What happened to the budget in July? Would the revenue plan have been met without international support? Which of the taxes missed the plan and why? Which additional risks arise for budget stability and what to expect going forward? For these and other details on budget execution, read the Budget Barometer for July 2023.

What was achieved?

- In July, it was finally adopted and published a law, according to which, starting from August 1st, the pre-war taxation system was reinstated. This move was one of the structural benchmarks of the IMF program. Such changes will contribute to an increase in tax revenue from companies that previously benefited from the privilege of paying a 2% single tax.

- In July, the second tranche of a loan in the amount of USD 890 million from the IMF was received into the general fund of the state budget of Ukraine.

- The financial position of the Pension Fund remains stable. Transfers from the state budget to cover the Pension Fund’s needs continue with international assistance playing a significant role.

What wasn’t achieved?

- The plan for revenues of the state budget general fund, excluding international assistance, was not achieved (by 4.2%). Taking into account UAH 47.6 billion of grants, the total revenue amounted to UAH 136.7 billion.

- Tax revenues administered by the State Customs Service reached UAH 38.5 billion, which is 11% lower than the plan. Implementing customs reforms, particularly combating smuggling, remains one of the potential reserves for generating additional funds for the state budget.

* All planned indicators in the budget barometer are taken into account in accordance with the monthly plan of the State Budget 2023 as of 1 August 2023.

What’s next?

- The active work continues on the development of the Financial Instrument for Ukraine (Ukraine Facility) by the EU, which was announced by the European Commission during the Ukraine Recovery Conference (URC-2023). This instrument envisions funding over the span of 2024-2027, totaling up to 50 billion euros, with a significant portion representing direct budgetary support.

- According to the assessment of the National Bank of Ukraine (NBU), the reinstatement of pre-war fuel tax levels from July 2023 is expected to further stimulate inflation (+0.7 percentage points direct contribution to the change in the Consumer Price Index in 2023, plus an indirect impact due to the inclusion of fuel expenditures in the prices of many goods and services). However, its level by the end of 2023 is still anticipated to be lower than considered in the budget.

- The crackdown on the shadow economy and tax evasion is intensifying.

- Ukraine is launching a new Roadmap for the implementation of the BEPS Action Plan to align the tax system with international tax standards. OECD support is anticipated to facilitate the adoption of international tax standards aimed at combatting Base Erosion and Profit Shifting (BEPS), addressing tax policy and administration issues arising from the war and more.

- The President has signed into draft law No. 8287, which mandates the introduction of an electronic excise stamp starting from January 1, 2026. This move will enable the tracking of the movement of alcohol, tobacco products, and e-cigarette liquids from manufacturer/importer to end consumer, while also ensuring the completeness and timeliness of excise tax payment for such goods.

Key risks:

- The decline in revenues (compared to planned indicators) is attributed to potentially lower inflation figures than initially budgeted for. Year-on-year inflation has been decelerating for six consecutive months. Consumer inflation, which exceeded 26% at the beginning of the year, slowed to 12.8% in June (comparable to the same period last year), surpassing the expectations of the National Bank of Ukraine (NBU). This contrasts with the budgeted inflation of 28.4% year-on-year for December (a high risk).

- The necessity for unplanned additional expenditures arises. The potential recapitalization of the state-owned “Ukreximbank” might be required, funded from the state budget. Additional funds could also be needed for defense (given Russia’s increased military budget and plans for enhanced mobilization) and for addressing the aftermath of escalating shelling incidents (moderate risk).

- The reduction in business activity leading to decreased tax payments towards the year-end is influenced by the restoration of electricity shortages and the likelihood of significant missile attacks by adversaries on infrastructure (moderate risk).

- Income tax receipts from individuals are lower than anticipated. According to data from the European Business Association, labor market challenges persist, encompassing issues of mobilization, predictability of conscription procedures, labor emigration, and the implementation of overseas assignments. Currently, up to 20% of personnel in regional companies are serving in the Armed Forces (low risk).

Details:

(1) In July, the general fund of the state budget received UAH 136.7 billion (including UAH 47.6 billion in grants), while the projected revenues were expected to be UAH 93.0 billion excluding grants. Consequently, own-source revenues (revenues excluding grants) fell short of the forecast by 4%.

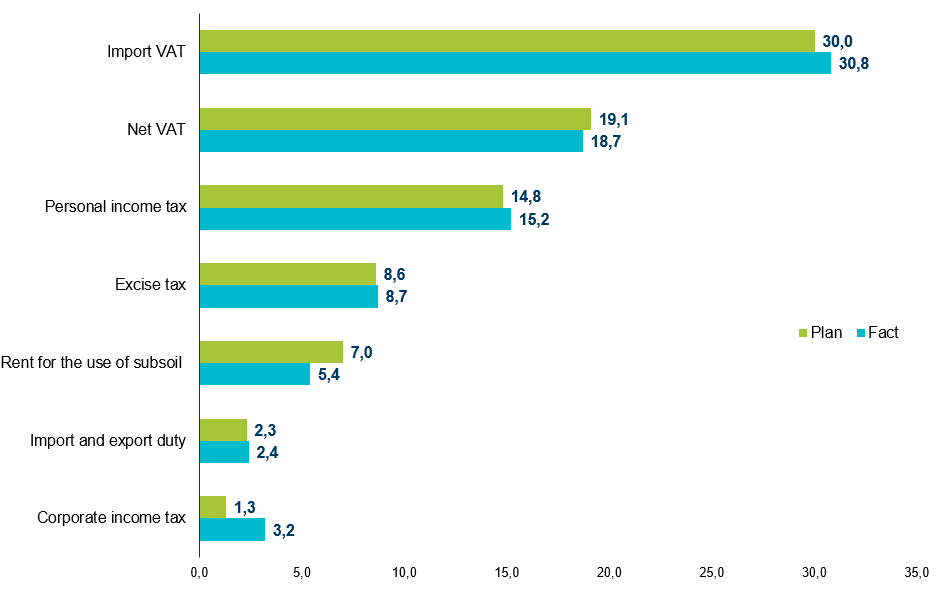

As outlined by the Ministry of Finance, tax revenues to the general fund of the state budget were anticipated at UAH 89.4 billion. However, primary tax contributions to the general fund of the state budget were projected to amount to UAH 83.1 billion, while the actual receipts reached UAH 84.4 billion (Figure 1).

Fig. 1. Main tax revenues to the general fund of the state budget in July 2023, UAH billion

Source: Ministry of Finance of Ukraine.

In July, the corporate income tax experienced the most significant overperformance against its plan. Considering that the actual receipts amounted to UAH 3.2 billion (compared to UAH 4.8 billion in July 2022 and UAH 2.0 billion in July 2021), the revenue projections were formulated under a pessimistic scenario.

The overperformance of excise tax reached 1.2% (with receipts to the general fund amounting to UAH 8.7 billion). Additionally, UAH 2.4 billion was collected from taxes on international trade (primarily import duties), surpassing the plan by 4.3%. This trend is likely connected to the higher customs value of imported goods.

Income from Personal Income Tax (PIT) exceeded the previous month’s figures and met planned receipts, reaching UAH 15.2 billion, which is 2.7% above the projected amount. A significant factor remains the taxes from the monetary allowances of military personnel, which might have been higher due to increased offensive operations, implying greater payments to frontline troops. Moreover, moderately positive trends in the labor market suggest an increase in compensation funds within the private sector, further expanding the PIT tax base.

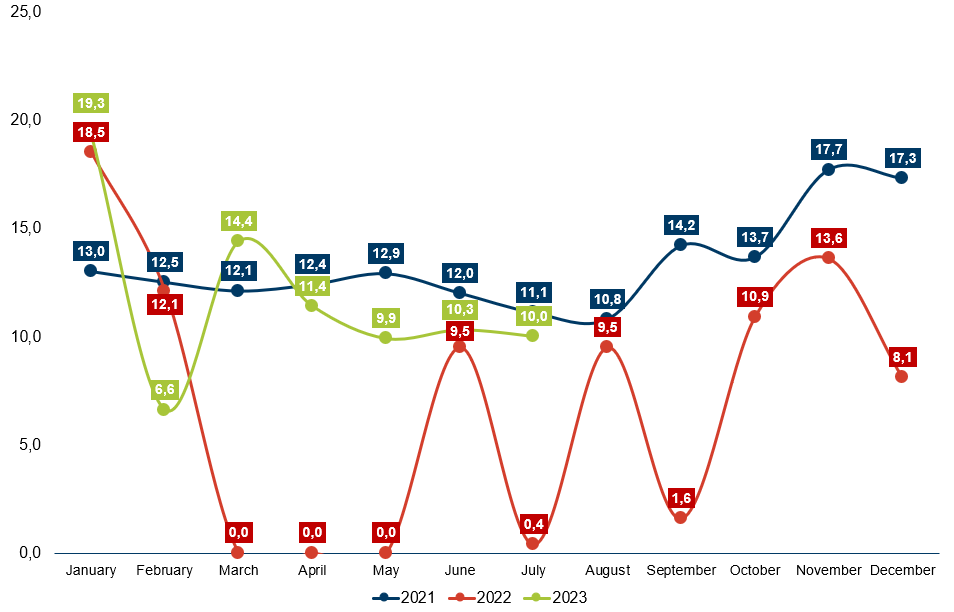

Fig. 2. VAT refunds in 2021-2023, UAH billion

Source: Ministry of Finance of Ukraine

The receipts from rent payments to the general budget fund once again fell short of planned values, amounting to UAH 5.4 billion (a shortfall of 22.9%). This can be partially attributed to lower global prices for natural gas than budgeted, as well as a decline in extraction at certain wells (DTEK reports a decrease of 15-18%). Reduced receipts are also linked to seasonal variations (in summer months, rental income is slightly lower due to reduced gas consumption).

(2) In July, privileged loans amounting to UAH 148 billion (equivalent to USD 4 billion) were received into the state budget. This includes USD 890 million (UAH 32.5 billion) in privileged loans from the IMF, USD 1.5 billion (UAH 54.9 billion) in loans guaranteed by Japan through the World Bank mechanism, as well as EUR 1.5 billion (UAH 60.6 billion) in loans from the EU.

(3) In July, cash expenditures from the general fund of the state budget totaled UAH 231.9 billion or 92.4% of the allocated budget for the reporting period. The largest expenditure category, as planned, was traditionally allocated for funding the Ministry of Defense programs (UAH 113.6 billion), of which 50% is earmarked for personnel compensation (UAH 57.3 billion). The second-largest planned expenditure category was for Ministry of Social Policy programs – UAH 36.4 billion, with UAH 22.7 billion designated for transfers to the Pension Fund for pension payments. A planned allocation of UAH 33.9 billion was set aside for the Ministry of Internal Affairs, including:

- UAH 9.5 billion – National Guard,

- UAH 9.5 billion – National Police,

- UAH 9.3 billion – State Border Guard Service,

- UAH 4.3 billion – State Emergency Service.

For the Ministry of Health programs, a planned allocation of UAH 14 billion was designated, with UAH 11.9 billion allocated for the state-guaranteed medical service program. Furthermore, servicing the state debt was projected to receive a significantly smaller amount compared to previous months (higher payments were driven by military bond redemptions), specifically UAH 7.4 billion. Overall, in accordance with the planned indicators for July, approximately 60% of general fund expenditures were intended for the defense and security sector, 14.5% for social welfare, and an additional 3% for servicing the state debt.

(4) The actual deficit of the state budget in July amounted to UAH 107.6 billion (UAH 94.9 billion for the general fund), which is 1.7 times less than the planned indicator of UAH 158 billion. The achievement of a lower deficit in the state budget for July compared to the planned figure was due to the receipt of a grant from the US in the amount of UAH 45.7 billion (USD 1.25 billion), accounting for 33.4% of the general fund revenues. The grant receipts also contributed to exceeding the planned indicator for general fund revenues by 47%. Additionally, budget expenditures were lower than planned. Overall, for the first seven months of 2023, the state budget operated with a deficit of UAH 583.9 billion (UAH 627.6 billion for the general fund), which is 1.7 times less than the budgeted amount of UAH 1088.4 billion.

(5) In July, the Ministry of Finance attracted UAH 39.1 billion through the placement of domestic government bonds (OVDP), of which UAH 17.2 billion or 44% were benchmark bonds. Out of the total sum, UAH 8.3 billion (USD 227.3 million) were received from foreign currency-denominated bonds, constituting 21.2% of the total amount raised from bond sales. The maximum placement rate remained unchanged at 19.75% (in August, the government began slightly reducing the rate, made possible after the National Bank reduced the key rate by 3 percentage points). Overall, in the first seven months of 2023, the Government raised UAH 94.3 billion more from OVDP sales than it spent on servicing and redeeming the domestic state debt.

(6) In July, both domestic and external borrowings exceeded the amounts spent on servicing and redeeming Ukraine’s state debt by UAH 149 billion. For servicing and redeeming the state debt in July, UAH 38.1 billion were spent, of which 92% or UAH 35.1 billion were allocated to servicing and redeeming the internal state debt.

(7) In July 2023, the revenues of local budgets from payments administered by the State Tax Service amounted to UAH 39.2 billion, which is 16.9% higher than in July 2022. This increase was driven by higher receipts from the Personal Income Tax (PIT), which primarily flows into local budgets from military personnel payments. Additionally, the Ministry of Finance facilitated the transfer of intergovernmental transfers to local budgets in the amount of UAH 15.1 billion (84.5% of the allocated appropriations as per the budget plan), including a basic subsidy of UAH 2.4 billion and additional subsidies totaling UAH 437 million. Moreover, local self-government authorities in communities located in areas of ongoing or temporary military conflict were allocated a reverse subsidy of UAH 240.8 million in July, which was not transferred to the state budget during times of armed conflict.

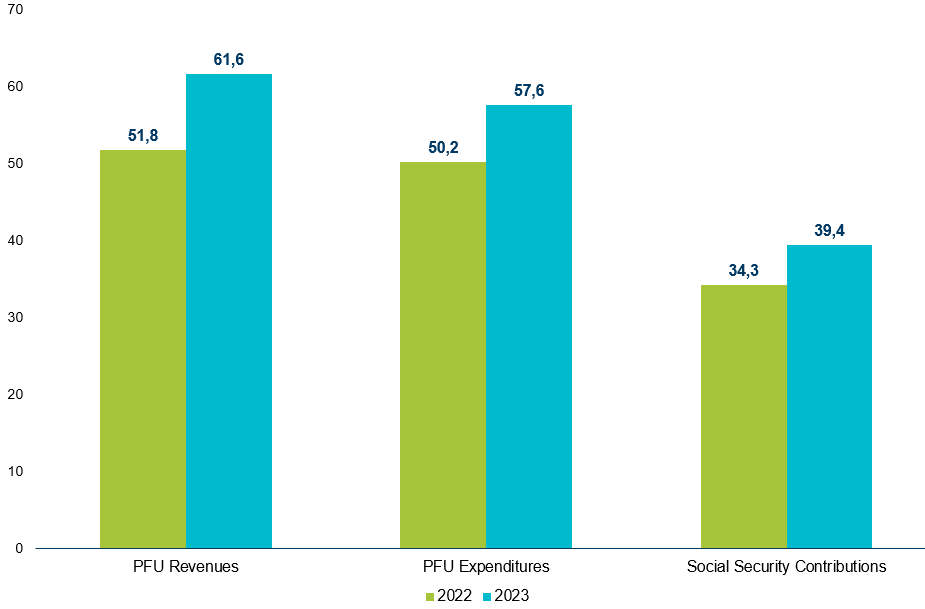

(8) Aggregate revenues from the social security contributions (SSC) in July 2023 increased by 14.9% or UAH 5.1 billion compared to the corresponding period in 2022, reaching UAH 39.4 billion (Figure 3). This growth can be attributed to the gradual recovery of economic sectors, a higher minimum wage in July 2023 compared to July 2022 (UAH 6700 versus UAH 6500), and increased receipts from military personnel payments.

(9) In July 2023, revenues of the Pension Fund increased by 18.9% or 9.8 billion UAH compared to the same period of the previous year, reaching 61.6 billion UAH. This growth was driven both by the increased own revenues of the Pension Fund from the social security contributions (SSC) and the expanded authority of the Fund in providing social insurance benefits (Figure 3). From the state budget, the Fund received UAH 20.6 billion for financing pension and other related payments in July 2023, marking a 10.8% increase over the previous year. The Pension Fund also received UAH 600 million from the state budget for subsidy and welfare payments related to housing and communal services, while UAH 2.5 billion from the SSC revenues were allocated for social insurance payments.

In July, the Pension Fund allocated UAH 57.6 billion UAH for pension payments, which is 14.7% or UAH 7.4 billion UAH more than in the same period of the previous year (Figure 3). Starting from July 1, pensions for 19.4 thousand civil servants and researchers were increased by 19.7% through recalculation, with an average increase of UAH 1020.71 UAH.

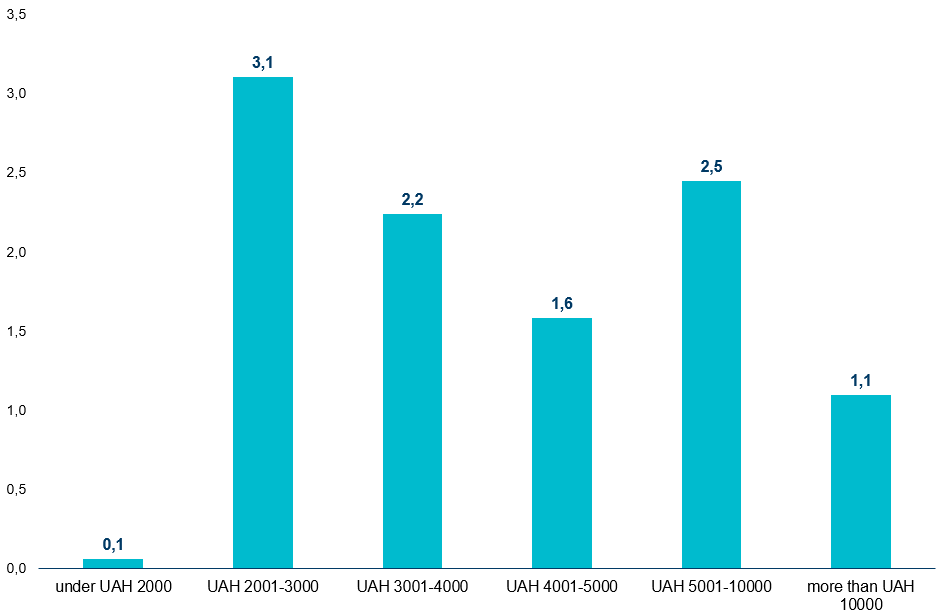

(10) As of July 1, 2023, the average pension amounted to UAH 5,311.44, which is UAH 873.99 higher than the previous year. The total number of pensioners decreased by 200,000 individuals compared to the corresponding period of the previous year, totaling 10.6 million pensioners.

Fig. 3. Revenues and expenditures of the Pension Fund of Ukraine, social security contributions (SSC) in July 2022-2023, UAH billion

Source: Pension Fund of Ukraine, Ministry of Finance of Ukraine

Fig. 4. Distribution of pensioners by the size of their pensions as of July 1, 2023, million people

Source: Pension Fund of Ukraine

Table 1. Plan and fact of the state budget (general fund) in 2023, UAH billion

| Indicators | January | February | March | April | May | June | July | |||||||

| Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | Plan | Fact | |

| Revenue, including | 69,6 | 104,4 | 77,0 | 132,2 | 101,8 | 152,2 | 112,4 | 162,8 | 125,3 | 184,0 | 84,1 | 133,7 | 89,4 | 136,7 |

| Personal income tax | 10,6 | 11,3 | 11,6 | 13,0 | 11,9 | 13,3 | 11,8 | 13,4 | 12,0 | 14,1 | 17,2 | 15,0 | 14,8 | 15,2 |

| Corporate income tax | 1,4 | 1,2 | 4,1 | 7,4 | 22,1 | 26,2 | 1,5 | 2,3 | 24,7 | 28,5 | 2,9 | 2,3 | 1,3 | 3,2 |

| Rent for the use of subsoil | 5,2 | 5,6 | 7,0 | 2,7 | 6,7 | 7,7 | 7,1 | 4,9 | 8,3 | 4,5 | 7,1 | 4,5 | 7,0 | 5,4 |

| Excise tax | 4,7 | 5,3 | 6,1 | 7,0 | 7,1 | 9,8 | 7,4 | 9,9 | 7,7 | 9,5 | 8,3 | 8,8 | 8,6 | 8,7 |

| Net VAT | 20,0 | 11,8 | 14,8 | 15,1 | 16,7 | 10,0 | 16,1 | 16,6 | 14,8 | 17,3 | 15,6 | 17,5 | 19,1 | 18,7 |

| Import VAT | 22,6 | 24,4 | 26,8 | 27,1 | 31,0 | 29,3 | 27,1 | 25,1 | 27,1 | 27,0 | 27,3 | 28,7 | 30,0 | 30,8 |

| Import and export duty | 1,7 | 2,0 | 2,2 | 2,3 | 2,4 | 2,7 | 2,0 | 2,2 | 2,1 | 2,5 | 2,0 | 2,6 | 2,3 | 2,4 |

| Expenditures | 227,7 | 183,6 | 245,6 | 226,7 | 246,1 | 225,2 | 220,2 | 229,7 | 282,7 | 277,7 | 303,9 | 264,7 | 251,0 | 231,9 |

| Deficit (-) / surplus (+)* | -158,6 | -78,9 | -168,0 | -93,2 | -144,6 | -72,6 | -106,6 | -65,6 | -155,7 | -91,6 | -219,6 | -130,8 | -158 | -94,9 |

| Sources of deficit financing | ||||||||||||||

| Net borrowings | 279,4 | 147,3 | 55,6 | 31,8 | 37,8 | 127,8 | 195,1 | 147,3 | 67,9 | 86,9 | 169,3 | 59,4 | 82,4 | 160,2 |

| Loans | 292,5 | 160,1 | 93,3 | 66,7 | 96,3 | 176,8 | 233,2 | 193,3 | 125,0 | 142,0 | 219,7 | 107,7 | 112,9 | 187,1 |

| Repayments | -13,1 | -12,8 | -37,7 | -34,9 | -58,5 | -49,0 | -38,1 | -46,0 | -57,1 | -55,1 | -50,4 | -48,3 | -30,5 | -26,9 |

* The size of the deficit is not equal to the arithmetic difference between revenues and expenditures since the size of the deficit is additionally affected by the volume of loans from the state budget and their repayment

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 2. Main indicators of budget financing, UAH billion

| Indicators | January | February | March | April | May | June | July | Cumulative (Jan-Jul) | |

| Financing, including | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 | 846,6 | |

| in % to the plan (for the entire period) | 54,7 | 71,5 | 183,5 | 82,9 | 113,6 | 49,0 | 165,7 | 79,9 | |

| From the placement of domestic government bonds (total), including | 41,4 | 42,6 | 53,7 | 34,0 | 68,6 | 45,4 | 39,1 | 285,7 | |

| in UAH | 38,8 | 30,5 | 36,3 | 25,1 | 29,3 | 28,3 | 30,8 | 188,3 | |

| in foreign currency in UAH billion (USD million + EUR million) | ₴2,6

($40,2+€29,4) |

₴12,1

($268,5+€57,5) |

₴17,4

($476,4) |

₴8,9

($242,6) |

39,3

($616,4+€418) |

17,1

($319,7+ |

8,3

($227,3) |

₴97,4

($1963,8+ |

|

| From external sources | 118,7 | 24,1 | 123,1 | 159,3 | 73,4 | 62,3 | 148 | 560,9 | |

| Public debt repayments | 12,8 | 34,9 | 49,0 | 46,0 | 55,1 | 48,3 | 26,9 | 246,1 | |

| In % to the plan for the full period | 97,7 | 92,6 | 83,8 | 120,7 | 96,5 | 95,8 | 88,2 | 96,6 | |

| Debt service payments | 0,6 | 12,0 | 11,6 | 13,9 | 45,7 | 33,0 | 11,2 | 116,8 | |

| In % to the plan for the full period | 28,6 | 114,3 | 78,4 | 101,5 | 90,3 | 84,0 | 151,4 | 89,2 | |

Source: Ministry of Finance of Ukraine, Center`s calculations

Table 3. External financial resources* attracted in January-July

| Resources | Amount, UAH billion

(EUR million; USD million; CAD million) |

| Macro-Financial Assistance in accordance with the Memorandum of Understanding between Ukraine and the EU | ₴417,9 (€10500) |

| Loans from the Government of Canada | ₴64,2 (CAD$2400) |

| IMF funds under the four-year Extended Fund Facility program | ₴131,4 ($3590) |

| Loan from the IBRD within the framework of the Fourth additional financing of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴18,3 ($499,3) |

| IBRD Loan for Development and Recovery Policy | ₴54,7 ($1500) |

| IDA loans within the framework of the project “Supporting public expenditures to ensure sustainable public administration in Ukraine” | ₴16,1 (€404,3) |

| Loan from the IBRD within the project “Strengthening the Healthcare System and Saving Lives” | ₴1,3 (€33,4) |

| Loan from the IBRD within the project “Accelerating Investments in Ukraine’s Agriculture” | ₴4,8 ($132) |

| Loan from the IBRD within the project “Additional Financing for the Health System Improvement Project” | ₴0,2 ($6) |

*excluding grants

Source: Ministry of Finance of Ukraine

Table 4. Monthly dynamics of state budget financing

| Indicators | January | February | March | April | May | June | July |

| Total borrowing, UAH billion | 160,1 | 66,7 | 176,8 | 193,3 | 142,0 | 107,7 | 187,1 |

| Total borrowed, % for January-July | 26,8 | 11,2 | 29,6 | 32,4 | 19,2 | 12,7 | 18,1 |

| From the placement of domestic government bonds, % for January-July | 24,1 | 24,8 | 31,3 | 19,8 | 28,5 | 15,9 | 12,0 |

| Borrowed from external sources, % for January-July | 27,9 | 5,7 | 29,0 | 37,5 | 14,7 | 11,1 | 20,9 |

| Debt repayment payments, % for January-July | 9,0 | 24,5 | 34,4 | 32,2 | 27,9 | 19,6 | 9,9 |

| Servicing payments, % for January-July | 1,6 | 31,5 | 30,5 | 36,5 | 54,5 | 28,3 | 8,8 |

| Difference between borrowed financial resources and expenses for debt repayment and servicing, UAH billion | 146,7 | 19,8 | 116,1 | 133,4 | 41,2 | 26,4 | 149,0 |

Source: Ministry of Finance of Ukraine, Center`s calculations

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations