreements, are generally considered the most likely of their kind to harm competition, because they by definition remove an actual or potential competitor from a market. The Horizontal Merger Guidelines issued in 2010 by the antitrust enforcement agencies in the US – the Antitrust Division of the Department of Justice, and the Federal Trade Commission – describe what I will summarize as a four-step process for the analysis of the likely competitive effects of horizontal mergers, and that is the rubric that we will use here as well. Merger analysis by the European Commission and other bodies using an EU standard generally follows a very similar analytical framework.

The analytical steps of the Horizontal Merger Guidelines may be summarized as follows:

- Market definition (and description)

- Barriers to entry into the market

- Identification of potential adverse competitive effects from the merger

- Efficiencies

Market definition

The first conceptual step in the analysis is market definition: the outlining of the specific locus of competition between the two merging firms. (If the firms produce a hundred competing products, this and the following steps may be performed a hundred times, but we will consider a single instance.) In turn, the market defined in merger analysis has two dimensions: product and geography.

The product market in which the two firms compete is the specific product or service that the two firms sell, in competition with each other, to customers. The products are in the same product market if customers consider them to be close economic substitutes for the satisfaction of their wants; more technically, they are in the same product market if the cross-price elasticity of demand between them is significantly different from zero. (Indeed, Landes and Posner noted thirty-five years ago that the process of market definition in antitrust analysis would be unnecessary if we could estimate price and cross-price elasticities of demand with confidence[2].)

In turn, the geographic market in which the two firms compete is the physical area from which customers may economically acquire the product or products defined as the product market. This may be anything from a particular region within a country (as with bulk commodities such as cement) to the entire world (as with high-value products and services such as musical instruments and electronic consumer durable goods).

Both the product market and the geographic market are defined from the explicit standpoint of the customer: what are the economic alternatives facing customers – in terms of the product itself and the geographic source of the product – as they seek to satisfy their wants? If a particular alternative product seems functionally identical to products within the market but is too expensive to be considered an economic alternative to customers, it is not in that product market. If a particular product is within the product market but is manufactured so far away that its transport cost makes it too expensive to be considered an economic alternative for customers located in a particular area, or if customers require local service organizations and distant suppliers are unable economically to provide them, then the location where the distant product is produced, and the producers situated there, are not in that geographic market.

The Horizontal Merger Guidelines of the US enforcement agencies formalize this determination of product and geographic markets in the so-called “hypothetical monopolist” paradigm. The logic is as follows. Consider the two products of the merging firms that compete with each other. (Again, if there are one hundred such products produced by each firm, this process is undertaken one hundred times.) Now imagine a firm having a monopoly on those two products. Would that firm profitably raise the price of one or both of the products to a level significantly above the current level? (In the language of the Guidelines, one is imagining a “small but significant and non-transitory increase in price,” or SSNIP.) If so, those two products constitute a market, and the Guidelines analysis proceeds accordingly. If not, the analysis asks, what is the product that customers will switch to that will defeat the attempted price increase? (If one is defining the geographic market rather than the product market, substitute the words “geographic area” for “product”.) Now add that product (or geographic area) to the posited “market”, and ask the question again. Repeat this process until the answer is yes – that is, until one has a group of products for which a monopolist of all those products would indeed profitably raise the price to a level significantly above the current level. That group of products is then a product market for the purposes of analyzing the likely competitive effects of the merger.

An example: Coca-Cola trying to buy Dr.Pepper

Market definition is often the determining factor for whether a proposed merger is judged as likely to harm competition. One interesting example is provided by the proposed acquisition of the Dr. Pepper Company by Coca-Cola in the 1980s[3]. The staff of the Federal Trade Commission was concerned that the merger would reduce competition in the product market that they termed “carbonated soft drinks”, a market in which Coca-Cola had about 37 percent of US sales and Dr. Pepper had almost 5 percent. The merging parties argued that the product market was broader; they contended that carbonated soft drinks compete with other beverages, such as fruit juices, milk, coffee, tea, and water, for the business of customers. (In terms of the “hypothetical monopolist” paradigm, the merging parties were arguing that a monopoly seller of carbonated soft drinks could not raise prices above the pre-merger level, because a sufficiently large share of customers would switch to these alternative beverages rather than pay the higher price for carbonated soft drinks.)If the market were indeed that broad, the market shares of the merging parties would of course be very small, and the merger would likely be judged not harmful to competition. However, the FTC was able to show in the companies’ own planning documents that their actions were constrained by worries about competition from other carbonated soft drink manufacturers but not from producers of these other beverages. In this narrower market, the proposed merger was ruled to violate the Clayton Act, and was prohibited.It is interesting to note here, however, that a narrower market definition does not always lead to the conclusion that a merger would more likely be harmful to competition. Some analysts writing about the Coca-Cola-Dr. Pepper merger ex post suggested that the merging parties might have been better off arguing for a very narrow product market – in particular, cola-flavored carbonated soft drinks. Since Dr. Pepper is not a cola, that definition of the market would have led to the conclusion that the merger would not reduce competition at all, in fact would not even be a horizontal merger.

It is also interesting to note that the analytical and empirical process of market definition has – like other parts of the economy – been undergoing technological change in recent years, with advances in econometrics, improvements in computing capabilities, and, perhaps most important, the availability of very large data sets concerning the sale of particular products (especially nondurable consumer products). Economists have begun seeking to estimate the cross-price elasticities of substitution between and among different products directly from observations of quantities purchased and prices charged in retail stores, in addition to the traditionally less direct methods of (for example) interviews with market participants, examination of internal company documents, and a search for “natural experiments”. These econometric techniques are already proving quite helpful in enforcement agency deliberations concerning possible challenges to mergers.

Identifying market shares

Included in this step in horizontal merger analysis is the identification of the firms that participate in the product and geographic market, and the estimation of their shares of the market. This is normally a fairly straightforward exercise, once the product and geographic market definitions are determined. The firms identified as “in the market” normally include all current sellers.

The “market shares” of firms are typically measured using their current sales. Alternatively, or in addition, they may be measured using their physical production (i.e. not multiplied by prices, as in the sales figures) or production capacity. Production may be a better reflection of the importance of different firms in the market than sales if, for example, in a particular year an unusual amount of production has gone into inventory or has been sold in different geographic markets.

Capacity may be a better reflection than production or sales if the capacity utilization is currently very low, or if for some other reason the firm’s current levels of production and sales are not a good indicator of its likely future production or sales – for example, if the firm’s capital stock is antiquated and deteriorating, or if its stock of a particular resource is becoming seriously depleted. For example, in U.S. v. General Dynamics Corp.[4], the US Supreme Court declined to block a merger between two companies with large shares of regional coal production, on the grounds that one of the companies had nearly exhausted its reserves of coal and hence was unlikely to be an important competitor in that market in the future.

Furthermore, if all the firms in a group seem equally well positioned to compete for customers, and if all are not capacity constrained, they may be usefully considered to have effectively equal market shares. In that case it is the number of (effectively competitive) firms in the market rather than their existing shares of sales, production, or capacity that may be considered to provide the most accurate indicator of the extent of competition.

The US antitrust agencies typically use their estimates of market shares to calculate the Herfindahl-Hirschman Index, or HHI, which is a summary statistic for market concentration. The US Guidelines provide HHI numbers which may indicate roughly when a proposed merger is likely or unlikely to be considered a competitive problem. Other agencies around the world may use the HHI, the four-firm concentration ratio, and/or other concentration statistics.

However, it is important not to overestimate the precision of such statistics, or the weight that is put on them by the enforcement agencies. Regardless of the apparent scientific precision of one statistic or another, these indexes are only as exact as the assumptions behind them, and these assumptions – concerning, for example, the exact metes and bounds of the definitions of product and geographic markets – are inherently imprecise. Therefore, very low estimates of industry concentration – however measured – may lead directly to agency decisions not to challenge a proposed merger, but high estimates are almost never dispositive on their own in leading to a challenge.

Barriers to entry

The second step in the Guidelines approach to horizontal merger analysis is to examine the degree to which there are barriers to the entry of new firms into a particular (product and geographic) market. Even if a proposed merger would increase concentration in a market by a significant amount, and to a significantly high level, the merged firm would arguably not be able profitably to raise prices if other firms could easily enter the market and take away their business[5].

Among barriers to entry in a particular market might be

- patents, licenses, or other intellectual property,

- government regulations, including the need for environmental or other permits,

- high levels of sunk costs,

- difficulty of obtaining access to particular inputs,

- incumbents’ brand name and reputation, and

- possible responses to entry by incumbents.

Over the past few decades, barriers to entry and market definition have been probably the two most important steps in the Guidelines analysis in terms of both agency decisions whether to challenge a merger and judicial decisions whether to uphold a challenge.

Merger analysis asks whether a presense of a praticular barrier to entry presence in the market will delay or prevent market entry in response to anticompetitive price increases. The point is to understand the likely competitive consequences of a proposed merger, and for that, as noted earlier, it is necessary to attempt to predict the future.

Even if entry is demonstrably possible, it does not follow that entry or the threat of entry will necessarily protect customers from anticompetitive behavior by a merged firm with a large market share. As emphasized in the US Guidelines, for ease of entry to mitigate structure-related concerns that a merger would be anticompetitive, entry must satisfy three criteria:

- it must be timely, in that it will come sufficiently quickly that customers will in fact be protected from anticompetitive price increases;

- it must be sufficiently likely – not simply a theoretical possibility – that the merged firm must take it into account in its competitive behavior; and

- it must be of sufficient scope to protect customers who would otherwise be the victims of anticompetitive price increases.

In both the US and the EU, if post-merger entry is adjudged to be “timely, likely, and sufficient”, then even mergers that would result in highly concentrated markets may not be challenged.

Two examples are illustrative. First, one reason for the EU competition directorate’s decision to block the proposed merger of SCA and Metsa Tissue was its finding that the merged firm’s large share of consumer tissue markets in Nordic countries would be protected from entry by other firms because of the importance of local manufacturing capabilities, regional supplier networks, and strong brand name loyalty[6]. On the other hand, an important reason for the Circuit Court of the District of Columbia decision not to block the proposed merger of two of a small number of underground oil drilling operators was its finding, confirmed on appeal, that entry into that market was not overly difficult[7].

Competitive effects

The third step in the Guidelines analysis is to consider the specific competitive effects likely to result from the merger. If market shares suggest a concentrated post-merger market where customers may be subject to anticompetitive behavior, and further analysis determines the presence of significant barriers to entry into the market, what is the exact mechanism through which the loss of competition is likely to appear? Analysts, agencies, and tribunals generally differentiate between two classes of possible anticompetitive effects of a merger: coordinated effects and unilateral effects.

“Coordinated effects” refer to the possibility that, by reducing the number of competitors in a market, the merger will make formal or informal coordination among the remaining competitors easier, and thus facilitate the increase in price and reduction in output that accompanies seller coordination. This was the theory of harm emphasized in the earlier versions of the US Horizontal Merger Guidelines, where much of the discussion followed the logic of the classic work of George Stocking, Myron Watkins, and George Stigler[8].

Stigler argued that a successful agreement among firms to coordinate their competitive behavior must solve three problems: how to reach an agreement on the particular course of action, how to detect “cheating” on the agreement, and how to punish cheaters[9]. He then outlined a number of factors that seemed likely to help “solve” these problems, and so to facilitate coordinated behavior among competitors in a particular market. Among the most important of these were a) homogeneity of product, b) fragmentation of buyers, c) small size of typical transactions, d) small number of sellers, and e) secrecy of prices.

In markets exhibiting these characteristics, Stigler argued, a reduction in the number of competitors would be more likely to lead to a coordinated outcome among the remaining firms than would a similar merger in a market with the opposite characteristics that made coordination more difficult. The Guidelines sensibly added past findings of collusion in this market to the list of factors that would be considered to make collusion a more serious danger in a particular market, and hence a merger of two market participants more of a matter of antitrust concern.

An example of a merger challenged on coordinated effects grounds in the US was the proposed merger of H.J. Heinz and BeechNut, two of the three (along with industry giant Gerber) principal sellers of “baby foods” in the US[10]. The Federal Trade Commission ruled, and the appeals court agreed, that the reduction of the number of significant competitors in the market from three to two would make collusion between the remaining two sellers much easier and so more likely. (Note that this is an example of a merger challenged under the “SLC” paradigm of merger control that might not have been as subject to agency challenge under the old EU-style “dominance” rubric, since the merger would arguably not have strengthened – and might have weakened – the dominant position of the number one firm in the market, Gerber.) Recent EU decisions prohibiting mergers on the grounds that they would lead to “collective dominance” – for example, Gencor/Lonhro – are based on similar logic.

“Coordinated effects” remain in the Guidelines and remain a matter of real concern in merger enforcement. In 1992, however, they were joined in the Guidelines by “unilateral effects” as a second and distinct competitive worry from a horizontal merger[11]. The “unilateral effect” means that a merged firm can, for example, raise the price and thus make consumers worse off, while separate firms would be competing on this dimension. The unilateral effects paradigm seems in fact closer to Stigler’s original point concerning the importance of cross-price elasticities of demand among competing products, and, appropriately, econometric demand estimation has taken a much more important place in the analysis of the possible unilateral effects of mergers than in that of coordinated effects.

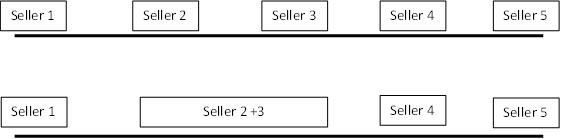

Unilateral effects are perhaps most easily visualized in a Hotelling-type model with multiple sellers arrayed on a line, where the line may represent some dimension of product attribute or quality (or, in a more straightforward fashion, may represent physical location)[12]. Consider five sellers located equidistantly on this line, numbered from left to right as seller 1 through seller 5 (Figure 1).

If customers are spread uniformly along the line and they tend to purchase the product located closest to their position, then each seller competes most intensely with the seller on each side of it. So, for example, if seller 2 considers raising its price, its most serious concern will be the potential loss of business to the sellers on either side, that is, sellers 1 and 3. Seller 4 and a fortiori seller 5 are less important as competitive constraints on the competitive behavior of seller 2 than are sellers 1 and 3.

Now suppose that seller 2 merges with seller 3. If the product and customer locations are unchanged, then a price increase by seller 2 remains most constrained by the potential loss of customers to sellers 1 and 3. But now sellers 2 and 3 are maximizing profits jointly, so that any customers diverted from seller 2 to seller 3 are no longer lost as a result of the price increase; those customers remain as customers of the combined firm. For this reason, the prices charged by sellers 2 and 3 are likely to be higher post-merger than pre-merger. Since sellers 4 and 5 were less important as constraints on the behavior of the original seller 2, a merger of seller 2 with either seller 4 or seller 5 would reduce competition less, and hence would be of less concern to the competition authorities.

Again this goes back to the original insights of Stigler that the more we know about cross-price elasticities of demand, the more directly we can estimate the competitive effects of mergers and the less we need to know about the precise definitions of markets. In the case of this merger of seller 2 with seller 3, a unilateral effects model renders arguments concerning whether, for example, seller 5 is actually in the same product or geographic market as sellers 2 and 3 much less interesting; likewise with the precise calculations of market shares and HHI levels accompanying the proposed merger. These “structural indicia” of competition in the market contain less useful information than the more detailed and more focused analyses of how significant are the constraints currently imposed by the merging firms upon one another.

However, firms in a Hotelling-style model may not be fixed in their locations on the line. An additional question in unilateral effects analysis of a merger like this one is whether a new or existing firm would find it profitable to “reposition” itself closer to seller 2 in response to an anticompetitive increase in price by seller 2. If repositioning is easy, a post-merger price increase would be likely to simply encourage other sellers to move closer to sellers 2 and 3, allowing them to attract some of the customers suffering the price increases. In that case, the merged firm would be unlikely to increase prices in the first place. If, on the other hand, repositioning is difficult, seller 2 could indeed raise price post-merger without worrying about losing sales in the direction of seller 3: it has merged with its closest competitor in this range of product space.

Unilateral effects are often a matter of competitive concern in mergers of firms that sell differentiated products, since such firms, pretty much by definition, devote a good deal of resources to seeking to locate their products in a desirable “position” in market space. (On the other hand, if products are differentiated, they are also by definition not homogeneous, and under the Stiglerian theory, coordinated post-merger behavior would thus be less of a worry.)

In one of its earliest unilateral effects cases, the Antitrust Division of the Justice Department successfully challenged the proposed merger of Continental Baking and Interstate Baking. In some regions of the US, Continental and Interstate were either the only two or two of the only three producers of branded white bread. White bread is in the US a product heavily advertised and highly differentiated by brand name, and the evidence suggested that if these two firms merged and raised their prices, most of the sales lost by either one would go to the other, not to “private label” – i.e. less strongly branded – competitors.

Conversely, the Division declined to challenge the proposed acquisition of Maybelline by L’Oreal in 1996[13]. These two were at the time two of the leading manufacturers of women’s cosmetics in the U.S. In the product market that appeared most problematic, mascara, Maybelline was the number one seller and L’Oreal number four, with Revlon (Revlon and Almay brands), and Proctor and Gamble (Max Factor and Cover Girl) together making up 90 percent of sales.

Despite these high market shares – as well as barriers to entry mostly associated with entrenched brand names and high advertising budgets – the Division determined that the merger was unlikely to substantially harm competition, because the two firms competed at opposite ends of the spectrum of product characteristics: Maybelline was a popular-price brand, competing with other popular-price brands like Cover Girl at mass outlets like pharmacies, while L’Oreal was a prestige brand, competing with other prestige brands like Clinique at higher end department stores like Macy’s and Saks Fifth Avenue. In other words, very few high school and college students, faced with a price increase for Maybelline at the local pharmacy, would likely switch to buying L’Oreal at Saks, and very few society ladies, faced with a price increase for L’Oreal at Saks, would switch to buying Maybelline at the pharmacy: there were apparently few marginal customers likely to be harmed by the merger.

Efficiencies

The final step in the US Horizontal Merger Guidelines analysis is the examination and accounting for efficiencies – that is, results of the merger that would improve welfare, through, for example, the lowering of costs – and so might arguably outweigh any reductions in welfare from losses to competition from the merger. Different jurisdictions treat efficiencies differently under their merger control statutes – in the US, this “balancing” of merger efficiencies with competitive harms has arguably been approved by appeals courts but not so far by the Supreme Court – but almost all antitrust agencies consider possible efficiencies in their internal deliberations as to whether a particular merger proposal deserves challenge.

The Ukrainian competition law provides that the Cabinet of Ministers may authorize a merger that was initially turned down by the Antimonopoly Committee “if a positive effect produced by the concentration on the public interests outweighs negative consequences of the restriction of competition” (Article 25, section 2), unless the losses of competition from the merger “are not necessary for attaining the purpose of the concentration” or “constitute a threat to the system of market economy” (Article 25, section 3).

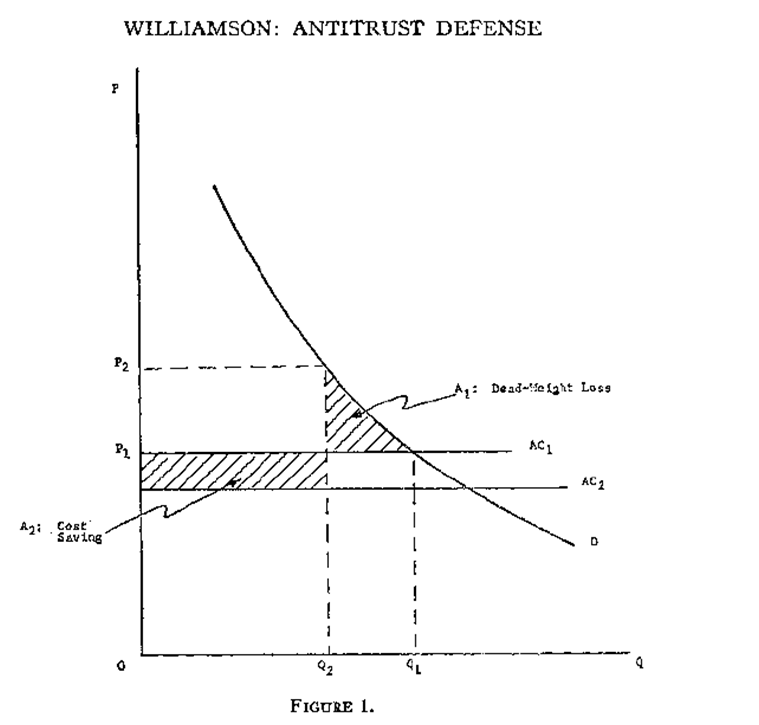

The paradigm under which these agencies consider possible merger efficiencies has not changed much since the classic article by Williamson, which suggested diagrammatically the tradeoff between the “rectangles” of cost savings and the “triangles” of welfare losses from price increases[14] (see diagram below).

Dynamic efficiencies, though even more difficult to specify with any certainty, may also be considered and may dominate the static calculations of the Williamsonian tradeoff.

The US antitrust agencies have made it clear in their Horizontal Merger Guidelines that they will take prospective merger efficiencies into account in their deliberations as to whether to challenge a merger when the efficiencies can be demonstrated with some confidence and when it is clear that the efficiencies could not be achieved by some other means that would not involve the elimination of competition between the two firms.

For example, merger-generated efficiencies may enhance competition by permitting two ineffective competitors to form a more effective competitor, e.g., by coming complementary assets. In a unilateral effects context, incremental cost reductions may reduce or reverse any increases in the merged firm’s incentive to elevate price. Efficiencies also may lead to new or improved products, even if they do not immediately affect price. In a coordinated effects context, incremental cost reductions may make coordination less likely or effective by enhancing the incentive of a maverick to lower price or by creating a new maverick firm. (Guidelines at 10)

In both the US and Europe, there is one class of efficiencies that have received special legal treatment: those arising in the presence of a so-called “failing firm.” If one of the parties to a merger is losing money and in danger of leaving the business, and if as a result of this its productive assets would leave the market, a likely result would be a reduction in quantity produced and an increase in price – hence a welfare loss, however measured. If the proposed merger would prevent this scenario from playing out, then its a priori effect on welfare is positive, not negative. Both enforcement agencies and adjudicative bodies have recognized this effect and have shown some degree of tolerance for mergers, even among close competitors, that keep the assets of “failing firms” in the market.

However, as with the consideration of efficiencies generally, there are certain requirements that must be met if the “failing firm defense” is to be successful, and these have to do with the likelihood that the assets of the firm alleged to be failing would indeed leave the market if the merger does not take place.

In the course of nearly every US and EU merger investigation, the merging parties present arguments and evidence concerning the large efficiencies likely to result from the merger. Typically these claims are quite speculative and lacking in concrete evidence, and the enforcement agencies treat them with appropriate skepticism. (An exception is where the evidence demonstrates that the efficiencies were identified in advance of the decision to merge, but this is the case in surprisingly few instances.) However, in this author’s judgment the efficiencies implicit in the “failing firm” argument are more easily verified using objective measures, so this argument is more likely to be successful than more general forecasts of efficiencies in persuading an agency or adjudicatory body not to seek to block a proposed merger.

It is important to emphasize, however, that in most antitrust jurisdictions, including the US and the EU, the vast majority of proposed mergers, horizontal or otherwise, are not challenged. In particular, in most jurisdictions there is generally no burden of proof at all on the merging firms to demonstrate that the merger would result in efficiencies or any other kinds of public benefits: the framers and enforcers of the antitrust laws assume that the market will usually do a better job of recognizing these benefits than will government agencies, and will lead profit-maximizing entrepreneurs and investors into those mergers that add value to the economy. It is only in that relatively small number of cases where the agencies identify and demonstrate the likelihood of significant harm to competition from the merger that the burden of proof may switch to the merging firms, either to demonstrate that the agencies are incorrect in their fears of a loss of competition from the merger or to demonstrate that, in spite of the possible loss of competition, the likely efficiencies from the merger are so substantial that they will outweigh the harm from the loss of competition.

For example, in the United States and many other jurisdictions, firms seeking to merge are required to notify the antitrust authorities in advance if both the magnitude of the proposed transaction and the size of the participating firms meet certain thresholds[15]. During the decade 2006-2015, the U.S. agencies received an average of 1525 premerger notifications per year. Of these, the Antitrust Division opened an average of 64 preliminary investigations per year, issued an average of 24 “second requests” (demands for more extensive and detailed information from the companies), and filed an average of seventeen “public challenges”[16]. The FTC averaged 21 “merger enforcement actions” per year during the same decade.[17]

Notes:

[1] The views expressed do not purport to represent the views of the U.S. Department of Justice.

[2] William Landes and Richard Posner, “Market Power in Antitrust Cases,” Harvard Law Review 94 (1981), pp. 937-996.

[3] This case is discussed in detail in Lawrence J. White, “Application of the Merger Guidelines: The Proposed Merger of Coca-Cola and Dr. Pepper,” in J.E. Kwoka and L.J. White, eds., The Antitrust Revolution, 2nd ed., Boston: Scott, Foresman, 1994.

[4] 415 U.S. 486 [1974].

[5] At the extreme, this is the logic behind the idea of “contestability”: even a monopolist may not be able to charge a price higher than the competitive price if entry is sufficiently quick and easy. See William J. Baumol, J.C. Panzar, and Robert Willig, Contestable Markets and the Theory of Industry Structure, New York: Harcourt Brace Jovanovich, 1982, but also Marius Schwartz, “The Nature and Scope of Contestability Theory,” Oxford Economic Papers 38 (1986, supplement), 37-57.

[6] Comp/M2097, 31 January 2001

[7] U.S. v. Baker Hughes, 908 F.2d 981 [D.C. Cir. 1990].

[8] George Stocking and Myron Watkins, Cartels in Action (New York: Twentieth Century Fund, 1947); George Stigler, “A Theory of Oligopoly,” in Stigler, The Organization of Industry, Homewood, IL: Richard D. Irwin, 1968.

[9] See also E. Green and R. Porter, “Noncooperative collusion under imperfect price information, Econometrica 52 (1984), 87-100, and Louis Kaplow and Carl Shapiro, “Antitrust”, in A.M. Polinsky and Steven Shavell, eds., Handbook of Law and Economics, vol. 2 (Amsterdam: Elsevier, 2007).

[10] For more information, see Jonathan Baker, “Efficiencies and High Concentration: Heinz Proposes to Acquire Beech-nut,” in J.E. Kwoka and L.J. White, eds., The Antitrust Revolution, 5th ed. (New York: Oxford University Press, 2009), and the appeals court decision, Federal Trade Commission v. H. J. Heinz Co., 246 F.3d 708 (D.C. Cir. 2001).

[11] See Robert Willig, “Merger Analysis, Industrial Organization Theory, and Merger Guidelines,” Brookings Papers on Economic Activity: Microeconomics (1991), 281; Janusz Ordover and Robert Willig, “Economics and the 1992 Merger Guidelines: A Brief Survey,” Review of Industrial Organization 8 (1993), 139-150; and Carl Shapiro, “The 2010 Merger Guidelines: From Hedgehog to Fox in Forty Years,” Antitrust Law Journal 77 (2010), 701-759.

[12] Harold Hotelling, “Stability in Competition,” Economic Journal 39 (1929), 41-57, reprinted in George Stigler and Kenneth Boulding, eds., A.E.A. Readings in Price Theory (Chicago: Richard D. Irwin, for the American Economic Association, 1952); or Stephen Martin, Industrial Organization in Context (New York: Oxford University Press, 2010).

[13] For more information, see Constance Robinson, “Quantifying Unilateral Effects in Investigations and Cases,” George Mason Law Review Symposium, Antitrust in the Information Revolution: New Economic Approaches for Analyzing Antitrust Issues, George Mason University School of Law, Arlington, Virginia, October 11, 1996.

[14] Oliver Williamson, “Economies as an Antitrust Defense: The Welfare Tradeoffs,” American Economic Review 58 (1968), 18-36.

[15] See FTC, “To File or Not to File: When You Must File a Premerger Notification Report Form,” Hart-Scott-Rodino Premerger Notification Program, Federal Trade Commission, September 2008.

[16] Calculated from Antitrust Division Work Statistics, FY2006-2015. The number of challenges includes both “Actions Filed in District Court” and “Transactions Restructured or Abandoned Prior to Filing a Complaint as Result of an Announced Challenge”.

[17] Calculated from FTC, “Competition Enforcement Database”. That number is the sum of “Part 2 Consents”, “Federal Injunctions”, “Part 3 Administrative Complaints”, and “Abandoned/Fix-It-First/Restructured”.

The first part of this article on agreements among firms and abuse of dominance can be found here. The second part of the article on mergers and antitrust authorities can be found here.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations