What happened to the budget in March? What are the peculiarities of budget revenues? What is the impact of international cooperation on the sustainability of public finances? What changes can be expected in the near future and what risks could arise? Read about these and other details of the budget execution in the Budget Barometer for March 2023.

What was achieved?

- In March, the revenues of the general fund amounted to UAH 152.2 billion, and excluding international aid, the general fund of the state budget received UAH 106.4 billion (the plan was UAH 101.8 billion, i.e. the plan was exceeded by 4.5%).

- The government has reached an agreement with the IMF that is critical for fiscal sustainability in 2023 and beyond. The four-year Extended Fund Facility (EFF) program provides financing to Ukraine of USD 15.6 billion (SDR 11.6 billion). The EFF program is conditional on Ukraine implementing a number of macroeconomic and financial measures to support its economic recovery. The first tranche of the program of USD 2.7 billion was disbursed on 3 April 2023.

- In March, the government borrowed UAH 116.1 billion more than it spent on repaying and servicing Ukraine’s public debt. In February, the surplus was UAH 19.8 billion. The increase is due to the attraction of a large amount of macro-financial assistance in March – UAH 123.1 billion, or 183.5% of the plan (EUR 1.5 billion from the EU and USD 1.8 billion from Canada), while in February only UAH 24.1 billion was attracted (USD 498 million from the UK and USD 161 million from the World Bank).

- Despite the difficult macroeconomic environment, pensions for 10.5 million pensioners were indexed by 19.7%, and minimum pensions and pension payments were increased on 1 March. Pensions were increased by UAH 100-1500.

What wasn’t achieved?

- Throughout March, the shortfall of funding for all planned expenses persisted. In the first quarter, the total budget expenses amounted to UAH 747.4 billion, with UAH 635.5 billion from the general fund, which equates to 88.7% of the plan for the reviewed period.

- The goal for VAT revenues (including refunds), which is an essential tax for budgeting, was not achieved. The lower-than-expected VAT balance is mostly due to a considerable sum of refunds that were credited to taxpayers’ accounts, amounting to UAH 14.5 billion

What’s next?

- The government bill to increase state budget spending by a record half a trillion hryvnias has been passed by Parliament and signed by the President. The Ministry of Defence will receive UAH 366.65 billion, the Ministry of Internal Affairs will receive an additional UAH 98.4 billion, the State Special Communications Service – UAH 30 billion, the Security Service of Ukraine – UAH 9.3 billion, and the Defence Intelligence Service of Ukraine – UAH 4.6 billion. Additionally, the Reserve Fund will be more than doubled, with an increase of UAH 19 billion. The main source of financing for the new spending will be borrowing, but the budget also includes an increase in revenues of UAH 60 billion, with UAH 36.5 billion coming from an increase in personal income tax and UAH 5.2 billion from VAT.

- As per the conditions of the cooperation agreement with the IMF, the government should adopt and implement the National Revenue Strategy while resuming medium-term budget planning. Moreover, the parliament and the government should avoid and cancel measures leading to erosion of the tax base, such as cancelling tax deferrals implemented during martial law. Another structural benchmark for May 2023 is submitting a draft law to strengthen the provisions of Article 52 of the Budget Code, limiting the possibility of ad hoc budget amendments. This move will enable the Ministry of Finance to manage the budget more efficiently.

- Improved tax administration and a renewed fight against tax evasion will be key to meeting tax revenue targets. Stricter control over tax payments is expected to resume from 1 July – the State Tax Service has published a schedule of documentary audits for 2023, which includes the audit of 95 individuals with annual incomes of more than UAH 100 million. In addition, since the beginning of 2023, the tax authorities have submitted analytical studies on tax evasion totalling UAH 10.6 billion to law enforcement agencies. The moratorium on audits is expected to be lifted on 1 July, along with the cancellation of tax exemptions introduced in the beginning of the full-scale invasion.

Key risks:

- Lower than planned revenues from exchange rate-related taxes. Continued strengthening of the hryvnia in the cash market due to stabilization of external support, improved logistics, the start of the sowing season, and other reasons may keep the official exchange rate at the current level – below the one set in the state budget (exchange rate was expected to be 42.2 UAH/USD (average) when the draft budget was prepared, and 45.8 UAH/USD at the end of the year). This will reduce budget revenues from imports (high risk).

- Decrease in revenues (compared to the plan) due to potentially lower inflation rates as a result of the strengthening of the hryvnia exchange rate on the cash market and optimistic expectations for the economy (medium risk).

- Lower revenues due to lower-than-expected economic activity. The World Bank has lowered its forecast for Ukraine’s GDP growth in 2023 (to 0.5% from 3.3% previously). However, as uncertainty remains high, forecasts from different organisations vary widely. At the same time, the business activity expectations index rose in March 2023 for the first time in recent months (to 49.5 – neutral level, up from 45.0 in February) (low risk).

Details:

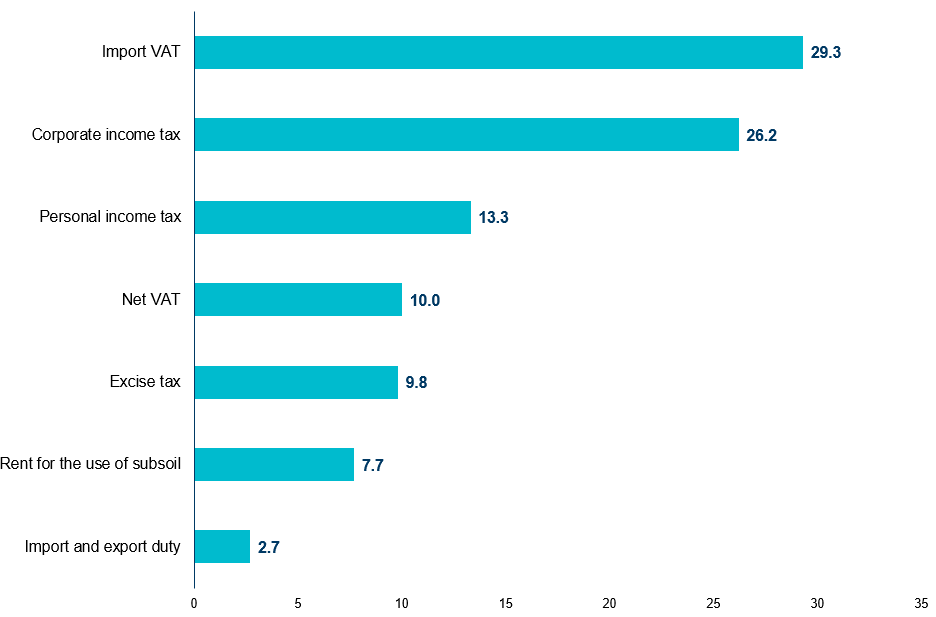

(1) In March, the general fund of the state budget received UAH 152.2 billion (UAH 101.8 billion was planned), as international aid – UAH 45.8 billion grant from the US – was included in revenues. According to the Ministry of Finance, tax revenues were expected to reach UAH 98.2 billion, while the state budget actually received UAH 99.0 billion in revenues from the main taxes (Figure 1).

Figure 1. Main tax revenues to the general fund of the state budget in March 2023, UAH billion

Source: Ministry of Finance of Ukraine

The execution of the budget for various taxes was either higher or lower than planned. Specifically, the excise tax had the highest overperformance of planned targets, with a 38% increase (UAH 9.8 billion collected versus the planned UAH 7.1 billion), possibly due to de-shadowing measures (law enforcement actions to uncover counterfeit products and combat the black market in alcohol and tobacco).

Revenues from most other budget-forming taxes also exceeded the plan. Personal income tax revenue amounted to UAH 13.3 billion, compared to the planned UAH 11.9 billion (+UAH 1.4 billion or 11.8%), probably due to payments to a larger than planned number of military personnel.

Corporate income tax revenues to the state budget reached UAH 26.2 billion, compared to the expected UAH 22.1 billion (+UAH 4.1 billion or 18.6%). These revenues are nominally at the level of 2021-2022 (UAH 25 billion were paid in March 2021 and UAH 27 billion in March 2022).

Rental revenues exceeded expectations by UAH 1 billion, or 14.9% (UAH 6.7 billion was expected according to the plan), which may be due to JSC UkrGasVydobuvannya transferring UAH 4.25 billion in rental payments to the state budget based on the results of January and February 2023.

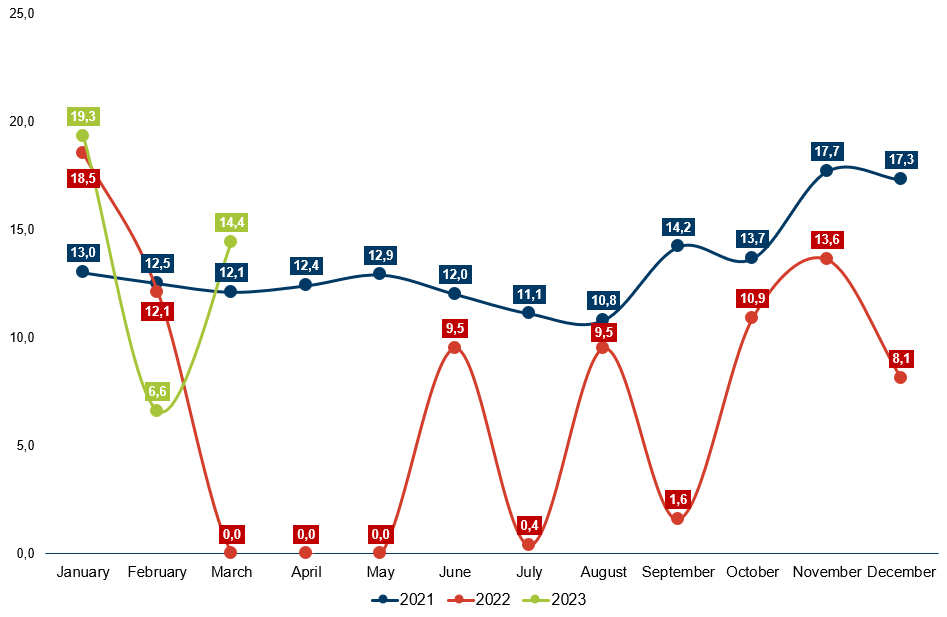

At the same time, VAT revenue targets was not met in March. In particular, it was collected UAH 29.3 billion of import VAT against the planned UAH 31.0 billion (-5.5%), probably due to a decrease in the supply of oil products and fertilizers. Also, revenues from net VAT amounted to UAH 10.0 billion, against the expected UAH 16.7 billion (-40.1%). In March, VAT refunds amounted to UAH 14.5 billion (compared with UAH 6.6 billion in February and UAH 19.3 billion in January) (Figure 2).

Figure 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

(2) In March, the state budget received UAH 45.8 billion, or USD 1.25 billion, in grants provided by the US through the World Bank Trust Fund. In total, the US is expected to provide USD 9.9 billion in budget support in 2023. The first grant of USD 1.25 billion was received on 27 February 2023 and the second grant of the same amount was received on 29 March 2023.

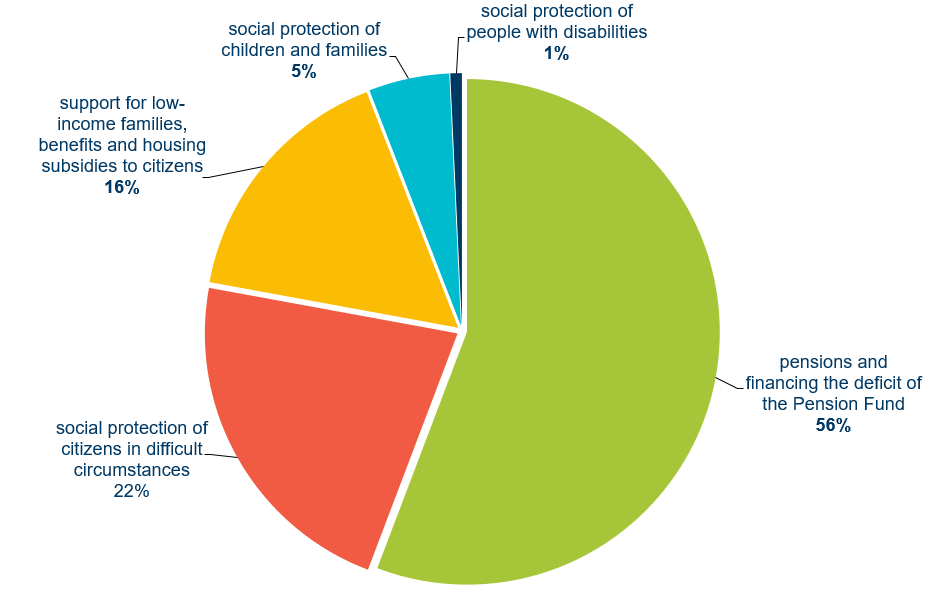

(3) In March, expenditures of the state budget amounted to UAH 300.8 billion (including the general fund – UAH 225.2 billion) or 95.1% of the plan for the reviewed period. In March, general fund expenditures of the state budget were planned at UAH 246.1 billion, and the largest item was the financing of the programs of the Ministry of Defence (UAH 119.3 billion), of which 47.4% was for wages (UAH 56.6 billion). It was planned to allocate UAH 39.8 billion to the programs of the Ministry of Social Policy. However, the state budget actually allocated UAH 40.7 billion to social payments (Figure 3), of which:

- UAH 22.7 billion – pensions and financing the deficit of the Pension Fund;

- UAH 9 billion – social protection of citizens in difficult circumstances;

- UAH 6.6 – billion – support for low-income families, benefits and housing subsidies to citizens;

- UAH 2.1 billion – social protection of children and families;

- UAH 0.3 billion – social protection of people with disabilities.

UAH 27.3 billion was allocated for the programs of the Ministry of Internal Affairs, including UAH 6.4 billion for the State Border Guard, UAH 9.1 billion for the National Guard, UAH 1.1 billion for the State Emergency Service and another UAH 9.8 billion for the National Police. Overall, according to the planned figures, 59.6% of all spending in March was allocated to the defence and security sector, which is in line with the trend of previous months, while the programs of the Ministry of Social Policy were to account for over 16.2% of spending.

Figure 3. Social expenditures in March 2023, %

Source: Ministry of Finance of Ukraine

(4) The actual budget deficit in March was UAH 59.2 billion, and the deficit of the general fund was UAH 72.6 billion, which is half of the planned UAH 144.6 billion. The lower deficit in March was achieved, among other things, by the receipt of UAH 45.8 billion in grants. According to the results of the first quarter of 2023, the state budget deficit amounted to UAH 220.3 billion, and the general fund was implemented with a deficit of UAH 244.7 billion, which is 1.9 times less than planned.

(5) In March, the financing of the state budget from international partners amounted to UAH 123.1 billion (USD 3.36 billion in equivalent). In particular, from the European Union – EUR 1.5 billion or UAH 57.3 billion (the second tranche under the concessional loan program for 2023, which totals EUR 18 billion) and from Canada – USD 1.8 billion (UAH 65.8 billion).

(6) In addition to external financing, in March the Ministry of Finance raised UAH 53.7 billion through the placement of domestic government bonds (including UAH 24.2 billion from benchmark domestic government bonds), which is almost UAH 11.1 billion more than in February, when UAH 42.6 billion was raised. As in previous months, the maximum placement rate was 19.75%. In March, the government also raised UAH 5.3 billion more through the sale of foreign currency-denominated domestic government bonds – UAH 17.4 billion compared to UAH 12.1 billion in February. The government also managed to raise UAH 26 billion more than the amount of bond repayments during this period. The surplus provides an opportunity to finance the budget deficit by means other than debt. The government and the NBU continue to work on ways to finance the budget deficit – from April, non-resident investors will be able to repatriate interest on domestic government bonds received after 1 April 2023. This should make Ukrainian securities more attractive to foreign investors.

(7) In March 2023, local budget revenues from taxes administered by the State Tax Service amounted to UAH 34.5 billion (39.7% more than in March 2022). The implementation of local budget revenue plans remains generally at a good level, with over UAH 100 billion of tax revenues received in the first quarter against the annual plan of UAH 363.7 billion (up by UAH 17.1 billion compared to the same period in 2022). This was mainly due to an increase in income tax revenues (mainly from payments to military personnel) – in January-March 2023, local budgets received UAH 68.2 billion of this tax.

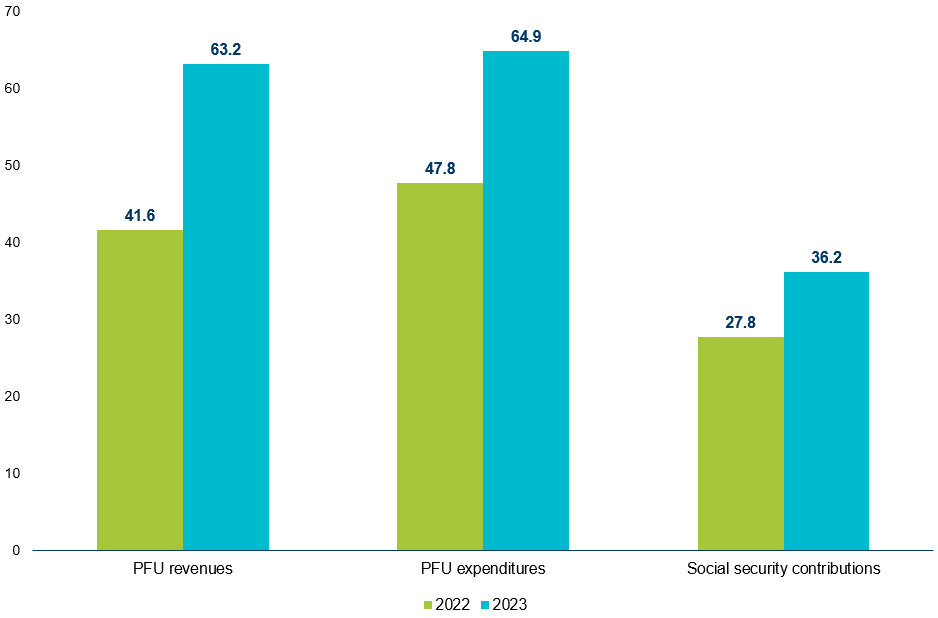

(8) In March 2023, the total revenue from the social security contributions (SSC) increased by 30.2%, or UAH 8.4 billion, compared to March 2022, and amounted to UAH 36.2 billion (Figure 4). Three factors caused the increase: 1) at the beginning of the war in March 2022, there was a sharp decline in SSC revenues due to the advance payment of salaries in February 2022, the sending of some employees on unpaid administrative leave, and the inability of enterprises to operate; 2) the payment of the military contribution; and 3) the minimum wage in 2023 is UAH 6,700, which is UAH 200 higher than in 2022.

(9) In March 2023, the revenues of the Pension Fund increased by UAH 21.6 billion (51.9%) compared to the same period in 2022 and amounted to UAH 63.2 billion due to an increase in the revenues of the Pension Fund from SSC and the new powers of the Fund to pay housing and utilities subsidies and social insurance benefits. The Pension Fund received UAH 5.3 billion from the state budget to deliver housing and utilities subsidies and benefits, and UAH 2.2 billion SSC for social insurance benefits. In March 2023, the Pension Fund received UAH 20.7 billion from the state budget to finance pensions and other related payments (42.8% more than last year). Already in March, the Pension Fund allocated UAH 56.4 billion for pension payments, which is 18% more than in the same period last year (Figure 4). On 1 March, pensions for 10.5 million pensioners were indexed by 19.7% and pension payments were increased. The average pension increase was UAH 579.10. After indexation, the average pension is UAH 5219.69, which is UAH 849.24 higher than the previous year.

Figure 4. Revenues and expenditures of the Pension Fund of Ukraine and the SSC in March 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | |||

| Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 | -168,0 | -93,2 | -144,6 | 72,6 |

| Sources of deficit financing | ||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,7 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,7 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49,0 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | Cumulative (Jan-Mar) | |

| Financing, including | 160,1 | 66,7 | 176,7 | 403,5 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 83,7 | |

| From the placement of domestic government bonds (total), including | 41,4 | 42,6 | 53,7 | 137,7 | |

| in UAH | 38,8 | 30,5 | 36,3 | 105,6 | |

| in foreign currency in UAH billion (USD million + EUR million) |

₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴32,1

($785,1+€86,9) |

|

| From external sources | 118,7 | 24,1 | 123,1 | 265,9 | |

| Public debt repayments | 12,8 | 34,9 | 49,0 | 96,7 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 88,5 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 24,2 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 88,3 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-February

| Resources | Amount, UAH billion (EUR million; USD million; CAD million) |

| Macro-Financial Assistance in accordance with the Memorandum of Understanding between Ukraine and the EU | 177,4

(€4500) |

| Loans from the Government of Canada | 64,2

(CA$2400) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | 18,3

($499,3) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | 6,0

(€152) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,7 |

| Total borrowed, % for January-March | 39,7 | 16,5 | 43,8 |

| From the placement of domestic government bonds, % for January-March | 30,1 | 30,9 | 39,0 |

| Borrowed from external sources, % for January-March | 44,6 | 9,1 | 46,3 |

| Debt repayment payments, % for January-March | 13,2 | 36,1 | 50,7 |

| Servicing payments, % for January-March | 2,5 | 49,6 | 47,9 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,1 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations