Reform Index’s 226th issue covers the period from November 20 to December 3. It incorporates nine reforms contributing to progress in three of the six observed areas – Public Governance, Business Environment, and Human Capital. Overall, the Index scored +1 point (on a scale ranging from -5 to +5). In the previous issue, it was half as low, at +0.5 points.

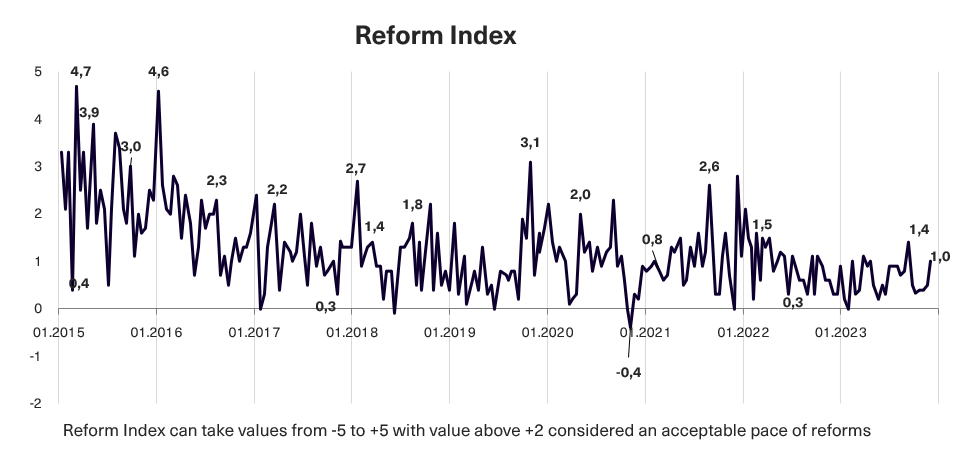

Graph 1. Dynamics of the Reform Index

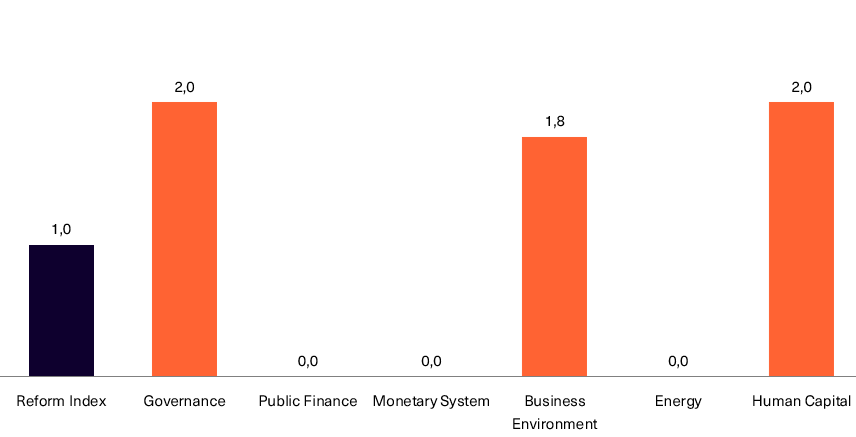

Graph 2. Values of the Reform Index and its Components in the Current Assessment Round

Supervisory boards will be established in healthcare facilities, +1.5 points

Corporate governance reform has also reached the healthcare sector. Cabinet of Ministers Resolution No. 1221 stipulates that public authorities that own hospitals providing specialized medical care must establish supervisory boards for them.

These boards will consist of representatives from the governing body that owns the hospital and independent members (representatives of the public, selected through a competitive procedure). The same individual cannot be a supervisory board member for more than two consecutive terms and cannot simultaneously serve on the supervisory boards of more than five healthcare facilities in one hospital district.

Hospitals must have supervisory boards of varying sizes: 5-7 members for general hospitals, 7-11 for cluster-level hospitals, and 11-15 for supercluster-level hospitals. To ensure the board’s validity, the number of independent members must exceed the number of members appointed by the governing body.

Among the responsibilities of the supervisory boards are approving the annual activity plan of the healthcare facility and endorsing KPIs, approving the principles of organizational structure formation, establishing an internal audit unit, monitoring the functioning of accounting systems, creating a control system to ensure compliance with ethical norms, legal requirements, and patient rights, among other similar functions. To fulfill these responsibilities, members of the supervisory boards will have access to all necessary information, including information with restricted access, provided that it is depersonalized.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Sanctioned property will be auctioned online through the Prozorro.Sale system, +1 point

Cabinet of Ministers Resolution No. 1233 regulates how the State Property Fund (SPFU) should manage property confiscated from sanctioned individuals and organizations and expands the possibilities for selling assets seized from legal entities from Russia.

The auctions are to be conducted through the Prozorro.Sale system. This will enhance transparency in the auctions and ensure access to all interested parties. The State Property Fund will be responsible for organizing these auctions. The funds generated from the sale or leasing of Russian assets will be directed to the accounts of the Fund for the Elimination of the Consequences of Armed Aggression.

In addition to leasing or selling, the SPFU will also have the authority to transfer such assets to other state authorities if this ensures effective corporate rights management generating income for the state or sanctioned property is used by state-owned enterprises working to meet the needs of the Armed Forces of Ukraine or directly by military formations.

Recently, Vox Ukraine also published an overview of Resolution No. 1250 regarding the sale of arrested assets under the management of the Asset Recovery and Management Agency (ARMA) through the Prozorro.Sale platform.

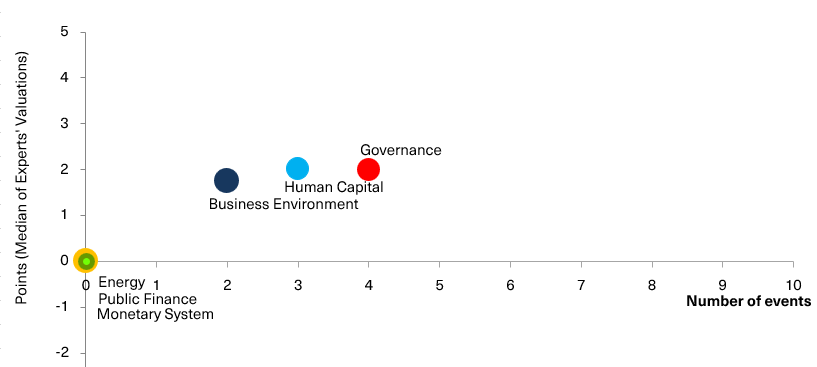

Chart 3. Value of Reform Index components and number of events

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations