The process of preparation of the corporate tax reform in Ukraine was unprecedented in its openness and inclusivity. No other economic reform ever took so many time; involved so many high-level discussions among the best experts in the field; was supported by so many detailed calculations, etc. In this process, especially at the MinFin’s working group on the topic, all possible pro and contra of the tax on withdrawn capital (or, in another version of English translation used in the article, the Exit Capital Tax, ECT) were scrutinized very carefully.

Then, the State Fiscal Service (SFS), the MinFin, the MEDT, and two think tanks – Ukrainian Institute for the Future (UIF) and the Institute for Social and Economic Transformation (ISET) – provided their calculations of its fiscal effect, discussed them, and finally all of them but the SFS (that has its own view obviously motivated by the conflict of interests described below) came up with consensus forecast. The draft law that appeared as a result of these efforts will hopefully be submitted to the Rada soon. Scrupulous analysis of it’s costs and benefits yielded generally positive conclusions, although with some reservations, actually quite similar to the ones made in the article, however with important distinctions that trigger overall balance into positive.

The article “Introduction of the Exit Capital Tax: Negative short run fiscal impact necessitates solid budgeting” is based on two studies performed by the German Advisory Group (GAG) last Summer. None of their authors took part in the above described process. No surprise that these studies contained serious inaccuracies that were already pointed out to authors. Notably, all of these mistakes were biased against the ECT, which looks strange in itself. But in spite of the critical comments received, the article replicates some of already falsified results of these studies, although it is generally more balanced comparing to them. It also contains new and wrong (again, many times falsified) argument that acting Corporate Profit Tax (CPT) allegedly works decently so there is not need in its reform at all.

The CPT is highly problematic, and this is major issue that, among all, prevents the SFS’s successful overhaul

First of all, it is said that “ …the tax system is not ranked by companies as a major impediment to investment at present” and, elsewhere, “The main problem of Ukraine’s tax system is not the tax system, but deficient tax administration”. Both statements hardly match the facts, however.

The former is, probably, drawn from non-representative survey of foreign investors and would-be investors performed by the EBA, CES, and the Dragon Capital. And even there tax issues closely follow such notorious impediments to investments as judicial problems, corruption, and the Russian aggression against Ukraine, along with some issues specific to foreign investors. But tax system is routinely rated as the highest policy-related obstacle for doing business in Ukraine in the nearly all of representative enterprise surveys, such as ABCA conducted by the same IED that co-authored in the study in question. Besides, the problem of corruption is by large also related to tax issues, as the SFS strongly leads in the corruption pressure exerted over firms.

Tax system is routinely rated as the highest policy-related obstacle for doing business in Ukraine at nearly all kinds of the representative enterprise surveys, such as ABCA conducted by the same IED that co-authored in the study in question.

Among the tax system’s components, tax administration used to be ahead of tax rates for almost all time of observations, and only recently they got nearly equalized. This can be considered as a confirmation of second statement mentioned above, however, in fact, problems in tax administration (especially, corruption) are indispensable of tax legislation and the very composition of taxes. Particularly, taxes on incomes, chiefly CPT, are proved to be associated with corruption, and Ukraine’s experience confirms this in full. I already wrote about these links in general, and analyzed the issues of CPT in particular, in greater details before.

Then, the statement made in the article that “No major defects of present CPT system” is as far from the truth as it can be. This is a typical argument meant for armchair surface analysts that work mostly with hard data available online, as international comparisons of the laws’ texts, rates, and some macro figures. However, such kind of analysis says nothing about the way this tax works in deed – here a thorough fieldwork is required. In case of Ukraine, institutional problems in compliance and administration (irresolvable by just tax service’s reform) are main reasons for criticism of the CPT and the main argument for it’s replacement with ECT. Ignoring them or boiling them down to re-shuffling of the SFS even along with more effective punishment of corruption is the fatal mistake that typically results from armchair analysis, including, unfortunately, the study in question.

In brief, the CPT is discretional by its nature, which makes it highly vulnerable to corruption. For this reason it causes problems in all of the countries that are as prone to corruption as Ukraine is, and this can be hardly handled by any organizational reform of tax service. The opposite, as long as corruption opportunities persist, it is extremely hard to keep this service clean, especially given strong and deep-rooted traditions (not to mention cultural factors) that cannot be altered overnight. So, this tax is, and will ever be, a strong factor of risk and institutional distortions. Particularly, this is one of the main reasons for setting plan tasks on tax collection for the inspectors – bad practice that became necessary for the reason that otherwise they will just share the potential tax revenues with a payer. If this is not a major defect, than what is it?

Unfortunately, there is no detailed data on corruption in tax compliance by specific taxes. But statistics on the lawsuits confirms that despite some improvements that indeed have reduced discretion substantially, the CPT remains more problematic (in relative terms) than even the VAT notorious with its poor administration, especially in 2017 when the firms sounded of awkward implementation of the risk-based automatic system for blocking suspicious VAT invoices. While the CIT brought just about 10.7% of all tax revenues that year, court cases regarding this tax constituted 13.6% of all similar cases, and the amount in question was 23.5% of all corresponding amount, or 64% of all CPT revenues. Meanwhile, for the VAT (again: in that, especially problematic, year) the respective figures were 41.6% and 34.5% – just about 3 and 1.5 times higher, which is not much given that the VAT revenues were almost fifth fold higher than the ones of CPT, at 50% of total tax revenues. Isn’t it a sign of some major defect?

Unfortunately, there is no detailed data on corruption in tax compliance by specific taxes. But statistics on the lawsuits confirms that despite some improvements that indeed have reduced discretion substantially, the CPT remains more problematic (in relative terms) than even the VAT notorious with its poor administration, especially in 2017 when the firms sounded of awkward implementation of the risk-based automatic system for blocking suspicious VAT invoices.

As a result, collections of the CPT use to be driven more by political factors than economic ones. The most of revenues normally come from a few (not all) foreign-owned large public companies that have to make transparent accounting of profits and prefer to pay tax in Ukraine. Recently they were joined by some state-owned firms with new management appointed as a result of reform, mainly the oil and gas giant NaftoGaz. The latter’s contribution was crucial for recent advances in the CPT collections. Overall, in 2015 (even before the NaftoGaz reform) less than 0.6% of taxpayers brought 70% of CPT revenues.

However, the rest of potential taxpayers, including the largest Ukrainian firms and holdings, use to pay little or no CPT, and, in fact, are enforced to do so only if they fail to “negotiate” with the SFS officials (hence, bribe them). They widely use aggressive tax planning, mostly involving tax havens. According to the calculations based on Global Financial Integrity’s reports and the SFS data, Ukraine suffers from illicit capital outflows consisting about 10% of the GDP – which means that potential budget revenues from the CPT are almost halved. If this is not a major defect, than what is it?

Small business is not a big problem here, because according to official data it constitutes just about 16% of the country’s economy, and normally generates only marginal profits due to fierce competition. For this reason it was even temporarily released from annoying and corrupt inspections that mostly extorted bribes while bringing negligible fiscal results – and this is one of the main factors behind some decrease in acuteness of the problem of CPT inspections-related extortion in the recent years. However, the moratorium is not a normal way of coping with such kind of problems, and it should be lifted better sooner than later.

Small business is not a big problem here, because according to official data it constitutes just about 16% of the country’s economy, and normally generates only marginal profits due to fierce competition.

Therefore, in fact the present CPT system performs very poor. However, some domestic tax consultants (including high-profile ones) with vested interests in either providing “communications” between the SFS officials and large business, or in providing consultancy service on tax planning, insist that the CPT works as it should. It is easy, however, to trace obvious conflict of interests in their positions whet they are used as source persons in a field study.

Respectively to the abovementioned mistake, the study focuses mostly on purely economic side of the story: positive effects on investments coupled with negative fiscal one. It is, of course, important – but not so much as the role of proposed reform in preventing corruption.

The ECT’s main job in this regard is to eliminate the most of discretion, and limit the necessity in inspections to just a few per cents of taxpayers. This would also open the way for genuine SFS reform that should, among other things, re-focus it from numerous (tens of thousands) inspections of ordinary taxpayers that yield little but bribes, to scrupulous scrutiny over especially risky operations performed by limited number of large companies. Such a reform is barely possible and very likely to fall short of desirable results without advance careful extinction (to the possible extent) of major corruption vulnerabilities, such as the ones inherent to CPT. Otherwise, even in case of SFS’s total overhaul that we all pursue, newly hired personnel will come attracted by lucrative opportunities to raise bribes, as described above, rather than to serve and get paid. Or it will be soon tempted to do so. Therefore, the SFS’s overhaul is, of course, badly needed, but the abolishment of the CPT and a few other measures (automation, to the maximal possible extent, of the VAT administration; further cut or, better, elimination of the payroll tax; and modernization – including elimination of discretionary elements – of the property tax) are required as advance or, at worse, simultaneous steps complementing this reform.

The ECT’s main job in this regard is to eliminate the most of discretion, and limit the necessity in inspections to just a few per cents of taxpayers. This would also open the way for genuine SFS reform that should, among other things, re-focus it from numerous (tens of thousands) inspections of ordinary taxpayers that yield little but bribes, to scrupulous scrutiny over especially risky operations performed by limited number of large companies.

If only investments are concerned, then one can suggest (as the European Business Association (EBA) does) that there is no need in exotic ECT, it is enough to just allow investments as deductibles in the CPT’s calculations. However, this is exactly what has been done in Moldova with sour results – the fact that is mentioned in the GAG’s study as an argument against the ECT. As was already pointed out in the discussions at the MinFin’s working group (and communicated to the authors) neither Moldovan, nor Macedonian examples are relevant to the ECT proposal that is currently under consideration in Ukraine. The former, as mentioned above, missed the main component of the Ukrainian version, while in Macedonia this was just temporary arrangement that obviously motivated taxpayers to retain their profits for all period of its duration. If boosting investments and fiscal stimulus were the purposes of this, then it was a success – but in case of Ukraine these aspects are of secondary importance.

Economic calculations provided in the study have grave deficiencies

Secondly, the calculations provided by the authors were already criticized because they do not account for many important effects considered in the consensus forecast mentioned above. Most importantly, they pretend to estimate total fiscal effect. And, indeed, they count some, even rather minor, negative effects more accurately than the consensus forecast does. At the same time they miss large positive effects on proceedings from other kinds of taxes, mainly the VAT, labor tax and the PIT, that would be paid while ECT payers invest their retained profits – this adds 7 bn. UAH to forecasted budget revenues, while the de-shadowing effect criticized by the article’s authors yields only 5 bn UAH. Still, the latter’s calculations (originally provided by the MEDT with a use of modeling) are supported by the fact that actual cumulative tax rate on dividends decreases from 23% (18% as the CPT + 5% as the PIT on dividends) to 15%, hence, by one-third. And the assumption of 30% de-shadowing was derived from actual effect of de-shadowing of wages after quite similar decrease in the payroll tax’s rate. This voluntary effect should be furthermore, on the one hand, augmented by much less overall (but better focused) fiscal and administrative pressure, and, on the other hand, complemented by better administration of controls over main avenues of tax planning, particularly transfer pricing and thin capitalization. Besides, during the work on consensus forecast some important corrections in the raw numbers were made, particularly on the revenues stemming from SOE (mostly NaftoGaz) not accounted for in the GAG calculations.

All in all, the final numbers of the immediate fiscal gap provided by four-party consensus forecast are 1.5-2 times lower than the ones given by the GAG’s study – the losses were estimated at 23-25 bn. UAH, which is within the usual forecast error, and can be handily covered by at least two sources: the NaftoGaz’s dividends payments, and improvements in the other taxes’ (mainly VAT) collection. The authors of the study were told about abovementioned corrections, but did not take them into account.

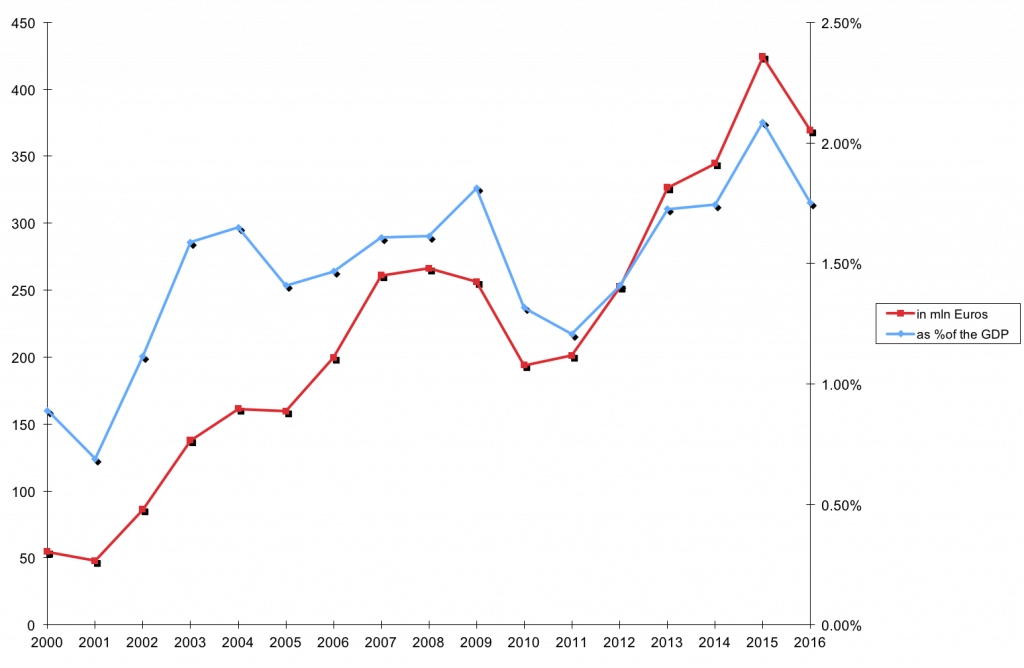

Coming to long-run effect, the article replicates from the study the chart for budget revenues in Estonia that for some reason ends in 2009 – in the year of economic crisis. It also covers just first, not the most successful, half of the whole period when the tax on redistributed profit was in force. The full chart looks quite differently (see below), and suggests much different conclusions, especially if the revenues in absolute numbers are concerned.

Estonian CIT and GDP

All of this does not mean that the ECT is flawless, and without difficulties. We are fully aware of the problems and risks associated with such a reform. As the bill’s authors work closely with foreign investors, we know that there would be some additional costs incurred by the necessity to train the accountants and tax lawyers in this exotic arrangement. However, if it will work as intended, they will have to just study a new law, which is feasible, while now they have to learn on how to “negotiate” with tax authorities, which is impossible for a normal Western-educated person. All involved parties, the MinFin first of all, also value the fiscal stability and fully admit that the reform should be fiscally responsible. But unlike in 2014-15, for the last two years the forecasted budget revenues are over fulfilled, which would leave enough fiscal space for that reform should it be introduced before.

At the same time, economic growth remains slack, and lags behind both the EU and the World average. As suggested by enterprise surveys mentioned above, it is restrained first of all by corruption – where the SFS leads by large – and lack of access to finance. Note, however, that, contrary to widespread illusion, corruption of the systemic sort that Ukraine suffers cannot be curbed by any punitive and organizational measures. They are, of course, necessary but futile without dramatic elimination of corruption vulnerabilities, mostly associated with discretion and personal contact, where an inspection on CPT is almost ideal combination of two.

Now it is time to spur growth, but there are not much tools for it: the Keynesian methods, even if considered effective elsewhere, work poorly in Ukraine due to the number of reasons; and so does industrial policy (again, if at all effective anywhere). However, these are fiscal methods that can be of great help in this. Namely, the business can be released from corrupt pressure, profitable firms encouraged to invest, with money kept within the country – and the ECT largely helps achieving these goals. At the next stage, expenditures/tax cuts and fiscal maneuver suggested by the OECD – from direct income taxes to recurrent property taxes – should further unleash the market forces therefore speeding the growth. But this is the task for upcoming years.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations