Budget execution is entering a new phase. Following a large-scale review in the year’s second quarter due to the crisis, the Government and MPs began to accommodate the budget to the pre-election reality. It has mainly to do with a change in the approach toward social and development spending on the eve of local elections. VoxUkraine analyzed how the 2020 budgetary targets were met in the year’s first half and what to expect in the future.

Revenue

According to the Treasury, revenue came in at 92% of the target amount.

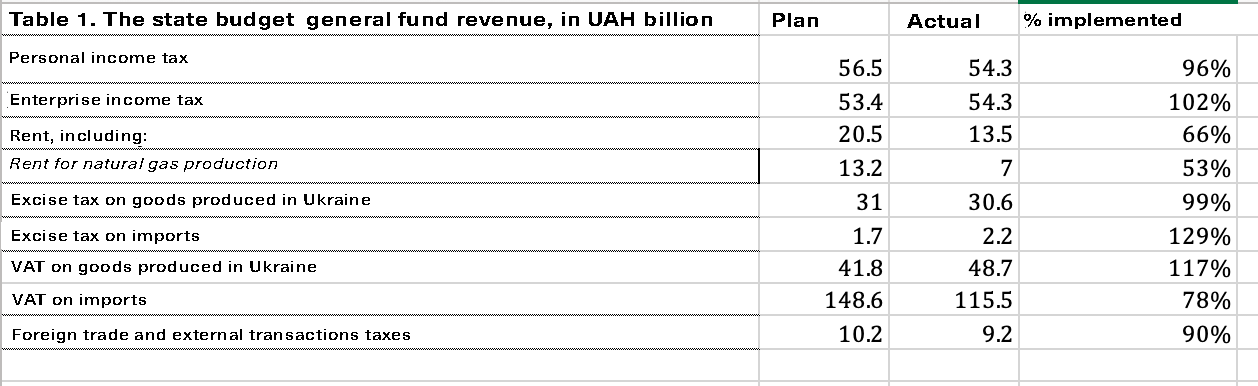

The targets were exceeded with regard to the value added tax on imports, excise tax on imports and income tax. (Table 1). Under quarantine, surpassing the targets is a positive phenomenon. However, it is not known how long this situation will last. For example, in the case of income tax, a slower pace of surpassing the targets was observed. In the first quarter of 2020, the general fund of the state budget received UAH 33.5 billion in income tax (a UAH 1.2 billion surplus). In January-June 2020, actual revenue came in at UAH 54.3 billion, with a UAH 0.9 billion surplus.

Rental revenue continues to dip significantly, being 66% of the target amount.

Source: The State Treasury Service

According to the Ministry of Finance, the slower pace of surpassing the targets with regard to income tax during the second quarter is due to the quarantine restrictions, introduced in March 2020. Quarantine also had a negative impact on revenue from other taxes, such as personal income tax, value added tax, and excise tax.

But this effect is not as visible in the May-June figures as it was in April. The thing is that in April, when an updated version of the budget was adopted by Parliament, the Ministry of Finance did not update the April revenue targets. Therefore, the April performance indicators were worse than those of the next two months.

When analyzing budget execution, we can see a positive trend with respect to excise duties, including tobacco products. Tobacco companies explained to VoxUkraine that the trend was due to the absence of pressure from the so-called “Kholodov amendment” that established a fixed profit margin of selling tobacco products. The amendment was at one time voted by the MPs but ended up vetoed by the President. And it did not take long to see the effect.

Starting in February, there was a steady monthly surpassing of the excise tax targets. According to the results of the year’s first half as stated by the Finance Ministry, there was a cumulative UAH 1.1 billion surplus.

In Ukraine’s reality, dividends from state-owned enterprises are used as a means to patch the budget holes. It is common practice for the Government to adjust the payment schedule in line with the periods when the budget needs additional resources. At the end of last year, the Government instructed Naftogaz to transfer part of the dividends in advance, with the remaining part to be transferred by the end of June this year. Another source of pumping up the budget was PrivatBank transferring UAH 24.5 billion in dividends.

Spending

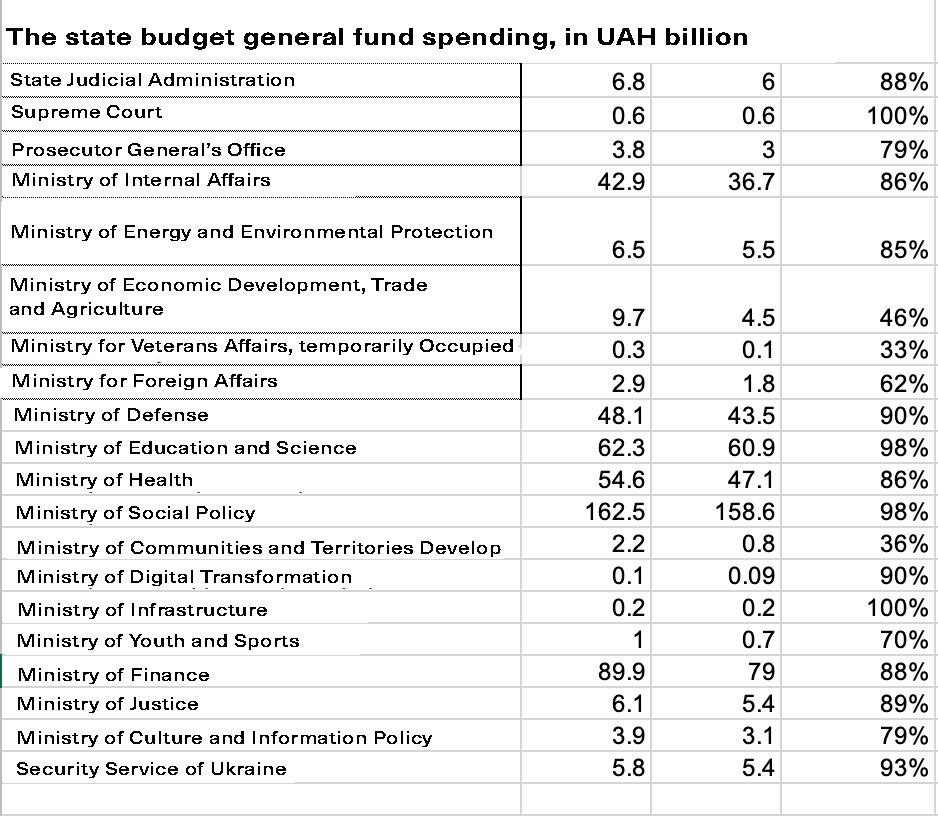

The level of expenditure in the year’s first half was 90% of the target amount. The state did not use about UAH 50 billion of the planned spending (Table 2).

The low level of funding available for the “coronavirus-related” spending strikes the eye. We are talking about spending foreseen in the budget to overcome the effects of the coronavirus crisis: allocations to the Social Insurance Fund of Ukraine for financial aid and insurance payouts. Spending under this program in the year’s first half amounted to 1.6% of the program’s planned spending.

The minimal funding can be partly explained by the Government’s belated decision to appropriate funds. The Cabinet began to allocate funding to the COVID-19 Response Fund in late April – May. However, there is another reason.

The Social Insurance Fund is used to provide temporary disability benefits due to coronavirus-related treatment or self-isolation under medical supervision, as well as one-time assistance to the families of doctors.

“Funds are transferred on the basis of information about the actual need,” the Ministry of Finance explained to VoxUkraine. Simply put, the state pays just as much as is needed. In actual fact, it turns out that much less was needed than planned.

According to the Ministry of Finance, it was planned that 241,872 people would get temporary disability benefits, but as of July 30, they were actually received by 6,989 people. The same with assistance to the doctors whose relatives died of coronavirus: similarly, it was received by only 6 families of the originally estimated 148.

Another type of coronavirus-related support, assistance to individual entrepreneurs with children under 10 years of age suffering from quarantine restrictions, is also in low demand. Of the UAH 1.6 billion available in the year’s first half, only UAH 0.3 billion or 19% was spent. The reason is the same as with the previous types of benefits. Spending under this program is made available for 337,207 entrepreneurs, while according to the Ministry of Finance, starting in May this year, assistance was awarded to 80,950 individual entrepreneurs but actually received by four times fewer people – 74,892.

Given the state of affairs, this budget program’s amount was reduced by UAH 0.5 billion.

Implementation of some development and state support programs is also on a low level. For example, 63% was spent on financial assistance to agricultural producers over the six months.

In the year’s first half, subventions from the state budget to local budgets for the social and economic development of territories were put on hold. The Regional Development Fund did not get enough funding either: of the UAH 2 billion available, only UAH 0.6 billion was spent. Funding for these programs increased in July-September, on the eve of local elections. On July 8, the Government already had nearly 99% allocated as a subvention for social economic development for more than 1,150 projects.

Additionally, the state saved UAH 7.1 billion in public debt service, including because of the stronger hryvnia.

Spending on road construction was quite buoyant. Over the six months, the state spent over 40% of the annual amount for Ukravtodor.

Future trends

The key changes regarding the state budget in the near future will have to do with social spending in the first place.

What exactly to expect?

First, both revenue and expenditure are highly likely to increase due to the Government’s plans on raising the minimum wage from September 1.

The budget employees salary fund will increase by UAH 2.9 billion. In addition, spending under the medical guarantees program will increase by UAH 1.1 billion. According to the calculations by the Ministry of Finance provided to VoxUkraine, the largest increase in the wage bill is UAH 1.9 billion in the education sector and UAH 0.2 billion in the healthcare sector. Budget revenue will also increase, with extra revenue expected to reach UAH 3.1 billion.

For reference. The anticipated fiscal effect of raising the minimum wage

The state budget will receive UAH 0.54 billion, including UAH 0.46 billion in personal income tax; value added tax on goods (works, services) produced in Ukraine with the budget reimbursement of UAH 0.1 billion.

Local budgets will receive UAH 0.94 billion, including UAH 0.7 billion in personal income tax; and UAH 0.2 billion in the unified tax.

Source: Ministry of Finance

Second, changes in the rules of implementing certain social programs, and an increase in some kinds of social spending. The biggest major change in this area is the Government’s decision to monetize the Baby Package one-time assistance. This program was introduced at one point by the Government of Volodymyr Groysman. When a child was born, a young family received a box of basic necessities for the baby. Now, families will receive UAH 5,000 to their PrivatBank payment card, which they will be able to spend on things for their child in a clearly defined list of stores. The Cabinet of Ministers also approved an increase in certain kinds of social spending. This includes increased pension supplements for those hit by the Revolution of Dignity.

Third, spending is highly likely to increase because of the local elections. Introducing new types of assistance and increasing the existing ones is a classic tool of flirting with the electorate, and the current Government’s course shows that it will not be neglected.

Fourth, less saving with regard to debt service because of the exchange rate factor. In April-May, the hryvnia exchange rate strengthened to UAH 26.5-26.8 / USD, which reduced the cost of national debt service. In June-July, the national currency weakened somewhat, hence less saving. However, it is important to remember that the exchange rate factor also affects income, with a weaker hryvnia generating more tax revenue from imports.

Fifth, one cannot rule out new tax benefits with an unknown effect on the budget. Under the stand-by cooperation program with the International Monetary Fund, the Ukrainian side promised to refrain from introducing new tax exemptions or benefits (except for the reliefs adopted because of COVID-19). But the fulfillment of this promise may have to grapple with the position of the MPs who are in favor of a large number of tax preferences.

This material was prepared as part of the Budget Watchdog project with the support of the German Government’s project “Good Financial Governance in Public Finance III”, implemented by Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations