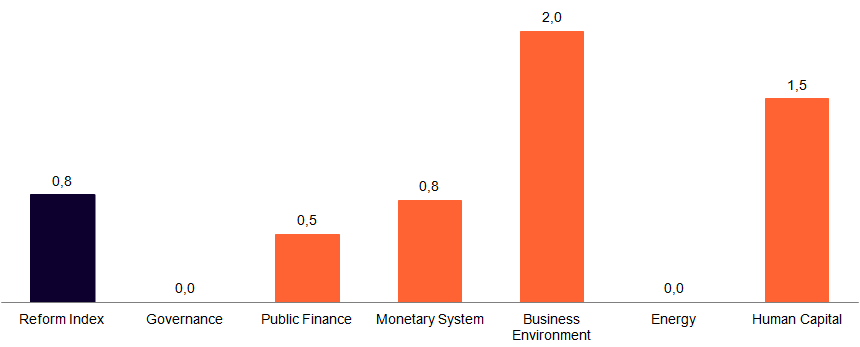

Issue 272 of the Reform Index, covering the period from August 25 to September 7, includes seven reforms. The main development of this issue is the creation of Defence City — a legal framework offering tax incentives for enterprises in the defense sector. This reform falls under two subcategories — “Public Finance” and “Business Environment” — and received a combined expert score of +1.5 points (on a scale from -5 to +5). Also featured in this issue is the law on veteran entrepreneurship (+1 point). The overall Index score stands at 0.8 points, up from 0.5 in the previous issue.

Graph 1. Dynamics of the Reform Index

Graph 2. Values of the Reform Index and its Components in the Current Assessment Round

Legal regime “Defence City” for arms manufacturers, +1.5 points

Ukraine has established a special legal regime — Defence City — for enterprises in the defense sector. It will remain in effect until January 1, 2036, or until Ukraine joins the European Union. Residents of Defence City will enjoy tax incentives — they will be exempt from corporate income tax if profits are reinvested in the production of defense goods or technologies, as well as from land tax, environmental tax, and property tax.

In addition, residents are promised simplified customs procedures. The relevant law detailing these procedures was signed by the President later — on September 19. In particular, Defence City residents will benefit from shorter processing times for customs documents (currently averaging one to three days), expedited clearance for equipment imported for processing or temporary use — without the need for re-declaration after modernization or repair — and simplified arms exports, requiring only a license and payment of a special fee to the Ministry of Defense, without waiting for Cabinet approval or supporting documents. Permits for exporting technologies to establish production abroad are also expected to be issued as quickly as possible — within 15 days.

Resident status from the Ministry of Defense of Ukraine may be granted to a legal entity whose significant share of income is derived from the production of defense products — at least 75%, and for aircraft manufacturing enterprises, 50%. Companies with tax debts exceeding ten minimum wages (currently UAH 80,000) or those connected to jurisdictions of the aggressor state cannot obtain resident status.

Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Expert commentary

Oksana Kuziakiv, executive director at the Institute for Economic Research and Policy Consulting (IER)

“The law on enterprises operating in the defense sector appears logical under wartime conditions. Granting such companies benefits and preferences makes sense, as they perform a critically important function for the state.

However, it is essential to establish clear safeguards to ensure that entities not genuinely engaged in defense activities are not classified as ‘defense enterprises.’ This is not only a matter of fairness but also of ensuring the efficient use of public resources.”

Law on veteran entrepreneurship, +1 point

The Verkhovna Rada has adopted Law No. 4563-ІХ “On Veteran Entrepreneurship,” which establishes a special framework of economic support for such enterprises. The Ministry for Veterans Affairs will grant veteran-enterprise status for a five-year term. This status provides priority access to national and local business-support programs, as well as to grants and subsidies that partially cover company expenses — such as rent or utility payments. It is stipulated that at least 10% of the annual budget for entrepreneurship-support programs will be allocated specifically to veteran-owned businesses. Veteran entrepreneurs will also have priority rights to participate in national and local public procurement — up to 5% of procurement budgets may be reserved for veteran-owned enterprises.

Veteran entrepreneurs will be able to lease state or municipal property without having to participate in an auction. To do so, a veteran entrepreneur must submit a request to the lessor through the electronic trading system, after which the system will publish the decision to transfer the property and the corresponding lease agreement. Veterans will also be eligible for preferential terms when participating in technology parks and industrial zones. In particular, quotas will be established for veteran enterprises within tech parks, along with subsidies and reimbursements for rent, utilities, and other expenses, as well as grants for purchasing equipment, developing new technologies, and conducting research.

The Ministry for Veterans Affairs is to create a unified web portal to provide information on programs, grants, and training opportunities, as well as to organize training and retraining for veterans.

Expert commentary

Oksana Kuziakiv, executive director at the Institute for Economic Research and Policy Consulting (IER)

“The law supporting veteran entrepreneurship is an important and necessary step aimed at fostering veterans’ economic activity, professional fulfillment, and social integration. At the same time, certain provisions of the law that establish special preferences raise concerns about potential violations of market competition principles.

The designated framework for economic support grants veteran-owned businesses preferential conditions—such as participation in national and municipal support programs, access to grants, subsidies, concessional loans, and specialized procurement procedures. However, the introduction of such special conditions, particularly in the area of tenders, requires maximum transparency and safeguards against abuse.

Support for veterans must be balanced with adherence to the principles of open competition, fairness, and equal access so that it truly contributes to the sustainable development of veteran businesses and strengthens public trust.”

Reform Index from VoxUkraine aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in six areas: Governance, Public Finance, Monetary system, Business Environment, Energy, Human Capital. Information about the Reforms Index project, the list of Index experts and the database of the regulations assessed are available here.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations