Ten years ago, in the midst of one of the most turbulent periods in Ukraine’s modern economic history, the National Bank of Ukraine (NBU) made a decision that would set the country’s monetary policy on a new course, reshape its credibility, and embed a rules-based approach at the heart of its strategy of macroeconomic management. How was the inflation targeting regime implemented and calibrated, how did it impact the economy and what has changed since the full-scale invasion?

Introduction: ‘A Decade Since a Bold Turn’

On 18 August 2015, the NBU Board adopted Resolution No. 541, approving proposals for the Main Guidelines of Monetary Policy for 2016–2020. Although the document was formally endorsed by the NBU Council only at the end of 2016 — after the appointment of the new Council members — it effectively became a roadmap for monetary policy for the years ahead, marking the start of a new era in the NBU’s approach to conducting monetary policy. It was within this framework that the NBU committed to adopting an inflation targeting (IT) regime as the backbone of its strategy for ensuring lasting price stability.

This was no ordinary policy adjustment. The move came on the heels of a ‘perfect storm’ — a deep recession coupled with a banking sector meltdown and currency crisis, triggered by years of macroeconomic imbalances, structural weaknesses, and the shock of the first wave of Russia’s military aggression. Within a year and a half, Hryvnia had lost two-thirds of its value, inflation had surged above 60%, and public trust in monetary policy was quite low.

Adopting inflation targeting in such conditions was a bold and forward-looking decision — one that required building new institutional capacities almost from scratch: sound decision making process, a disciplined commitment to rule-based policy, advanced forecasting and policy analysis system, and transparent communication practices.

Ukraine entered the club of inflation-targeting central banks rather late, benefiting from the lessons of earlier adopters (summarized for Ukraine by Vavra (2015)) and embedding global best practices in policy design, communication, and institutional setup from the outset. Even so, the task was daunting: to establish a regime built on credibility, independence, and consistency while the country was still grappling with deep economic and financial turbulence.

A decade later, the results speak for themselves. Inflation has been brought under control multiple times despite repeated shocks — from sizeable food supply-side shocks to the COVID-19 pandemic, and now the full-scale war. The NBU has earned a reputation for professionalism and resilience, and the inflation targeting framework — adapted when necessary — has proved to be not just a universal set of technical tools, but an institutional anchor for economic stability.

The 10th anniversary is more than a date on the calendar. It is a moment to reflect on why this regime was chosen, how it has performed under extraordinary pressure, and what lessons it holds for the next chapter of NBU’s monetary policy.

Why Ukraine Chose Inflation Targeting

When the National Bank of Ukraine committed to inflation targeting in 2015, it was driven by two key motivations: the urgent need to respond to a domestic crisis and the strategic aspiration to align monetary policy with modern international standards.

The shift to inflation targeting marked a deliberate break from Ukraine’s previous monetary policy frameworks. For decades, the country had relied on exchange rate pegs and administrative controls to restrain inflation — approaches that repeatedly failed under the strain of fiscal dominance, shallow financial markets, and external shocks. At best, these frameworks provided temporary stability; in practice, they collapsed under pressure, leaving the economy vulnerable to cycles of devaluation, price surges, and erosion of public trust.

The first discussions about a possible transition to inflation targeting date back to the early 2000s, during the NBU’s cooperation with the IMF—particularly in the context of preparing for greater exchange rate flexibility. At the end of 2008, amid the global financial crisis, the NBU abandoned its hard peg to the US dollar. However, doubts persisted about the potential of active monetary policy, given the high degree of openness of the economy, underdeveloped financial markets, and the large share of administratively regulated prices. As a result, in 2009 the NBU effectively re-pegged the hryvnia to the US dollar.

Recognizing these constraints, the IMF’s 2008 and 2010 programs with Ukraine identified the transition to inflation targeting as a medium-term objective, allowing time to create the necessary conditions for a gradual shift to exchange rate flexibility. The IMF (2006) presents a list of preconditions for a successful move to inflation targeting:

- Institutional independence of the central bank, with a clear mandate to ensure price stability and protection from fiscal and political pressures.

- Strong analytical capacity for forecasting inflation and understanding the monetary transmission mechanism.

- An economic structure characterized by liberalized prices, moderate sensitivity to shocks, and low dollarization.

- A stable, well-developed financial system to enable effective policy transmission.

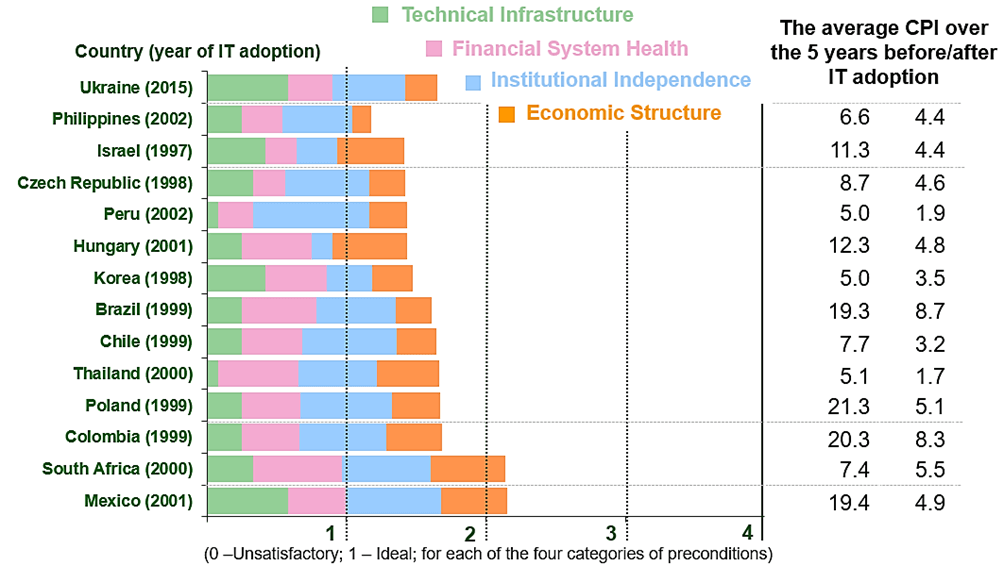

By 2015, assessments of these preconditions showed that the NBU’s readiness for inflation targeting remained incomplete — yet, by the NBU’s own estimates, it was stronger than in many emerging market countries that had adopted the regime earlier (figure 1).

Figure 1. Comparative Country Analysis of IT Preconditions at Time of Adoption

Source: World Economic Outlook, September 2005: Chapter 4. Does Inflation Targeting Work in Emerging Markets?; NBU staff estimates

What ultimately proved decisive was the political will to embrace modern approaches to monetary policy, with inflation targeting emerging as the only viable choice. The regime offered a fundamentally different approach: instead of trying to influence prices through the exchange rate or monetary aggregates, the NBU would commit to a clear, measurable inflation goal and adjust its policy instruments accordingly.

The strategy rested on three pillars:

- Anchoring expectations by clearly stating the target and ensuring policy decisions were consistent with it.

- Enhancing transparency through regular publications, press conferences, and forecasts.

- Ensuring flexibility so that monetary policy could respond to shocks without abandoning its medium-term focus.

Determination in building the pillars of the new framework proved critical to its early credibility and spurred rapid progress in strengthening the foundations for effective monetary policy under an inflation targeting regime.

Building the IT Framework

Since 2014, the NBU has been consistently upgrading the architecture of monetary policy — from internal decision-making procedures to mechanisms for communicating with economic agents. The shift to inflation targeting was not implemented overnight; its key elements were built step by step, combining institutional reform, analytical enhancements, and communication improvements.

From August 2015, inflation, as measured by the Consumer Price Index (CPI), has become the main benchmark for monetary policy decision-making, while the exchange rate of the hryvnia began to be viewed through the prism of its impact on inflationary dynamics. At that time, the NBU publicly set a medium-term inflation target of 5% ± 1 pp for 2019 and further, with interim targets of 12% ± 3 pp by the end of 2016, 8% ± 2 pp by the end of 2017, and 6% ± 2 pp by the end of 2018.

The choice of a 5% target for Ukraine was not accidental. In emerging market countries, higher frequency of external and domestic shocks, combined with structural economic transformation, often justifies medium-term inflation targets above those in advanced economies. According to Gorodnichenko (2014), taking into account the volatility of shocks, a target range of 3 to 5 percent could be considered optimal for Ukraine. With effective targeting and clear communication, even this level can anchor expectations and preserve confidence in the central bank’s policy.

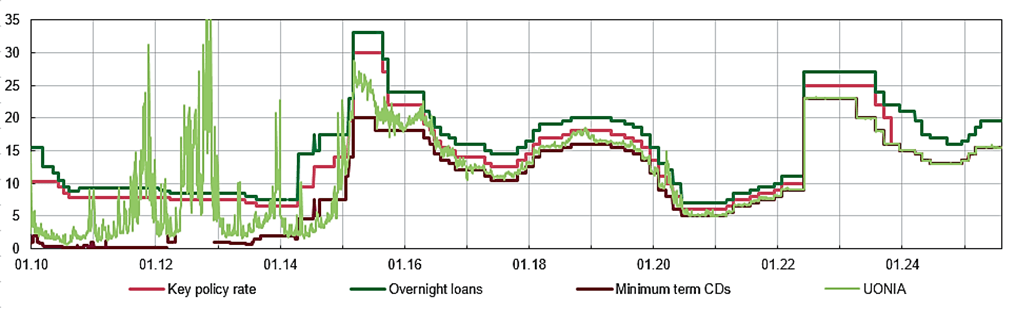

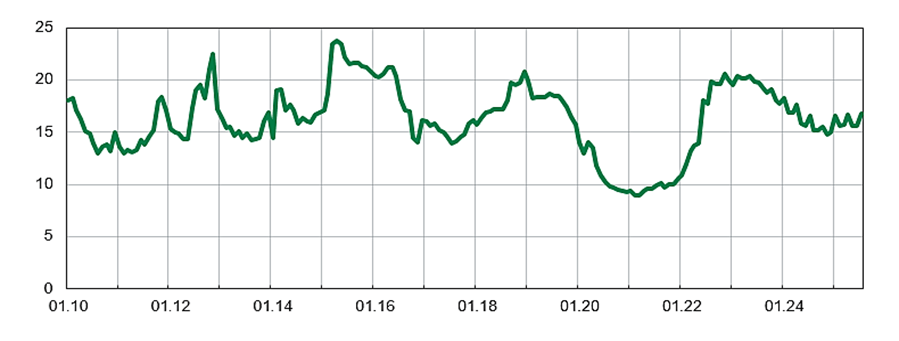

The introduction of inflation targeting became a catalyst for profound institutional changes. A critical milestone came in 2015 with substantial amendments to the NBU Law, which significantly strengthened the regulator’s institutional independence. These changes shielded the central bank from short-term political pressures and clearly anchored its primary mandate of price stability. In early 2016, the operational design of monetary policy was refined: the role of the key policy rate as the main policy instrument was reinforced, and the interest rate corridor was narrowed to improve the transmission of policy signals to money market rates (figure 2).

Figure 2. NBU’s interest rates and UIIR/UONIA, %

Source: NBU

Another important institutional innovation was the establishment of the Monetary Policy Committee (MPC) — a formal platform for collective discussion and facilitation of decision-making on the policy stance, fostering transparency and accountability. This was complemented by the introduction of regular press conferences and detailed press releases explaining the reasoning behind monetary policy decisions, as well as the launch of the quarterly Inflation Report. Over time, the report became one of the primary analytical references for market participants, journalists, and policymakers. In subsequent years, the NBU began publishing Summaries of Discussions from MPC meetings and joined the ranks of the most transparent central banks by publishing the projected path of the key policy rate.

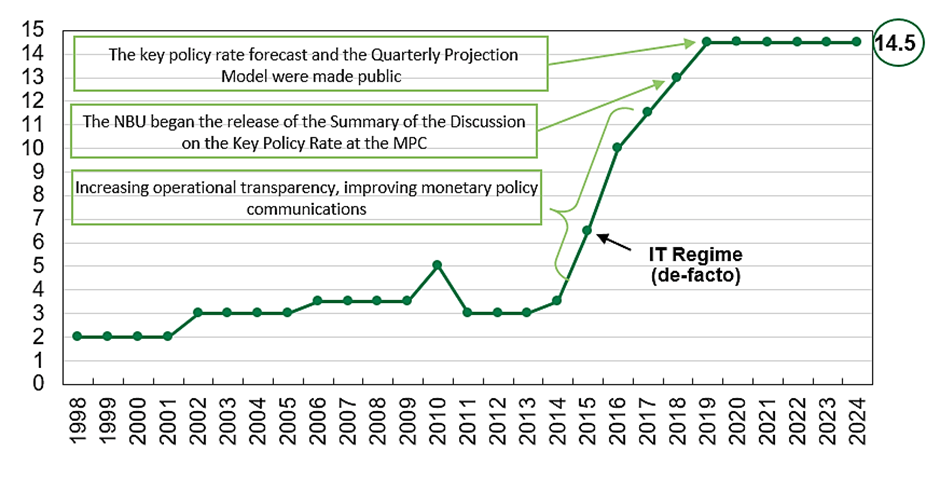

Communication became a strategic pillar of the framework. The NBU developed a series of technical reference materials on key aspects of inflation targeting — including the interpretation of the inflation target, the estimation of the equilibrium real interest rate, and mechanisms for responding to different types of shocks. For a broader audience, the NBU released simplified, non-technical publications to make monetary policy concepts more accessible, thereby strengthening public understanding and trust. The impact was measurable: since the adoption of inflation targeting, the NBU’s Monetary Policy Transparency Index has risen sharply, reflecting a new standard of communication and openness in decision-making (figure 3). In 2019, this progress was recognised internationally when the NBU received the Central Banking Transparency Award.

Figure 3. Monetary Policy Transparency Index

Source: NBU staff estimates based on the methodology by Dincer, Eichengreen and Geraats (2022)

On the analytical side, the NBU continued to improve its Quarterly Projection Model (QPM) and expand its short-term forecasting toolkit, enabling more accurate assessments of inflationary pressures and economic developments. The NBU also strengthened its research function, launching the Working Papers Series and expanding research outreach. Publications increasingly addressed topics such as the effectiveness of the monetary transmission mechanism (Zholud, Lepushynskyi and Nikolaychuk (2019)), the development of macroeconomic models (Nikolaychuk, Sholomytskyi (2015); Grui, Lepushynskyi and Nikolaychuk (2018); Shapovalenko (2021)), central bank independence (Koziuk (2016)), and inflation expectations (Coibion, Gorodnichenko (2015)).

By combining these institutional, operational, analytical, and communication reforms, the NBU built the infrastructure required for a credible inflation targeting regime. This decisive pproach created robust internal processes and a clear public understanding of policy objectives. Professional rigour within the institution and transparency toward the public proved essential for the resilience of the framework in the years to come.

Performance before the Full-Scale War

When the NBU announced its inflation targets in August 2015 — against the backdrop of inflation exceeding 50% — many doubted the realism of these benchmarks. Yet, by the end of 2016, inflation stood at 12.4%, meeting the announced target. This was the first tangible evidence that inflation targeting could work in Ukraine.

At the time, doubts about the appropriateness of the new regime were widespread both outside the NBU and even within the institution itself. Many believed that inflation could not be reduced so quickly. Experience proved otherwise: monetary policy under the inflation targeting framework enabled rapid stabilization of prices and subsequently demonstrated its effectiveness over the medium term. IT became the regime that ‘taught’ the market to trust the central bank’s actions.

The first years also brought significant challenges. In 2017, the economy was hit by a combination of shocks: a poor harvest and a substantial food supply shock (amid food items making up about 40% of the consumer basket), the introduction of a visa-free regime with the EU, and large-scale labour migration. These factors drove rapid wage growth and pushed inflation upwards. In response, the NBU first paused its monetary policy easing and then moved decisively to tighten, raising the key policy rate from 12.5% to 18% in several steps. As a result, inflation declined to the lower bound of the target range — 4.1% at the end of 2019. This was the second major test for the regime after the initial 2015–2016 disinflation, and the NBU passed it convincingly, earning a reputation as the ‘Bundesbank of Eastern Europe’.

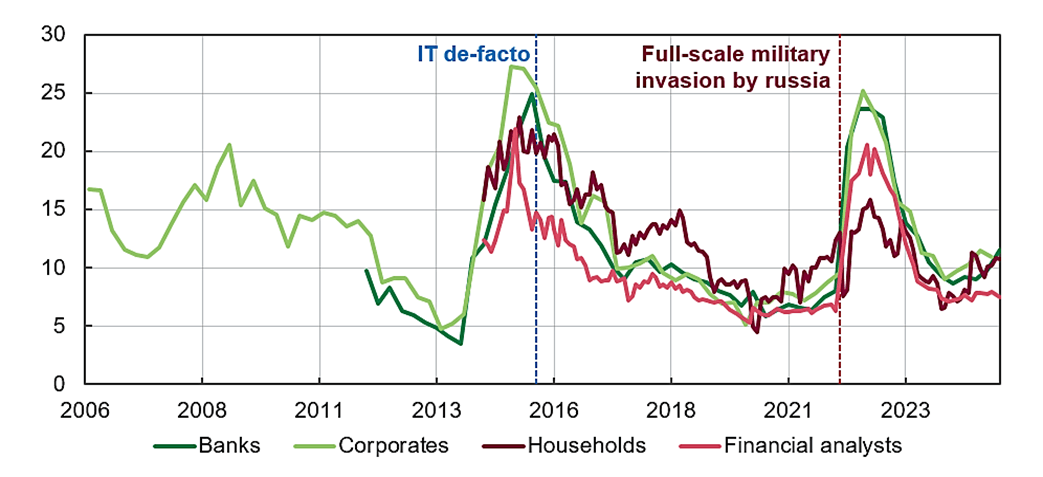

One of the main challenges in implementing inflation targeting during the first years was building trust in the new regime — in particular, convincing economic agents that interest rates and consistent communications can impact inflation under the IT regime. Trust in the central bank’s actions and stability of inflation expectations became central conditions for the regime’s effectiveness. Since expectations are shaped by both past experience and forward-looking guidance, the greater the share of expectations anchored to the central bank’s targets, the more effective the policy transmission is. A crucial part of the framework, therefore, was providing clear information on the expected inflation trajectory so that businesses and households could base their decisions on a stable nominal anchor.

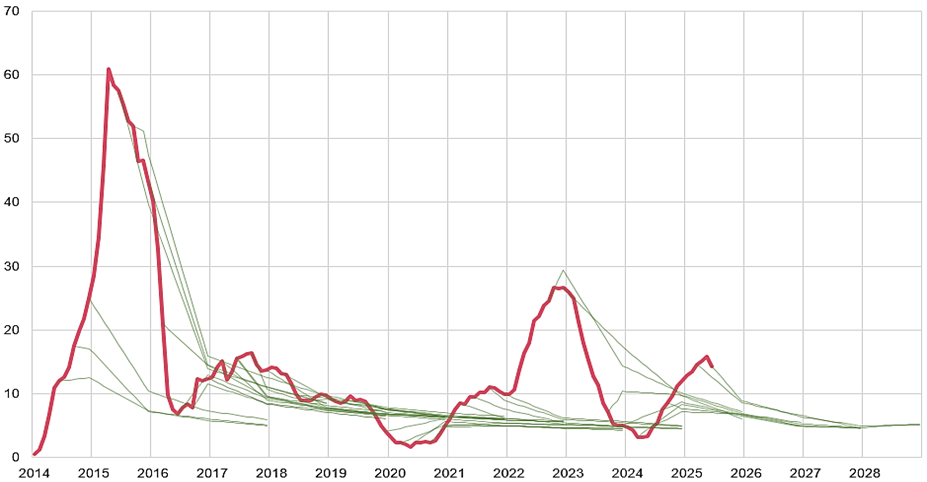

The introduction of inflation targeting created the conditions for stabilizing inflation expectations and gradually anchoring them around the announced target. By early 2020, thanks to consistent monetary policy, a stronger hryvnia, and slowing actual inflation, businesses’ and analysts’ 12-month inflation expectations were closely aligned with the 5% ± 1 pp target. Expectations of banks and households also improved (figure 4).

Figure 4. 12-Month-Ahead Inflation Expectations, %

Source: Info Sapiens, NBU

Moreover, medium-term (two- to three-year) inflation expectations of financial analysts had already moved into the target range by early 2019 and remained there until the start of the full-scale Russian invasion (figure 5).

Figure 5. CPI and Financial Analysts’ Short- and Medium-term Inflation Expectations, %

Source: FocusEconomics, NBU

Beyond disinflation and expectations anchoring, the 2016–2021 period brought other notable achievements under the inflation targeting regime:

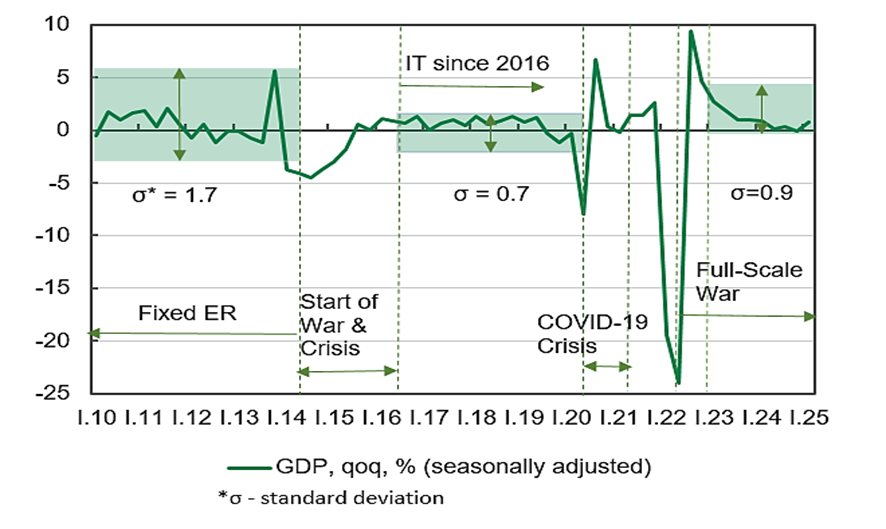

- Significant reduction in GDP growth volatility — the stabilizing role of monetary policy for economic activity increased markedly (figure 6).

Figure 6. Real GDP, qoq, % (seasonally adjusted)

Source: SSSU, NBU staff estimates

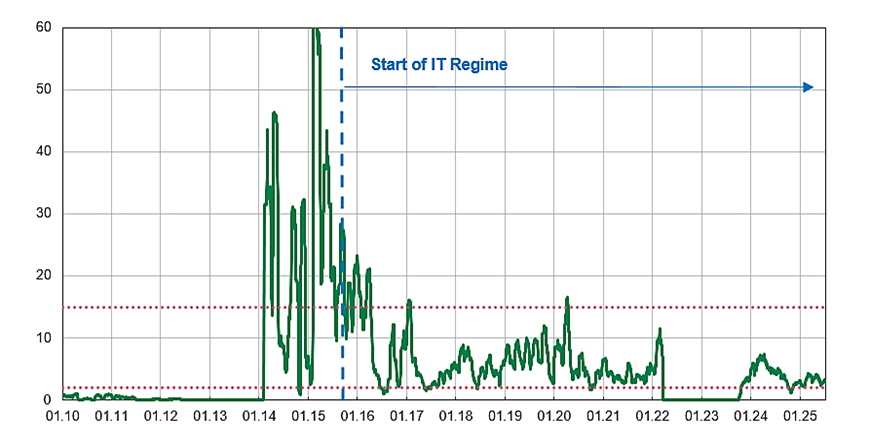

- Adaptation to exchange rate flexibility — the economy became more resilient to currency risk, reducing the likelihood of currency crises (figure 7).

Figure 7. Monthly Exchange Rate UAH/USD Volatility*

* Standard deviation of the daily ER change over a rolling month (quarter), annualized

**24.02.2022 до 02.10.2024 – fixed exchange rate regime

Source: NBU staff estimates

- Improved external position — international reserves rose from USD 5 billion at the start of 2015 to about USD 31 billion by the end of 2021.

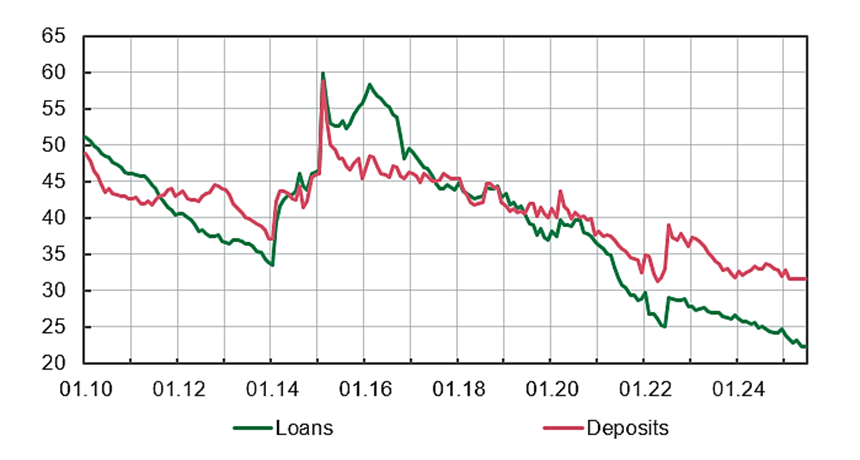

- Dedollarization of loans and deposits — a clear sign of growing confidence in the NBU and the national currency (figure 8).

Figure 8. Share of Foreign Currency Loans and Deposits, %

Source: NBU

- Lower lending rates — as inflation expectations fell, interest rates on loans for business dropped to historic lows, supporting access to credit (figure 9).

Figure 9. Interest Rates on UAH Loans to Non-financial Corporations, %

Source: NBU

By the eve of the full-scale war, the inflation targeting framework had established itself as a credible, flexible, and well-understood monetary policy regime in Ukraine — one capable of delivering price stability and reinforcing macroeconomic resilience even in the face of major shocks.

Resilience under Full-Scale War

The full-scale Russian invasion in February 2022 radically changed the operating environment and became a severe test for Ukraine’s monetary policy and the NBU’s ability to fulfil its mandate. The NBU acted swiftly, fixing the hryvnia exchange rate, introducing extensive currency restrictions, and imposing capital controls. This necessary ‘180° turn’ preserved international reserves, stabilized the financial system, and curbed inflationary pressures under the extraordinary conditions of a wartime economy.

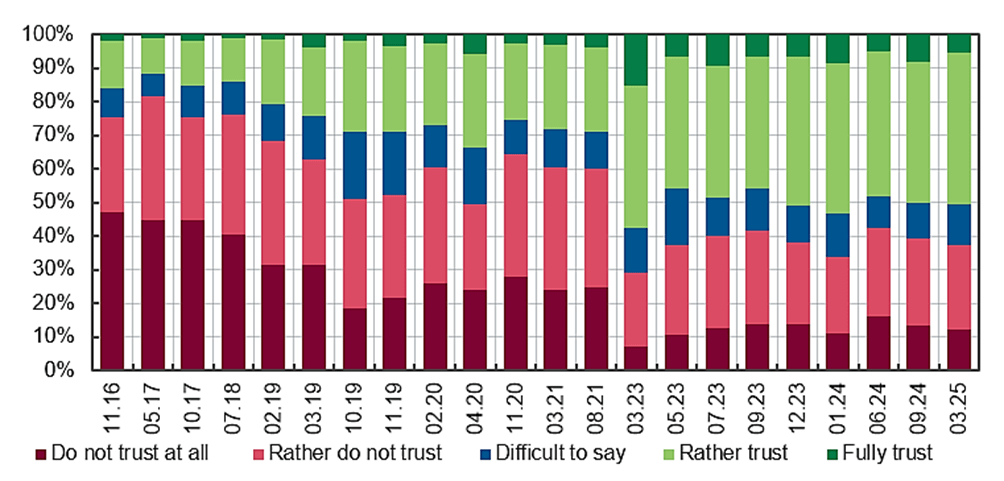

After an initial surge in inflation to nearly 27% due to the direct and indirect effects of the invasion, a comprehensive set of monetary policy measures — including exchange rate stability, making hryvnia-denominated instruments more attractive, unprecedented support from international partners, and favourable food supply factors — enabled the NBU to bring inflation down to 5.1% by the end of 2023, effectively returning it to the 5% target. This achievement became a key driver of improved public trust in the NBU (figure 10) and provided a solid foundation for shifting from a ‘survival strategy’ to Ukraine’s ‘recovery strategy’.

Figure 10. The Level of Public Confidence in the NBU

Source: Razumkov Centre sociological studies

Gradual improvements in the effectiveness of the key policy rate as an operational tool, the strengthening of inflation’s role as the nominal anchor for expectations, the easing of some administrative restrictions on FX operations and capital movements, and the successful introduction of a managed exchange rate flexibility regime created the necessary preconditions for further progress toward a return to inflation targeting.

Thus, in 2024, the NBU transitioned to an interim monetary regime — flexible inflation targeting. Under this framework, monetary policy — as before the full-scale invasion — is aimed primarily at achieving and maintaining price stability, bringing inflation to the 5% target over an appropriate policy horizon. At the same time, the specific features of the new regime allowed the NBU to respond more flexibly to shocks, tolerating moderate temporary deviations of inflation from the target to help the economy adapt to changes in domestic and external conditions.

The shift to flexible IT enhanced the NBU’s ability to maintain an optimal balance between ensuring price stability and supporting economic recovery during wartime, using a coordinated mix of interest rate policy, exchange rate policy, FX restrictions, and, if needed, other monetary tools.

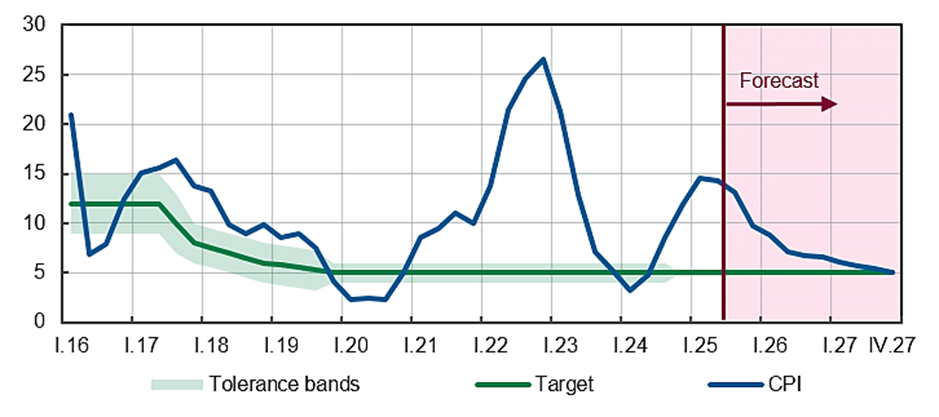

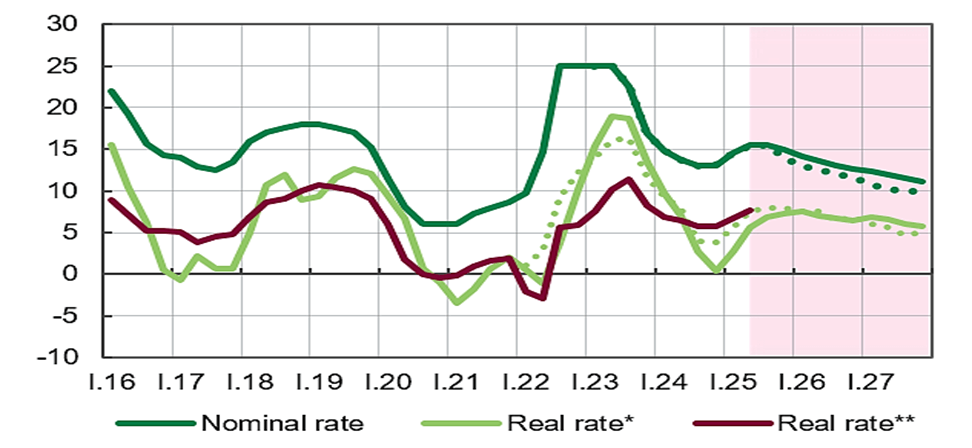

Unlike in earlier episodes of countering inflationary pressures — such as the sharp monetary tightening in 2015, 2017–2018, and 2022 — the NBU, benefiting from the trust it had built and the relative anchoring of inflation expectations, had the privilege of acting more moderately. As a result, the NBU first paused its monetary policy easing cycle and, by the end of 2024, shifted to a tightening cycle. The effects of key policy rate hikes were reinforced by changes to the operational design of monetary policy. In line with the latest forecasts, these measures reversed the inflation trend by mid-2025 and kept inflation expectations under control. It is likely that, to return inflation to the 5% target over the policy horizon (figure 11), the NBU will need to maintain a relatively tight monetary stance for an extended period (figure 12).

Figure 11. Inflation and Inflation Targets (with Forecast), %

Source: NBU Inflation Report (July 2025)

Figure 12. Real Key Policy Rate (with Forecast), %

*Deflated by model expectations (QPM+). Revision of historical estimates is due to changes in modelling the expectations in QPM+.

**Deflated by the expectations of financial analysts.

Source: NBU Inflation Report (July 2025)

At the same time, this prolonged monetary policy response is expected to have a largely neutral effect on lending, which has remained dynamic thanks to strong competition among banks for reliable borrowers, and on overall economic recovery. This wartime monetary regime demonstrates not only tactical flexibility, but also a new level of strategic thinking in an environment of constant turbulence.

Conclusion: Inflation Targeting in a New Era of Uncertainty

A decade after its adoption, inflation targeting has fundamentally transformed the NBU’s capacity to deliver on its mandate. It is now widely recognized — both domestically and internationally — as one of the most important and successful reforms since the Revolution of Dignity. Over the past decade, the framework has proven effective in navigating an extraordinary sequence of shocks: from domestic and global crises to the unprecedented challenge of a full-scale war.

This experience confirms a core lesson from international practice: the ultimate test of a monetary policy framework is not the absence of deviations from the target, but the central bank’s ability to respond appropriately to shocks. In this respect, inflation targeting has allowed the NBU to react with agility, maintain credibility, and anchor expectations — even when circumstances caused temporary departures from the target path.

The 5% inflation target has been a reliable nominal anchor through some of the most severe and persistent shocks in recent economic history. At the same time, the framework’s medium-term orientation has provided the flexibility to absorb exceptionally large disturbances — reducing the overall cost of disinflation while still enabling a timely and orderly return of inflation to target.

Ukraine’s inflation targeting record has inevitably been ‘less tidy’ than in many other countries, reflecting the scale and persistence of the shocks faced. Yet the benefits have been unequivocal. The institutional capacity for monetary policy today is incomparably stronger than it was a decade ago. What once seemed an ambitious aspiration — to operate a credible inflation targeting regime — has become a tested reality.

Looking ahead, the challenge is to preserve this credibility and effectiveness in an environment of permanent uncertainty. In such conditions, the NBU will continue to constantly follow the data-dependent approach, basing decisions on the inflation outlook, the latest economic and financial data, and the strength of monetary policy transmission. While publishing its key policy rate projection, the NBU will not pre-commit to any particular rate path. Instead, it will focus on providing clarity about its reaction function — explaining how policy will respond to shocks of different origin, size, and persistence.

This means being systematic yet context-specific: avoiding overreaction to small or temporary shocks, but acting decisively when needed to protect medium-term price stability. Inflation targeting is not an autopilot. It is a framework that enables the central bank to steer expectations — but only if supported by the daily, meticulous work of analysing conditions, communicating clearly, and making sound decisions.

The greatest institutional achievement is not adopting a framework, but proving it can endure through the most severe storms. Rules provide the compass, but judgment steers the ship. And, to borrow Mervyn King’s analogy, effective inflation targeting should follow the ‘Pep Guardiola theory of monetary policy’: equipping players to make the right decisions on the pitch in real time. Agility must be combined with clarity to help reduce, rather than amplify, uncertainty.

As before, the central bank will make everything possible to provide price stability, adapting our policy frameworks to new realities. In an age of turbulence, a strong and credible commitment to our inflation target is more important than ever.

The author is grateful to Viktor Koziuk, Volodymyr Lepushunskyi, Sofiia Petsiurkivska, Mykhailo Rebryk, and Taras Tokarchuk for their useful comments and help in writing this article.

References

- Coibion, O., Gorodnichenko, Y. (2015). Inflation Expectations in Ukraine: A Long Path to Anchoring?. Visnyk of the National Bank of Ukraine. 233, 6-23.

- Dincer, N., Eichengreen B. & Geraats P. (2022). Trends in Monetary Policy Transparency: Further Updates. International Journal of Central Banking. vol. 18(1), 331-348.

- Gorodnichenko, Y. (2014). Inflation target for Ukraine. VoxUkraine.

- Grui, A., Lepushynskyi, V., Nikolaychuk, S. (2018). A Neutral Real Interest Rate in the Case of a Small Open Economy: Application to Ukraine. Visnyk of the National Bank of Ukraine. 243, 4-20.

- International Monetary Fund. (2006). Inflation Targeting and the IMF. Policy Papers (Washington).

- International Monetary Fund. Research Dept. (2005). Chapter 4. Does Inflation Targeting Work in Emerging Markets? World Economic Outlook, September 2005.

- Koziuk, V. (2016). Independence of Central Banks in Commodity Economies. Visnyk of the National Bank of Ukraine. 235, 6-25.

- Nikolaychuk, S., Sholomytskyi, Y. (2015). Using Macroeconomic Models for Monetary Policy in Ukraine. Visnyk of the National Bank of Ukraine. 233, 54-64.

- Shapovalenko, N. (2021). A Suite of Models for CPI Forecasting. Visnyk of the National Bank of Ukraine. 252, 4-36.

- Vavra, D. (2015). Inflation Targeting Experience: Lessons for Ukraine. Visnyk of the National Bank of Ukraine. 233, 39-53.

- Zholud, O., Lepushynskyi, V., Nikolaychuk, S. (2019). The Effectiveness of the Monetary Transmission Mechanism in Ukraine since the Transition to Inflation Targeting. Visnyk of the National Bank of Ukraine. 247, 19-37.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations