Indeed since the ancient times some sort of taxes existed in human civilization (for instance in ancient Egypt and Roman Empire), so one can easily refer to taxes as something eternal. It is not surprising that taxation is often subject to extensive discussion on their purpose, means, size and effects. This is particularly true in the rapidly changing environment as a result of technological advancements.

While in ancient times the prevalent purpose of taxation was to finance war, nowadays on top of defense function governments collect taxes to raise means for provision of many public goods and services (including law and order, public infrastructure, education and healthcare).

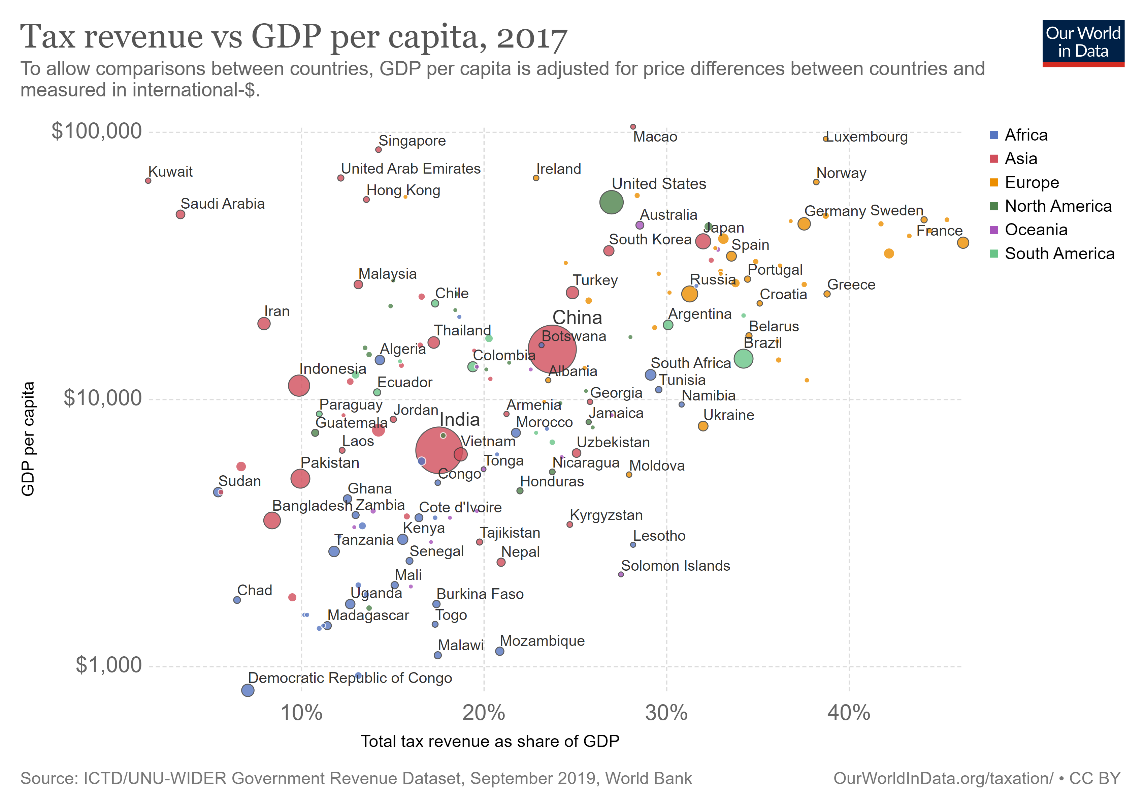

Despite the notion of taxation is pretty old, taxes in their modern shape are only about 200 years old – the first modern income tax was introduced in the UK in 1799, while in the US the government imposed the first personal income tax in 1861. While in the beginning of the 20th century the largest industrial economies of the world were collecting less than 10% of GDP in tax revenues, nowadays some advanced economies are hoarding more than 40% of GDP. Such a great variation in taxation and the scope of government across the world can be explained by the different preferences and needs of the society in provision of goods and services subject to existing constraints. In many European countries citizens pay relatively high taxes and in return they receive many public goods and services which are unavailable in the countries with low taxes. On the other hand, there are governments that lack capacity to collect enough taxes to finance provision of public goods that society needs.

Cross-country differences in tax composition and revenues depend on the government goals and its capacity to efficiently collect taxes. According to the IMF research, countries with the lowest levels of corruption collected 4% of GDP more in tax revenues on average than countries with higher levels of corruption.

What is optimal taxation?

There is extensive amount of theoretical research on how to impose taxes with optimal results. The optimal taxation theory in fact is an attempt to solve the problem to maximize a social welfare function subject to a number of constraints (economic, political, informational etc.) However, theoretical underpinnings do not always help in designing specific tax schedules applicable to different real-life situations. For instance, the least distortionary and preferred for the fiscal authorities type of tax is a lump-sum tax, which is a fixed amount of tax applied uniformly to all taxpayers. However, lump-sum tax does not differentiate between the rich and the poor and is deemed as unfair. In real life, different people have different ability to pay and also within one society there are different views on how much the government should provide to citizens and how much taxes it should raise. Thus, except for revenue maximization, there are other considerations for formulating a good tax policy.

Taxes do have effects on the economic agents’ behavior and reduce welfare of those who bear the largest tax burden. So, optimal tax system has to minimize negative effects on taxpayers’ welfare and productivity, maximize positive distributional effects and correct for market failures (for instance, taxation of alcohol and tobacco use is called to limit consumption of those products as they have negative effects on human health and productivity; the same is true for pollution taxes and gasoline taxes). In other words, it has to comply with certain principles.

Good taxation principles

Principles of good taxation were formulated a long time ago by the father of modern economics Adam Smith in his well-known The Wealth of Nations (1776). These basic principles form a backbone of any taxation system in the world albeit they were modernized relative to the original formulation.

The main good taxation principles in the modern world are as follows:

Fairness: Taxpayers in a similar financial condition should pay similar amounts in taxes. This principle calls for equity in distributing tax burden among taxpayers. It implies that taxpayers with the same income level should pay the same amount in taxes (horizontal equity) and that taxpayers with greater ability to pay should pay more than those with lower ability to pay (vertical equity). The latter dimension is addressed via different tax schemes: progressive (rich taxpayers pay higher share of their income in taxes than poor taxpayers); regressive (low-income taxpayers pay higher share of their income in taxes); proportional/flat rate (all taxpayers pay the same proportion of their income in taxes).

Simplicity and ease of compliance: Taxpayers should easily understand why the tax is imposed and how to comply with tax regulations.

Transparency and certainty: Taxpayers should understand when and where they pay taxes and can easily see the link between their tax burden and the amount of public goods and services provided to them.

Administrative ease: Cost of tax collection should be minimized. It is important to keep the balance between the cost of tax enforcement and tax compliance rate.

Neutrality: Tax system should minimize economic inefficiency and welfare losses and be neutral to the economic agents’ behavior (except for cases when taxes are deliberately designed to alter the behaviour).

Overall, these principles call for low tax rates imposed on the broad tax base and limited list of exemptions, albeit implementation of fairness principle is seen differently in different societies. It is difficult to fully implement all the principles within one tax system. There are still taxes that are imposed on specific categories of people or consumption (luxury goods taxation, alcohol and tobacco taxes, gambling tax etc).

In some countries, paying taxes entails filling in numerous tax forms and reports to comply with national legislation, thus violating the principle of simplicity and convenience. There are many instances when the tax authorities lack capacity and information to enforce tax compliance that leads to disproportionate tax burden for diligent/honest taxpayers.

Different governments combine different taxation schemes, introduce tax exemptions or use tax refunds to pursue their taxation policy goals, which nowadays often go beyond revenue collection. Subsistence incomes may be exempt from income taxes, some goods that are deemed as basic necessities may be exempt from sales or value-added tax, luxury items or gifts may be taxed at higher rates than labor income and so on. The higher the inequality in the society the more rational it is to use progressive tax schedule, while in the countries with more equitable distribution of income a flat tax scheme may be preferred as it is deemed to be fair to the taxpayers.

What is subject to taxation?

Nowadays the governments deploy different types of taxes and in different proportions depending on the subsequent use of the collected tax revenue or behavioral responses to the taxation. All known taxes can be roughly split into six major categories (see Table 1):

- taxes on income, profits and capital gains;

- taxes on payroll and workforce;

- taxes on property;

- taxes on goods and services;

- taxes on international trade and transactions;

- other taxes.

This classification, however, excludes social security contributions. The latter are part of social insurance scheme – every contributor is entitled to receive social benefit in case of an insured event – but often they are referred to as “labor tax” and added to the overall tax burden calculations even though they are not paid to the benefit of the government.

Table 1. Tax Classification by tax base

| Tax base | Taxes |

| Income Profit/Capital Gain |

• taxes on income from wages and salaries, tips and fringe benefits

• taxes on interest, dividends, rent and royalties • taxes on capital gains and distributions of investment funds • taxes on profits of corporations, partnerships, trusts etc. |

| Payroll and Workforce | •taxes collected from employers or self-employed as a proportion of payroll size or as a fixed amount per person that are not earmarked for social security schemes |

| Property | •taxes on use, ownership or transfer of wealth

•taxes on immovable property (land, housing) •inheritance and gift taxes |

| Goods and services | •Value-added tax/Sales tax/ turnover tax

•Excise taxes • Taxes on financial and capital transactions • taxes that provide permission to use certain goods or perform activities (e.g. pollution taxes, motor vehicles taxes and others) |

| International Trade and Transactions | •Customs and import duties

•Taxes on exports •Exchange taxes |

| Other | •Poll taxes (head taxes)

•Stamp taxes that cannot be attributed to a certain type of transactions, goods or services |

Source: GFS Manual 2014 Chapter 5. Revenue

Taxes imposed directly on the taxpayers’ income or property are so-called direct taxes, while taxes that are imposed on products and paid by consumers with every purchase are indirect taxes (like value-added tax, sales tax, excise taxes etc.) The governments use the mix of different taxes to collect tax revenue needed to match the desired level of its expenditures (‘revenue’ taxes) and also to change the economic agents’ behavior – in case of the so-called ‘sin’ taxes (e.g. taxes on the use of tobacco/alcohol/ gasoline or pollution) the government aims at discouraging undesired behavior.

There are different ways to administer taxes – some countries impose taxes based on residency criteria, some on territorial or citizenship criteria. Residency criteria for paying taxes means that those who live on the country’s territory should pay taxes there regardless of their citizenship, while citizenship-based taxation implies tax liability regardless of the place where a taxpayer resides. Goods and services taxes are usually levied at their final destination, thus implying that countries relying on imported goods may collect more in consumption taxes than largely export-oriented countries.

Pros and Cons of Different Taxes

Taxes, in general, alter economic agents’ choices of work-leisure balance for individuals and levels of production by businesses. The economic and behavioral effects of different types of taxes vary (see Table 2). Thus, the governments should choose the mix of direct and indirect taxes depending on the structure of the economy, societal preferences on income redistribution, effects on economic growth and inflation, its administrative capacity etc.

Table 2. Advantages and disadvantages of Different Types of Taxation

| Advantages | Disadvantages | |

| Direct Taxes |

|

|

| Indirect Taxes |

|

|

Source: authors’ compilation based on materials on economicsdiscussion.net

Apart from deciding on the quantity and kinds of taxes, the government has to consider tax rates. Here, the famous Laffer curve provides the framework for discussion.

If tax rates are set too high, there are little incentives to work or produce in a formal economy. Firms may go out of business as higher tax burden forces them to increase prices of their product resulting in lower demand and lower firm’s revenues. In case of high tax burden for individuals, they may choose not to work at all or work less – in any case their productivity diminishes – it makes little sense to work hard if a great part of your earnings is sent to government coffers. On a global scale, high taxation bodes ill with the country’s economic growth and its citizens’ well-being. The question of how much to tax to incentivize domestic production and employment is vital in the political agendas of many countries.

In the global economy with growing mobility of labor and capital as major means of production, governments have to compete in the tax rates to limit tax avoidance. That said, if taxes are higher in one jurisdiction, there is risk that taxable objects flee to jurisdiction with lower taxes. While the latter is less relevant to labor (even though human migration is on a rise over the recent decade) and not relevant to land and immovable property, capital flows have long become increasingly mobile making it difficult to tax it.

What taxes do economic agents pay in different countries?

The prevalent types of taxes that the majority of governments collect are income and consumption taxes. In advanced economies with more developed institutions and higher share of diligent taxpayers, governments rely more on direct taxation of income, while less developed economies collect relatively more revenue from consumption taxes.

Income taxes are the most widely used taxes around the world. The use of individual income taxes has become increasingly widespread upon industrialization and as the authorities’ capacity to collect them grew. In OECD countries individual income tax revenue represents roughly 1/3 of total tax revenues (in Ukraine – 12% in 2018).

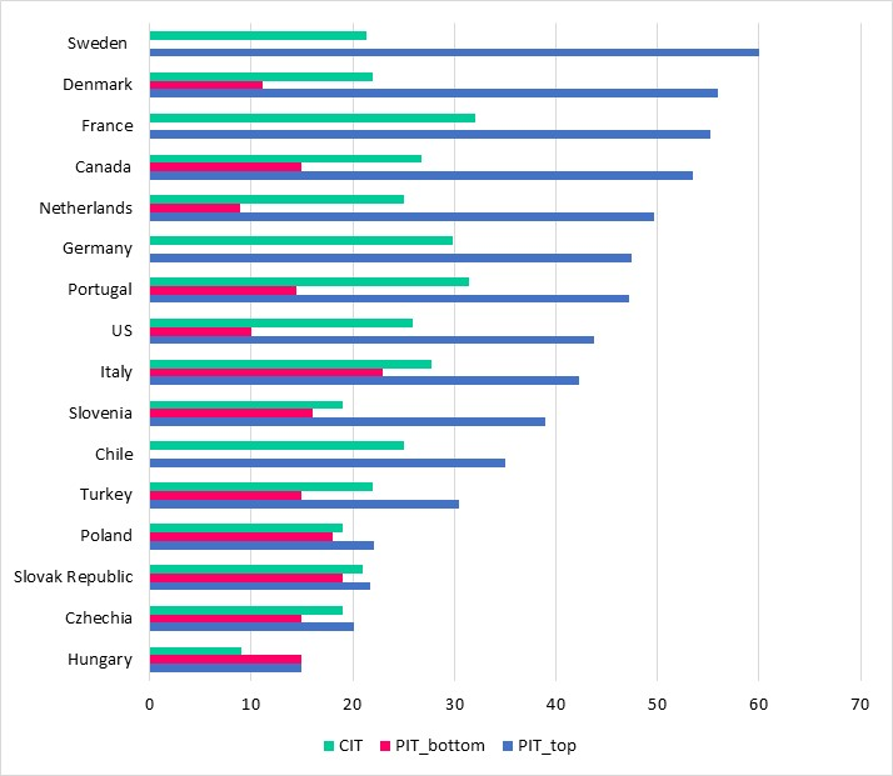

More often than not, the advanced economies use progressive schedules for income taxes as a wealth redistribution tool – they impose higher tax rates on wealthier households’ incomes and lower rates for poorer ones. Personal income tax rates vary dramatically around the world – from 0% to 60% on personal income (see Figure 2). There are a few countries that do not have personal income tax at all, but those countries either have large natural resource endowment or are low populated island states that have low capacity to administer income taxes. These countries raise revenue from high taxation of imports and tourism. Such income-tax heavens are Saudi Arabia, Qatar, Kuwait (all oil-rich economies) and such island states as Bahamas, Barbuda, Anguilla and Antigua. In general, the use of progressive personal income tax systems helps to reduce income inequality albeit the administration of such systems is costly. The study covering the sample of 35 countries deploying progressive taxation and social transfers showed that they lowered their income inequality by around one-third on average with the declines ranging from about 40% in Denmark and Ireland to about 8% in South Korea.

Figure 2. Income tax rates in selected OECD countries (2018)

Source: OECD Statistics database

With the rise of multinational corporations and their profit-shifting activity around the globe, many governments had to lower corporate income tax rates to be able to collect some tax revenue from corporate profits. Over the recent 30 years corporate income tax rates were on the constant decline in all countries going down from about 40% to below 25% on average. The average European corporate income tax rate is 18.7%, which is lower than the worldwide average of 22.8%.

Consumption taxes, largely value-added and excise taxes, are also an important source of government revenue. In OECD countries, consumption taxes account for about 30% of total tax revenue and on average about 7% of GDP (in Ukraine – 51% of tax revenue and 14% of GDP in 2018). The value-added tax is one of the most widespread and is being used in around 140 countries. Among European countries the average VAT rate is 20%, while in the rest of the world it is about 5 pps lower. In Asian economies VAT rates are on average slightly higher than 10%. Countries relying on imports usually have a higher share of their tax revenue coming from consumption taxes. In many countries the governments use reduced VAT rates for basic products (food, pharmaceuticals etc) to reduce the tax burden on low-income households and/or for products that are deemed socially beneficial (books, art, newspapers, theatre etc).

Conclusion

Tax systems should adhere to certain principles – fairness, neutrality, administrative ease, simplicity of compliance, transparency and certainty. Taxes can be levied on income, labour, property, consumption, on international trade and others. Since taxes alter behaviour of economic agents and often distort markets, all of them have pros and cons. Thus a typical tax system is a combination of different taxes. Of course, no tax system perfectly implements all the principles. But they provide a useful framework for comparison of different tax system designs.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations