The full-scale Russian attack on Ukraine in February 2022 has had significant humanitarian and economic impacts. Several studies have shown that the invasion led to sharp increases in wheat and corn prices, although these increases were lower than initially projected. Efforts such as the EU Solidarity Lanes and the Black Sea Grain Initiative were implemented to facilitate agricultural trade amidst the conflict. Goyal & Steinbach (2023) use event study methods and detailed futures price data to examine how these events affected agricultural commodity markets.

Earlier studies found that the futures markets responded sharply to the Russia-Ukraine war. For instance, Carter & Steinbach (2023) revealed that wheat and corn futures prices increased by 35% and 16%, respectively, compared to counterfactual levels following the Russian invasion of Ukraine until the EU Solidarity Lanes were established in May 2022. However, these observed price increases are considerably lower than the initial projections at the conflict’s outset. The World Trade Organization (WTO) had forecasted a potential surge of up to 85% in wheat prices in 2022. While those earlier studies have explored the impact of the Russia-Ukraine war on various aspects such as food security, trade, and market volatility, the paper by Goyal & Steinbach (2023) assesses the specific response of agricultural commodity markets to the Black Sea Grain Initiative.

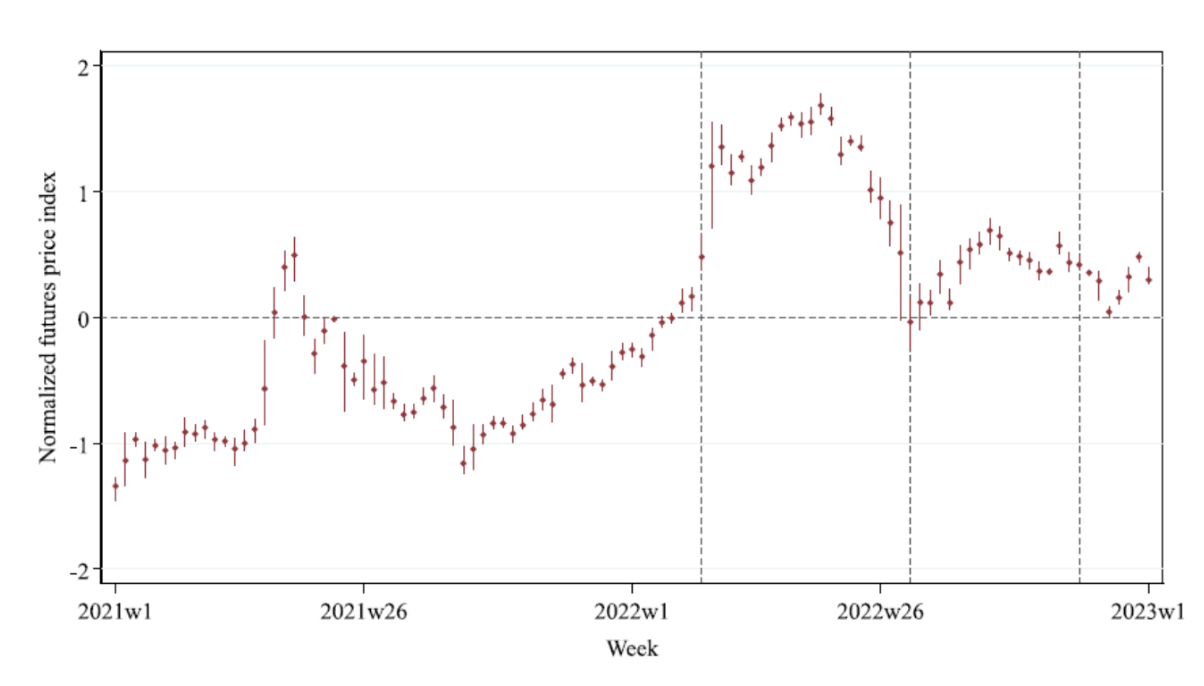

The EU established the Solidarity Lanes to address transportation challenges for agricultural commodities in May 2022. Subsequently, the Black Sea Grain Initiative, brokered by the United Nations and Turkey, aimed to revitalize agricultural shipments from blockaded Black Sea ports. Employing event study methods, Goyal & Steinbach (2023) find that agricultural futures prices rose by 16% above the counterfactual within the first nine weeks of the Russian full-scale invasion. However, prices started to decline after the EU Solidarity Lanes were established, indicating a positive market response to improved transportation routes for agricultural commodities. Contrary to expectations, the Black Sea Grain Initiative had little effect on market uncertainty caused by the conflict, with futures prices remaining unchanged post-implementation (figure 1).

Figure 1. Agricultural commodity futures price index

Note: Futures prices were normalized by subtracting the mean of the futures price and dividing it by the standard deviation between 2021 and 2023. This way, each futures price has a mean of 0 and a standard deviation of 1. The futures prices for barley, canola, corn, rapeseed meal, rapeseed, rice, soybeans, soybean oil, sunflowers, vegetable oil, and wheat were normalized. The index represents the global weighted average of all futures prices. We used average global production at the commodity level averaged for 2017 to 2021 as analytical weights (United States Department of Agriculture, 2023). The dot indicates the mean weekly index value, while the whiskers show the high and low index values within the week. The three vertical lines indicate the Russian full-scale invasion of Ukraine (week 8), the Black Sea Grain Initiative (week 29), and the first renewal of the Grain deal (week 46).

Analyzing different agricultural commodities, Goyal & Steinbach (2023) find that wheat futures were more reactive to the war than corn ones, suggesting anticipation of a complete shutdown of Russian and Ukrainian shipments via Black Sea ports (total volume of wheat transported by sea is higher than that of corn). Additionally, there was limited evidence of contagion effects on agricultural commodities not directly impacted by the conflict, with soybean futures prices remaining largely unaffected.

The findings challenge the prevailing narrative that the Black Sea Grain Initiative was critical in lowering agricultural commodity prices. Instead, our study highlights the importance of considering broader market and geopolitical factors in assessing the impact of conflicts on agricultural commodity markets. The research also provides valuable insights into the dynamic response of agricultural commodity markets to the Russia-Ukraine war and associated trade initiatives, emphasizing the need for policymakers and market participants to consider various factors in understanding market behavior during the war. Lastly, our findings illustrate that international cooperation and coordination played a key role in lowering the prices of agricultural futures.

References

Carter, C.A. and Steinbach, S., 2023. Did Grain Futures Prices Overreact to the Russia-Ukraine War? MPRA Working Paper 118248. Accessed at: mpra.ub.uni-muenchen.de/id/eprint/118248

Goyal, R., and Steinbach, S. 2023. “Agricultural commodity markets in the wake of the Black Sea Grain Initiative.” Economics Letters 231, 111297. Accessed at: doi.org/10.1016/j.econlet.2023.111297

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations