“We received a very complicated budget. Generally it is difficult to close the year with someone else’s budget. Last year, people adopted a budget, stated the amount of revenue, and then adopted a lobbying rule to exempt the green energy component from taxation. So we lost 9 billion. That is, there is budget, but there is no real money,” Prime Minister Oleksiy Honcharuk explained the reasons for not fulfilling the 2019 budget to MPs.

He mentioned the cost of tax breaks for the import of solar panels to the budget, which was approved by the previous parliament.

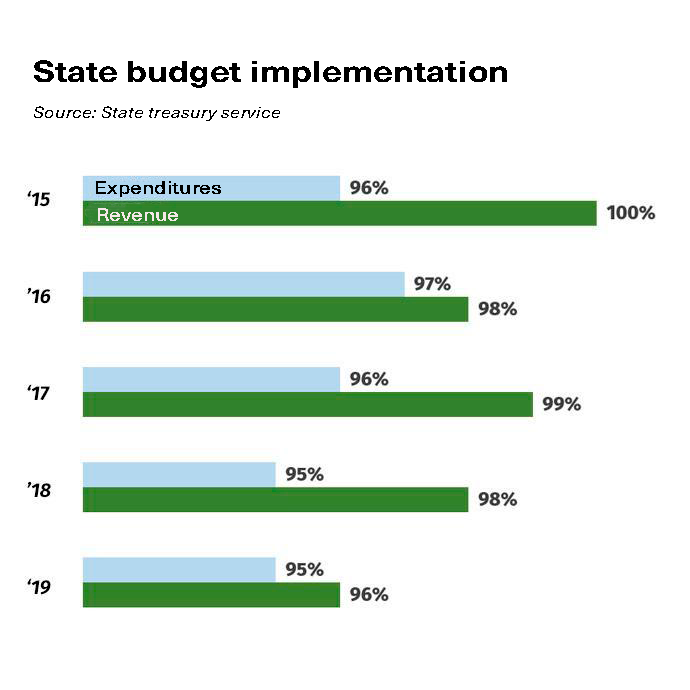

Of course, there were more reasons for non-compliance. Not all of them are related to the previous government, but all together, the 2019 budget showed the worst performance in five years — 96%. Expenditures are not so bad. In percentage terms, their implementation level is the same as in 2018 — 95% (Table. 1).

VoxUkraine analyzed the reasons behind the failure to implement the 2019 budget and explained why they threaten the 2020 budget as well.

The revenue failure chronicles

Failure to comply with the 2019 budget began as early as last January.

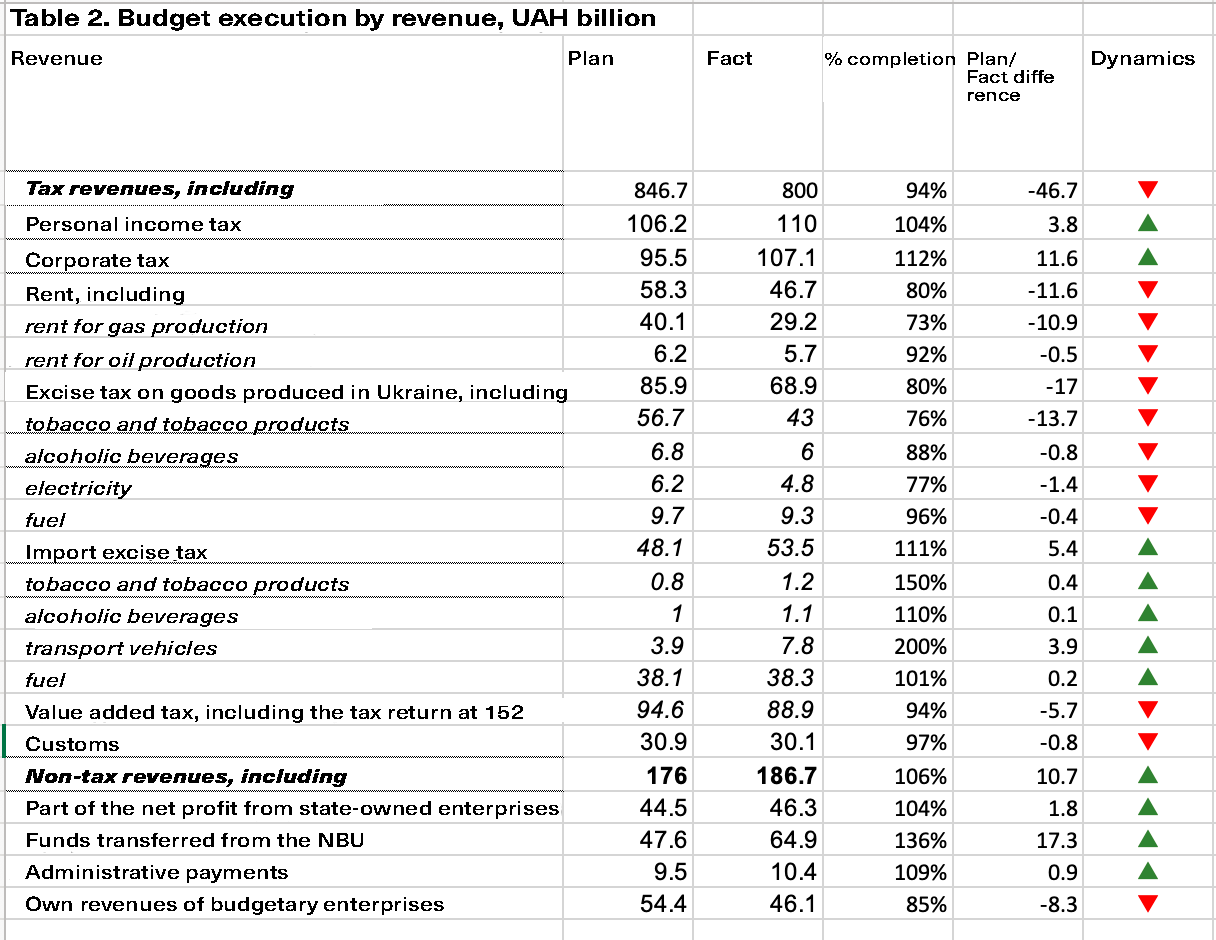

The year began with a slowdown in GDP growth, which was immediately reflected in the budget. At the same time, there were a number of factors that influenced tax revenues during the year and which, in fact, determined the share of the estimate (Table 2).

Last year, budget revenues totaled UAH 998.2 billion, down UAH 37.9 billion from the plan. This shortfall could be several tens of billions more if the National Bank did not recalculate 17.3 billion more of its net income and Naftogaz failed to pay UAH 15.1 billion in dividends and taxes ahead of schedule. Moreover, the prime minister ordered Naftogaz to pay 8.5 billion dividends on the eve of the New Year holidays — on 26 of December. According to the results of 11 months of its work, Naftogaz had transferred these funds. These money do not include the taxes and dividends the Finance Ministry expects from the $2.9 billion paid by Gazprom under Stockholm arbitration.

Source: State treasury service

According to the results of the year, only three taxes — the corporate income tax, the personal income tax, and the excise tax on imports — have been exceeded. Corporate tax was exceeded 12% due to better financial results of enterprises.

In the case of PIT, the positive trend continued throughout the year due to the increase in average wages. According to the results of 2019, over-performance constituted 4%. The budget was estimated at an average monthly salary of UAH 10129. In fact, the average salary for the past year was UAH 10497.

Official data on imports from excise duty on imports indicate that more than 70% of the over-performance have provided unplanned revenue from excise duty on vehicles. Extra income was obtained through the mass customs clearance of the car tickets with Euro numbers. According to the State Customs Service, last year imports of foreign cars increased 2.2 times compared to the previous period.

Annual targets on imports, customs and VAT taxes were not met. The main reason is import taxes are hryvnia dependent. Last year, the national currency strengthened. Consequently, imported goods in UAH equivalent became cheaper. Accordingly, their taxes also decreased. Import growth also slowed. So, for 11 months of 2019 imports increased by 6.2% to $553 billion, while in 2018 and 2017 they increased by 17% and 28%, respectively.

The impact of the exchange rate factor on imported VAT was the most painful for the budget. Its share in the tax revenues is considerable — about 40%. As a result of the year, VAT revenues from imports amounted to UAH 289.8 billion, which is UAH 33.3 billion less than planned.

VAT on goods manufactured in Ukraine reached UAH 240.8 billion. With the UAH 151.9 billion tax refund, UAH 88.9 billion was left in the budged, which is also less than planned.

The shortfall in excise duty on goods manufactured in Ukraine by UAH 13.7 billion is mainly due to the reduction in the production of tobacco products.

Last year, the state messed up relations with tobacco companies. As VoxUkraine wrote, because of MPs’ intentions to redistribute trade margin among market participants, tobacco companies threatened to leave Ukraine. Some companies have stopped production. The prime minister claimed that a compromise had been found, but it had not happened.

In early February, MPs were unable to cancel the results of voting for the law with this innovation. The president put a stop to it. On February 19, he vetoed the scandalous draft law.

Contribution to the budget “hole” was also made by the failure to fulfill the plan for excise tax revenues from electricity.

Starting on July 1, 2019, a new model of the electricity market was introduced. This has influenced the definition of the circle of excise tax payers and the objects of taxation.

The Ministry of Finance explains that until July 1, 2019 – before the market launch – the wholesale supplier of SE “Energorynok” and licensed producers were the payers of excise duty on electricity.

Starting July 1, 2019, electricity producers are the taxpayers. At the same time, they are not subject to taxation on the operation of the sale of electricity produced by qualified cogeneration units and/or from renewable energy sources.

“The average monthly excise tax revenue in the second half of 2019 amounted to UAH 286.8 million, while in January-July 2019 it amounted to UAH 479.2 million,” the Finance Ministry told VoxUkraine.

Excise tax revenue was also affected by a 4.9% decline in electricity production in 2019.

Rental income could not be collected as planned due to a reduction in the price of natural gas, lower volumes of its extraction, and a down payment of UAH 0.8 billion paid to Ukrgazvydobuvannya in 2018 due to tax liabilities of 2019.

What happened to the expenditures

The government saved the budget from large-scale shortfalls in two ways: by reviewing budgets and saving on spending. The deficit was financed by borrowing, since privatization revenues were far below planned.

Thus, in October last year, the government made changes to the budget, reducing revenues and expenditures by UAH 19 billion. This was not enough to make an estimate in economic reality. That is why they couldn’t avoid more radical methods.

The spending of last year can be briefly described as follows: protected expenditures were fully or almost completely, unsecured – with varying success, twice directly blocked.

As a result of the year, protected expenditures were funded in the amount of UAH 841.6 billion or 98% of the plan.

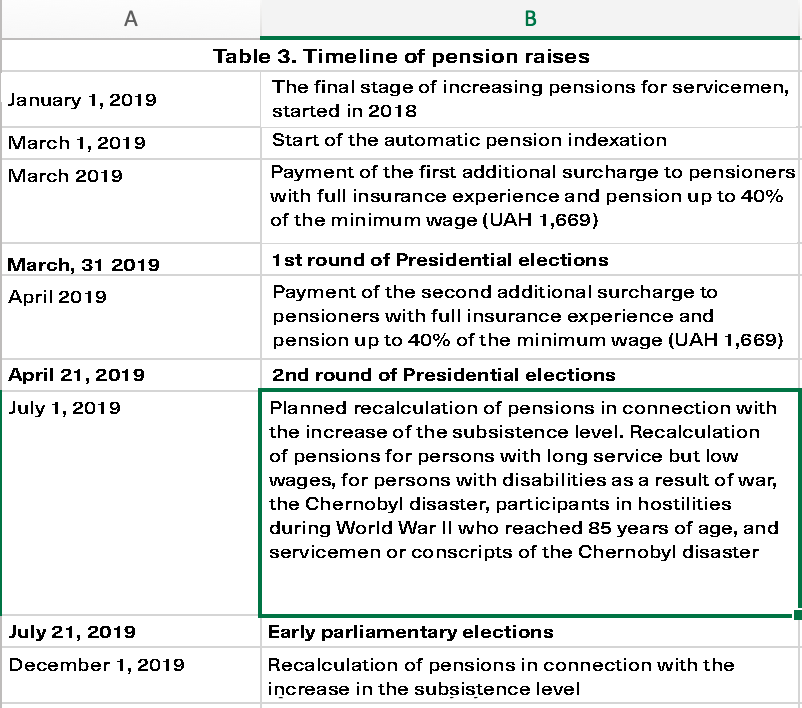

The social expenditures that make up the lion’s share of the protected have been significantly influenced by the election. In 2018-2019, the government adopted a number of decisions to increase pensions for certain categories of pensioners. It so happened that last year, these increases occurred right before the parliamentary or presidential elections (Table 3).

Source: prepared by the author based on open data

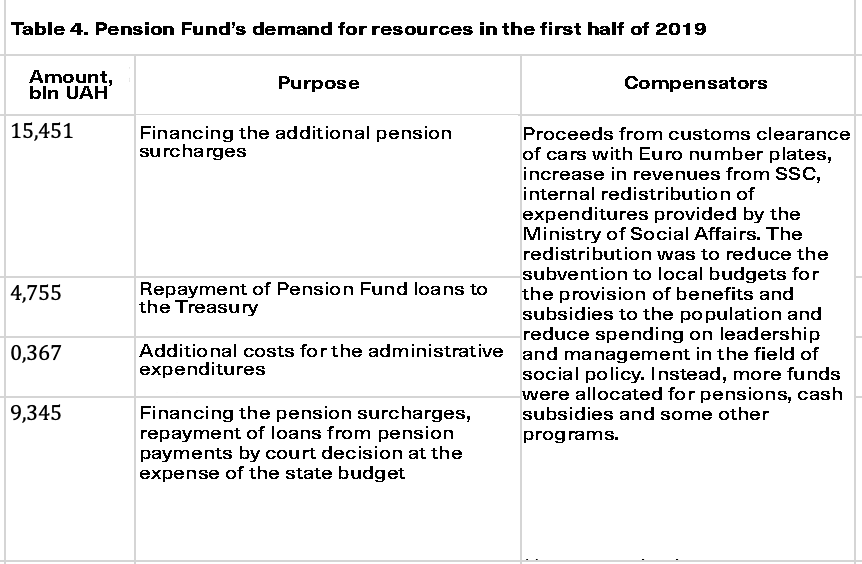

In the first half of last year, the Pension Fund needed additional resources, sources of which were both in its own budget and in the state budget (Table 4).

Source: Ministry of social politics

Among the protected ones, particular attention is paid to public debt service and subsidy payments. Due to the lower yields of new borrowings and the transition over the year to securities with longer maturities, maintenance expenditures decreased by almost UAH 19 billion. They decreased by another UAH 7 billion due to the exchange rate factor.

Due to lower gas prices and fewer subsidies, the state managed to save UAH 11.5 billion in subsidies. Instead of the planned UAH 58.1 billion, the budget spent UAH 46.6 billion.

Unprotected expenditures were financed with interruptions.

Last summer, the government had blocked them for the first time. The decision concerned regional development. At that time, at the “request” of the head of the Presidential Office, Andriy Bogdan, the government paid UAH 7.6 billion from the Regional Development Fund to the local authorities and UAH 2.5 billion from a subsidies for socio-economic development. In the fall, the investment projects that were to be financed from these funds were audited. In part, the government has unlocked the resource, but according to the Treasury, local budgets have not received 1.7 billion UAH of social subsidies.

The reason for the decision to block this expenditure in the president’s office was then called corruption risks during the distribution of these funds, although city mayors publicly stated the political motives behind the decision.

The transparency of this story leaves much to be desired. It is currently unclear who and by what criteria excluded investment projects from the list for implementation, and who as a result was held responsible for corruption.

The second time a spending failure occurred at the end of the year. In December, the Prime Minister instructed Finance Minister Oksana Markarova to «ensure the temporary suspension of payments by the Treasury and the registration of budget commitments on expenditures and the granting of loans to the General Fund of the State Budget (except for protected expenditures of the budget) by the end of the year.” Such savings should allow the budget to reach the planned deficit.

The Finance Ministry named two reasons for the suspension then. The first is to protect the budget from dubious “shifts” of funds from program to program in order to absorb them at the end of the year. The second is a significant failure to implement the revenue plan. We can assume that this is the second reason that was the key in this suspension. As of early December, the State Budget General Fund lacked UAH 51 billion before the plan was implemented.

How did it end up?

At the request of VoxUkraine, the Ministry of Finance replied that late last year, budget spending units told which unsecured expenditures were being made and which loans were prioritized, and the treasury had spent these expenditures.

“In 2009, unsecured expenditures of the general fund of the state budget were made in the amount of UAH 111.4 billion or 90% of the plan. Of the UAH 12.4 billion in unspent unsecured expenditures, UAH 7.2 billion is capital expenditure,” the ministry said.

New budget, old trends

Last year’s budgetary impact factors moved into 2020.

The Treasury’s operating data showed that in January the revenues of the general fund of the state budget amounted to UAH 42.6 billion and were by UAH 13.8 billion less than planned.

The main reason for the underperformance of revenues was the non-forecast macro indicators. In particular, imports are lower by 2.5% year on year, lower gas prices and stronger hryvnia exchange rates. The average January rate was UAH 24.1/USD, while the budget included the rate of UAH 27/USD.

The situation is compounded by the fact that in 2020 the budget will lose some sources of filling. For example, there will be no such amount of money from the customs clearance of cars with Euro numbers.

Due to this background, a budget review is more relevant than was expected.

Let us remind you that the talks on the budget 2020 revision started immediately after its approval. However, at that time government and parliament named other reasons for such a revision.

In the autumn, the Cabinet of Ministers and the Verkhovna Rada worked in the so-called “reform turbo-mode” and passed a number of laws that had an impact on the economy and budget which could not be fully understood at the hime. Of course, they said the effect would be positive and would allow to revise the budget approximately in the first half of the year.

The logic of Oksana Markarova was: “It is better to adopt a realistic 2020 budget to show its overperformance in the next six months and then return to its revision on the basis of collected additional revenues.”

If the tax deferral persists and there is no rapid economic effect from the adopted laws, the budget review will be more pessimistic.

The need to find new sources of revenue and view the macro forecast is being discussed right now.

For example, the National Bank’s inflation report states that Naftogaz may be offset by tax and dividend offsets of potentially lower tax revenues. “The source of the additional revenue is the payment of compensation by PJSC Gazprom in late 2019 for the implementation of the Stockholm Arbitration ruling,” the NBU claims. Like in 2019, it will be possible to save money on subsidies and debt service.

Minister of Economic Development, Trade and Agriculture Tymofiy Milovanov has already stated that his ministry intends to revise the macro forecast, which will allow the Ministry of Finance to update the budget indicators.

The article was prepared with the support of the German Government through the project “Effective Public Financial Management III”, implemented by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations