The discussion on the confiscation of Russian assets has moved beyond purely legal disputes. On the one hand, there are signs that sovereign immunity is gradually losing its absolute nature. On the other hand, the sluggish progress in confiscation is fueled by economic arguments concerning global macrofinancial stability and the prospects of key currencies in the international arena. The theory and practice of international currency functioning are often used to justify a cautious approach. However, emphasizing only legal factors in attaining and maintaining the status of an international currency is clearly a manipulative exaggeration that lacks support from either the theory or the practice of global macrofinance.

Rationale of the aggressor and vulnerability of international policy

Besides the desire to restore its chauvinistic empire, the violation by the Muscovite Horde of the fundamental principles of international law is based on fairly rational assumptions about the dysfunction of this law. In other words, it is nothing more than a cold-hearted calculation that there will be no counteraction to illegal actions. According to Russia’s assumptions, counteractions are limited by the perimeter of legal institutions. However, in reality this perimeter is quite flexible (if existent). Indeed, such a perimeter is defined by political agreements among key players. Thus, any references to international law limiting active countermeasures by Ukraine’s allies, despite legal rhetoric, ultimately boil down to economic arguments.

With respect to seizure of the Muscovite Reichsbank’s foreign assets, a typical economic reasoning is based on the assumption that it would undermine trust in the existing system of international currencies and encourage the search for a configuration of cross-border operations with goods and assets that would significantly weaken the restrictive capacity of sanctions imposed by developed countries.

Despite the legal and economic coherence of this position, it has several weak points that both Ukrainian negotiators and foreign partners need to take into account.

Muscovy, having experienced sanctions since 2014, was prepared for some additional restrictions. This means it was ready for the seizure (loss) of foreign assets. These assets amount to about $300 billion. The majority of them are under the jurisdiction of European countries (mostly Belgium, where the main offices of Euroclear are located). In geopolitical negotiations, Muscovy can perceive them as sunk assets but also as a tool of legal pressure on Western countries.

Moreover, these assets would not play a significant role in ensuring Muscovy’s macrofinancial stability. Given the trade surplus, budget surplus (maintained during the first year of the full-scale war against Ukraine), and resources in stabilization funds, its ability to support macrofinancial stability was not undermined at all. Even with an increase in the budget deficit and confiscation of sovereign assets, macrofinancial stability will persist as long as there is currency inflow. Therefore, asset confiscation should be one of the countermeasures, as well as a source of compensation for losses incurred by Ukraine and its international partners due to Muscovy’s aggressive actions. Sanctions should primarily focus on the energy sector. In other words, the assumption that prolonged delays in confiscating sovereign assets serve as a “carrot” in geopolitical negotiations is false.

Equally false is the belief that confiscation of sovereign assets would undermine the principles of global macrofinance. From a moral standpoint, this argument simply does not hold up. Starting a war, committing numerous war crimes, seizing a nuclear power plant, blowing up a hydroelectric power station, blackmailing the world with nuclear weapons—haven’t these actions already undermined the functioning of the global order?

Reserve currencies and global currency reserves: Are structural changes on the agenda?

The theory of reserve currency rests on the idea of the fundamental role of property rights protection and trust in the political institutions of the country whose currency is used in cross-border transactions. Such ideas fuel skepticism towards active measures involving immobilized assets of an aggressor country. However, the problem is that principles of global macrofinance, which timid policymakers protect so rigorously, do not rely on any specific act of international law (the Vienna Convention on Immunity of Sovereign Assets from Legal Claims contains no direct provisions regarding currency reserves). Unstead, they rely on competition in property rights protection among different jurisdictions. In other words, the opportunities for central banks to place assets abroad are limited not only by economic but also by institutional factors. What is the alternative? And who will make the choice between alternatives? If many countries with dubious geopolitical plans viewed Western countries with a purported (in their opinion) tendency to support rule of law as not the best places to “park” their sovereign assets, then why haven’t countries like Iran, India, or China become new emission centers for reserve assets? The answer is simple. Property rights protection is of paramount importance. At the same time, the theory of international currency is a more complex body of knowledge.

First, there are two approaches to explaining the durability of the status of an international currency over time. The natural monopoly approach and the network effects explain why countries with deep domestic markets, open trade and capital flows become issuers of reserve currencies. Using one or several currencies in international transactions generates benefits on the demand side. The acquired status of an international currency remains stable over time. However, the historical approach suggests that the status of an international currency can change. Due to structural changes, countries which are leaders in currency internationalization may lose or gain positions. If such changes affect the emergence of economies and financial sectors of competing scales, this also affects the competition among individual national currencies for the functions of an international currency. The first approach largely explains why the current dollar or euro is not very vulnerable to geopolitical shocks. The second approach suggests that the dollar or euro may be at risk if a strong competitor emerges.

Second, reserve currency is one of the functions of an international currency. It is the reserve currency status that ensures the stable position of an international currency. Often, the reserve currency status is associated with the global role of national currencies. The acquisition of reserve currency status follows a specific algorithm. First, a currency starts to dominate in cross-border transactions. Then, it becomes an invoicing currency. Only after this do central banks choose it to form currency reserves, as access to such currency will be linked to the ability to maintain international liquidity and ensure macrofinancial stability.

Third, a reserve currency that serves the central banks’ need to maintain international liquidity is not the end of the story. Central banks need assets in which they would agree to hold their external reserves. The status of reserve assets is determined by the scale of the financial market, its flexibility and liquidity, and low vulnerability to inflationary shocks. In other words, reserve assets must enjoy trust from both monetary and fiscal perspectives. In this way currency reserve management relies on economic logic. Note that depth and liquidity of the reserve asset market are primary factors that determine demand for them. Reserve diversification policy is determined by the volume of reserve accumulation and, with a few exceptions, is not heavily dependent on geopolitical considerations.

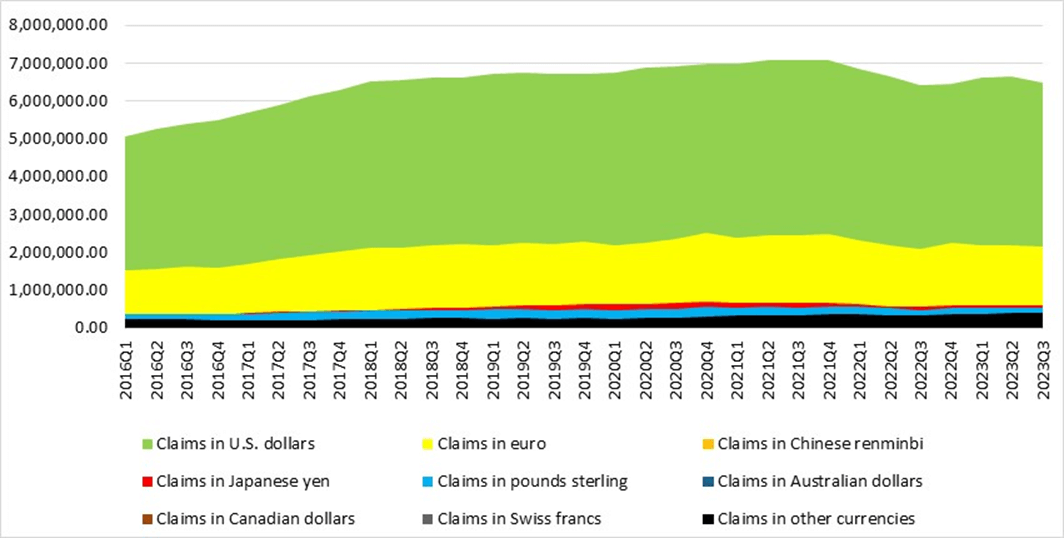

In line with international currency theory, the currency structure of central bank foreign assets remains stable (Figures 1 and 2). Strong economic factors support its current state. In the long term, structural changes are possible, and they are more likely to be technological rather than geopolitical.

Figure 1. Global reserves by currency, USD million

Source: based on IMF data

Figure 2. Structure of global reserves by currencies, %

Source: based on IMF data

Figure 1 shows that the volume of global currency reserves has not significantly increased over the past ten years. Share of reserves in USD and EUR has slightly grown. The currency structure of global central bank foreign assets (Figure 2) has seen a slight decrease in USD share, and EUR share remains rather stable. However, in absolute terms, the largest volume of issued and purchased reserve assets is nominated in these two currencies. Other currencies, even if there is some outflow from USD into them, look rather niche. Insufficient depth and liquidity of financial markets in these currencies cannot provide the liquidity necessary for currency reserves. And liquidity of currency reserves directly impacts the central bank’s ability to react to exchange rate and financial sector shocks. Even if some central banks with large reserves aim for diversification, this will not be a common behaviour because the supply of reserve assets is limited.

Alternatives to the long-term stability of the reserve currency system

Certainly, many countries with geopolitical ambitions bordering on aggression (towards neighbors or the global order) seek to diversify their external assets. However, increasing the share of reserve currencies in favor of small developed countries or emerging market countries will deteriorate the quality of currency reserves. This will have global consequences. This is a significant factor in the long-run stability of the global reserve asset system.

Recognizing their limited ability to affect many central banks’ individual choices, these countries are advancing an alternative option. They seek to replace cross-border transactions with their currencies to reduce dependence on the established reserve currency system. However, the idea of currency internationalization without a sufficiently liquid market for assets in such currencies faces limitations due to foreign trade imbalances. This is the key reason why cross-border trade in national currencies without a liquid asset market in such currencies sooner or later ends with dissatisfaction and collapse of such practices. A country with a trade surplus accumulates illiquid stock of currency which it can only use to purchase goods in the country that issued this currency. Meanwhile, a country with a trade deficit is forced to seek access to finance in the illiquid currency of its trading partner.

These schemes rely on political agreements and lack economic ground. On a worldwide scale, such schemes may reduce the volume of transactions in USD or EUR but they cannot affect the core of the global reserve asset system. If policymakers from Ukraine’s international partner countries fear that new technological possibilities in cross-border payments will reduce the demand for traditional dollars or euros, they should note that this will happen regardless of seizing Moscow assets. China, India, and a number of other countries are actively investing in new cross-border payment technologies. The fear that any actions with sovereign assets will accelerate this process is irrational. The market promotes technological advancements, and once they happen, efforts to capitalize on them will prevail, irrespective of geopolitics. Developed countries will simultaneously face changes in the global payment landscape, and waste precious time. Instead of mitigating one risk, they will expose themselves to both.

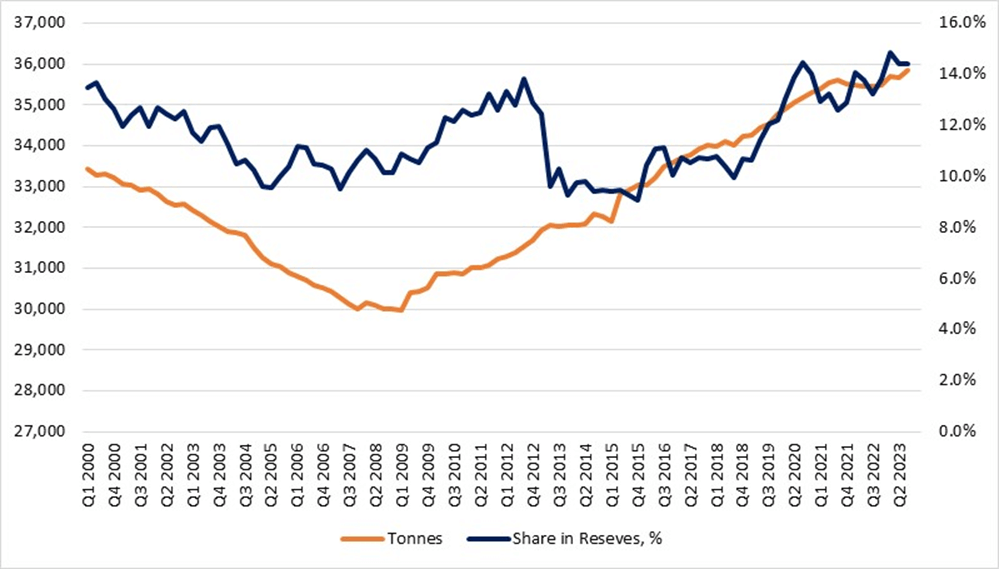

Similar reasoning applies to gold. The shift towards gold started relatively long ago (see Figure 3). Volumes of central bank gold reserves have been significantly increasing for some time. Importantly, this growth is not driven by developed countries, where gold reserves have remained stable since the 1970s. However, the share of gold in global currency reserves has only recently surpassed the level of 2000.

Is active diversification of currency reserves towards gold an indicator of geopolitical aggression? In some cases yes, but only when significant currency reserves are present. In other words, if a country does not mine substantial amounts of gold, its share in currency reserves cannot crowd out the liquid portion of reserve assets necessary to maintain macroeconomic stability. Similarly, it cannot fully replace the portion of currency reserves under investment management. Otherwise, the central bank would suffer significant losses from revaluation of reserves and would become extremely sensitive to changes in the price of gold. Only the central bank of a country where fiscal losses from owning foreign assets with unjustified risk management structures are already included in the list of acceptable risks can afford to take on fiscal risks associated with holding significant gold reserves. Acceptable risks are those taken in the name of “bright geopolitical ambitions.” Not all countries can afford this.

Figure 3. Global reserves in gold

Source: Constructed based on World Gold Council data

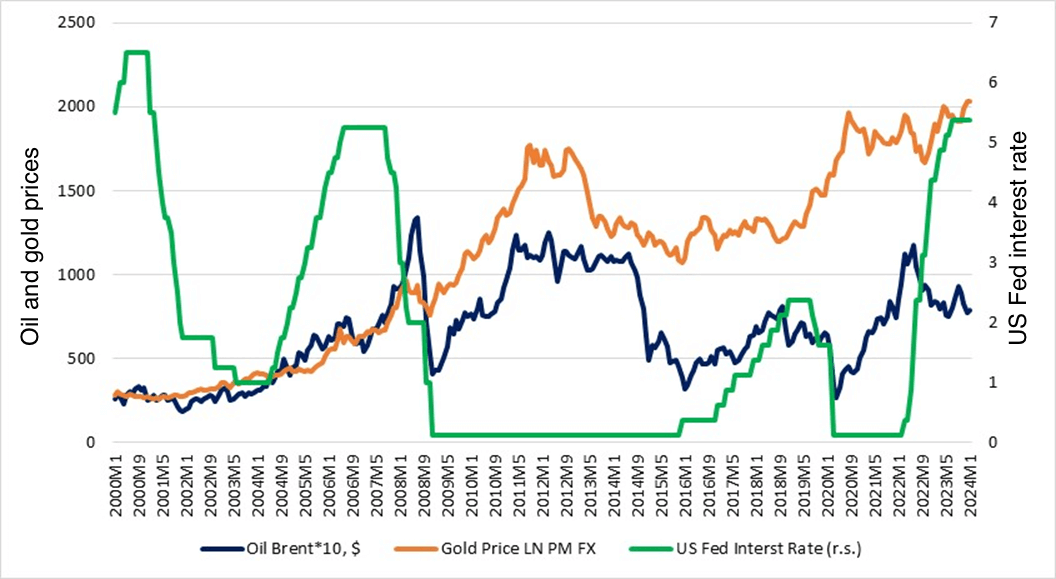

The resurgence of interest in gold has been largely influenced by the specific deployment of global monetary conditions in recent times. As seen in Figure 4, there were periods when gold prices increased primarily due to excessively loose monetary conditions. During these periods, relatively high correlation between prices of gold and oil is observed.

Figure 4. Prices of oil and gold and the key rate in the USA

Source: based on World Gold Council, IMF, and BIS data

During periods of loose global monetary conditions interest in gold increases because traditional reserve assets generate lower yields compared to investments into gold. However, gold prices are also sensitive to significant shocks. For example, during the COVID-19 crisis, gold and oil prices diverged. A similar situation has been observed since the end of 2022. However, this does not mean that gold can become a long-term alternative to traditional reserve assets. Gold liquidity is low, storage costs are high, and selling significant quantities, especially bypassing the dollar or euro, is politically loaded. Therefore, higher interest rates may restrain the flow into non-traditional assets.

Conclusions

Economic warnings about the collapse of trust in the global reserve currency system are overstated. Alternatives to it are extremely narrow, politically sensitive, and economically disadvantageous. Technological changes in the international payment landscape may provoke a widening gap between roles of USD and EUR for servicing cross-border transactions and for storing external assets. Technological changes proceed regardless of geopolitical tensions, and their benefits will be capitalized as soon as possible. On the other hand, developed countries that perceive the speed of such changes as a warning for decisive action, are losing time and signaling their inability to actively oppose violators of international law, constraining themselves within the blurred framework of international law. The weak position of developed countries does not contribute to the emergence of a new global agenda under which the absence of immunity for foreign assets would be a common instrument for punishing military aggression.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations