Key Findings

- The Budget Declaration for 2026–2028 does not differ significantly from the previous one in either structure or approach to budget policy. The document lacks major reforms or substantive innovations, with the sole exception being the introduction of two alternative scenarios reflecting differing durations of the war: the baseline scenario assumes an end to the war in 2026, while the alternative scenario envisions continued hostilities beyond 2026 without specifying an end date. This approach reflects a preference for maintaining planning inertia rather than a deliberate shift in fiscal policy. Experience from the previous year suggests that some provisions of the declaration may not be implemented in practice – for instance, the proposed reallocation of 4% of PIT to the state budget or the reinstatement of the Road Fund were not reflected in the State Budget draft law for 2025. It is therefore possible that certain measures set out in the current declaration may also remain unrealized.

- Macroeconomic and social forecasts continue to be shaped by increased uncertainty, primarily driven by persistent security risks. The macroeconomic outlook used in the preparation of the Budget Declaration for 2026–2028 is more conservative than the one underlying the previous Declaration for 2025–2027. A year ago, it was expected that Ukraine’s economy would grow by 7.5% in 2026; the current forecast projects growth of only 4.5%. A similar revision has been made for 2027, with the growth estimate downgraded from 6.2% to 5%. The projection for 2028 remains unchanged at 5.7%. The moderation in expected economic growth is attributed to the continued presence of security threats, damage to energy and other critical infrastructure, disruptions in production and logistics chains, labor shortages, and expectations of limited investment inflows. The trade balance is projected to remain negative, though its deficit is expected to slightly narrow–from $34.7 bn in 2026 to $33 bn by 2028. Annual inflation is forecast to average 9.7% in 2026 and 5.6% in 2028, indicating a return to the National Bank of Ukraine’s (NBU) target range of 5% ± 1 pp by 2028.

- The subsistence minimum (SM) and the minimum wage (MW) will grow at roughly the same pace as inflation in 2026–2028. The SM will increase by 9.2% in 2026, 4.2% in 2027, and 5.4% in 2028, but will still fall short of covering the population’s basic needs. The MW will rise by 9% in 2026 ($194), 6.7% in 2027 ($207), and 6.8% in 2028 ($221), contributing to the growth of real employee incomes and boosting revenues to the state budget, the Pension Fund, and the Unemployment Social Insurance Fund (through the Social Security Contributions).

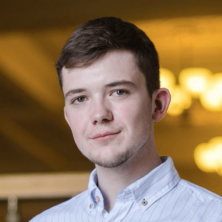

- The bulk of state budget revenues will continue to come from taxes, with their share increasing from 84% in 2026 to 90.4% in 2028. Once again, the government does not include a significant amount of non-tax revenues in the forecast, including foreign military assistance. For comparison, in 2024, such revenues accounted for 24.9% of total state budget receipts. This approach was also applied during the preparation of the 2023 and 2024 budgets, given the high uncertainty around the volume of such inflows and the security sensitivity of disclosing related information.

- The ratio of tax revenues to GDP is projected to gradually decline from 23.6% in 2025 to 21.4% in 2028. Starting from 2026, the rates of major taxes (excl. excise tax) will remain unchanged – for example, the corporate income tax rate for banks and financial institutions will stay at 25%. At the same time, the government plans to align excise tax rates with EU levels and introduce a new excise tax on sugar-sweetened beverages. In nominal terms, tax revenues are expected to grow throughout the forecast horizon, reaching $63.2 bn in 2028 – an increase of 54.1% compared to 2024 and 42.7% compared to the projected amount for 2025. This growth is expected to be driven in part by more effective administration of existing tax instruments, including through tax process digitalization and enhanced tax compliance and enforcement measures.

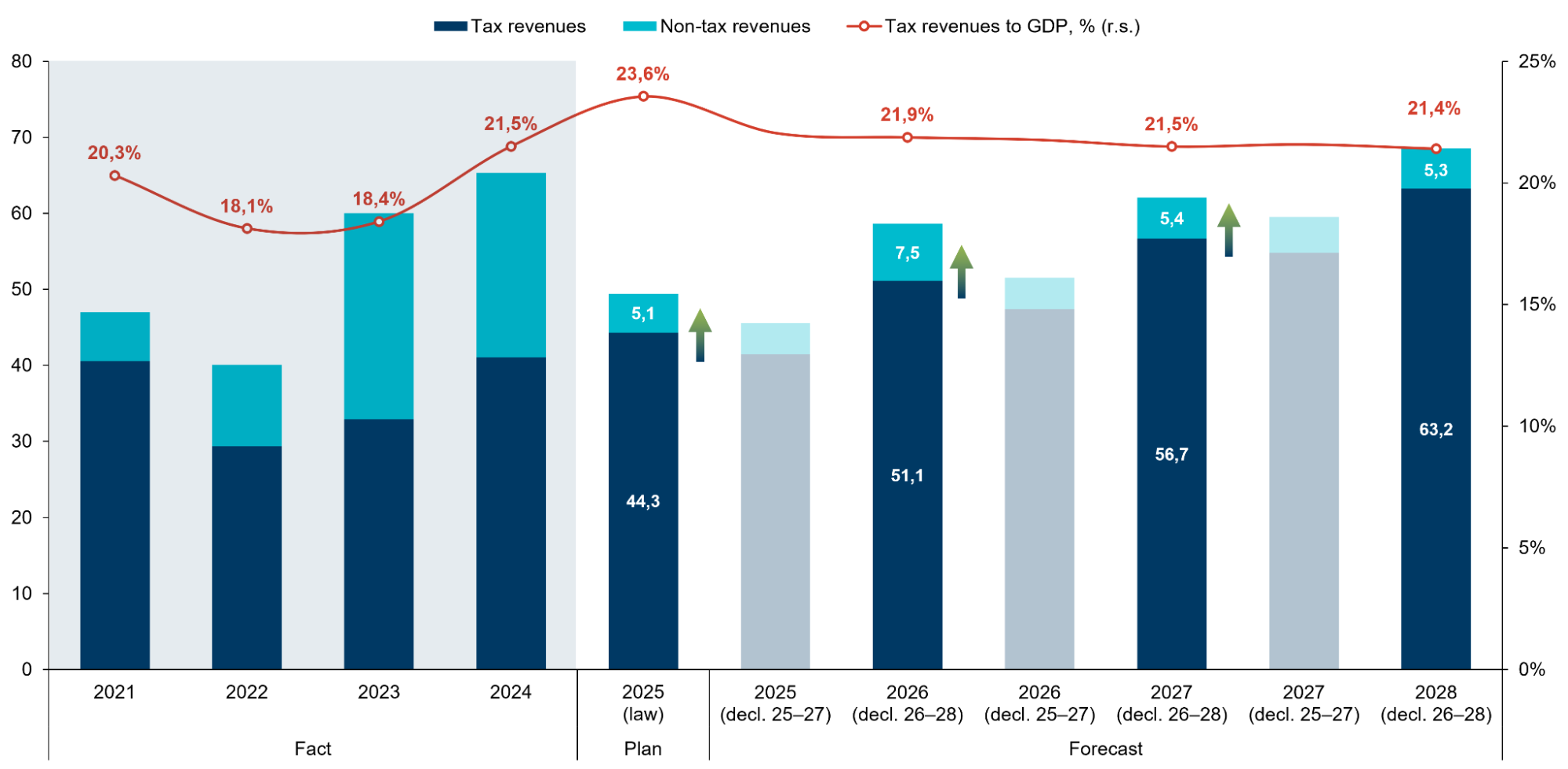

- The government plans a gradual reduction in expenditures from $87.3 bn projected for 2025 to $81.3 bn in 2028. The main driver of this decrease will be the security and defense sector, with its funding expected to be 36.8% lower in 2028 compared to 2025. This scenario assumes a cessation of hostilities in early 2026. At the same time, defense and security will remain a priority in the state budget, accounting for 38.1% of total budget expenditures even in 2028. Under an alternative scenario (continued warfare in 2026 and beyond), expenditures on the security and defense sector are expected to remain at the 2025 level—approximately $58 bn in 2026.

- Social expenditures in the medium term will grow slowly and will mostly fail to keep up with inflation and meet demographic challenges. The increase in social protection funding by 4.2% over three years (compared to 2025) is primarily driven by the rise in the subsistence minimum and pension indexation. Expenditures on education and healthcare will decrease in real terms by 15.3% and 10.7%, respectively. Overall, the expenditure structure reflects an attempt to maintain the social sector at a minimally necessary level, focusing on the most vulnerable groups.

- The main fiscal risk will remain the security situation in Ukraine. Among other risks are the deterioration of the demographic situation and population migration, as well as an acceleration of inflationary processes.

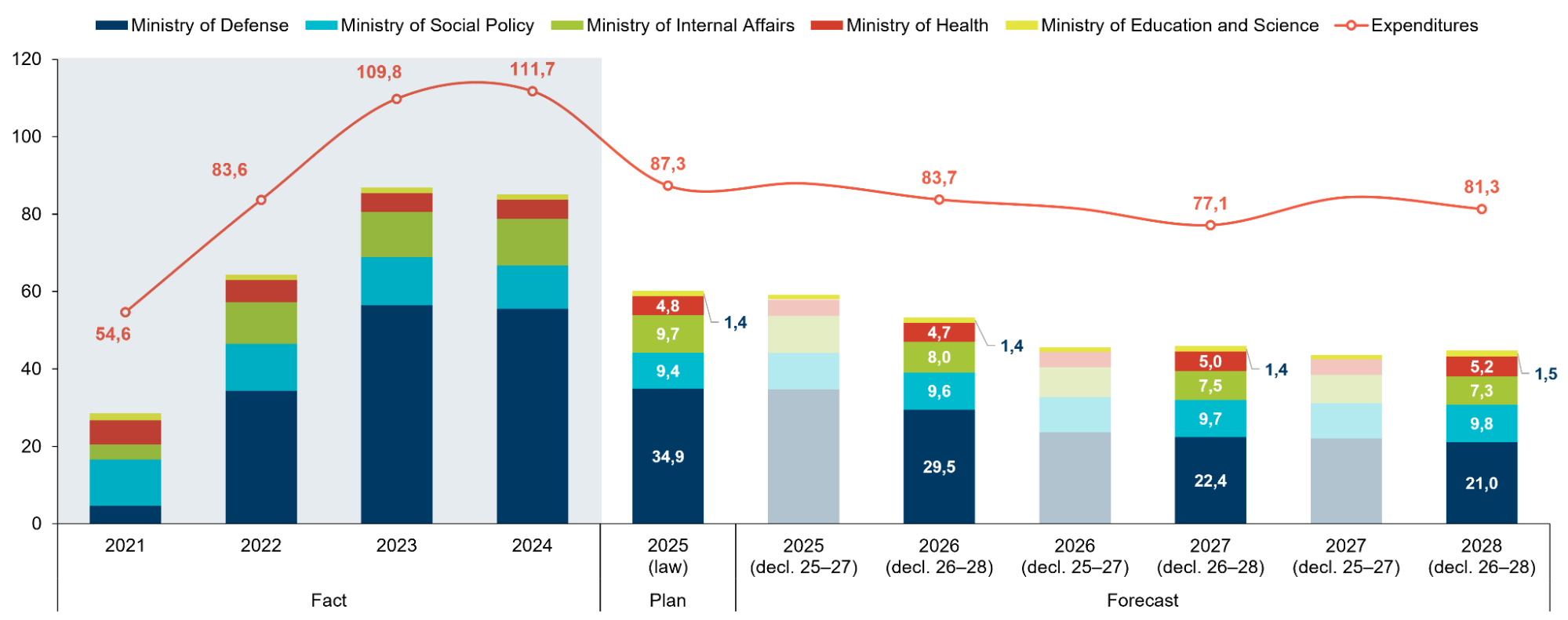

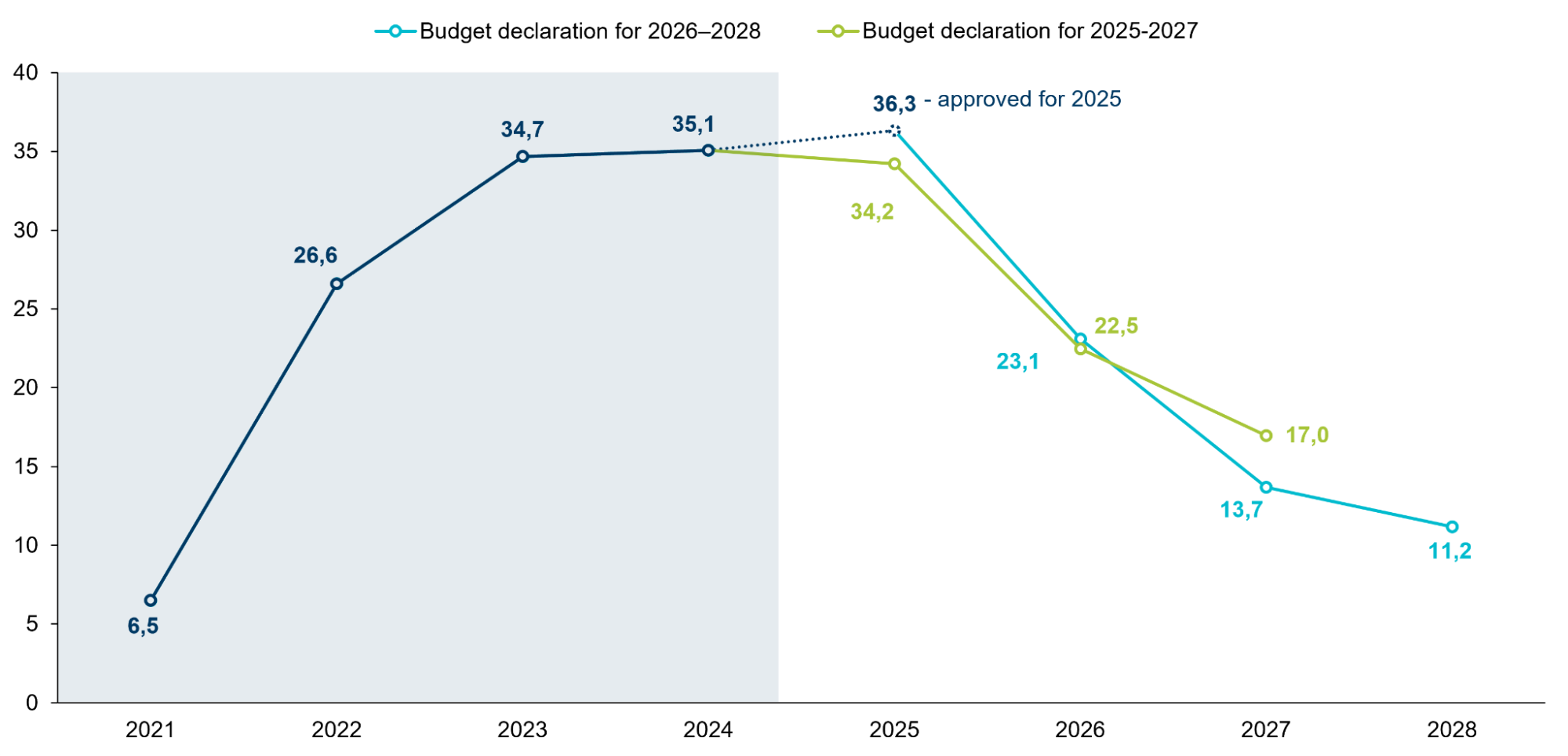

- The reduction of the state budget deficit will be a primary objective of fiscal policy for 2026–2028. The deficit is expected to decline sharply from 9.9% of GDP in 2026 to 3.8% of GDP in 2028. Continued active cooperation with international partners is likely to play a key role in financing the deficit. Consequently, an increase in public debt is anticipated.

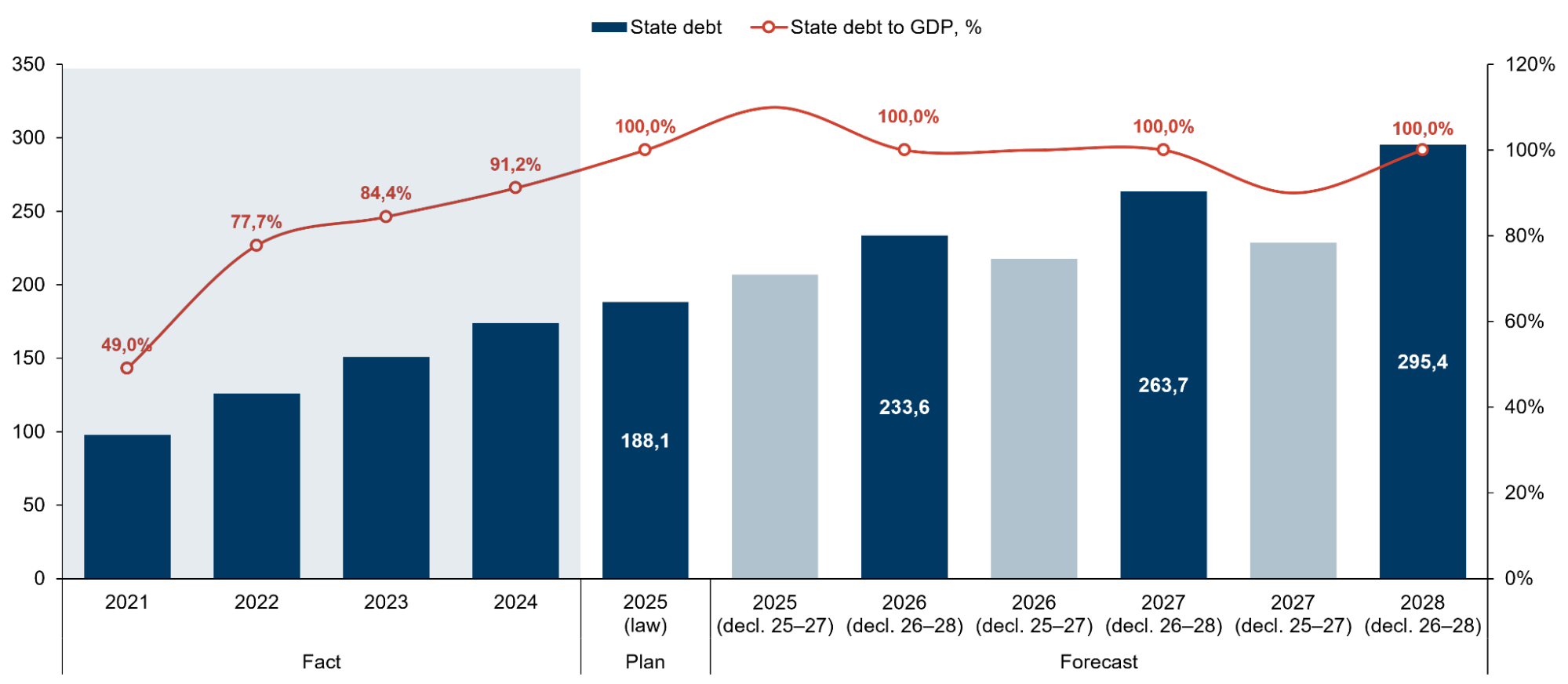

- Between 2026 and 2028, the total public debt will continue to increase, and at a faster pace than previously anticipated. According to the updated forecast, the debt-to-GDP ratio is expected to remain steady at around 100% throughout the projection period, whereas the previous forecast predicted a gradual decline from 110% of GDP in 2025 to 90% of GDP in 2027.

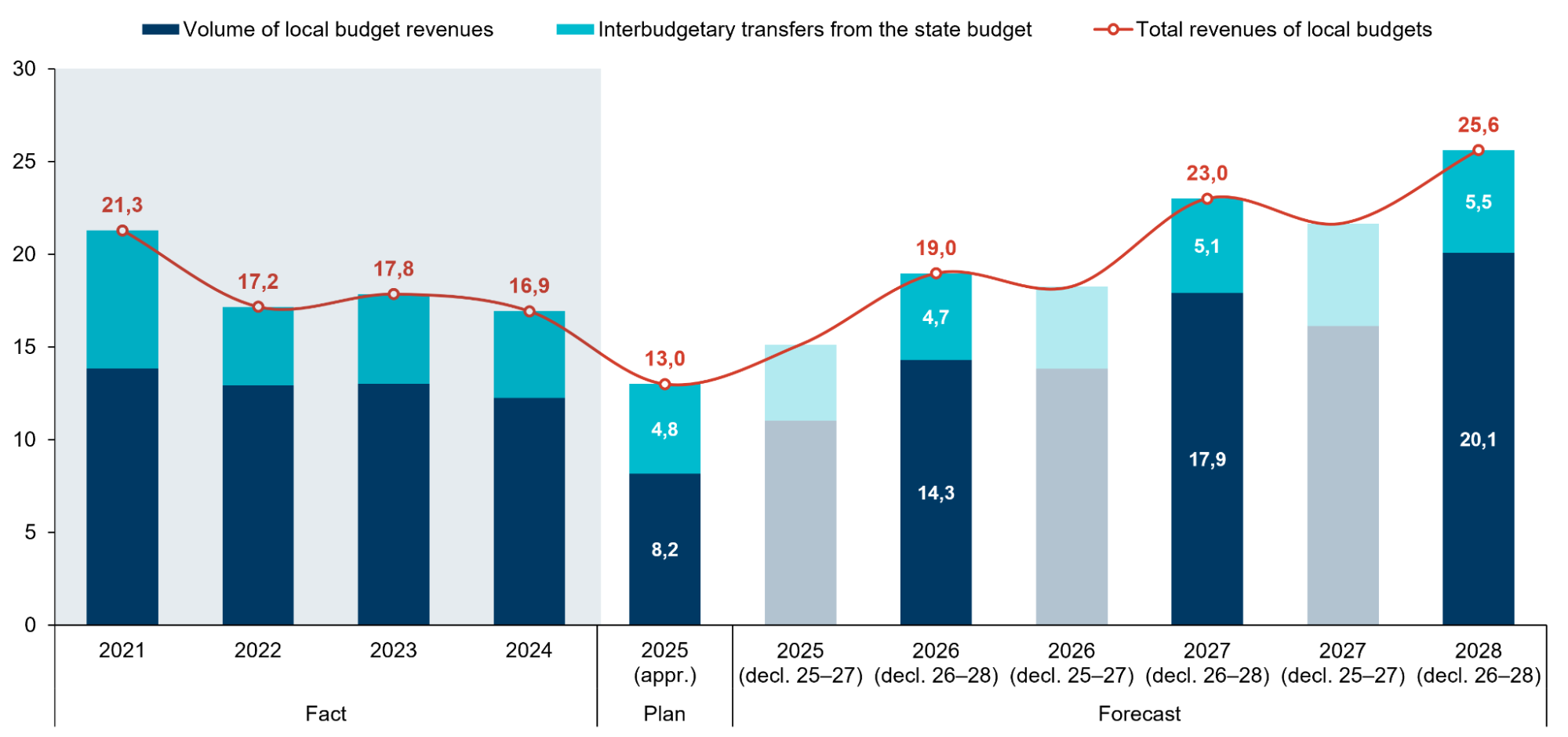

- In the coming years, the financial capacity of local budgets is projected to increase, with total resources expected to exceed the UAH 1 trillion (more than $22 bn) threshold as early as 2027. The primary driver of this growth will be the expansion of hromadas’ own-source revenues, while transfers from the state budget are expected to grow at a slower pace. However, several risks remain – most notably, the expiration of the temporary provision allocating an additional 4% of PIT to local budgets, which had served as a significant revenue source, and the continued allocation of military PIT to the state budget through 2027. The reinstatement of the State Regional Development Fund and the gradual alignment of excise duties with EU standards are expected to partially offset these revenue losses.

Main Changes in Macroeconomic Indicators

In preparing the Budget Declaration, the government relied on the updated macroeconomic forecast provided by the Ministry of Economy, which differs somewhat from the forecast underlying the Budget Declaration for 2025–2027. The new forecast appears more conservative – it includes lower-than-previously-expected real GDP growth rates, while projecting higher nominal GDP figures, likely due to higher assumed growth in the GDP deflator compared to the previous forecast (Table 1).

Table 1. Key Forecasted Macroeconomic and Social Indicators of Ukraine for 2026–2028

| Indicator | 2025 | 2026* | 2027* | 2028 |

| GDP, nominal, USD bn | 188.1 | 233.6⁽⁺⁷⋅³⁾ | 263.7⁽⁺³⋅⁹⁾ | 295.4 |

| GDP, real change, %, y-o-y | 2.7 | 4.5⁽⁻⁴⁰⋅⁰⁾ | 5.0⁽⁻¹⁹⋅⁴⁾ | 5.7 |

| CPI, %, avg | 109.7 | 109.7⁽⁻⁰⋅²⁾ | 107.1⁽⁻⁰⋅⁸⁾ | 105.6 |

| CPI,%, eop | 109.5 | 108.6⁽⁻¹⋅⁶⁾ | 105.9 | 105.3 |

| Trade balance, USD bn | -40.7 | -34.7⁽⁺²⁷⋅⁵⁾ | -33.6⁽⁺⁵⁹⋅⁶⁾ | -33.0 |

| Unemployment rate, % | 17.7 | 12.9⁽⁻²⁵⋅⁹⁾ | 13.3⁽⁻¹⁹⋅⁴⁾ | 12.8 |

| FX, UAH/USD, evg | 45.0 | 44.7⁽⁻³⋅⁹⁾ | 45.2⁽⁻²⋅⁶⁾ | 45.6 |

| FX, UAH/USD, eop | 45.6 | 44.8⁽⁻²⋅⁴⁾ | 45.3⁽⁻¹⋅⁹⁾ | 45.8 |

*Parentheses show % change vs. the 2025–2027 Budget Declaration.

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

The new macroeconomic forecast reflects the current situation in the country, which has not changed significantly compared to the previous year. Ukraine continues to face major challenges: prolonged security threats, destruction of energy and critical infrastructure, disruption of production and logistics chains, and a shortage of labor resources. The more restrained nature of this year’s forecast is explained by growing risks, particularly the potential decline or insufficient level of investment activity amid high uncertainty regarding the intensity and duration of hostilities.

The updated macroeconomic forecast includes slightly lower inflation compared to the previous one. Specifically, inflation in 2026 is projected at 9.7% (previously 9.9%), in 2027 at 7.1% (previously 8%), and in 2028 it is expected to decline to 5.6%, which falls within the National Bank of Ukraine’s target range (5% ± 1 pp). High inflation in 2026–2027 is driven by considerable uncertainty in the security environment, labor market instability, and the limited capacity of businesses to operate under conditions of persistent turbulence.

As in the previous forecast, the trade balance remains negative. This is due to the economy’s high import dependence and limited export capacity for key goods, particularly agricultural and food products. According to the new forecast, the trade deficit will amount to $34.7 bn in 2026 and gradually decline to $33 bn in 2028. By contrast, last year’s forecast was considerably more optimistic, anticipating a reduction in the trade deficit from $27.2 bn in 2026 to $21.1 bn in 2027. Given that the trade deficit in 2025 is projected at $-40.7 bn, the new Budget Declaration adopts a more realistic approach.

The exchange rate of the hryvnia to the US dollar in the new forecast appears more moderate and assumes a slower depreciation of the national currency than in the previous scenario. Specifically, the average exchange rate in 2026 is expected to be UAH 44.7/USD (previously UAH 46.5/USD), in 2027 – UAH 45.2/USD (previously UAH 46.4/USD), and in 2028 – UAH 45.6/USD. This indicates relatively stable expectations for the foreign exchange market, despite the challenging macroeconomic environment and external risks.

In 2026–2028, the SM for all population categories will increase at similar rates, which will gradually decline: from $65 in 2025 to $78 in 2028 (overall growth – 20%). In the previous Budget Declaration for 2025–2027, the SM remained unchanged at the 2024 level (Table 2). The increase of it in 2026–2028 will correspond to the projected consumer price index: 9.2% in 2026, 4.2% in 2027, and 5.4% in 2028. At the same time, the legislated SM remains 2.5–3 times lower than the actual one and will not cover the population’s basic needs. The slow growth of the SM is due to budget constraints and the need to curb the growth of social expenditures.

Table 2. Subsistence Minimum in 2026–2028

| Subsistence minimum, USD | 2025 | 2026 | 2027 | 2028 |

| per person | 65 | 71 | 74 | 78 |

| for children under 6 y.o. | 57 | 62 | 65 | 68 |

| for children aged 6–18 y.o. | 71 | 78 | 81 | 85 |

| for persons of working ability | 67 | 74 | 77 | 80 |

| for persons with lost work capacity | 52 | 57 | 60 | 63 |

| minimum wage | 178 | 194 | 207 | 221 |

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028

The minimum wage will increase in 2026–2028: in 2026 — $194 (+9%), in 2027 — $207 (+6.7%), and in 2028 — $221 (+6.8%), whereas in 2025 it amounts to $178. This will contribute to higher budget revenues due to increased tax receipts and SSC. The Budget Declaration for 2025–2027 did not envisage an increase in the minimum wage, which limited the potential for growth in budget revenues on the one hand and the purchasing power of the population on the other.

The expected unemployment rate will decrease from 17.7% in 2025 to 12.8% in 2028, which will have a positive impact on budget revenues. The decline in unemployment is linked to government policies aimed at actively engaging people in the labor market through retraining programs and acquiring new professions, helping to prevent structural unemployment. In addition, grant programs for entrepreneurship development with the creation of new jobs should also contribute to this trend. Labor market activity is also expected to increase as migrants gradually return to Ukraine, which will become possible with reduced security risks.

State Budget Revenues

Over the period 2026–2028, state budget revenues are expected to grow gradually in nominal terms – from $51.7 bn planned for 2025 to $70 bn in 2028 (Table 3). In 2026, revenues are projected to increase by 17.6% compared to 2025; in 2027 – by 4.8%; and in 2028 – by 9.8% relative to 2026 and 2027, respectively. The new forecast has been slightly revised: projected revenues for 2026 are 2.6% higher, and for 2027 – 5.6% lower than the estimates in the previous Budget Declaration.

Table 3. State Budget Revenues in 2024–2028, $bn

| Indicator | 2024

fact |

2025

plan |

2026

forecast |

2027

forecast |

2028

forecast |

| Revenues | 77.8 | 51.7 | 60.8 | 63.7 | 70.0 |

| tax revenues | 41.0 | 44.3 | 51.1 | 56.7 | 63.2 |

| non-tax revenues | 24.3 | 5.1 | 7.5 | 5.4 | 5.3 |

| tax revenues to GDP, % | 21.5 | 23.6 | 21.9 | 21.5 | 21.4 |

| tax revenues as % of state budget revenues | 52.7 | 85.7 | 84.0 | 89.0 | 90.4 |

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

Revenue projections are based on the assumption that the rates of the major taxes – VAT, PIT, and CIT – will remain unchanged: 20%, 18%, and 18% (25% for the profits of banks and financial institutions), respectively. In preparing the Declaration, the provisions of the National Revenue Strategy through 2030 were taken into account, particularly those related to improving tax administration, digitalizing taxation processes, enhancing the quality of tax control, and more. Strengthening oversight of income generated via digital platforms, improving tax debt collection practices, and the potential introduction-starting from 2026-of an excise tax on beverages containing added sugar or other sweetening or flavoring substances are among the planned measures (Table 4).

Table 4. Measures Included in State Budget Revenues for 2026–2028, $bn

| Measure | 2026 | 2027 | 2028 |

| restoration of the share of personal income tax allocated to the state budget | 0.36 | 0.43 | 0.50 |

| gradual alignment of excise tax rates on tobacco products with EU levels | 0.20 | 0.13 | 0.14 |

| gradual alignment of excise tax rates on fuel with EU levels | 0.39 | 0.43 | 0.44 |

| allocation of military PIT to the state budget* | 1.79 | -1.26 | -1.25 |

*minus sign indicate a reduction in state budget revenues by the corresponding amounts due to the reallocation of military PIT to local budgets

Source: Budget Declaration for 2026–2028

Tax revenues have traditionally formed the core of the state budget’s income. In 2025, their share in total revenues is projected at 85.7%; it will slightly decline to 84% in 2026 but is expected to increase to 89% in 2027 and to 90.4% in 2028. For comparison, in 2024 the actual share of tax revenues was only 52.7%. This is explained by the substantial volume of non-tax revenues, particularly international donor grants (15.2% of total budget revenues) and military aid provided by Ukraine’s foreign partners (24.9% of revenues). In the future, once the war or its active phase comes to an end, these sources of revenue will decline, increasing the relative weight of taxes in the budget structure.

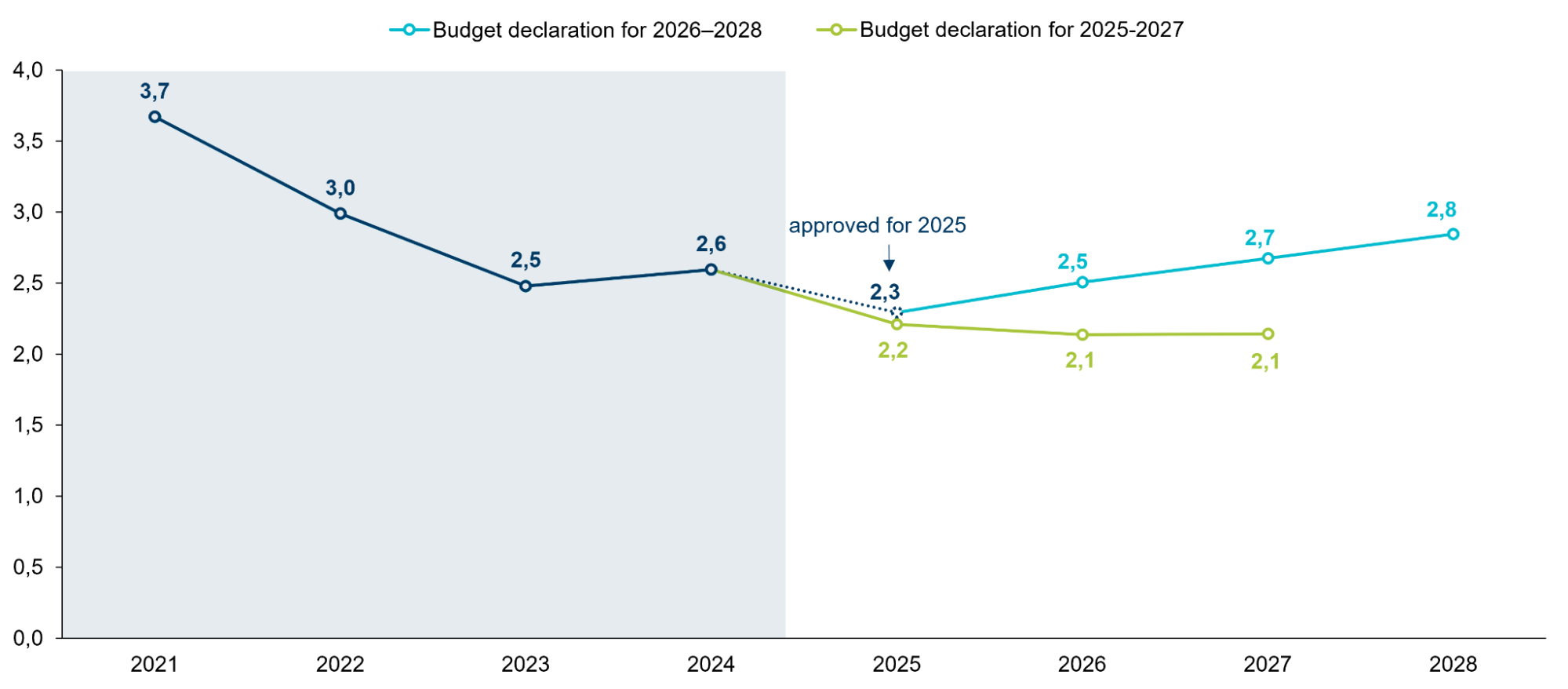

By 2028, nominal tax revenues are expected to increase significantly compared to 2024 and 2025. This is primarily due to the reinstatement of the 4% share of PIT being credited to the state budget, which since 2022 had been temporarily allocated to local budgets, and the gradual alignment of excise tax rates on tobacco products and fuel with EU levels. Additionally, quarterly accrual and payment of CIT by banks and financial institutions at a rate of 25% is planned. In 2028, tax revenues are projected to reach $63.2 bn – 54.1% more than the actual amount collected in 2024 and 42.7% more than the projected revenues for 2025. Compared to the previous declaration, the government has slightly revised upward its expectations for tax revenues: in 2026, an additional $3.7 bn (+7.8%) is expected, and in 2027 – $1.9 bn more (+3.4%) (Fig. 1).

The tax-to-GDP ratio over the period 2025–2028 is projected to average 22.1%. The highest level of this indicator is expected in 2025 – at 23.6% of GDP. It is then projected to gradually decline to 21.9% in 2026, 21.5% in 2027, and 21.4% in 2028. A declining tax-to-GDP ratio alongside growing absolute tax revenues may signal economic growth outpacing the fiscal burden, creating favorable conditions for business recovery.

Figure 1. Budget revenues in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

Importantly, starting from 2027, PIT from military personnel’s monetary allowances will be directed to the general fund of local budgets. In addition, amendments to budget legislation are foreseen to ensure that 100% of revenues of the State Road Fund will be allocated to the general fund of the state budget over the 2026–2028 period.

In 2026–2028, the government plans to mobilize additional non-tax revenues for the state budget, in particular by increasing the amount of profit transferred by the National Bank of Ukraine. According to the NBU, it plans to transfer $3.4 bn to the budget in 2026, $1.4 bn in 2027, and $1.2 bn in 2028. The gradual decline in these amounts may be linked to reduced foreign exchange interventions by the NBU and lower earnings from placing international assistance funds in the regulator’s accounts.

During 2026–2028, the main fiscal risks–similar to the past three years since the start of the full-scale invasion–will continue to be security and military-related, as well as demographic and migration-related risks. In addition, financial risks remain prominent, particularly the challenge of accumulating sufficient (domestic and external) financial resources to meet fiscal needs. These risks could significantly hinder the achievement of the fiscal objectives set out in the Budget Declaration and negatively affect the country’s socio-economic stability.

Security and military risks:

- Continued armed aggression of the Russian Federation against Ukraine;

- Massive missile and drone attacks on energy infrastructure, including the destruction of thermal and hydropower generation facilities;

- Blockade of seaports and strikes on port infrastructure.

External economic risks:

- Introduction of import or transit restrictions on Ukrainian agricultural products by neighboring countries;

- Global economic slowdown due to increased protectionist measures by the United States;

- Sharp increases in global food and energy prices.

Macroeconomic risks:

- Shortage of qualified labor, demographic and migration challenges, imbalances in the labor market;

- Low crop yields;

- Acceleration of inflationary processes;

- Deterioration of consumer sentiment and business expectations.

Budgetary risks:

- Possible overspending on public debt servicing and repayment;

- The need to finance additional unplanned expenditures for security and defense, infrastructure restoration, and social needs;

- Risk of reduction or suspension of military assistance from the United States;

- Significant increase in budgetary expenditures for post-war reconstruction and the elimination of war consequences;

- Reduction or delay of financial assistance from international partners.

State Budget Expenditures on Defense and Recovery

Total expenditures are projected to decline from $87.3 bn in 2025 to approximately $83.7 bn in 2026, and decrease by another $6.6 bn in 2027 to reach $77.1 bn. In 2028, expenditures are expected to return nearly to the 2026 level — $81.3 bn. The primary driver of this reduction will be the security and defense sector.

Despite the planned reductions, the security and defense sector will remain a top priority — accounting for 48.4% of all expenditures in 2026, and 42.1% and 38.1% in 2027 and 2028, respectively (Fig. 2). General government functions (including public debt servicing) and social protection will also receive a significant share of spending: between 20.5%-23.5% and 11.6%-12.2%, respectively, during 2026–2028.

The Ministry of Defense, the main spending unit of the defense sector, is planned to receive $29.5 bn in 2026 — a 30% reduction compared to the revised 2025 state budget (actual expenditures in 2025 may be even higher). The reduction in defense funding is primarily linked to the government’s expectations of a decline in combat intensity in 2026 due to the end of the war or a prolonged ceasefire agreement.

A similar funding reduction is anticipated for the Ministry of Internal Affairs, which is part of the security sector. In 2026, the MIA is projected to receive $8 bn (an 18% decrease compared to 2025), followed by $7.5 bn and $7.3 bn in 2027 and 2028, respectively. The likely reason for this decline is the expected reduction in National Guard personnel due to demobilization and a decrease in arms procurement as combat activity diminishes.

The government is also considering an alternative scenario, which assumes continued hostilities in 2026 and beyond. Under this scenario, funding for the security and defense sector would remain at the 2025 level — approximately $58 bn. In such a case, with all domestic financial resources directed to defense and security, Ukraine would require continued external financial support from partners at no less than the current level (approx. $40 bn annually) to sustain social programs and population support measures.

Among defense institutions, the only significant difference between the current Budget Declaration and the draft declaration for 2025–2027 concerns the Ministry of Defense’s funding in 2026. The current declaration envisaged $23.6 bn for 2026, while the new one increases this to $29.5 bn. This level of funding signals that the security and defense sector will maintain substantial needs even under a de-escalation or end-of-war scenario in 2026. It highlights the need for long-term decisions in defense financing — both in terms of fiscal sustainability and strategic planning for the transition from wartime to post-war conditions.

If the war ends, maintaining an adequate level of defense capability will remain a challenge. Therefore, the government proposes establishing a dedicated fund to finance the needs of the defense forces, which would be filled with contributions from international partners, particularly the Coalition of the Willing. This fund is intended to preserve the necessary number of active military personnel under contract to deter further aggression from Russia. It will serve as part of the security guarantees provided by European partners to Ukraine. It is likely that the fund will directly finance a program to support the Armed Forces of Ukraine, the main and largest component of which is the monetary remuneration of military personnel. In addition, the fund’s financial resources could be used for the procurement of Ukrainian-made weapons, logistics support, and other current expenses of the defense sector, which are currently covered by the state budget.

Figure 2. Top-5 Ministries by Expenditure Volume in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

In the non-defense sector, funding for key budget holders in 2026 will mostly remain at the 2025 level, with some exceptions involving reductions due to limited revenue sources. Specifically:

- Funding for the Ministry of Energy in 2026 is expected to decrease to $100 mln, compared to $231 mln in 2025. At the same time, in 2025, two-thirds of this amount (around $151 mln) was provided through the special fund — primarily from international partners. The absence of such funding in the 2026 forecast indicates either the low predictability of this type of financing or a shift in priorities.

- A similar situation is observed for the Ministry for Development of Communities and Territories, whose funding is projected to decline to $124 mln in 2026 from $918 mln in 2025, also due to the lack of special fund revenues in the 2026 state budget forecast.

The recovery sector remains a vital part of economic development, yet its funding is set to decrease due to a shortage of financial resources. Funding for the State Agency for Restoration in 2026 is expected to drop by $417 mln compared to 2025 — from $1 bn to $585 mln — and decline by another $82 mln in 2027. Given that the government does not anticipate funding from the special fund of the state budget, these figures could increase depending on the level of support from international partners.

Public Investment Projects

This year, significant amendments were introduced to the Budget Code of Ukraine, establishing a new framework for public investment management (PIM). Among other provisions, the updated legislation requires the preparation of a Medium-Term Public Investment Priority Plan, to be developed by the government in parallel with the Budget Declaration. This document identifies the key investment priorities, broken down by sector and projected financing volume. In essence, it serves as a strategic roadmap, enabling the targeted allocation of funds in line with national policy objectives.

The text of the Budget Declaration outlines the government’s primary investment priorities: enhancing energy efficiency, combating climate change, promoting gender equality, and fostering an inclusive and barrier-free environment.

The total volume of planned public investments for 2026–2028 amounts to $13 bn, including:

- $5.2 bn from the state budget, of which $2 bn via the State Regional Development Fund;

- $2 bn from international partners in the form of external assistance;

- $5.5 bn backed by state guarantees.

The Medium-Term Public Investment Priority Plan for 2026–2028 was prepared by the Ministry of Economy based on submissions from sectoral ministries. All proposals were aligned with the funding ceilings established by the Ministry of Finance and with relevant strategic planning documents.

The plan outlines which sectors the state considers to be investment priorities. These sectors are expected to receive the bulk of public investment over the next three years. Under the revised framework, only initiatives included in the respective sectoral investment portfolios and aligned with the key investment directions specified in Annex 1 (Table 5) of the Medium-Term Plan may be admitted into the Single Project Portfolio. This approach is intended to strengthen the strategic targeting of public investments and enhance transparency in project selection.

Table 5. Public Investment Allocation for 2026–2028

| Sector | Responsible Ministry | Investment Focus | Ceiling for 2026–2028 ($bn) | Share |

| Transport | Ministry for Development | Road modernization, railway network expansion, urban transport development, traffic safety | 4.39 | 34.1% |

| Energy | Ministry of Energy | Expansion of energy extraction, modernization of energy infrastructure | 2.67 | 20.8% |

| Regional Development Fund | Ministry for Development | Financing of regional development projects | 1.99 | 15.5% |

| Education and Science | Ministry of Education and Science of Ukraine | Modernization of educational facilities, infrastructure, quality improvement, safety | 1.82 | 14.1% |

| Healthcare | Ministry of Health | Cancer centers, medical education, accessibility of services, procurement of medical equipment | 0.97 | 7.5% |

| Housing | Ministry for Development | Construction of new housing units, development of social rental housing | 0.41 | 3.2% |

| Municipal Infrastructure & Services | Ministry for Development | Modernization of water supply and sanitation systems, energy efficiency, municipal infrastructure | 0.28 | 2.2% |

| Social Protection | Ministry of Social Policy | Housing for foster families, rehabilitation of war veterans, veteran support programs | 0.20 | 1.6% |

| Public Services & Digitalization | Ministry of Digital Transformation | Electronic systems, digital services, cybersecurity | 0.06 | 0.5% |

| Justice and Rule of Law | Ministry of Justice | Conditions of detention, protection of documentary heritage | 0.03 | 0.2% |

| Public Finance | Ministry of Finance | Modernization of border crossing points, improvement of customs procedures | 0.02 | 0.2% |

| Environment | The Ministry of Environmental Protection and Natural Resources | Flood protection infrastructure, radioactive waste management | 0.02 | 0.1% |

| Civil Security | Ministry of Internal Affairs | Emergency response systems, public safety, natural disaster preparedness | 0.02 | 0.1% |

| Total | 12.87 | |||

State Budget Social Expenditures

The expenditures of the Ministry of Social Policy will gradually increase: from $9.4 bn in 2025 to $9.6 bn in 2026, $9.7 bn in 2027, and $9.8 bn in 2028. Over three years, the projected increase will amount to $391 mln, or about 4.2% compared to the 2025 level. The growth in state budget expenditures on social protection is driven by the increase in the subsistence minimum, the level of which directly affects the amount of social benefits. In addition, the expenditures account for the annual pension indexation.

In the medium term, social policy will focus on continuing the basic social assistance pilot to enhance the targeting of support, implementing pension reform to improve fairness and establish uniform approaches to calculating insurance pensions for all categories of citizens, as well as introducing the second tier of the pension system. Other priorities include improving mechanisms for providing benefits and subsidies, stimulating birth rates, supporting families with children, protecting children’s rights, and supporting people with disabilities, particularly by providing modern rehabilitation equipment and creating conditions for their employment.

In 2026–2028, expenditures on veteran policy will decrease by 43.9% compared to 2025: after a slight increase to $258 mln in 2026, expenditures will decline to $223 mln in 2027 and further drop to $133 mln in 2028. The main factor behind this reduction will be the decrease in subsidies from the state budget to local budgets, both for supporting specialists assisting veterans and demobilized individuals, and for providing cash compensation for housing to persons with disabilities of groups I–II among Anti-Terrorist Operation / Joint Forces Operation participants and families of the deceased, internally displaced persons who are combatants or persons with disabilities of group III, as well as combatants abroad with disabilities of groups I–II and their families. The reduction in funding for specialists supporting veterans and demobilized persons reflects the gradual completion of mass employment in this field following the active phase of demobilization. A significant portion of compensation funding continues to come from the European Union, provided under the Ukraine Facility Plan, which allocates over EUR 450 mln for housing support for veterans and families of the deceased. Since this program is planned through 2027, expenditures in this area are reduced for 2028.

Despite this, the field of housing support for veterans is seeing an active launch of new initiatives, indicating a restructuring of programs rather than their reduction. For example, compensation payments for rental housing or obtaining a mortgage loan under the eOselya program. State support for veterans and their family members is gradually transforming from preferential lifelong provision to a system of motivation and self-realization in civilian life by creating new opportunities to meet their needs.

Expenditures of the Ministry of Education and Science (MES) in 2026 will remain at the 2025 level in dollar terms, at approximately $1.42 bn. However, in hryvnia terms, expenditures will decrease by 0.7% due to the cancellation of expenditures on energy efficiency measures within the Higher Education of Ukraine project. MES expenditures will increase to $1.46 bn in 2028, which is 2.6% higher compared to 2025. However, this growth is below the projected inflation rate and will result in a decrease in real education expenditures. This is due to budget constraints caused by military expenditures, the prioritization of the security and social protection sectors, as well as a decline in the number of pupils and students due to the demographic crisis.

Expenditures of the Ministry of Health will decrease by 1.6% in 2026 compared to 2025 — from $4.8 bn to $4.7 bn — followed by a gradual increase to $5 bn in 2027 and $5.2 bn in 2028. Although Ministry’s expenditures in 2028 will be 8.1% higher than in 2025, inflation over this period is projected to exceed this growth by 10.7 p.p., which will not be sufficient to meet the growing needs of the sector caused by the consequences of the war, the rise in chronic diseases, and the need to develop new medical services. The containment of healthcare expenditures reflects efforts to save budgetary resources.

Taking into account the principles of gender equality and social inclusion in projected state budget expenditures

Gender equality and accessibility are among the cross-cutting strategic objectives of public investment for 2026–2028. From 2025, the Budget Code of Ukraine stipulates that consideration of gender aspects is part of the efficiency principle of the budget system. The key spending units must reflect gender aspects when preparing requests and passports for budget programmes and reviews of state budget expenditures.

The Budget Declaration for 2026–2028 includes a number of gender-sensitive qualitative and quantitative indicators among the maximum expenditure indicators and state policy objectives for the first time in a more systematic manner. These indicators cover various areas of public administration, from anti-corruption and justice to health care, social policy, media, and economic security. In particular, the gender perspective has become more visible in the work of regulatory bodies and some local administrations, which indicates the institutional integration of gender equality principles into budget planning.

Such indicators are listed in Annex No. 1 to the Budget Declaration for 2026-2028, for example:

- gender equality index in Ukrainian media, based on content analysis;

- the number of documents (acts, certificates, reports, conclusions, etc.) drawn up as a result of state external financial control (audit) measures that contain gender aspects;

- the proportion of women with special ranks in the Bureau of Economic Security, among judges, state auditors and employees of other institutions.

However, there is still no comprehensive approach to taking gender aspects into account at the stage of forming budget revenues and expenditures in the budget process. Also, the structure of expenditures does not sufficiently reflect the needs of different groups of women and men.

Demographic changes, the migration crisis and a structural labor shortage create persistent macroeconomic risks that could complicate the achievement of projected budgetary targets in the medium term. In this regard, public policy is increasingly focused on investing in human capital, labor potential and attracting social groups that traditionally have lower employment rates to the labor market, such as women, IDPs, persons with disabilities and youth.

State Budget Deficit

The gradual reduction of the state budget deficit to ensure financial stability, debt sustainability, and strengthen public trust in the government has been defined as the primary objective of fiscal policy for 2026–2028. The deficit is projected to be 9.9% of GDP ($23.1 bn) in 2026, 5.2% of GDP ($13.7 bn) in 2027, and 3.8% of GDP ($11.2 bn) in 2028. Although the deficit is expected to remain well above the 3% of GDP limit set by the Budget Code throughout the forecast period, the planned trajectory reflects the government’s intention to steadily move closer to this target. The updated forecast represents a significant improvement compared to the previous projection, which estimated the deficit at 10.3% of GDP for 2026 and 6.7% of GDP for 2027 (Fig. 3).

Figure 3. State Budget Deficit in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

The state budget is planned to be financed through both domestic and external borrowings (Fig. 4). Continued cooperation with international organizations and foreign partners will remain a crucial factor in financing the budget deficit. The increase in domestic borrowing will depend on additional funding needs as well as the capacity and available liquidity of the domestic capital market. In 2026, part of the budget financing will be covered by government borrowings obtained in 2025 that exceeded the limits established by the Law on the State Budget of Ukraine for that year. This will help alleviate pressure on the domestic government securities market. The current Declaration does not include details concerning Ukraine’s potential re-entry into international borrowing markets. However, the probability of such a development after the end of hostilities is relatively high.

Proceeds from privatization are expected to be modest, amounting on average to $44.3 mln annually throughout the forecast period. However, a combination of issuing government securities on the domestic market to refinance internal debt, along with timely securing of external financing on favorable terms, could ensure stable funding of the state budget in 2027–2028.

Figure 4. Government Borrowing, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

Debt Policy

The debt management policy for 2026–2028 will, as before, focus on continuing close cooperation with international partners in order to attract long-term concessional financing. Among other measures, active debt management activities are planned, including the exchange and reissuance of domestic government bonds to secure the necessary financing for the state budget, reduce debt burden, and lower debt servicing costs.

The target indicator of debt sustainability for 2026–2028 will be to maintain the ratio of the total volume of public and state-guaranteed debt at less than 100% of GDP by the end of 2028 (Fig. 5). In case of a worse scenario, the state budget deficit may be revised and increased. The prolonged maintenance of the debt-to-GDP ratio at such a high level indicates the expected significant role of borrowings in financing the budget deficit.

In 2028, the state and state-guaranteed debt will not exceed 100% of GDP, with its nominal amount reaching $295.4 bn. Considering that at the end of 2024 the amount of state and state-guaranteed debt stood at $166.1 bn, and by the end of May 2025 it reached $181 bn, the debt volume is projected to increase by $129.3 bn during the forecasted period 2025–2028. Compared to the previous declaration, the assumptions foresee a more active growth of the public debt. According to the updated assessment, no reduction in public debt is expected even in relative terms by 2028, whereas the previous forecast anticipated a gradual decline in debt from 110% of GDP in 2025 to 90% of GDP by 2027.

Figure 5. State and State-Guaranteed Debt in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

Intergovernmental Fiscal Relations with Local Budgets

The overall financial capacity of local budgets is expected to increase in the coming years, as projected in the previous budget declaration. According to forecasts, its volume is anticipated to exceed UAH 1 trillion (more than $22 bn) for the first time by 2027 – an assumption also embedded in the earlier projections. Own-source revenues of local budgets are projected to grow at a significantly faster pace than central government transfers – by 40% compared to 19%. This dynamic is primarily attributed to the reinstatement of certain revenue sources to local budgets (Fig. 6).

Figure 6. Financial Resources of Local Budgets in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

PIT will remain the primary revenue source for local budgets. However, the latest projections are somewhat more conservative: in 2026, hromadas budgets are expected to receive $4 bn from PIT, which is 2% below the forecast for that year made in the previous declaration. In 2027, the projected PIT revenue amounts to $5.3 bn (a decline of 3.7%), and in 2028 – $7.3 bn.

In 2026, the current arrangement, under which PIT from military personnel is directed to the special fund of the state budget (a practice in place since the Q4 2023), is expected to continue. However, starting from 2027, this revenue stream is anticipated to return to the general fund of local budgets, resulting in a cumulative increase of $2.5 bn over 2027–2028 in local revenues. Notably, the budget declaration suggests that only the PIT paid by military personnel will be redirected to local budgets, excluding revenues from other security forces (e.g., police, State Emergency Service). This is likely a technical inconsistency that may be corrected during the adoption of the budget law.

Furthermore, beginning in 2026, the temporary provision in force from 2022 to 2025 – allocating an additional 4% of PIT to local budgets – will no longer apply. Although the previous declaration proposed repealing this provision as early as 2025, it was ultimately not included in the State Budget 2025. This issue is likely to re-emerge in political debates during the autumn. According to government estimates, returning this 4 percent share to the state budget will reduce local revenues by more than $1.28 bn over 2026–2028.

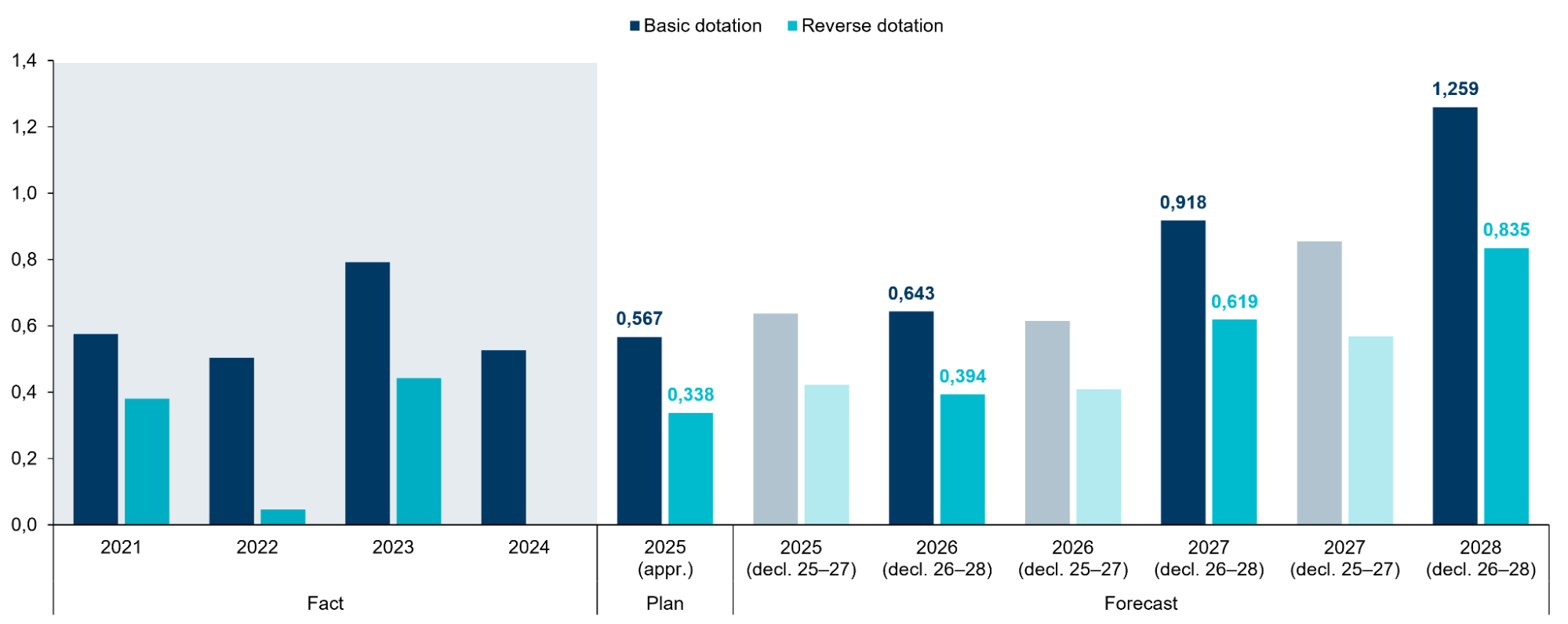

The horizontal fiscal equalization mechanism for territorial communities will remain unchanged. At the same time, the government is working on revising the methodology for determining the population size of hromadas – a parameter that, even prior to the full-scale invasion, did not reflect actual demographic conditions, and now urgently requires updating in light of large-scale migration and internal displacement. It is expected that beginning with the next budget cycle, calculations will be based on data from national registries, which local self-government bodies are currently actively populating. However, the declaration makes no reference to this issue, despite the fact that such a change could significantly affect the volume of both basic and reverse dotations, as population figures are a key factor in the respective calculations. As in previous years, the reverse dotation will continue to be transferred from local budgets to the state budget. However, if political discussions resume regarding the elimination of the additional 4 percent share of PIT allocated to local budgets, the reverse dotation may once again become a subject of negotiations and active lobbying by major associations of local self-government bodies. The Budget Declaration projects the volume of reverse dotations at levels close to last year’s forecasts: $0.39 bn in 2026, $0.62 bn in 2027, and $0.84 bn in 2028 (Fig. 7).

An additional source of revenue for local budgets may come from the gradual alignment of fuel excise tax rates with those applied in the European Union. Preliminary estimates suggest that this adjustment could generate approximately $0.2 bn over three years for local governments. The cumulative net impact of the planned revenue-side changes on local budgets over the three-year period is projected at $-0.3 bn. Specifically, revenues are expected to decrease by $2 bn in 2026, followed by increases of $0.9 bn in 2027 and $0.8 bn in 2028.

Figure 7. Indicators of Horizontal Equalization of Fiscal Capacity in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

As in previous years, the education subvention remains the largest intergovernmental transfer in terms of volume. It is allocated to cover the salaries of teaching staff. For 2026, the subvention is projected at $2.51 bn, with an annual increase of 6–7% thereafter (Fig. 8). Unlike the previous budget declaration, which projected a reduction in the subvention due to a declining student population resulting from internal and external migration, the current forecast reflects a more stable trajectory. The government anticipates that territorial communities will continue the process of optimizing their school networks. Should local authorities refrain from undertaking such unpopular measures, they will be required to co-finance educational institutions from their own budgets. A previously adopted regulation stipulates that, beginning on September 1, 2025, general secondary schools with fewer than 45 students will no longer be eligible for state budget funding, with the threshold increasing to fewer than 60 students as of September 1, 2026. The projected increase in the volume of the education subvention is driven in part by the need to raise teachers’ salaries in line with the revised wage scale.

Figure 8. Volumes of the Educational Subvention in 2021–2028, $bn

Source: Budget Declaration for 2025–2027, Budget Declaration for 2026–2028,

Law of Ukraine On the State Budget for 2025, Open Budget portal

The government plans to restore the operations of the State Regional Development Fund and allocate its resources to the implementation of public investment projects across the regions. According to the Budget Declaration, beginning in 2026, the Fund will receive $0.67 bn annually, in contrast to previous years when no funding was allocated due to martial law conditions.

Conclusions

The Budget Declaration for 2026–2028 reflects a continuation of the current budget planning framework with only minor policy adjustments and no significant innovations. The document outlines two scenarios for the duration of ongoing hostilities.

Compared to the previous year’s declaration, the government has revised downward its expectations for GDP growth and improvements in the trade balance. Inflation is projected to remain above the National Bank of Ukraine’s targets through 2027. At the same time, the government plans to reduce the fiscal deficit from 9.9% to 3.8% of GDP by 2028 and to maintain public debt below 100% of GDP.

State budget revenues are expected to increase primarily due to higher tax collections – driven by rising excise tax rates, the retention of elevated CIT rates for banks, and improved tax administration. Expenditures on social protection, education, and healthcare are projected to grow at a slower pace, while defense spending will remain the top priority.

The financial capacity of local budgets is expected to improve, primarily through growth in own-source revenues, whereas intergovernmental transfers will increase more gradually. At the same time, political debates surrounding PIT and the reverse dotation are likely to persist. Planned compensatory mechanisms – such as the reinstatement of the State Regional Development Fund and the return of military PIT to local budgets – will only partially offset the potential losses resulting from the reallocation of the 4% PIT share back to the state budget. Moreover, past experience suggests that certain provisions of the Budget Declaration may ultimately remain unimplemented.

Authors: Yuliya Markuts, Taras Marshalok, Inna Studennikova, Dmytro Andriyenko, Tetiana Lutai, Liudmyla Mykhalyk, Vladyslav Ierusalymov, Viktoria Klimchuk, Сenter of Public Finance and Governance at the Kyiv School of Economics

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations