The 252nd issue of the Reform Index, covering the period from November 18 to December 1, features four regulations. The Index value remains unchanged from the previous issue at 0.8 points. The highest expert rating (+2 points) was awarded to a law aimed at improving the procedure for medical and social assessments. This continues the reform of the disability assessment system, which was discussed in the previous issue. Additionally, this issue highlights the new law on tax increases.

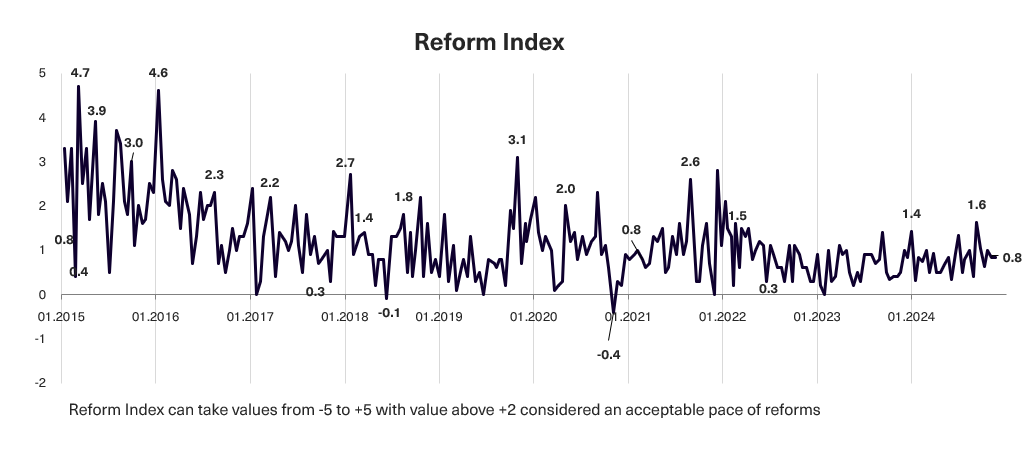

Graph 1. Dynamics of the Reform Index

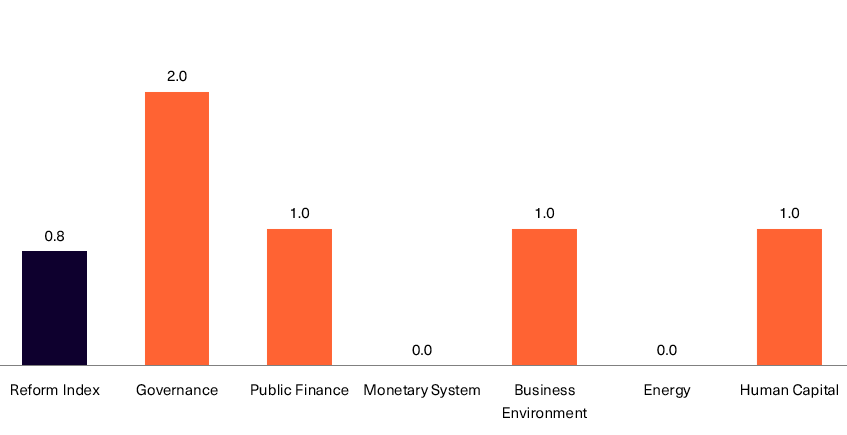

Graph 2. Values of the Reform Index and its Components in the Current Assessment Round

Improvements in disability assessment procedures, +2 points

Law 4030-ІХ improves the procedures for conducting medical and social assessments. To ensure greater transparency in the disability assessment process, the Medical and Social Expert Commission (MSEC) allows the presence of the individual’s attorney, legal representative, and/or a physician or rehabilitation specialist during the session. The attorney or representative also has the right to make audio and video recordings of the session.

The individual has the right to appeal the commission’s decision within one month of receiving it. The appeal may include a recording of the session. The commission that conducted the initial assessment must, within three days of receiving the appeal, forward the individual’s documents to a second-level commission, which will conduct a reassessment within one month.

The draft law on improving the operation of the MSEC was registered on April 30, 2024, and approved by Parliament on October 29. By the time the President signed Law 4030-IX (on November 18), the Cabinet of Ministers had already published a resolution to dissolve MSEC and establish expert teams for assessing daily functioning in its place. Therefore, it is assumed that the procedure for conducting assessments outlined in the law will automatically apply to the expert teams.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Expert commentary

Pavlo Kovtoniuk, co-founder of the Ukrainian Healthcare Center

“Establishing medical commissions at major hospitals and advancing digitalization will enhance the quality of assessments. However, addressing the main issue—the de facto assignment of social assistance by medical professionals and, more broadly, the persistence of Soviet-era approaches to assigning assistance—continues to be deferred.”

Changes to the Tax Code, +1 point

On November 28, the President signed Law 4015-IX on tax increases, which became effective on December 1, 2024.

The key innovations introduced by the law pertain to the military levy. During martial law, individuals, except for military personnel, will pay a military levy of 5% of their income, up from the previous 1.5%. Additionally, in 2025, the military levy will, for the first time, apply to:

- Single tax payers in Group III, at a rate of 1% of their income.

- Private entrepreneurs in Groups I, II, and IV, at a rate of 10% of the minimum wage, which amounts to UAH 8,00 UAH per month in 2025.

The military levy will now be directed to funding the Armed Forces of Ukraine through a special fund. Previously, these funds were allocated to the general state budget and could be used for non-military purposes.

Corporate income tax rates for banks have been raised again to 50% for profits earned in 2024 (previously applied to 2023 profits, with a planned 25% rate for 2024). For financial institutions, the rate has increased from 18% to 25%. To ensure the reservation system’s rapid response to changes in employee wage levels for those eligible for reservation, monthly reporting on personal income tax (PIT) and unified social contributions (USC) has been introduced, replacing the previous quarterly reporting system.

The law mandates that entrepreneurs involved in retail fuel sales make monthly advance corporate income tax contributions for each retail fuel outlet. The advance payment amounts are as follows: UAH 60,000 for selling two or more types of fuel; UAH 30,000 for selling exclusively liquefied gas; and UAH 45,000 if liquefied gas accounts for 50% or more of the total monthly fuel sales volume. For late payment of the advance contribution, the taxpayer may face a fine or even revocation of their fuel trading license. Fines are set at 5% of the repaid amount of tax debt (for delays of up to 30 days) or 10% of the repaid amount of tax debt (for delays of more than 30 days).

The law also increases the minimum amount of tax payments per hectare of agricultural land to UAH 1,400 per hectare, raises the minimum prices for wine and winemaking products, and increases the rent rates for sand, crushed stone, and kaolin.

Expert commentary

Yuliia Markuts, Head of the Center for Public Finance and Governance Analysis at the Kyiv School of Economics

“The changes introduced by the law have certain advantages for the state. Most importantly, the additional budget revenues will support critical sectors, particularly defense. Changes to tax administration—such as shifting the filing periods for personal income tax PIT and USC from quarterly to monthly reporting—will enhance the transparency of the tax system, allow tax authorities to access up-to-date information more quickly, and reduce the risk of tax evasion.

However, the law also presents challenges for businesses. The potential increase in the tax burden may lead to higher costs, which could negatively affect economic activity, particularly for small and micro-businesses. This is especially relevant for those under the simplified tax system in Groups I and II. Under the new rules, such entrepreneurs will have to pay an additional 10% of the monthly minimum wage as a military levy, currently amounting to UAH 800 UAH per month. Moreover, the increased administrative burden on employers will create additional financial and operational pressures on businesses, especially small and medium-sized enterprises (SMEs).”

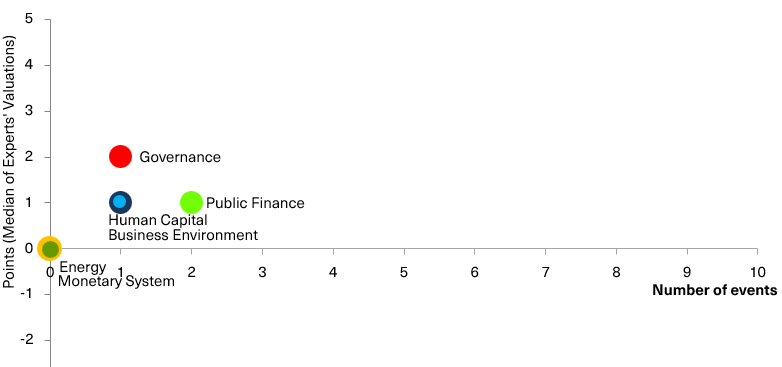

Chart 3. Value of Reform Index components and number of events

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital. Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations