What happened to the budget in November? Was the revenue plan achieved in terms of major taxes? What about international financing? What risks are emerging for budget stability and what can be expected going forward? Read more about these and other budget issues in the Budget Barometer for November 2023.

Authors: Yuliya Markuts, Lina Zadorozhnia, Taras Marshalok, Inna Studennikova, Dmytro Andriyenko, Center of Public Finance and Governance at the Kyiv School of Economics

What was achieved?

- In November, approximately USD 2 billion, or UAH 73.8 billion, in external loans were secured. This is crucial for financing the non-defense expenditures of the government.

- The parliament passed changes to the taxation of bank profits. This is expected to bring in an additional over UAH 20 billion for 2023 and at least an additional UAH 5 billion for 2024. However, these funds will be received in the budget next year.

What wasn’t achieved?

- In November, the revenue plan was not met – the receipts of the general fund of the state budget amounted to UAH 121.7 billion, which is 5.9% less than expected. This shortfall is attributed to lower revenues from “import” VAT, which reached UAH 30.8 billion out of the planned UAH 39.7 billion. A primary cause for this was the blockade of the Ukrainian border by Polish carriers.

What’s next?

- In December, an inflow of USD 900 million from the IMF is expected. The decision for the final allocation of this tranche was approved on December 11 by the IMF’s Board of Directors.

- According to the Budget-2024 passed by the Parliament, Ukraine anticipates receiving UAH 1.77 trillion in revenues next year, of which UAH 2.4 billion will be grants. The country plans to finance UAH 3.3 trillion in expenditures, attracting UAH 1.7 trillion in external borrowings and UAH 525.9 billion from the sale of government bonds.

- The National Joint Stock Company “Naftogaz of Ukraine” has signed a loan agreement with the EBRD for EUR 200 million to create strategic gas reserves for the heating season. The agreement will come into effect after the state guarantee is formalized. This reduces the risks of additional budgetary financing for Naftogaz.

Key risks:

- Lower customs revenue this year is due to the continued blockade of the Ukrainian-Polish border by Polish carriers (high risk).

- The Ukrainian Facility program from the European Union, amounting to EUR 50 billion for the next four years, has not yet been adopted. This puts at risk the start of its implementation from the beginning of 2024. There is also a lack of clarity regarding the approval of subsequent financial assistance packages from the USA (high risk).

Details:

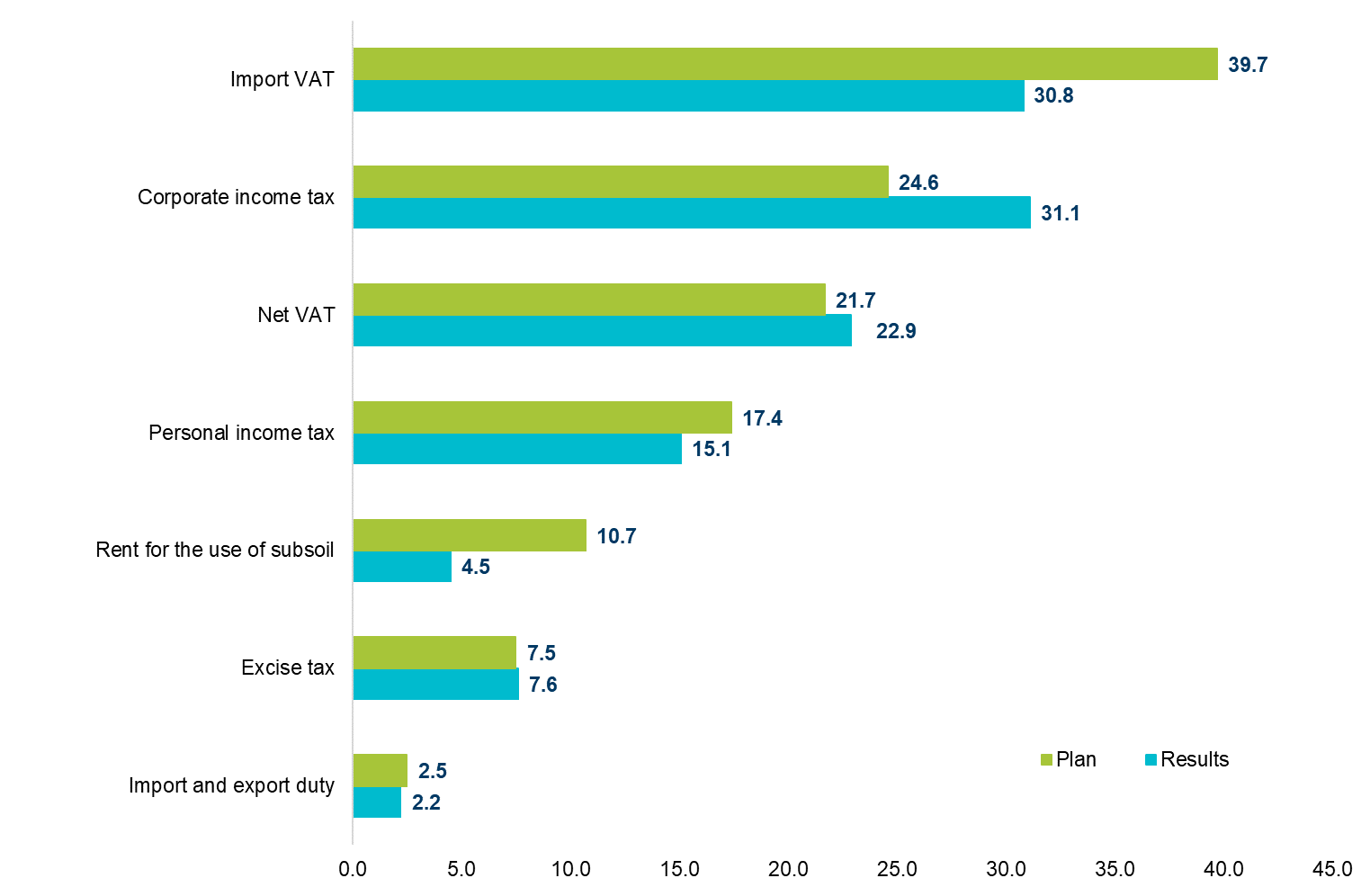

(1) In November, the revenue of the general fund of the state budget amounted to UAH 121.7 billion. The budget’s revenue part was underperformed by 5.9%. The state budget did not receive grants, which negatively affects the budget’s stability in the context of limited internal revenue sources. The reason for this is that the main grantor, the United States, provided all the assistance planned for the 2023 financial year to Ukraine. Moreover, the tax revenue plan was not achieved either: for the main taxes, it was planned to collect UAH 124.1 billion (for the general fund), but in reality, UAH 9.9 billion less was received (Fig. 1).

Figure 1. Main tax revenues to the general fund of the state budget in November 2023, UAH billion

Source: Ministry of Finance of Ukraine

The actual revenues from the corporate income tax (CIT) once again exceeded expectations (by 26.4%) and reached UAH 31.1 billion. The highest contribution to CIT revenues in the 3rd quarter likely came from banks, amounting to UAH 6.6 billion. Profits from other companies were also significant. For example, PJSC “Ukrnafta” recorded a net profit of more than UAH 20 billion by mid-November (for the first half of 2023, it was UAH 14.1 billion). This is influenced not only by rising oil prices but also by changes in the company’s management.

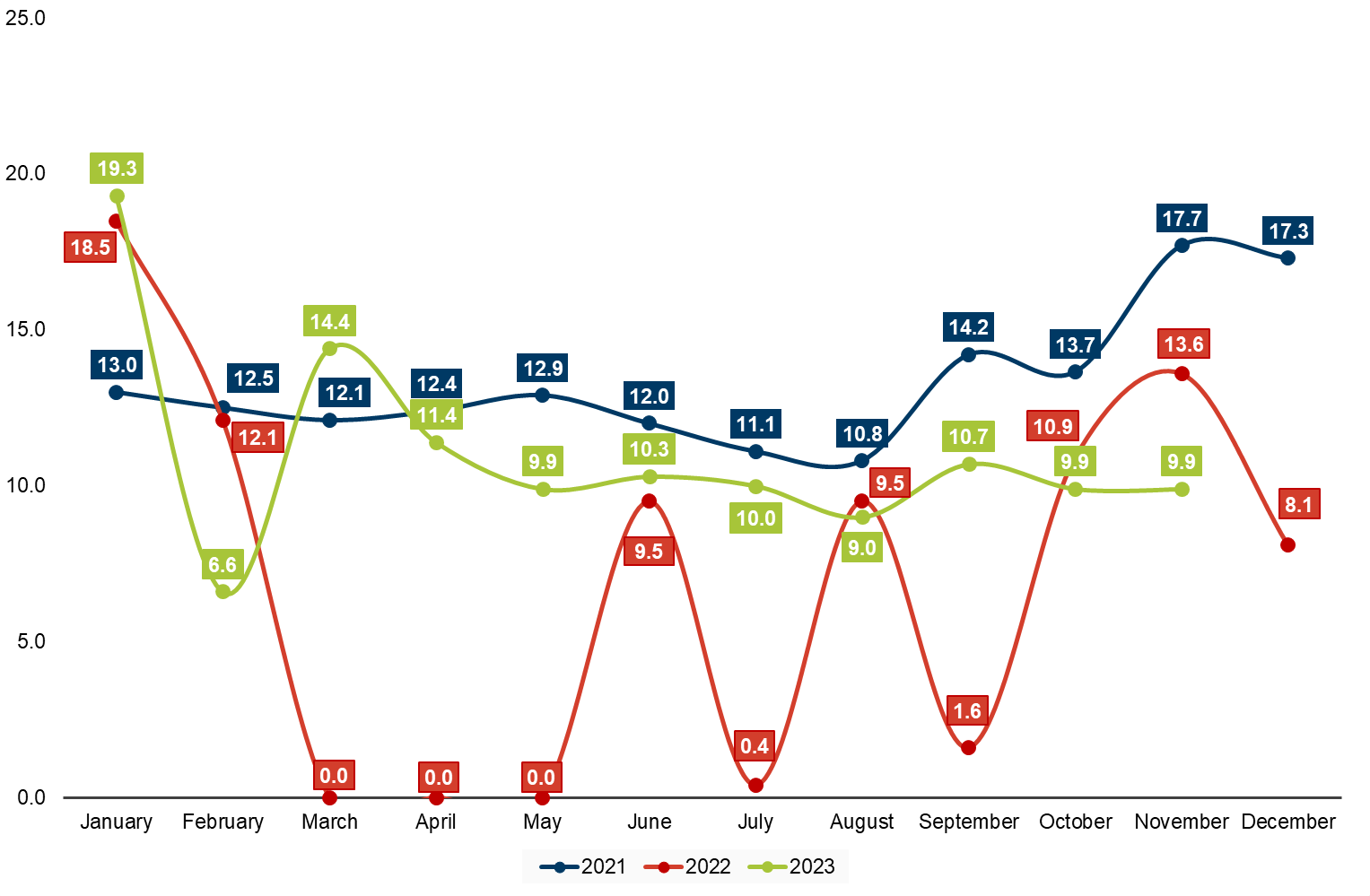

Net revenues from domestic VAT amounted to UAH 22.9 billion, which is 5.5% higher than the plan. The exceedance of planned revenues may be related to higher-than-expected consumption and GDP volumes. At the same time, taxpayers were reimbursed UAH 9.9 billion of VAT refund (the largest amount of agreed and reimbursed VAT in November for tax invoices were received by: LLC “Kernel-trade” – UAH 550.8 million, PJSC “Zaporizhstal” – UAH 455.8 million, PJSC “ArcelorMittal Kryvyi Rih” – UAH 367.2 million). The over-fulfillment of the plan for excise tax revenues to the general fund of the state budget was 1.3% or UAH 100 million – revenues reached UAH 7.6 billion.

Figure 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

In November, there was a significant underperformance in revenues from some taxes. The largest relative shortfall was in the rent payment for the use of subsoil resources, which was 57.9% below the plan. This was due to a decrease in the actual selling price of natural gas from UAH 28.9 thousand in November 2022, when the budget was approved, to UAH 15.2 thousand per 1.000 cubic meters in October 2023, and then to UAH 14.4 thousand per 1.000 cubic meters in November 2023. As a result, UAH 2.2 billion was received for the general fund from taxes on international trade (mainly import duties), which is 12% below the plan. The general fund of the state budget received UAH 30.8 billion from “import” VAT, which is 22% below the plan and 20% lower than the previous month. The shortfall in both taxes is most likely related to Polish carriers’ blockade of the border.

In November, revenues from personal income tax amounted to UAH 15.1 billion, which is 13.2% less than planned. This may be due to the reduction in the wage fund of small and medium-sized enterprises, 17% of which, according to a survey by the EBA, were forced to lay off employees in the 3rd quarter of 2023. Also, in the 3rd quarter of 2023, the number of public servants decreased by almost 2,000 people, leading to lower revenues not only from personal income tax but also from social security contributions.

(2) In November, grants to the state budget were not received. This is due to the exhaustion of all the assistance planned for Ukraine from the USA for 2023. As the fiscal year in the USA ended on September 30 and a new budget was not adopted, Ukraine is unlikely to receive financial assistance from the USA by the end of 2023, which the government was counting on, according to the Minister of Finance.

(3) In November, expenditures of the general fund of the state budget amounted to UAH 286.3 billion, or 78% of the schedule for the reporting period. They were planned to be higher than the average annual level of 2023 – UAH 366.7 billion. This level of planned expenditures in November was primarily due to increased funding for the Ministry of Defense (almost double the average annual level) and record payments for servicing the public debt this year.

The largest planned item was the funding of programs of the Ministry of Defense of Ukraine (UAH 164.3 billion), of which 37.8% was to be labor payment (UAH 62.1 billion). The second largest expenditure item was planned for the programs of the Ministry of Internal Affairs – UAH 47 billion, primarily for the structures subordinate to the ministry:

- National Guard: UAH 18.5 billion.

- National Police: UAH 11.4 billion.

- State Border Guard Service: UAH 10.8 billion.

- State Emergency Service: UAH 5 billion.

Ministry of Social Policy: UAH 39.7 billion was planned, with UAH 22.7 billion expected to go to the Pension Fund for financing pensions and supplements.

For servicing the state debt, UAH 54.2 billion was planned, a record figure for the year. However, in actuality, UAH 37.5 billion or 69.2% was spent, with the majority spent on servicing the internal state debt.

The Ministry of Health was allocated UAH 13.8 billion, of which UAH 11.9 billion was for the state medical service guarantee program.

Overall, according to the planned indicators for November, about 58% of all expenditures were to be directed to the defense and security sector, 10.8% to social security, and another 14.8% for servicing the state debt.

(4) Regarding the state budget deficit in November, it amounted to UAH 145.1 billion. The general fund showed a deficit of UAH 162.5 billion, which is 1.5 times less than the planned indicator for this fund (UAH 236.2 billion). Over the first 11 months of 2023, the state budget was executed with a deficit of UAH 1045.1 billion, and for the general fund, the deficit was UAH 1085.6 billion, which is 1.6 times less than the planned amount (UAH 1713.3 billion). This level of deficit was primarily achieved through the attraction of financial assistance in the form of grants – UAH 404.3 billion, and lower actual expenditure levels than planned.

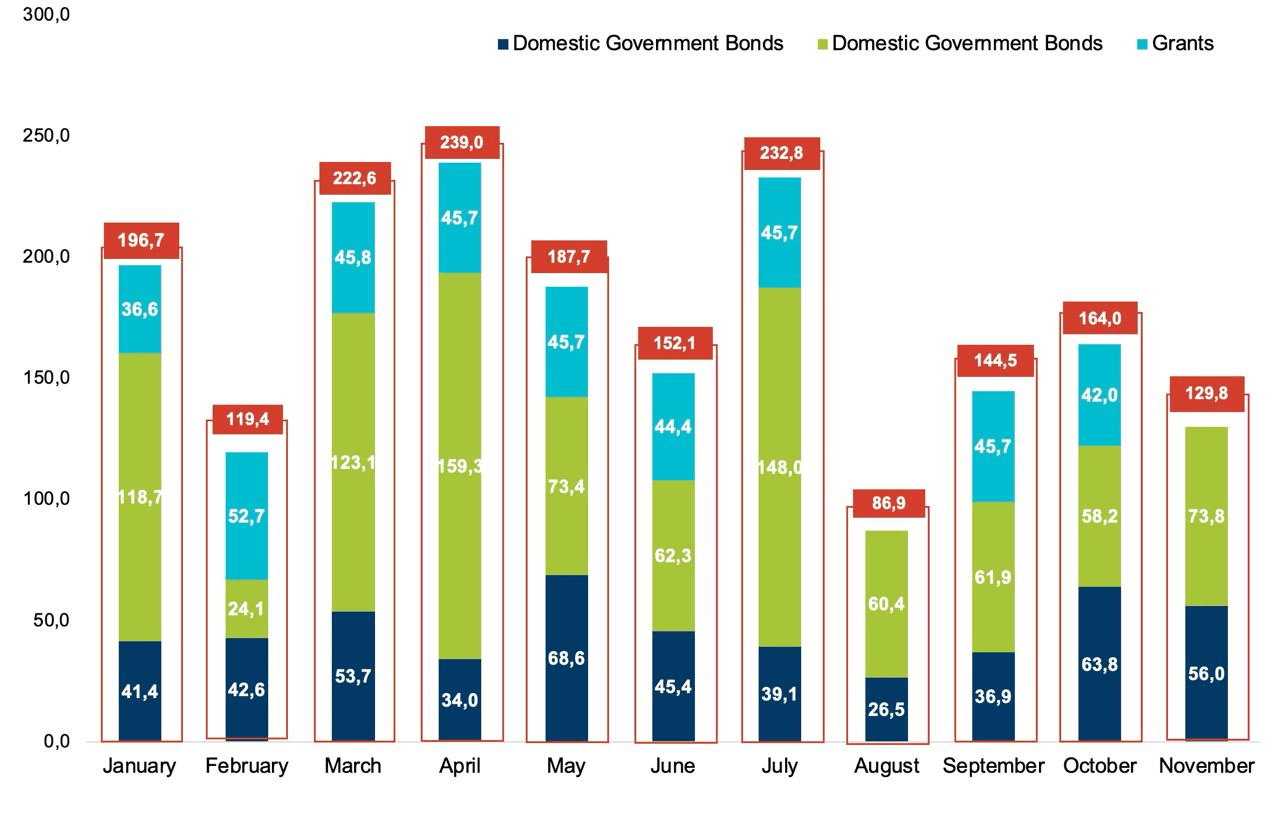

Figure 3. Budget financing for January-November 2023, UAH billion

Source: Ministry of Finance of Ukraine

(5) In November, Ukraine traditionally received a tranche of macro-financial assistance from the EU, amounting to EUR 1.5 billion (approximately UAH 59.2 bn), marking the tenth such installment in the year. These funds were allocated to finance priority expenditures in the state budget, aiding in maintaining macroeconomic stability. Additionally, Ukraine received USD 400 million (about UAH 14.4 bn) in loan funds under UK guarantees from the World Bank’s “PEACE in Ukraine” Trust Fund. These funds were directed towards pension payments and healthcare workers’ salaries. The loan terms are favorable, with a 19-year repayment period, including a five-year grace period. Moreover, the government secured USD 5 million (UAH 0.2 bn) from the World Bank through the International Bank for Reconstruction and Development (IBRD) for the “Strengthening Health Care and Saving Lives” (HEAL Ukraine) project. On December 11, the IMF’s Board of Directors approved the allocation of the third tranche amounting to USD 900 million under the Extended Fund Facility (EFF) program for Ukraine.

(6) Beyond external financing, in November, the Ministry of Finance of Ukraine raised UAH 56 bn from the placement of domestic government bonds, of which UAH 15.8 bn, or 28.2%, were benchmark bonds. The maximum placement rate decreased in November to 18.9%, 0.3 percentage points lower than in October. This decrease might indicate the domestic bond market’s response to the reduction of the National Bank of Ukraine’s discount rate and the maintenance of the national currency’s exchange rate stability after partial liberalization and the introduction of a “managed flexibility of the exchange rate” policy. However, the government had to keep yields high to ensure sufficient demand and secure the necessary funding volume. Additionally, in November, UAH 10.4 bn (USD 286.9 million), or 18.6% of the total funds raised from government bonds in the month, were sourced from foreign currency-denominated bonds. According to the Ministry of Finance, the funds raised from the placement of government bonds over the first 11 months of 2023 fully covered payments for bond redemption. Borrowings on the domestic debt market exceeded bond payments by UAH 165 bn over the first 11 months of 2023, with an excess of UAH 24.5 bn in November alone. Overall, the rollover of investments in government bonds from January to November 2023 was 140%, marking a positive outcome for the government’s work in the domestic debt market.

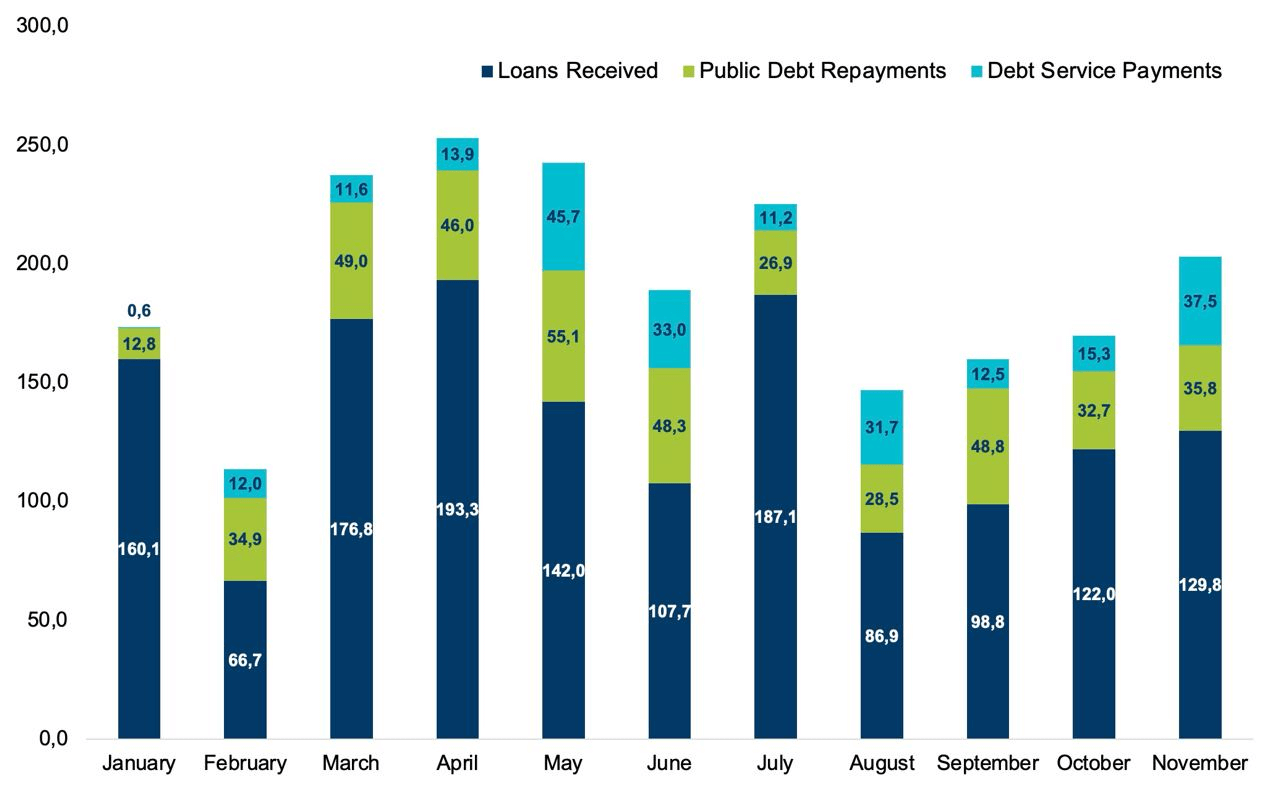

(7) In November, the total borrowings amounted to UAH 129.8 billion, which was UAH 56.5 billion more than the expenses for repayment and servicing of the state debt for the month. Over the first 11 months of the year, almost UAH 1.5 trillion was raised, while UAH 643.8 billion was directed towards repayment and servicing. The majority of the expenses for repayment and servicing were allocated to the internal debt – 84% or UAH 542.5 billion of all funds directed for such purposes, while the amount raised over the 11 months of 2023 on the internal debt market was UAH 508 billion.

Figure 4. Volume of borrowings, repayments and servicing of public debt of Ukraine for January-November 2023, UAH billion

Source: Ministry of Finance of Ukraine

(8) In November, local budgets in Ukraine received UAH 25.3 billion from payments administered by the State Tax Service. From January to November 2023, the total funds received in the general fund of local budgets amounted to UAH 407.3 billion, exceeding the previous year’s figure by 14.9%. The structure of the general fund of local budgets is 65% from Personal Income Tax (PIT), 13% from the unified tax, 8% from land payments, 5% from excise tax, and 3% from corporate profit tax. At the end of the month, the withdrawal of “military” PIT paid since October from local budgets to the state budget began. As of November 1, local budgets held UAH 3.2 billion of unused educational subvention funds.

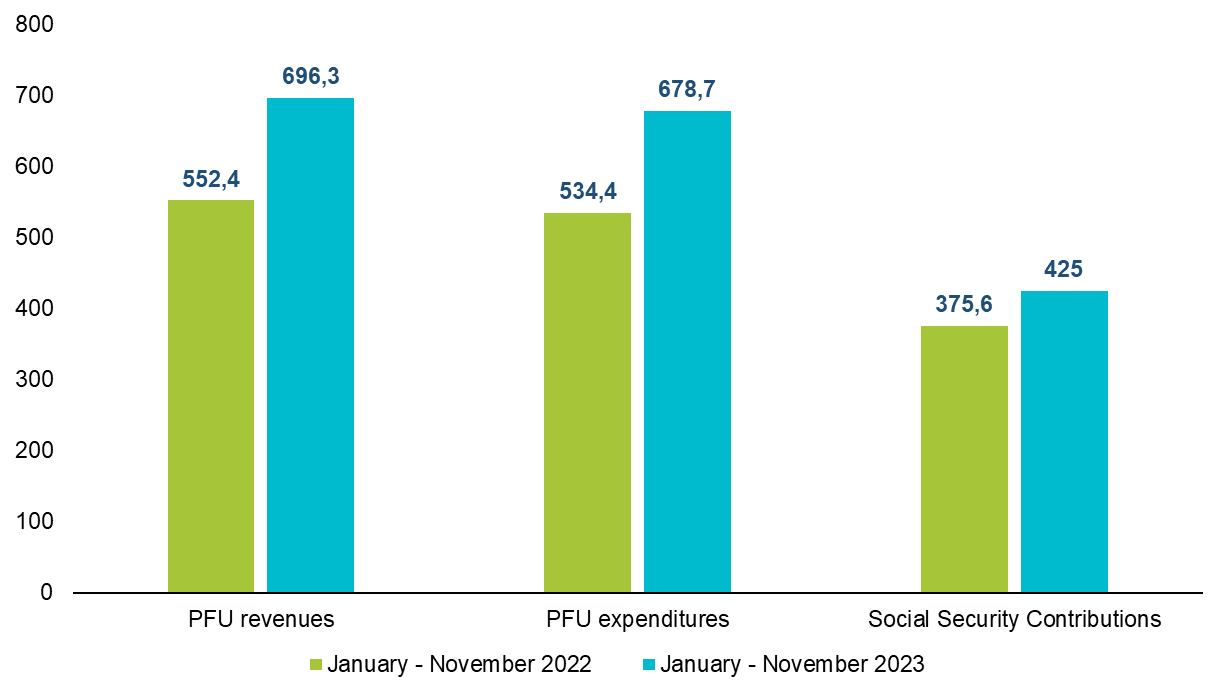

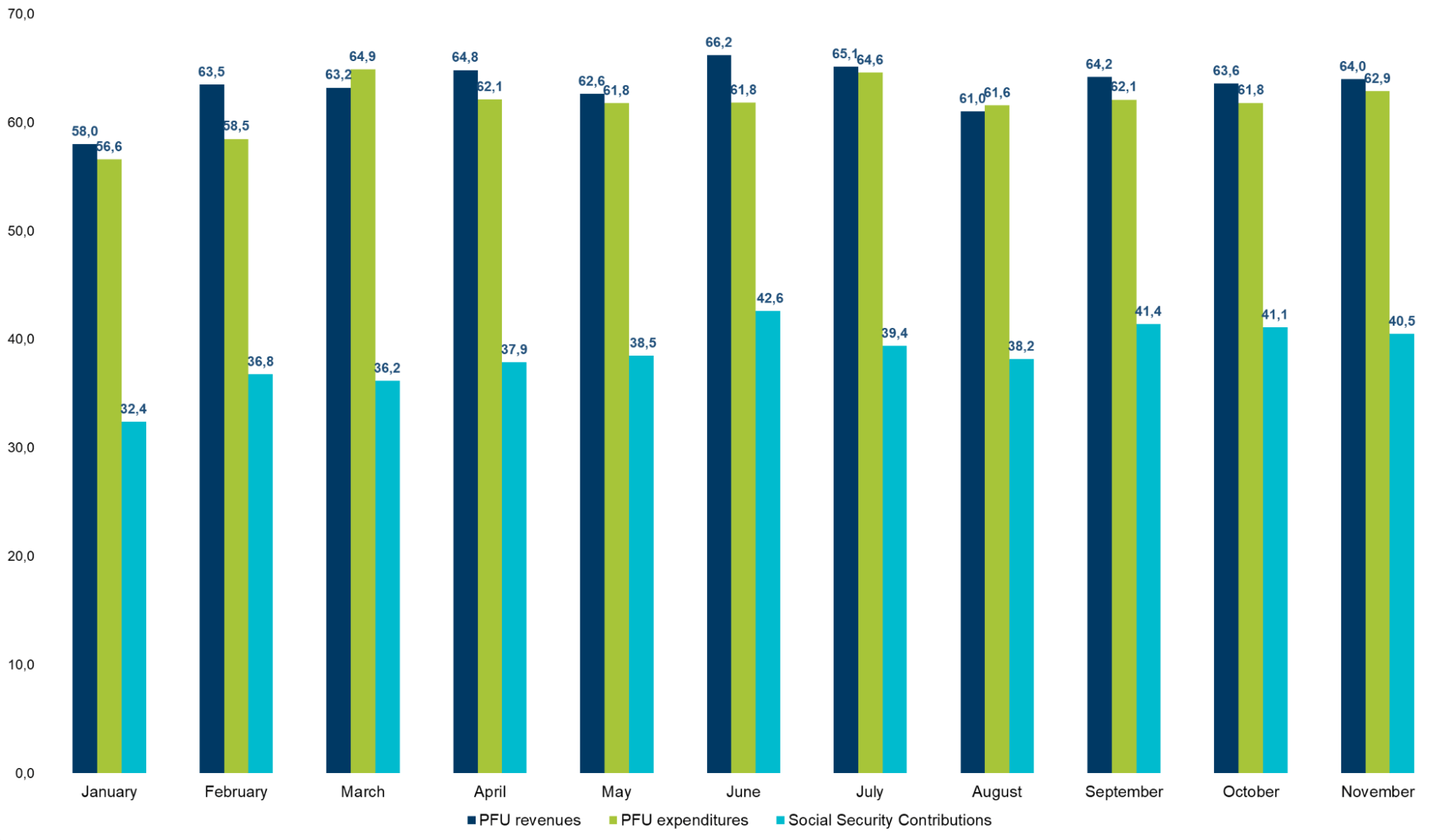

(9) In November 2023, total revenues from the Social Security Contributions (SSC) in Ukraine increased by 3.8% or UAH 1.5 billion compared to the same period in 2022, amounting to UAH 40.5 billion. This increase is primarily attributed to higher payments for military personnel.

(10) The income of the Pension Fund in November 2023 rose by 7.6% or UAH 4.5 billion compared to the same period last year, reaching UAH 64 billion. This increase was due to both a rise in the Fund’s own income from SSC and its responsibility for handling payments within the framework of social insurance. In November 2023, UAH 21.5 billion was allocated from the state budget to the Pension Fund for pension financing and other planned payments, a decrease of 3.2% compared to the previous year. This reduction in transfers from the state budget to the Pension Fund was a result of an increase in the Fund’s own income, thus lessening the financial burden on the state budget. The Pension Fund received UAH 2.3 billion from the state budget for subsidy payments and utility discounts, and UAH 2.4 billion from SSC income for social insurance payments. For pension financing in November, UAH 57.9 billion was allocated, which is UAH 7.0 billion or 13.8% more than in the same period of the previous year. The total expenditures of the Pension Fund in November 2023 amounted to UAH 62.9 billion, an increase of UAH 10.3 billion or 19.6% over the previous year.

Figure 5. Revenues and expenditures of the Pension Fund of Ukraine, revenues of the Social Security Contributions in January-November 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Figure 6. Monthly dynamics of revenues and expenditures of the Pension Fund, revenues of the Social Security Contributions in January-November 2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Jan-Nov | ||||||||||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 | 84,1 | 133,7 | 89,4 | 136,7 | 124,7 | 124,7 | 99,7 | 144,1 | 94,9 | 139,4 | 129,3 | 121,7 | 1108,2 | 1535,9 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 | 17,2 | 15,0 | 14,8 | 15,2 | 16,3 | 14,6 | 16,9 | 15,2 | 15,2 | 14,8 | 17,4 | 15,1 | 155,7 | 155,0 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 | 2,9 | 2,3 | 1,3 | 3,2 | 24,1 | 30,9 | 1,3 | 4,2 | 1,4 | 2,6 | 24,6 | 31,1 | 109,4 | 139,9 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 | 7,1 | 4,5 | 7,0 | 5,4 | 8,7 | 4,2 | 7,7 | 6,7 | 2,5 | 2,4 | 10,7 | 4,5 | 78,0 | 48,6 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 | 8,3 | 8,8 | 8,6 | 8,7 | 8,4 | 10,1 | 8,6 | 10,9 | 7,4 | 8,2 | 7,5 | 7,6 | 81,8 | 88,2 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 | 15,6 | 17,5 | 19,1 | 18,7 | 24,0 | 20,0 | 20,7 | 19,4 | 22,3 | 22,8 | 21,7 | 22,9 | 205,8 | 169,2 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 | 27,3 | 28,7 | 30,0 | 30,8 | 36,1 | 34,0 | 38,0 | 34,5 | 39,6 | 38,6 | 39,7 | 30,8 | 345,3 | 299,5 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 | 2,0 | 2,6 | 2,3 | 2,4 | 2,5 | 2,8 | 2,5 | 2,8 | 2,7 | 2,9 | 2,5 | 2,2 | 24,9 | 25,2 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 | 303,9 | 264,7 | 251,0 | 231,9 | 279,8 | 248,2 | 255,2 | 230,2 | 220,3 | 228,1 | 366,7 | 286,3 | 2899,2 | 2346,0 |

| Deficit (-) / surplus (+)* | -156,6 | -78,9 | -165,7 | -93,2 | -130,5 | -72,6 | -102,7 | -65,6 | -152,6 | -91,6 | -215,2 | -130,8 | -152,8 | -94,9 | -150,7 | -122,2 | -126,9 | -85,6 | -123,4 | -87,7 | -236,2 | -162,5 | -1713,3 | -1085,6 |

| Sources of deficit financing | ||||||||||||||||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 | 169,3 | 59,4 | 82,4 | 160,2 | 67,3 | 58,4 | 50,3 | 50 | 155,9 | 89,3 | 128,4 | 94 | 1289,4 | 1052,4 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125 | 142 | 219,7 | 107,7 | 112,9 | 187,1 | 97,1 | 86,9 | 100,6 | 98,8 | 183,4 | 122 | 163,3 | 129,8 | 1717,3 | 1471,2 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49 | -38,1 | -46 | -57,1 | -55,1 | -50,4 | -48,3 | -30,5 | -26,9 | -29,8 | -28,5 | -50,3 | -48,8 | -27,5 | -32,7 | -34,9 | -35,8 | -427,9 | -418,8 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Jan-Nov | |

| Financing, including: | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 | 86,9 | 98,8 | 122 | 129,8 | 1471,2 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 49,0 | 165,7 | 89,5 | 98,2 | 66,5 | 79,5 | 85,7 | |

| From the placement of domestic government bonds (total), including: | 41,4 | 42,6 | 53,7 | 34,0 | 68,6 | 45,4 | 39,1 | 26,5 | 36,9 | 63,8 | 56,0 | 508,0 | |

| in UAH billion | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 28,3 | 30,8 | 25,7 | 22,8 | 42,9 | 45,6 | 356,1 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

₴39,3

($616,4+€418) |

₴17,1

($319,7+€136) |

₴8,3

($227,3) |

₴0,8

(€20) |

₴14,1

($334,6+€48,4) |

₴20,9 ($572,6) |

₴10,4

($286,9) |

₴ 151,9

($3385,2 + €709,3) |

|

| From external sources, UAH billion | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 62,3 | 148,0 | 60,4 | 61,9 | 58,2 | 73,8 | 963,2 | |

| Public debt repayments, UAH billion | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 48,3 | 26,9 | 28,5 | 48,8 | 32,7 | 35,8 | 418,8 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 95,8 | 88,2 | 95,6 | 97,0 | 118,9 | 102,6 | 97,9 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 33,0 | 11,2 | 31,7 | 12,5 | 15,3 | 37,5 | 225,0 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 84,0 | 151,4 | 101,9 | 91,9 | 340 | 69,2 | 93,1 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-November 2023

| Sources | Amount, UAH billion

(EUR million; USD million; CAD million) |

| Loans from the Government of Canada | ₴64,2

(CAD$2400) |

| Programs of macro-financial assistance from the EU for 2023 | ₴653,3

(€16500)

|

| IMF funds under the four-year Extended Fund Facility program | ₴131,4

($3590) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3

($499,3) |

| IBRD Loan for Development and Recovery Policy | ₴54,9

($1500) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴16,1

(€404,3) |

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,8

(€47,0) |

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8

($132) |

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,2

($6) |

| IBRD Loan under the Fifth Additional Funding for the Project “Support for State Expenditure to Ensure Sustainable Public Governance in Ukraine” | ₴18,1

($500) |

*excluding grants

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 4. Monthly dynamics of state budget financing

| Indicators | Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142 | 107,7 | 187,1 | 86,9 | 98,8 | 122 | 129,8 |

| Total borrowed, % for January-November | 10,9 | 4,5 | 12,0 | 13,1 | 9,7 | 7,3 | 12,7 | 5,9 | 6,7 | 8,3 | 8,8 |

| From the placement of domestic government bonds, % for January-November | 8,1 | 8,4 | 10,6 | 6,7 | 13,5 | 8,9 | 7,7 | 5,2 | 7,3 | 12,6 | 11,0 |

| Borrowed from external sources, % for January-November | 12,3 | 2,5 | 12,8 | 16,5 | 7,6 | 6,5 | 15,4 | 6,3 | 6,4 | 6,0 | 7,7 |

| Debt repayment payments, % for January-November | 3,1 | 8,3 | 11,7 | 11,0 | 13,2 | 11,5 | 6,4 | 6,8 | 11,7 | 7,8 | 8,5 |

| Servicing payments, % for January-November | 0,3 | 5,3 | 5,2 | 6,2 | 20,3 | 14,7 | 5,0 | 14,1 | 5,6 | 6,8 | 16,7 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,2 | 133,4 | 41,2 | 26,4 | 149,0 | 26,7 | 37,5 | 74,0 | 56,5 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations