In recent years, and especially during the international pandemic, the slogans of protection of national producers are beginning to prevail over the slogans of globalization. In Ukraine, where for some political forces such an agenda is constant, they also decided not to lag behind and use the global trend to implement measures to support national industry. This time with new (old) way — by introducing localization criteria in public procurement. In particular, the bill №3739 “… on creating preconditions for sustainable development and modernization of domestic industry” appeared in the summer. The Verkhovna Rada has already even voted for it in the first reading.

Sources of localization. Return to protectionism

The introduction of localization criteria should be seen in the broader context of protectionist policies, which Ukraine is cautiously pursuing. Protectionism restricts international trade to help domestic industry. At first glance, such a policy seems reasonable. But in reality, only individual manufacturers benefit from it, and society as a whole loses. After all, the inefficiencies that arise in other sectors due to localization actually reduce the effect of job growth and the possibility of achieving economies of scale, undermining the original goals of localization.

Localization, better known in the international economy as “Local content requirements” (LCRs), is the first of a set of possible protectionist measures. This is the least obvious and fairly flexible mechanism to reduce imports by setting a requirement that the claimed part or parts of the product must be manufactured domestically.

Contrary to long—standing and largely negative evidence of the impact of localization on economic development and trade, it still plays an important role in economic policy. The OECD estimates that since the 2008 financial crisis, governments have taken more than 340 localization measures, including more than 145 new local content requirements. The purpose of these measures was mainly to increase employment and production.

While localization can help governments achieve certain short-term goals, such measures undermine long-term competitiveness. Thus, according to OECD estimates, from the introduction of only about 8% of all localization measures that took place in the world in 2015, world trade lost almost 23 billion US dollars. Another $ 5 billion in revenue has been lost by global companies.

However, despite the unequivocal position of the expert community, the EU and other partners of Ukraine, who see in the draft law №3739 high corruption risks, economic losses and violations of international obligations, there are a significant number of people in power who plan to implement localization. Moreover, localization can only be the first of a pool of protectionist initiatives. The rest – tariffs, subsidies, quotas, etc. – can bring even more damage to both the country’s economy and its reputation.

So what are the supporters of protectionism guided by? Who and from whom are they trying to protect and will it be worth the candle?

Ghost enemy. There is no one to protect Ukrainian producers from.

Let’s speak facts. Consider several groups of goods for which the bill 3739 proposed to introduce localization of. This is primarily transport, as well as industrial equipment.

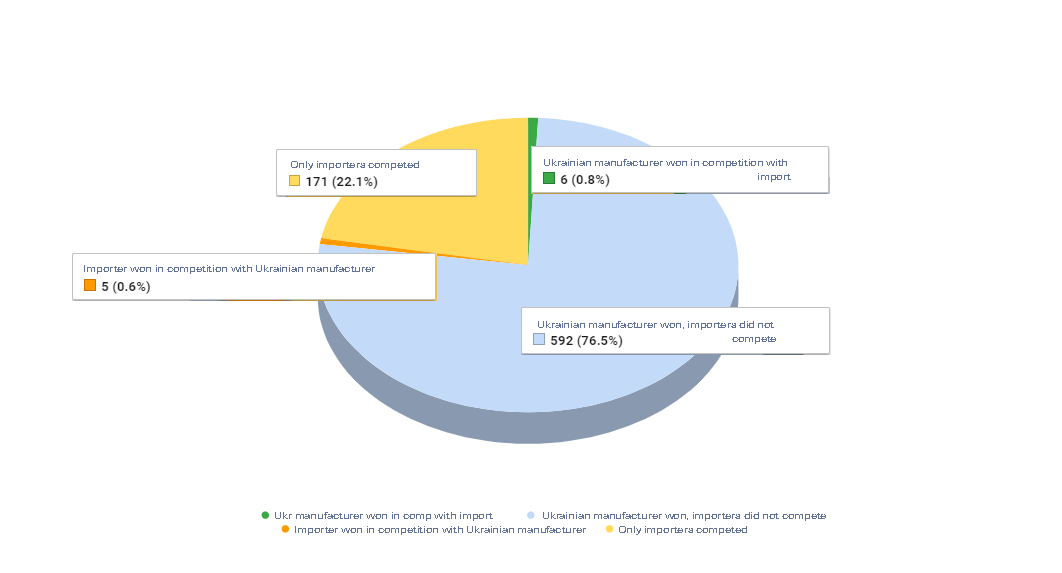

According to the estimates of the experts of the Ministry of Economy, among the procurement of buses that fall under the bill, in 2018-2019 in 77.3% of cases (597 procurement procedures) Ukrainian manufacturers competed with each other. (These are the CPV codes: 34120000-4 Motor vehicles for the carriage of 10 or more persons, 34121000-1 City and tourist buses, 34121100-2 Public buses, 34121500-6 Tourist buses).

The share of importers under these codes is 22.7% (177 procedures): these are cases when only foreign manufacturers took part in the tender, or they won in competition with Ukrainian companies (Figs. 1, 2).

Figure 1. Distribution of participation of national companies in public procurement against foreign companies in the bus sector 2018-2019

Source: Calculations of the Ministry of Economy and RST based on data from the Prozorro Electronic Procurement System

Out of 49 tenders, as a result of which buses of foreign manufacturers were purchased, suppliers of Ukrainian goods participated in only four, but lost in price. It is unknown why Ukrainian companies almost did not participate in these tenders. If the tender conditions were written for specific foreign bus manufacturers, Ukrainian companies could challenge the discriminatory tender conditions in the AMCU. But no one did. Therefore, it is logical to assume that our manufacturers could not offer the necessary product at all.

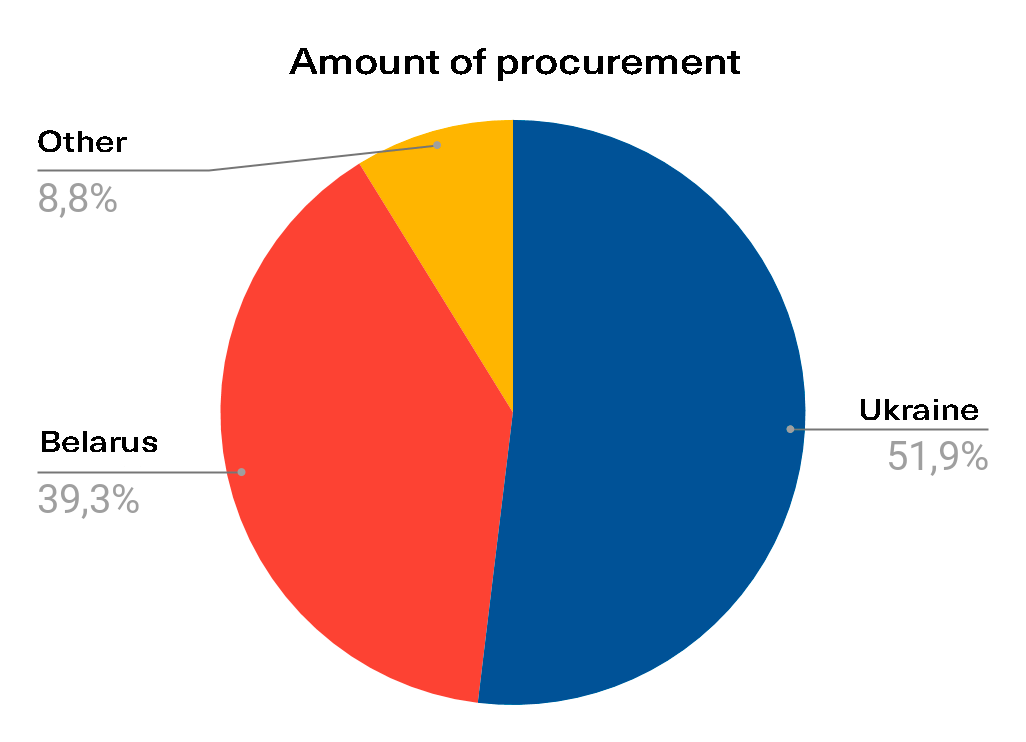

Figure 2. Analysis of bus procurements in Prozorro by the amount of contracts, the number of procurement procedures and purchased bus units, 2017-2019.

Source: Calculations of the Ministry of Economy and RST based on data from the Electronic Procurement System

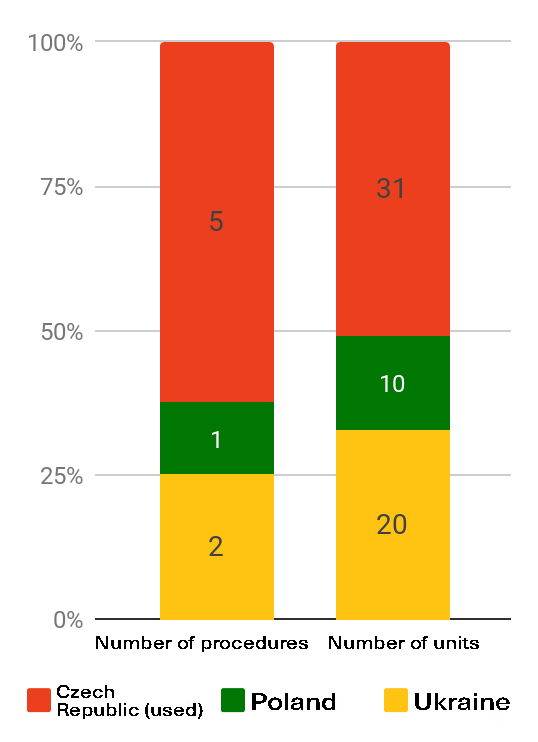

We analyzed the procurements of other goods mentioned in the localization bill. These are cars / gondola cars (2017—209) and trams and trolleybuses (2018-2019). A total of 26 procedures for the procurement of rail rolling stock worth UAH 5.39 billion were carried out, 746 units of equipment were purchased, in particular:

- 8 procedures for procurement of cars / gondola cars, 573 units worth almost UAH 3 billion were purchased. All are of Ukrainian production.

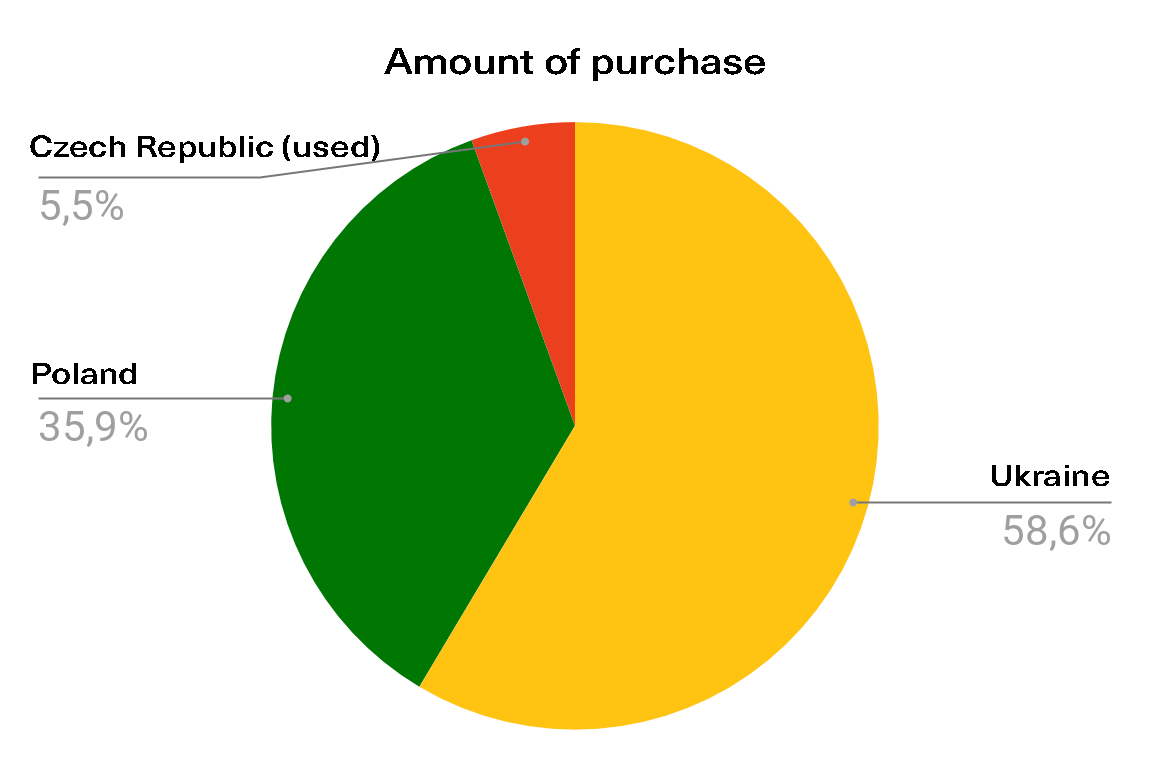

- 8 procedures for procurement of trams, 86 units worth almost UAH 1.6 billion were purchased. Of these, 20 pieces worth 926.8 million UAH — Ukrainian manufacturing. In quantity it is 32.8%, in value 58.6% (Fig. 4);

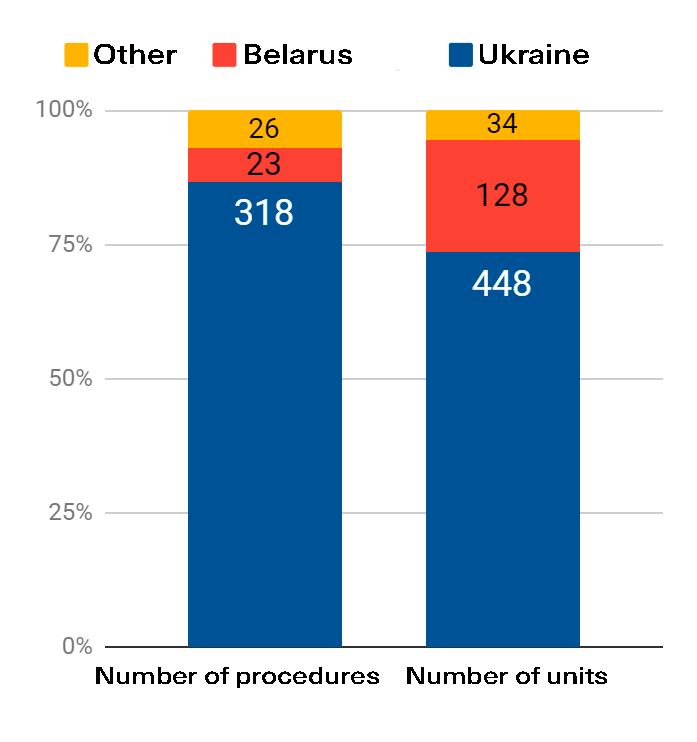

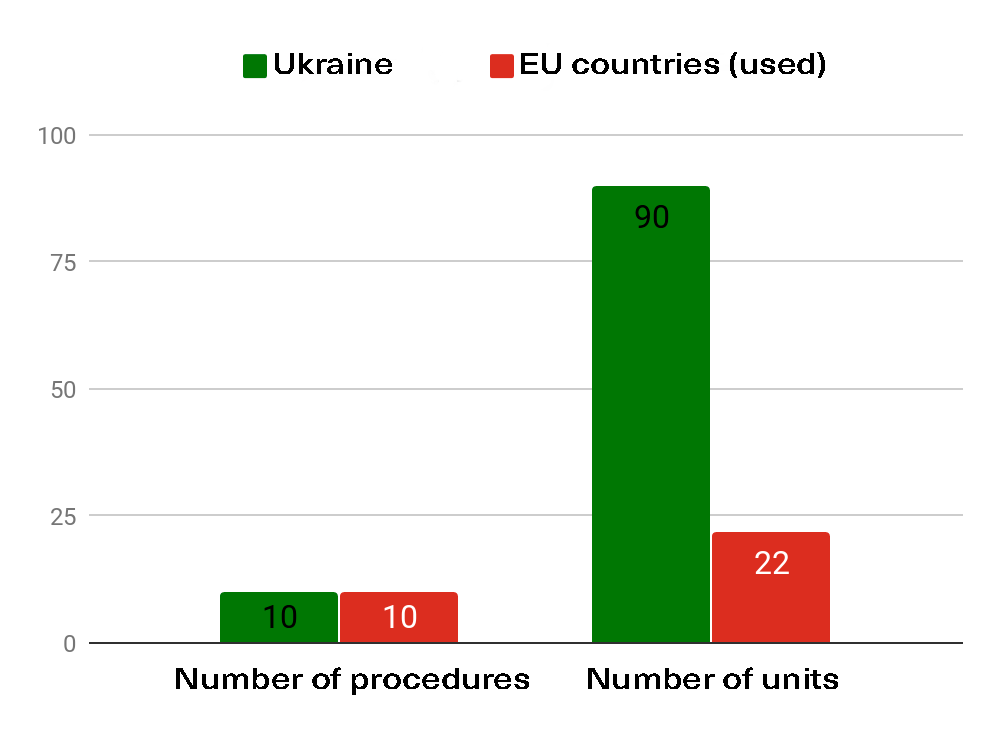

- 20 procedures for procurement of trolleybuses. 112 units worth UAH 809.8 million were purchased. Of these, 90 pieces for 782.1 million UAH (80.4% in quantity and 96.6% in value) — Ukrainian production (Fig. 3).

Figure 3. Analysis of procurement of trolleybuses in Prozorro by the amount of contracts, number of procedures and units 2017-2019

Source: Calculations of the Ministry of Economy and RST based on data from the Electronic Procurement System

Figure 4. Analysis of tram procurement in Prozorro by the amount of contracts, number of procedures and units 2017-2019

Source: Calculations of the Ministry of Economy and RST based on data from the Electronic Procurement System

It is important that Ukrainian trams and trolleybuses are the cheapest among the new ones and win at the price offered by foreign manufacturers, but cities choose foreign-made equipment that was in use, which is many times cheaper than the new one.

The purchase of 5 used tram cars TatraKT4D from the city of Erfurt (Germany) in the amount of 254 thousand euros and 30 used tram cars 1435mm from Berlin (Germany) in the amount of 782 thousand euros within the purchase of a component of the project “Lviv Public Transport” for EBRD loan funds is an example.

In the auction through the Prozorro system, Zaporizhzhya and Mariupol communal services bought used Czech Tatra cars at UAH 1.7-2.5 million per unit. At the same time, the new domestic trams Electron or Tatra—South cost Kyivites from 43 to 50 million hryvnias per car, according to the results of the auction, ie about 20 times more expensive than used equipment.

Based on the results of processing the information available in Prozorro and in open sources on the procurement of buses and rail rolling stock, it can be concluded that a significant proportion of such purchases are made outside the electronic procurement system at the expense of (including credit) international financial institutions. This is primarily due to the procurement procedures of international financial institutions, which do not involve working with the Prozorro system. At the same time, in contrast to procurement through the Ukrainian system, there is no complete information on IFO procurement in the public domain, so only some known cases can be analyzed.

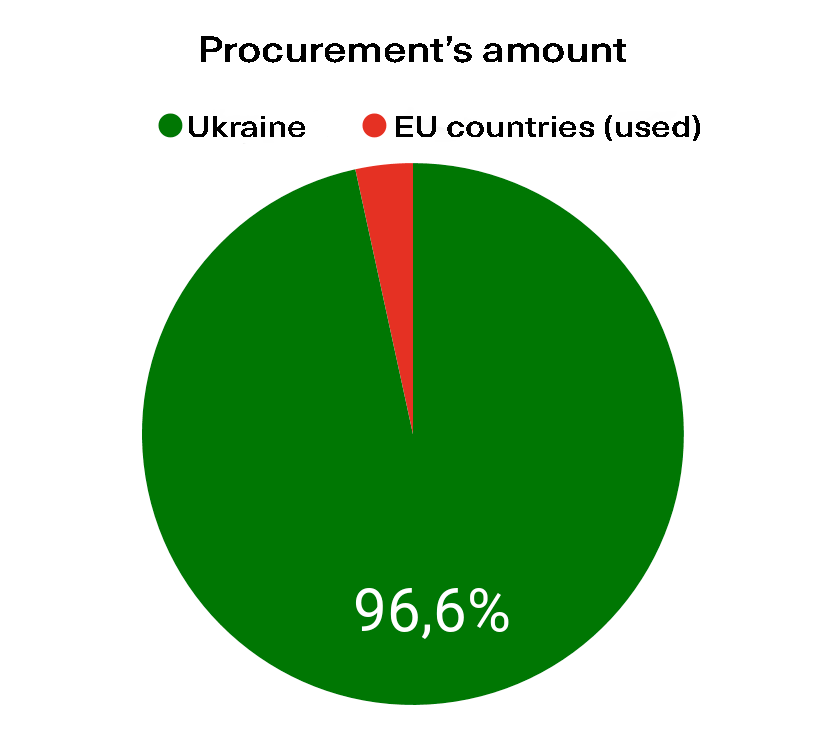

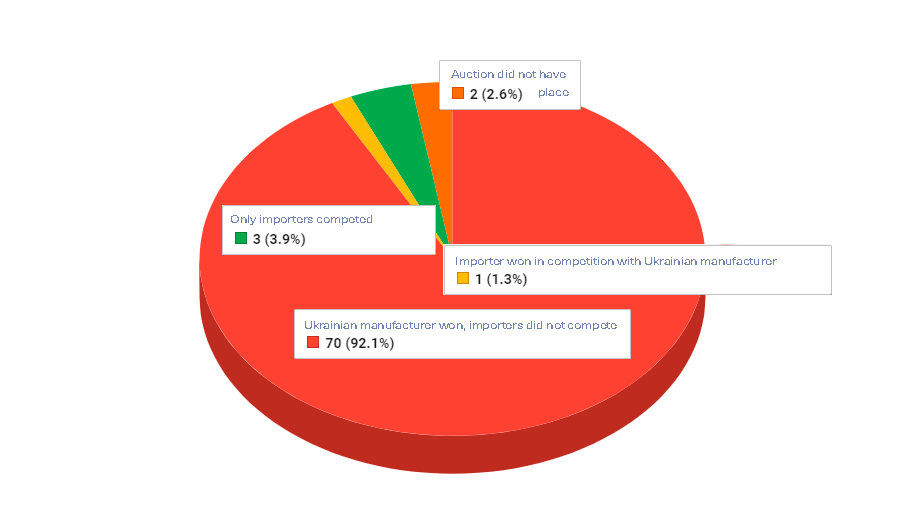

Another example. Analysis of the Turbines and Engines sector (CPV code 42110000-3) for 2018-2019 shows that in 92% of cases (or 70 procurement procedures) Ukrainian manufacturers competed with each other. The share of importers under this CPV code is only 5.2% (4 procedures for less than UAH 0.1 billion is 4% of the money spent on turbines and engines)). At the same time, foreign manufacturers won in Ukrainian only in one of these four tenders. Only foreign manufacturers took part in the other three tenders — because only imported components were suitable for the customer’s vehicle (mostly spare parts for the Taprogge power unit cleaning systems).

Therefore it is not clear, how the atomic power station will complete set of its own cleaning system after the introduction of localization. It is also unclear of whom the new law will protec our manufacturers, since even now in 90% of cases they supply turbines and motors to state-owned companies without competition with import. But all will have to obtain confirmation of localization on each of dozens of positions on any contract.

Figure 5. Distribution of national manufacturers’ participation in public procurement against foreign companies in the Turbines and Engines sector 2018-2019

Source: Calculations of the Ministry of Economy and RST based on data from the Electronic Procurement System. Note: Among the suppliers of turbines and motors, the leaders were the Ukrainian JSC Turboatom (15 procedures, 19.7%) and the Ukrainian company SPE ATEN (13 procedures, 17.1%) — fig. 5.

Conclusions

Analysis of other sectors of production shows a similar trend. The conclusion is obvious — there is no one to protect Ukrainian manufacturers from in the vast majority of purchases. In cases where the share of imports is present, such as in the procurement of trams, it is not a question of direct price competition, as a rule, it is rather about the terms of tenders for the purchase of used equipment, which is not available in Ukraine.

Another case is the procurement of rolling stock within the credit lines of the International Financial Organizations (IFIs). Such purchases are governed by their high requirements and rules. However, Ukrainian companies still win such tenders by joining consortia.

Will the introduction of localization facilitate the placement of foreign production in Ukraine? Given the overall investment attractiveness of our country, this remains a big question mark. After all, the Ukrainian market is currently too small and, frankly, poor for foreign players to place production here to participate in public procurement. This is unprofitable for them, especially given the unfavorable investment climate.

The potential risks of localization are well known. Even under the ideal theoretical conditions that the authors of the initiative hope for, such a bill will reduce competition and strengthen the monopoly position of Ukrainian companies, which, as we know, will not contribute to their development. It is much more correct to create in the country attractive conditions for investments — both Ukrainian and foreign. This is exactly what the countries of Central and Eastern Europe did during the transition from a planned to a market economy.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations