Moratorium on agricultural land sales is a key reason for underutilization of Ukraine’s agriculture potential, under-investment in the country’s rural areas, and mediocre growth[1]. Yet, when it is time to decide on whether or not to lift it, there was always a consensus that the preconditions for doing so are not met and it was extended for another time. Will this time be different?

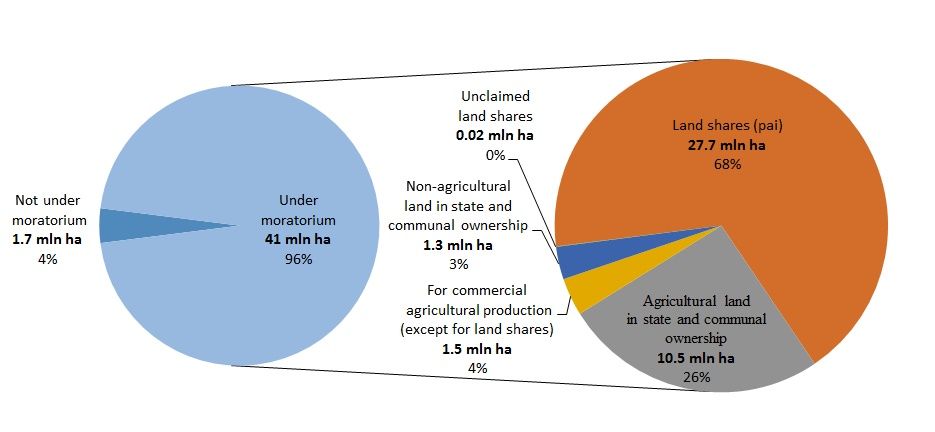

Figure 1. Distribution of agricultural land in Ukraine

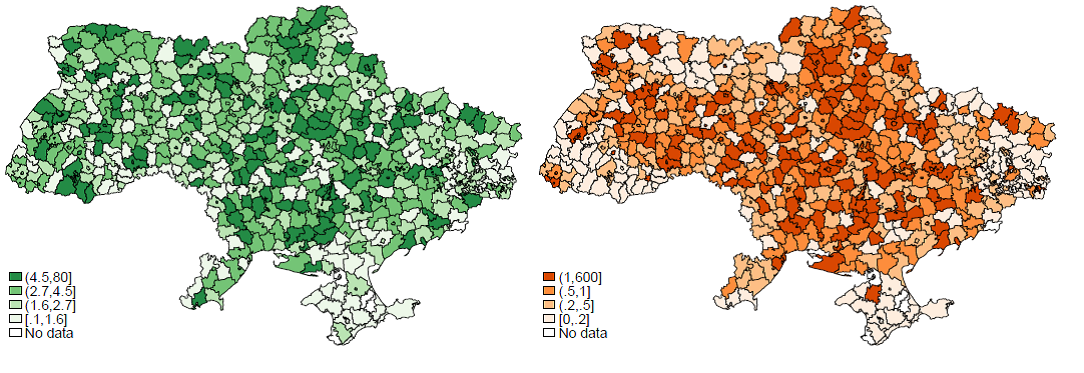

The scale of moratorium on agricultural land sales impresses (see Figure 1). It was introduced as a temporary measure in 2001, and it exists now. Out of more that 42 mln ha of agricultural land (or 70% of Ukraine’s territory), about 41 mln ha or 96% of all agricultural land in Ukraine is under moratorium. 68% of land that is under moratorium is land shares (payis) in private ownership of 6.9 mln people or 16.2% of Ukraine’s population. Majority of them lives in rurual areas.

At the moment a major discussion is going on the design of the future land market, however, past efforts to lift the moratorium suggest that the debating on market design is not enough. It needs to be complemented with action well in advance of market opening to help a transparent and well-functioning land market to emerge. Three preconditions are particularly relevant, namely (i) protecting rights in a transparent rule-based environment; (ii) ensuring that state and communal land is used for public benefit; and (iii) creating the conditions for banks to support sustained flows of capital to rural areas to facilitate much-needed investment in social and economic infrastructure, agricultural production, and value chains.

Transparency and protection of rights

According to surveys[2], the main reason for land owners and land users to oppose opening of the land market is that they doubt markets will function in transparent manner. The majority believes that, though being far from optimal, the status quo is preferable to a situation where they may be permanently deprived of their rights. Thus, to ensure the infrastructure needed to protect land rights is in place before the market opening, actions are needed in a number of areas:

Mandate use of an e-auction platform for transfers of state or communal land: A cornerstone of transparency is that rental or sale of state land be conducted transparently via e-auction. As Ukraine already has more than 50 e-auction service providers[3], incurring the cost of developing customized software may be unnecessary. Small adjustments to the PROZORRO-Sales software would allow use of this platform in the short term for land rentals to ensure a system for sales is ready when the moratorium is lifted.[4] Needed legal changes can be incorporated into the law “On land turnover” or promulgated as a standalone Act to stipulate e-auction as a legitimate modality for sales of property and rental rights. To prevent loss to the budget and to stimulate development of the land market, the law should stipulate a minimum starting price for auctioning state and communal land.

Mandatory registration and publication of land prices: As land prices are expected to increase with the lifting of the moratorium, public data on actual and historic sales prices is a cornerstone of transparency that is needed for land owners and courts to determine a “fair” value; for Banks to use land as collateral; and for the public sector to assess the success of reform and properly plan land use.[5] Price differences across regions will then reflect variation in quality of soil or market infrastructure, creating implicit incentives to improve these. Registration of prices for land rental is already mandated by law, though not practiced currently[6]. Routine registration of prices for all newly registered leases and digitization of at least all rental prices since 2013 would provide an ideal reference for landowners and banks when sales markets open. Up to date price information should be provided freely and regularly to the public in aggregate form and to real estate professionals and banks for a fee, e.g. under a subscription model.

Establish and regularly publish systematic data on Land Governance Monitoring. Beyond prices for land sales or rental, regular data at rayon level on a range of parameters, such as the share of state or private land registered; volume of land transactions; levels of land disputes; amounts of land taxes owed and collected, will be essential to provide information on the quality of land governance in a transparent manner that allows specific measures for improvement to be taken.[7]

Enhance access to justice and recourse in case of rights violations: Awareness of land rights and the ability to seek redress in case of violations varies widely among land owners/users and the institutions charged to protect such rights. Roundtables to create awareness, training of judges, paralegals, and land commissions, and measures, e.g. a waiver of court fees for land cases, to allow equitable access to courts will be essential to ensure that lifting the moratorium will allow land owners to consciously exercise their constitutional rights rather than being deprived of assets by manipulative schemes. Enhancing capacity of Ombudsman for human rights to address potential shortcomings of existing court system with respect to protection of land rights will provide an additional layer of protection.

All the above conditions are essential for opening a transparent and efficient land market and can be established in a relatively short time before January 1, 2018. The progress with establishing these conditions will clearly signal on the political will to move this reform forward.

Using state land for public benefit

To allow use of more than 10 million ha of state and communal land in a sustainable ways and benefit local communities rather than well connected individuals, such land needs to be registered and brought to effective use via transparent procedures. State land could be used to jump-start access to capital by small and medium producers in the short term and that generate sustained flow of revenues to local communities in the medium and long term if the following steps are taken:

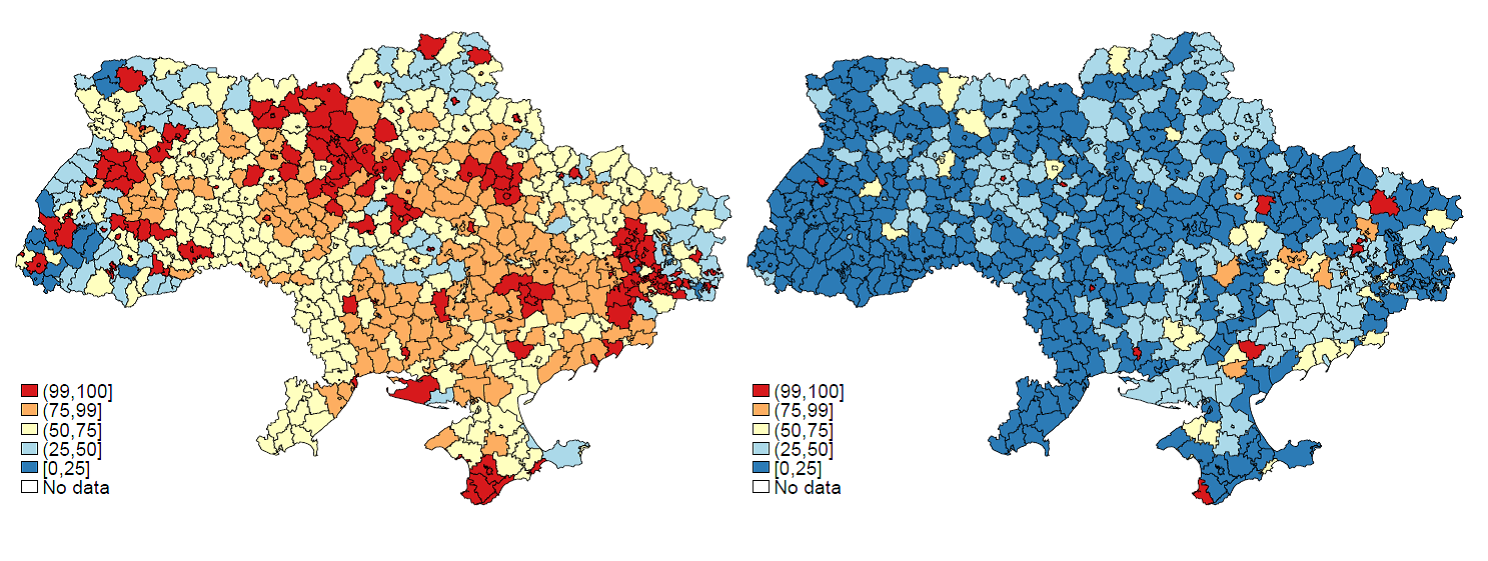

Complete registration of state and communal land: Until recently, only about 25% of state and communal agricultural land was registered in the Cadaster and registered lease contracts exist only for about 2.5 mn ha. Another 1 mn ha is used by various state enterprises and the National Academy of Agricultural Sciences. This creates a huge ‘shadow economy’ where land is used without documentation in ways that are not conducive to investment and long-term sustainability. Proceeds often flowing into private pockets rather than benefiting local communities and the state. Registration of such land is possible without any legal changes; all that is needed is political will and funding, which can be quickly recouped via increased local revenues from such land. Given the high social and economic returns to registering state land, this should be a top priority and clear targets should be set to complete registration of all state and communal land as soon as possible.

Figure 2. Share of private land (left map) and state land (right map) registered in the State Land Cadaster

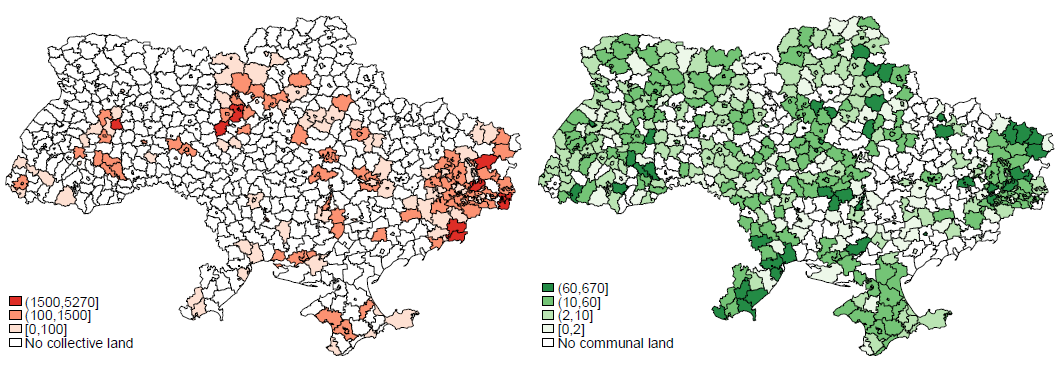

Define the legal status of the formerly collective land: This issue has been unresolved since the initial land privatization and dissolution of collective farms. As a result, some 8% of all agricultural land (more than 2 mn ha), particularly forest belts and field roads has no owner. Most is cultivated illegally. Unless the legal status of such land is clarified by law, neither registration nor assignment of responsibility for land management is possible and such land continues to be vulnerable to misuse, fails to contribute to local and state budgets, and slows demarcation and registration of adjacent state, communal and private land. Legal drafts for doing so exist and should be adopted as soon as possible.

Figure 3. Total area of collective land (left map) and communal land (right map) in rayons (in ha), 2014

Amend the Budget Code to provide resources for state land registration and error-correction: Although revenue from leasing or sale of state land can contribute significantly to state and local budgets, upfront investment for state land registration is needed. Amendments to the Budget Code to allow use of the proceeds from lease or sale of state and communal land, together with some UAH 625 mln (or US$ 24 mln.) of already available funds in the land conversion fund, to register state and communal land, fix administrative boundaries, and correct errors in the Cadaster. This can be legislated immediately and provide a sustainable source of funding for performing land administration functions and invest in other types of productive local infrastructure.

Operationalize deferred payment schemes for acquiring state or communal land: Such schemes can be a powerful tool to allow key groups such as the youth or veterans of antiterrorist operation to access land. While the legal basis is clear,[8] it lacks clear eligibility criteria. Amending it to clearly define who will be eligible (e.g. young small farmers, internally displaced people, veterans) will help to avoid risks of corruption in applying it and help targeted groups to use land access as catalyst for development.

Set standards for elaboration and publication of local land management plans: As not all state or communal land is fit for private use, land use plans to identify communal or state land that can be made available for lease or sale, based on clear technical standards and approved in a transparent process, need to be elaborated and publicized. They could then guide land use decisions by public and private sector in ways that streamline decision making and reduce corruption opportunities. Such plans could then gradually expand to stipulate a process for identification and registration of communal property and field-based error-correction on private land.

Link tax and cadastral records for private and communal land: Concerns about land acquisition for overly speculative rather than productive purposes[9] in the wake of lifting the moratorium can be more effectively addressed if records in the cadaster, the registry, and the fiscal service are linked.[10] If combined with registration of sales prices, this would also allow to levy a tax on land price appreciation in a way that would also allow local communities to capture part of the benefits from increases in land prices over time.Another instrument for fighting unproductive usage of land is an increase of land tax rate to the level that would preclude from such a usage of land.

Register local administrative units’ boundaries: As long as local administrative units (rayons, amalgamated communities, settlements) lack clearly defined boundaries, authority for planning or tax collection remains vague and transfer of state land to communal property virtually impossible. Although the normative base exists, implementation is lagging.[11] Given the high social and economic returns from such an activity, it should commence without delay.

State and communal land can be managed effectively and in a transparent manner only if the above legal and normative base is adopted and technical implementation starts without delay. Registration of all state and communal land is a key benchmark to indicated completion of land reform by 2020 as was announced by Government earlier.

Improving access to finance and productive investment

While state support can be a temporary catalyst, the resources that can be made available through it pale in comparison to what is needed and can be mobilized by the private sector. To create incentives for such financing, a number of steps, in addition to those listed under transparency above, are needed.

Facilitate and conduct systematic error correction: Errors in the State Land Cadaster and the Registry of Rights (e.g. errors in coordinate systems or those created in the process of data transfers) can threaten land owners’ or users’ rights and banks’ ability to accept land as a collateral. Currently, even systematic errors (of which owners may not even be aware) can be corrected only at owners’ request. Legislation to give state institutions the right of initiating a systematic process of error detection and correction (informing owners and providing them with an opportunity to object) is available as draft. Once the normative base is established, the Cadaster and the Registry should be able to complete most of the nation-wide error correction before the land market is opened. This would include making cadastral entries for parcels that received a cadastral number but have not been entered on the cadastral map.

Figure 4. Share of land with errors in the total volume of registered land (left map) and a share of area with errors in the total rayon area (per form 6-zem) (right map), 2014/2015

Allow Banks to own foreclosed land for a limited time and mandate e-auctions for its disposal: Technically banks can sell foreclosed collateral by making use of state law enforcement authorities without taking it in ownership. But in many cases, it is less costly and complex to take the foreclosed collateral on their balance sheet and sell it directly. As the associated savings in transaction costs will allow them to extend credit to more clients, it will be desirable to give banks the legal right to, if needed, take land that served as security for foreclosed loans into ownership for a limited amount of time. To help with price discovery, increase transparency, and prevent strategic defaults, the foreclosed land should be disposed of only via transparent e-auctions such as ProZorro Sales.

Simplify the out of court foreclosure in case of default. Such improvements are related to clarifying the notary actions in case of foreclosure with disputes, and making specific provisions on the time for the law enforcement authorities to take actions on the foreclosed land as well as procedures for replacement of responsible law enforcement officers in case of non-satisfactory performance. Foreclosure through courts is slow and not necessarily transparent, thus an improvement of out of court procedures would significantly reduce the costs for management foreclosure cases and increase attractiveness of land as a collateral.

Addressing the above constraints before 2018 is critical as many of the benefits from land reform will be contingent on bank financing.

The Prime Minister’s far-sighted decision to make land reform a Government priority creates an opening to implement the measures needed to allow lifting the moratorium in a way that would indeed help to unlock Ukraine’s potential. At the technical level, there is an unprecedented consensus and understanding what is needed. But the window for actions to ensure that preconditions are in place by Jan. 2018 is closing soon. To prevent missing it, key legislative acts and implementation plans should be in place before the summer break. Leadership, quick action, and a dialogue involving all stakeholders, will be needed to ensure that this unique opportunity will not go to waste.

Notes

[1] see e.g. World Bank (2013). Ukraine: Agricultural Policy Review. World Bank Policy Note. Report No 83763

[2] http://agravery.com/uk/posts/show/comu-ukrainci-boatsa-rinku-silgospzemel-ta-ci-vipravdani-ci-pobouvanna та http://agravery.com/uk/posts/show/moratorij-pidtrimuu-ale-hocu-prodavati-zemlu-so-naselenna-dumae-pro-rinok-zemli

[3] Including the state owned SETAM (https://setam.net.ua/), used by the Ministry of Justice to sell foreclosed property and the PROZORRO-Sales (https://prozorro.sale/) platform that is used by more than 20 providers.

[4] See Електронні земельні торги: за яких умов ідея спрацює at https://voxukraine.org//2016/10/11/elektronnie-torgi-ua/ or Electronic Land Sales: Conditions for Success https://voxukraine.org//2016/10/18/elektronnie-torgi-en/ on Vox Ukraine for more details.

[5] As a key reason to open up land markets is that it will benefit land owners via higher prices for land rental and sales and registering and publishing prices will indicate if this objective is achieved.

[6] Law of Ukraine ‘On state registration of rights on immovable property’ and Article 22 of the Order for administration of the State Register for Rights for Immovable Property

[7] The concept of the Land Government Monitoring was developed and tested in 2015 by the Project “Capacity Development for Evidence-Based Land & Agricultural Policy Making in Ukraine” (http://land.kse.org.ua) jointly with a cross-agency government Working Group. Recently, the Ministry of Agricultural Policy and Food and the State Geocadastre have submitted a proposal of a Resolution on the Land Governance Monitoring (http://www.minagro.gov.ua/uk/node/23860 ) to the Cabinet of Ministers of Ukraine that would provide a normative base for the monitoring. For more information and the results of the concept development please see our earlier publication at AgraVery of 1 August 2016 «Terra (in)cognita: чи відкриють в Україні дані про земельні відносини?» http://agravery.com/uk/posts/show/terra-incognita-ci-vidkriut-v-ukraini-dani-pro-zemelni-vidnosini

[8] The Land Code and Cabinet resolution #381 of 22 April 2009 (signed by Yulia Timoshenko) provide all necessary normative base for using this instrument after the moratorium is lifted.

[9] It has been widely accepted that speculation distorts resource allocation and land market operation. Where markets are competitive and there is a equal access to information, then specilation ensures market liquidity and a risk is transferred onto those that have comparative advantage in managing the risks. Nonetheless, this situation is not pertinent to land markets in the developing countries, where policy distortions and market failures is rather a rule than exception. Asymmetric information is a source of speculative profits.

[10] Part of the proceeds from such a tax could be earmarked for supporting productive development of small and medium farms at the local level.

[11] According to the results of the Land Governance Monitoring, by the end of 2015 there were only 50 administrative units (out of more than 29 772) with registered boundaries. Some rayons do not have formally established and registered boundaries either.

Main photo: depositphotos.com / prudkov

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations