During the full-scale invasion, business support has become critically important because taxes, which depend on business activity, are the main source of funding for defense expenditures of the state budget. Ukraine’s international partners emphasize the need to increase the share of internal financing and reduce dependence on external support for the purposes of recovery and further economic growth. One of the most well-known business support instruments is the state program “5-7-9.” How effectively does it work in times of war?

During the full-scale war in 2022-2023, the state program “Affordable Loans 5-7-9%” played an unprecedentedly high role in providing debt financing for enterprises against the backdrop of slowing down bank lending on market terms. As of December 2023, approximately 40% of the net hryvnia loan portfolio of Ukrainian banks consisted of subsidized loans provided under the Program, and according to the chairman of the Entrepreneurship Development Fund, 90% of new loans to businesses during the full-scale war were issued within the framework of the Program.

However, the current design of the Program is far from optimal. The Program has lost its initial focus, as it has been utilized as a broad and convenient tool for supporting businesses during the COVID-19 crisis and full-scale war. As a result, over its four years of existence, it was revised more than 20 times.

The scale and multi-faceted nature of the Program may seem an example of one of the most significant interventions by the state into the market mechanism in the banking sector, 53% of whose assets are already controlled by state-owned banks. This raises legitimate concerns within the professional community regarding the increasing threat of market discipline violations, misaligned incentives, and possible corruption and moral hazard.

On the other hand, under the “perfect storm” and contraction of business activity due to initial shocks from the full-scale invasion and the extraordinary challenges of the “war finance” regime, subsidized loans was a logical component of macro-financial stabilization policy for timely financing of agribusinesses, export support, retail sales, and increasing the chances of survival and resilience of numerous small and medium-sized enterprises.

Therefore, to develop recommendations for enhancing the “5-7-9” Program, it is necessary to thoroughly analyze it.

The Evolution of the “Affordable Loans 5-7-9%” Program

In January 2020, at the initiative of the President, the Government approved the State Program “Affordable Loans 5-7-9%” (hereinafter referred to as the Program), aimed at supporting investment activities, creating jobs exclusively in the micro and small businesses, and supporting startups by providing loans at preferential rates. The difference between the subsidized (5, 7, or 9%, later 0 or 3%) and market rates is compensated from the state budget, but the decision to issue a loan is made by banks.

The first significant change in the Program design occurred in a few months during the COVID-19 crisis when many businesses were unable to continue operations and, consequently, lacked liquidity. To support the financial stability and liquidity of micro and small enterprises (MSEs), two new types of loans were offered within the Program: crisis liquidity loans (at up to 3% per annum and 0% during the quarantine period and 90 days after it), and refinancing, with an interest rate of 0%. Additionally, the Program was expanded to include MSE manufacturers of pharmaceuticals and medical equipment. In 2021, individual entrepreneurs meeting specific criteria, such as a limit on annual income volume, being residents of Ukraine, etc., were allowed to receive loans under the Program.

With the onset of the full-scale invasion, the Program was significantly changed for the second time: the scope of recipients was greatly expanded (large companies were included), and new lending options were added to support businesses during the war. First, support opportunities for agricultural producers were expanded to finance sowing, and a separate Program area – sowing campaign support – was introduced. Second, a special type of loans – for overcoming the consequences of the full-scale invasion, including the restoration of production capacities – were offered (“anti-war goals” in the classification of the Entrepreneurship Development Fund (EDF), which administers the Program). Additionally, in 2022, the Program was expanded to include retail chains; in 2023, energy companies were added. Essentially, the Program transformed from a tool for supporting small businesses into a financing instrument for a wide range of enterprises.

During both COVID-19 pandemic and the full-scale invasion, changes to the Program were made under very tight time constraints and without careful analysis of the pros and cons. This resulted in imbalances, which were later discussed by experts from the National Bank, the Ministry of Finance, and the banking community. Among them were sectoral and regional disparities in the distribution of preferential credit funds, cases of lending to unreliable companies, and an increase in non-performing loans (NPLs) under the Program from 1% to 7% during 2022 and the first ten months of 2023. In March 2023, the NBU and the Government made changes to the Program, which included raising interest rates (particularly for working capital loans), discontinuing the provision of refinancing for previously issued loans to overcome the consequences of the COVID-19 crisis, and other. At the same time, the scope of lending goals was expanded, including businesses operating in de-occupied and front-line territories, and in the fall, the Program focused on supporting processing companies and energy efficiency projects.

In July 2023, during the Ukraine’s IMF Program review, development of a new strategy for the 5-7-9 Program and return of its focus to SMEs became one of the structural benchmarks. The implementation of this structural benchmark was planned by the end of September 2023, but it was not achieved, and after the second review of the Program, the deadline was extended to the end of March 2024. Therefore, returning the Program’s focus is essential for maintaining macroeconomic stability in Ukraine.

The Program is complemented by the possibility of providing loans under portfolio guarantees, the volume of which exceeded UAH 105 billion for 33.2 thousand contracts by mid-February 2024. The volume of guaranteed loans being serviced as of February 1, 2024, amounted to UAH 67.2 billion, of which almost 70% were provided under the “5-7-9%” Program. However, a detailed analysis of the state guarantee instrument is beyond the scope of this study.

Who and when received loans under the “5-7-9” Program? Data analysis

In the context of improving the development strategy of the “5-7-9” Program, let’s examine the financial data for the period of the Program’s existence. Below, we analyze the most detailed historical data available from the Entrepreneurship Development Fund (EDF) from August 2020 to September 2023 on a weekly basis, partially supplemented with latest aggregated data as of early February 2024. These data provide the opportunity to comprehensively investigate the dynamics of preferential lending volumes and assess the development, shortcomings, and effectiveness of the “5-7-9” Program.

Overall loan dynamics under the Program

During 2020-2023, the total volume of loans provided under the “5-7-9%” program steadily increased. The volume of newly issued loans each month exceeded the repayments of old ones (see Figure 1).

Chart 1. Cumulative Lending Dynamics under the 5-7-9 Program, billion UAH

Data: EDF

According to the latest data published by the EDF, the total amount of signed loan agreements has increased to UAH 276.9 billion as of February 19, 2024. Meanwhile, the current outstanding debt of borrowers holding subsidized loans amounted to UAH 126.8 billion in early 2024.

The Program's significant role for businesses and the economy as a whole is underscored by the rapid increase in the share of loans issued under the "5-7-9%" program in the net hryvnia corporate portfolio: from 5% in 2020 to 18% in 2021, 26% in 2022, and up to 40% by the end of 2023. (As mentioned above, among the new loans issued during the full-scale invasion, the share of loans subsidized under the Program reaches 90%).

Two-thirds of the volume of signed credit agreements under the Program (67.4%) corresponds to the period of martial law in Ukraine, from February 24, 2022, to February 5, 2024 (latest available data). Thus, the growth of the credit portfolio under the "Affordable Loans 5-7-9%" Program is mainly driven by the redesign of the Program in the context of the full-scale war.

The budgetary funding for the Program has significantly increased: in 2020-2021, UAH 2 billion was allocated for it, in 2022, this sum grew to UAH 7 billion, in 2023 to UAH 16 billion, and in 2024 to UAH 18 billion (see Table 1).

Expenditures under the budget program "financing 5-7-9" were paid in full, except for 2022 (however, in this year, actual expenditures were almost at the level of the initial plan). According to the Report on the implementation of the corresponding budget program for 2022, all funds received for this Program from the budget were spent.

Table 1. Indicators of Budget Financing for the Program

| Year | Initial annual plan, billion UAH | Revised annual plan, billion UAH | Executed during the period, billion UAH | Percentage of execution compared to the revised annual plan, % |

| 2020 | 2.0 | 2.0 | 2.0 | 100.0 |

| 2021 | 2.0 | 4.072 | 4.072 | 99.99 |

| 2022 | 7.0 | 9.326 | 6.326 | 67.8 |

| 2023 | 16.0 | 16.0 | 16.0 | 100.0 |

| 2024 (plan) | 18.0 | - | - | - |

Data: OpenBudget, NBU

According to OpenBudget data, Program financing planned for 2023 was exhausted in November. The National Bank admits the deficit of funds to subsidize interest rates in its December Financial Stability Report. According to the regulator's estimate, as of the beginning of 2024, the government debt to banks amounted to UAH 7 billion.

Monthly dynamics of the absolute lending growth shows that after the introduction of martial law, the average monthly volumes of net loans issued under the Program significantly increased, with local peaks in April-May 2022 and December 2022 (see Figure 2).

Figure 2. Net Increase in Lending Volumes under the 5-7-9 Program, billion UAH

Data: EDF

Thus, there is seasonality related to financing needs for spring sowing: the average growth rates of loans during March-May were 1.7 and 2.1 times higher than the annual averages in 2021 and 2022, respectively. However, in 2023, the difference became less acute. The local peaks in December (1.5-2 times higher compared to the average monthly volumes of issued loans) can be explained by the traditional expenditure of budgetary funds and banks fulfilling their annual plans. For the anomalous year of 2022, the increase in financial needs of businesses due to shelling and blackouts also contributed. Therefore, we observe an increase in demand for loans at preferential rates in early spring and in December.

Lending structure by program support areas

Numerous changes in Program design have resulted in high variability of support areas of "Affordable Loans 5-7-9%" instrument. The change in areas is shown in Table 2. However, the existing classification of loans from the EDF is not mutually exclusive (e.g., farmers may receive loans for both sowing campaign and working capital support), which complicates the analysis of the Program's effectiveness.

Figure 3 demonstrates a significant change in the structure of new loans issued under the 5-7-9% Program before and after the full-scale invasion. Following the initial active issuance of refinancing loans, there was a decrease in their share and an increase in the share of crisis loans, which involved financing companies' working capital as early as the second half of 2020. Loans for investment purposes did not play a significant role during this period, with their share between 7% and 18%.

In Figures 3 and 4, the classification for the years 2020-21 (6 types of loans) is shown, while the classification for 2022-2023 (14 types of loans) is adjusted to the previous classification, as shown in Table 2.

Table 2. Classification of Loans under the "5-7-9" Program by the Entrepreneurship Development Fund

| 2020-2021 | 2022-2023 |

| Anti-war | Anti-war |

| Anti-crisis | Anti-crisis, energy, processing (agriculture), commercial companies |

| Investment | Business recovery, investment, investment 2023 |

| Sowing campaign support (agro) | Sowing campaign support (agro), sowing campaign support (agro) 2023 |

| Support for individual entrepreneurs | Support for individual entrepreneurs |

| Refinancing | Working capital 2023, extension of (working capital) loans, refinancing |

Source: Compiled by the authors based on data from the EDF

Figure 3. Dynamics of the Increase in 5-7-9% Loans by support areas, billion UAH

Source: Compiled by authors based on EDF data

Figure 4. Cumulative Dynamics of 5-7-9% Loans by support areas, billion UAH

Source: Compiled by authors based on EDF data

With the onset of full-scale war, the list of loan types of the Program expanded. Mostly, loans were issued for "anti-war purposes" (as defined by the EDF), effectively replacing previous anti-crisis loans. Local lending peaks in spring 2022 were mainly formed by loans to farmers to support their sowing campaign, while in December, significant growth in anti-war loans was recorded. Most loans under the 5-7-9% Program are relatively short-term, contradicting the initial idea of long-term financing for investment purposes.

The structure of the Program has seen a noticeable increase in the share of loans at "5-7-9%" to support the sowing campaign for agricultural companies, while the share of investment loans continued to decline despite a temporary spike in May 2022 amid a brief activation of emission financing of the economy at that time.

In spring 2023, liquidity support loans and sowing loans formed the largest share of the total volume of new loans. The share of investment loans slightly increased. The share of loans provided to individual entrepreneurs (to replenish their working capital), to energy companies, and for the reconstruction remains relatively low.

The distribution of loans by support areas shows that the Program is mainly aimed at supporting companies' current activities rather than for investment purposes. On the one hand, the Program has become an important tool that helped companies navigate through crisis periods: since the inception of the Program, 81.4 thousand loan agreements have been signed. On the other hand, there is a question about the appropriateness of widespread financing of current activities at preferential rates, as this contradicts the initial idea of the Program as a driver of business development.

Lending structure by economic sectors

Agriculture and trade obtained the largest share of loan sums under the "5-7-9%" program (see Figure 5). By the end of 2023, agricultural companies accounted for 49% of the total volume of subsidized loans during the Program's existence. The smallest share of the agrarian sector in the portfolio of subsidized loans was in the second half of 2021 - 43%, after which it returned to previous levels. As a result of such intensive state support for agriculture with loans, "5-7-9%" loans currently constitute 68% of all outstanding hryvnia loans in this sector, and agricultural producers holding these loans accounted for about a third of the total industry revenue.

The retail sector accounts for 26% of all "5-7-9%" loans issued. Trade had a relatively high share even before 2022, when the Program introduced the additional opportunity to finance large retail chains. Only 15% of subsidized loans were issued to firms in the industrial sector. The remaining sectors, such as services, construction, and finance, accumulated even smaller shares of loans (6.4%, 2.1%, and 0.03%, respectively).

Figure 5. Dynamics of the Structure of Cumulative Volume of 5-7-9% Loans by Sector, %

Data: EDF

Monthly analysis of loan growth allows to see changes in lending dynamics across sectors. Since its inception and up to the present day, the "Affordable Loans 5-7-9%" Program has essentially been directed towards two sectors - agriculture and retail trade. The combined share of companies in these sectors in net loans under the Program exceeds 70% (although the Program was not initially planned for these sectors). This may be explained by companies in these sectors being the most creditworthy and meeting banking standards. However, since May 2023, the share of new loans issued to retail companies has become significantly higher than that of loans provided to agricultural companies.

Figure 6. Dynamics of the structure of the increase in 5-7-9% loans by sector, %

Data: EDF

Companies in the processing industry are in third place by the share of program loans, but their share (8-18%) remains significantly lower compared to the leading sectors. What is the rationale for providing support to the retail trade sector and other relatively well-off companies abstracting from the war losses? Clearly, banks benefit from lending to these companies, but is it necessary to support them at the public expense?

Regional distribution of issued loans

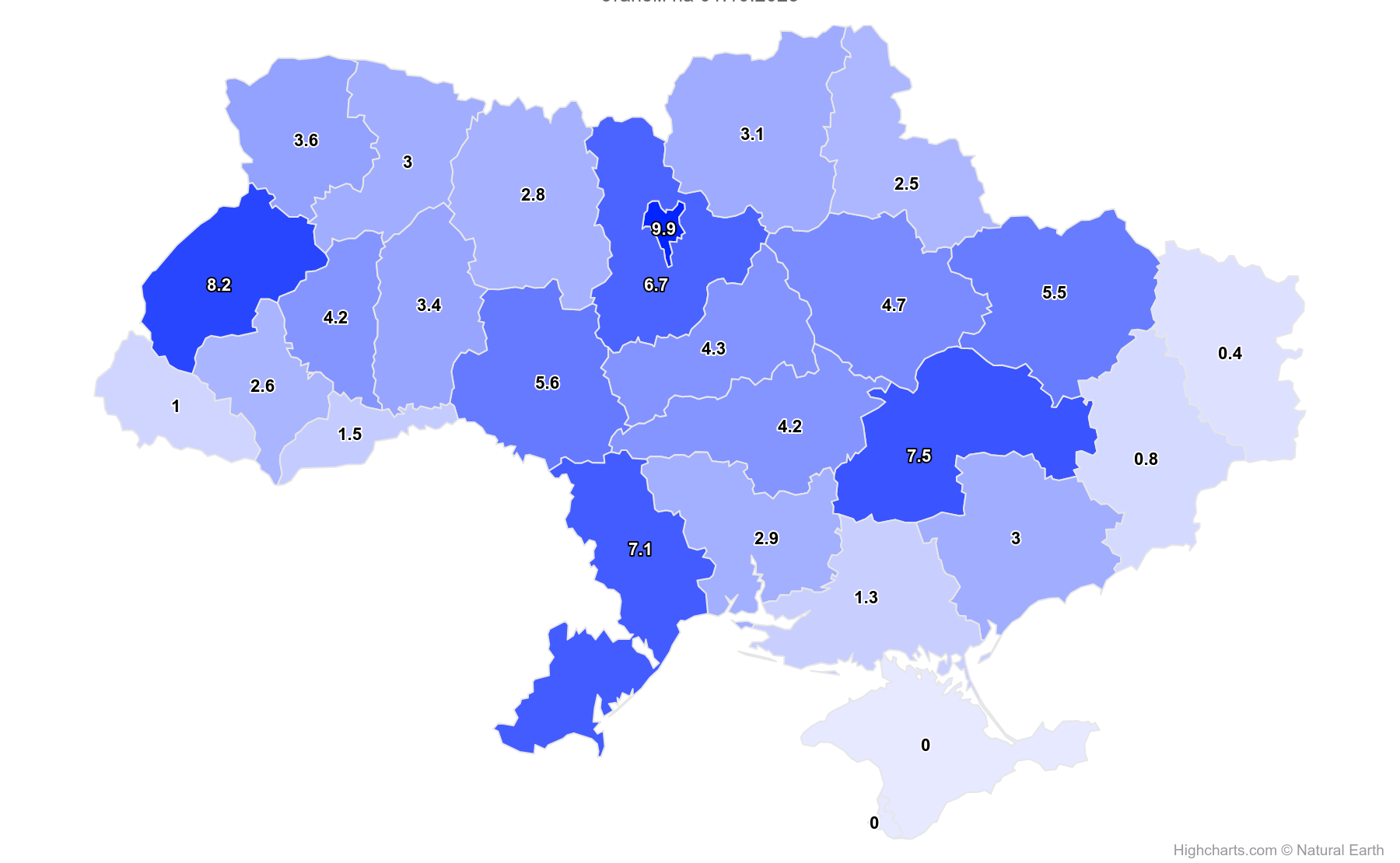

The geographic distribution of loans issued under the "5-7-9%" program has been rather uniform: no region has a considerably higher share of loans compared to other regions (see Figure 7). Top 3 regions in terms of the share of loans issued are Kyiv City (9.9%), Lviv region (8.2%), and Dnipropetrovsk region (7.5%). This corresponds to the overall ranking of regions by gross regional product. However, the geographic distribution of preferential lending is less concentrated than the distribution of economic potential.

The state program "Affordable Loans 5-7-9%" covers the entire territory of Ukraine except for the temporarily occupied territories in the South and East, where no loans were issued even before the full-scale invasion.

Figure 7. Structure of 5-7-9% Loans by Regions of Ukraine, %

Data: EDF

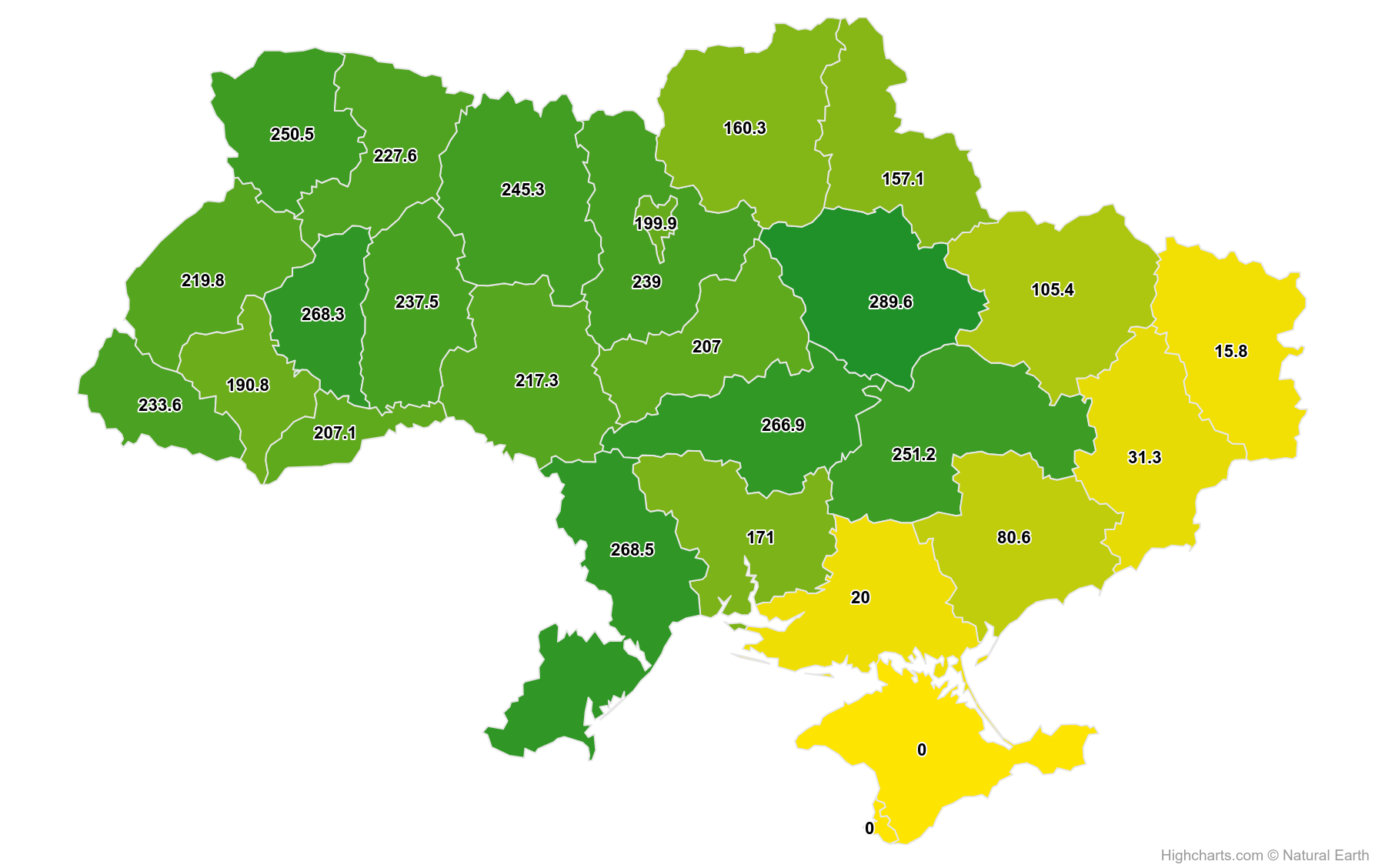

The "5-7-9%" regional loan portfolios grew at different rates during the Program implementation. In 2022-2023, despite the absolute increase in portfolio volume, a significant decrease in the total share of "5-7-9%" loans was observed in the Kharkiv region (from 8% to 5.5%), Zaporizhzhya region (from 5% to 3%), and Kherson region (from 3.2% to 1.3%). Relative increase in the total loan amounts during martial law is shown in Figure 8.

Figure 8. Growth of Loans by Regions of Ukraine during 2022 - 9 Months of 2023, %

Data: EDF

Note: The graph shows the ratio of the outstanding loans issued under the Program as of September 29, 2023, to the outstanding loans as of January 1, 2022 (%).

As shown in Figure 8, the volume of loans issued during 2022-2023 increased across the country, albeit least intensively (+15-80%) in South and East, where hostilities are ongoing and there are temporarily occupied territories. The highest growth rates of subsidized lending are observed in the central oblasts: Poltava (+290%) and Kirovohrad (+267%). Significant increases in lending volumes were recorded for companies in areas relatively close to the contact line, such as Odesa and Dnipropetrovsk regions, as companies from temporarily occupied communities primarily re-registered around these large cities. Moreover, the demand for funding from agribusinesses remains in these regions, and there is a new demand for loans to overcome the consequences of war. Due to business relocation and relatively better business conditions, significant increase in the volume of subsidized loans is observed in the western macro-region. The volume of loans provided to companies in Kyiv has tripled (+199.9%) since the beginning of 2022.

Table 3. Net Absolute Increase in 5-7-9% Loans, Aggregated by Macro-regions of Ukraine, million UAH

| Macro-region | 2nd half of 2020 | 1st half of 2021 | 2nd half of 2021 | 1st half of 2022 | 2nd half of 2022 | 1st half of 2023 | 3rd quarter of 2023 |

| West | 4 491 | 7 110 | 6 060 | 11 027 | 9 963 | 12 002 | 7 409 |

| North | 3 908 | 8 232 | 7 764 | 11 000 | 10 857 | 10 247 | 8 264 |

| Center | 4 306 | 8 985 | 7 666 | 15 520 | 11 957 | 15 559 | 7 888 |

| South | 2 977 | 5 827 | 5 049 | 6 644 | 5 294 | 5 030 | 3 714 |

| East | 1 768 | 3 755 | 3 439 | 2 708 | 1 923 | 1 870 | 978 |

| Total | 17 451 | 33 908 | 29 976 | 46 899 | 39 993 | 44 707 | 28 254 |

Data: EDF

Due to the decline in business activity resulting from elevated war risks, companies in the South and East started receiving significantly less financing under the Program. Instead, regions where the impact of the war was relatively weaker (the Center, Western Ukraine, and, more recently, the North) received the largest volumes of state credit support.

Banks participating in the "Affordable Loans 5-7-9%" Program

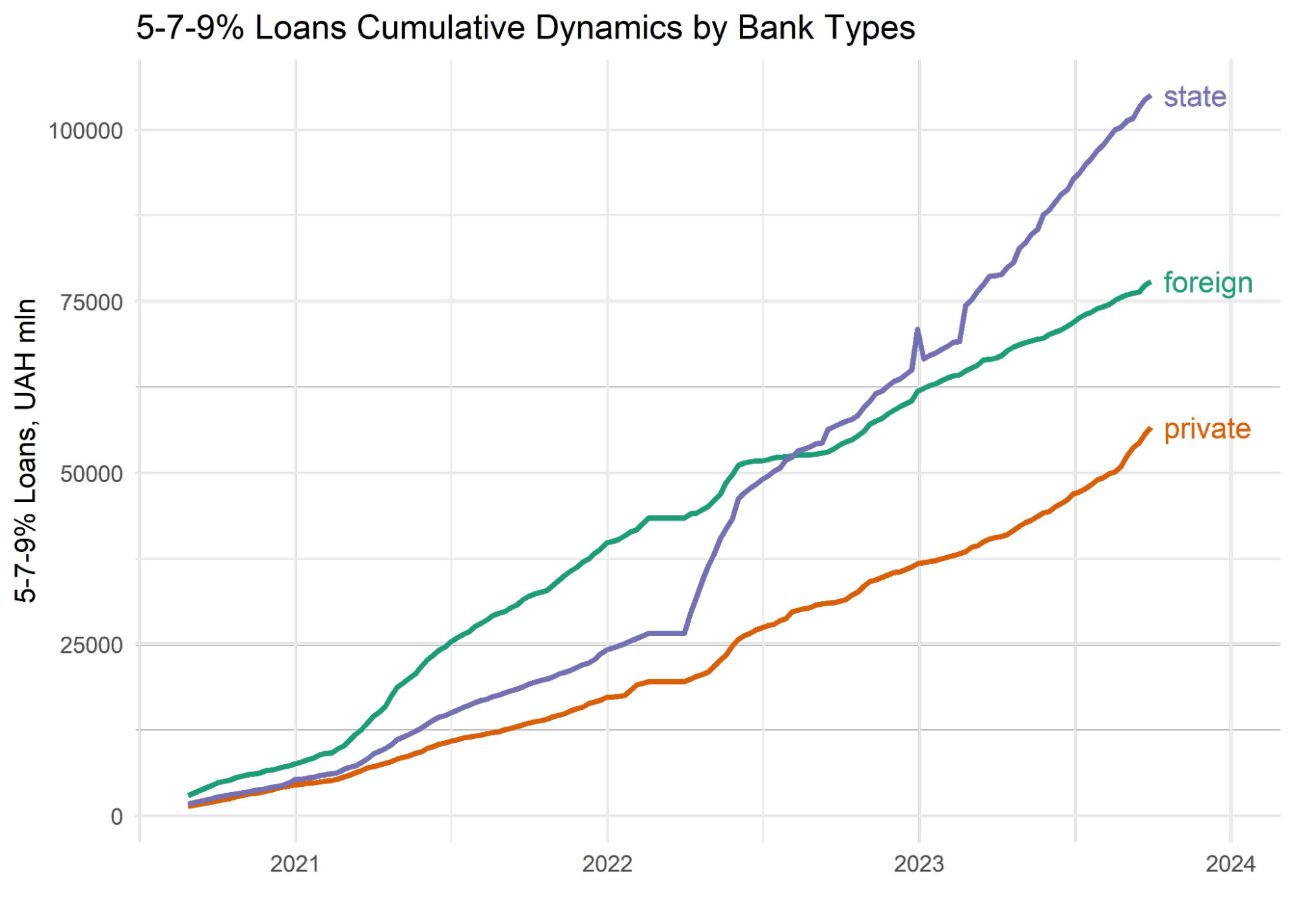

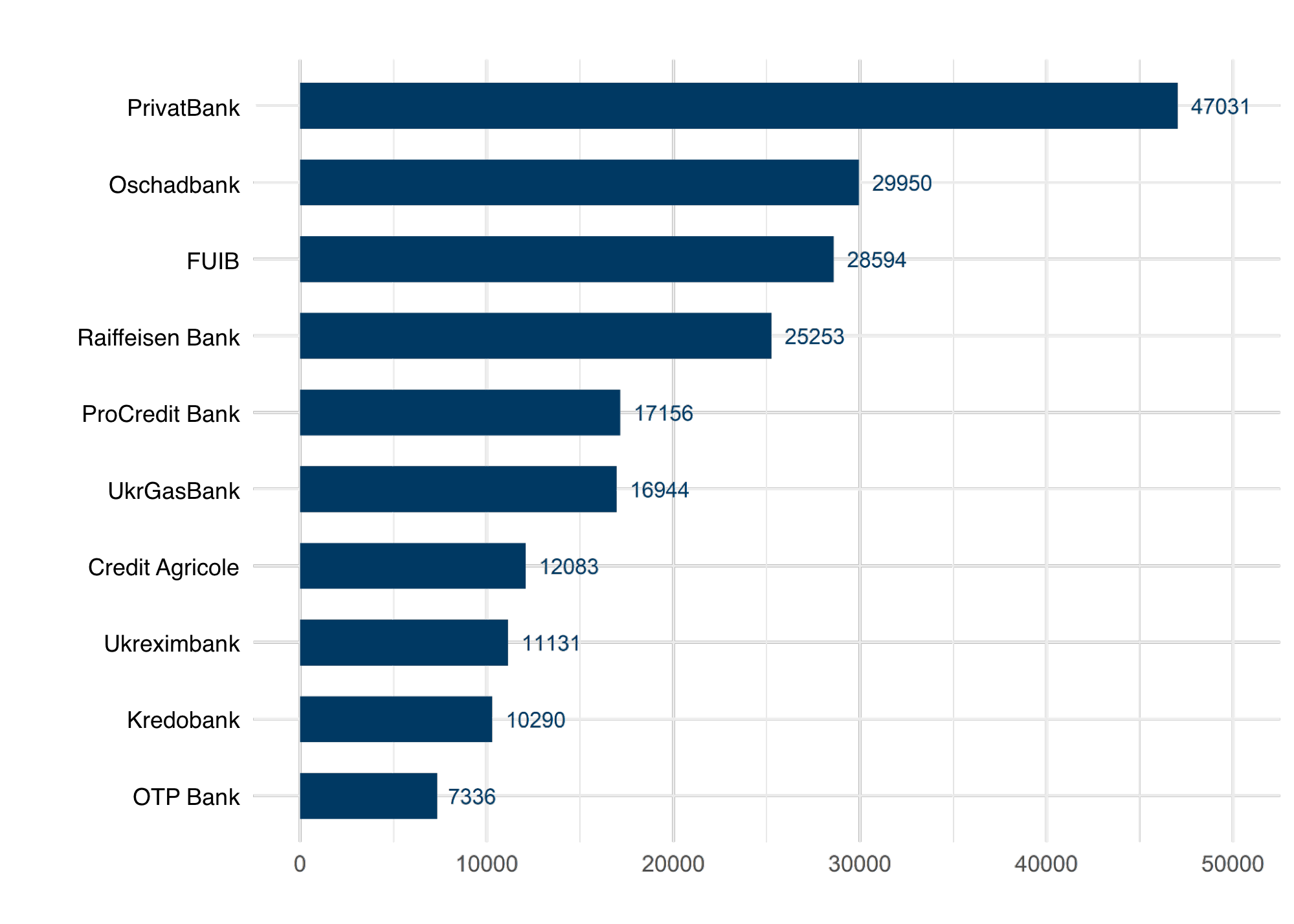

From the beginning of the Program until mid-2022, the leaders in affordable financing under the Program were banks with foreign capital (see Figure 9). However, starting from the second half of 2022, financing has been mainly carried out by state-owned banks, primarily PrivatBank and Oschadbank (see Figure 10). According to media reports citing representatives of Oschadbank, the bank issued loans to four large retail chains.

Figure 9. Cumulative Dynamics of 5-7-9% Loans by Bank Type, million UAH

Data sources: EDF, NBU, Bankografo.com. Note: "state" refers to state-owned banks, "foreign" refers to banks with foreign capital, and "private" refers to private Ukrainian banks (without foreign capital). Bank classification is aligned with the NBU approach.

Figure 10. Distribution of 5-7-9% Loans among the Top-10 Banks as of September 29, 2023, million UAH

Data: EDF

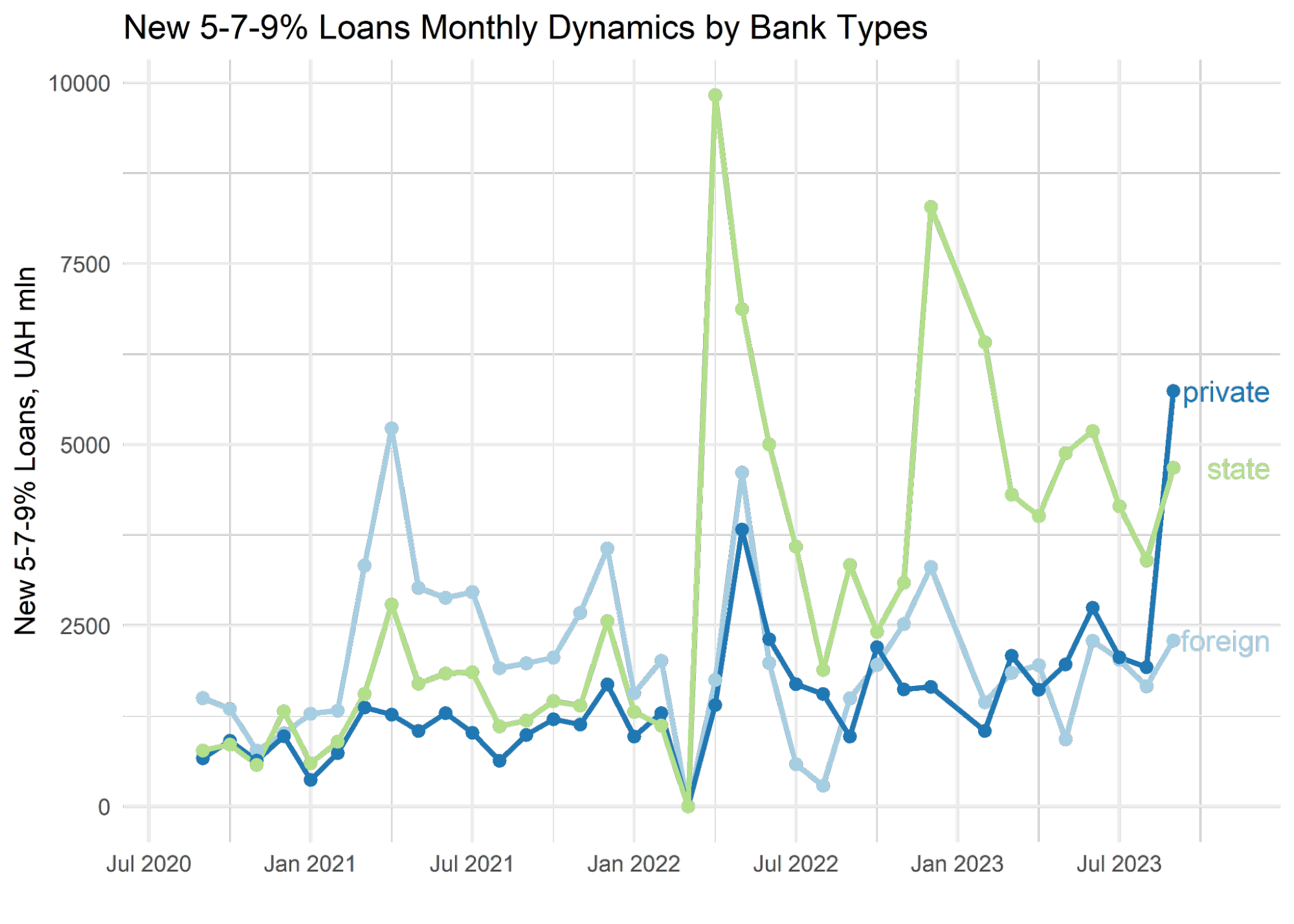

During martial law, banks with foreign capital clearly lag behind in the growth rates of "5-7-9%" loans not only compared to state-owned banks but also to the private FUIB (see Figure 11), which in September 2023 was responsible for domestic private banks surpassing foreign banks in the volume of loans for the first time since the start of the program.

Figure 11. New 5-7-9% Loans Dynamics by Bank Types, UAH million

Data sources: EDF, NBU, Bankografo.com. Note: "state" refers to state-owned banks, "foreign" refers to banks with foreign capital, and "private" refers to private Ukrainian banks (without foreign capital). Bank classification is aligned with the NBU approach.

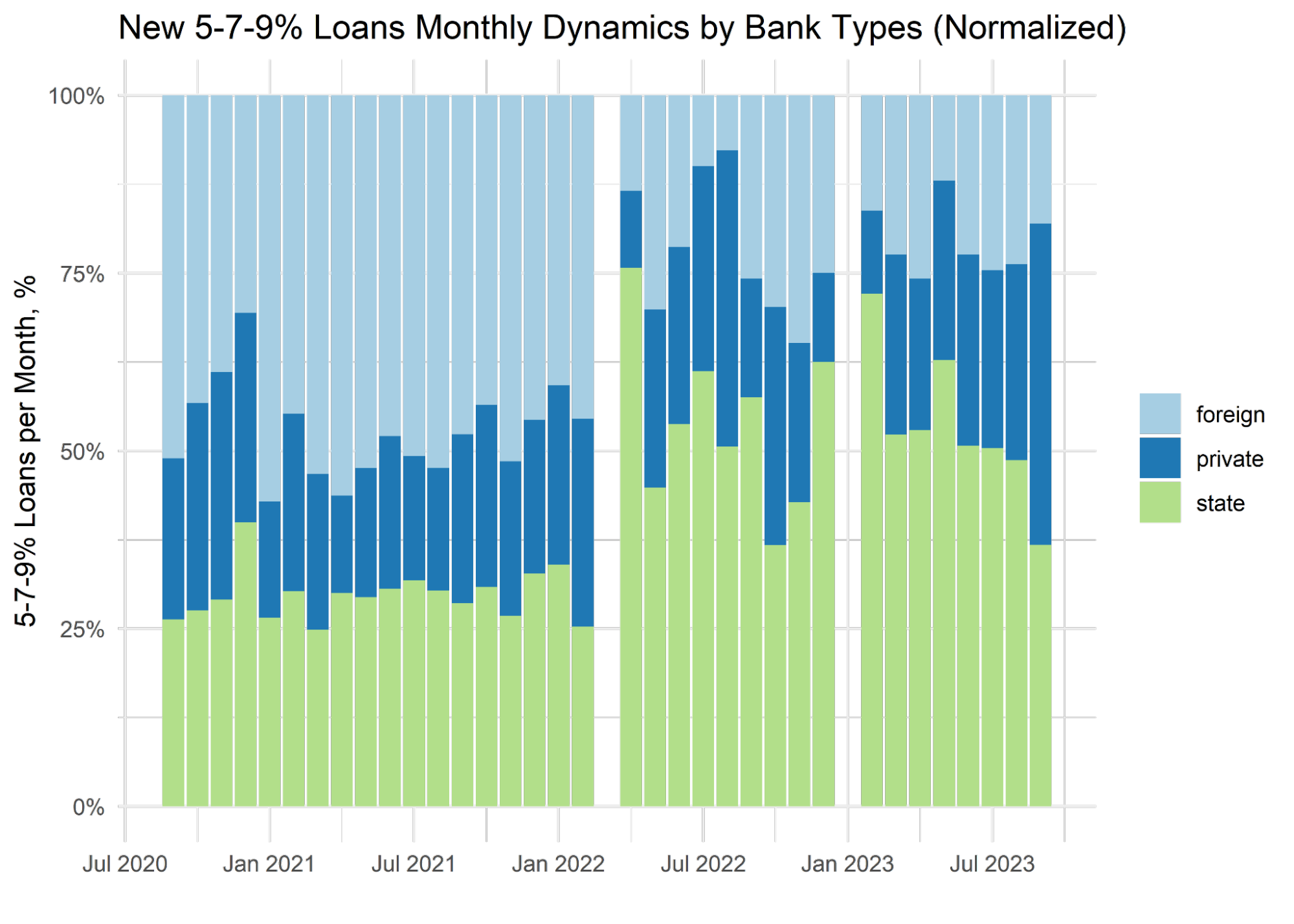

Figure 12. New 5-7-9% Loans Monthly Dynamics by Bank Type, %

Data sources: EDF, NBU, Bankografo.com. Note: "state" refers to state-owned banks, "foreign" refers to banks with foreign capital, and "private" refers to private Ukrainian banks (without foreign capital). Bank classification is aligned with the NBU approach.

Meanwhile, market leaders with foreign capital, such as Raiffeisen, ProCredit, Credit Agricole, Kredobank, and OTP Bank, remain within the top ten creditors. However, they consistently decrease their share in the Program. A possible reason for the decreased interest of banks with foreign capital in this Program is the delayed compensation of interest by the Government: the delay was two months by the end of 2022, and by the end of 2023, according to market participants, it increased to 5 months.

The increase in lending since early 2022 is primarily due to state-owned banks. This, despite the positive effects of smoothing the credit support collapse, increases the Government's share in the banking system assets, which is already quite high.

Suggestions for changing the Program design

Based on the analysis of the Program development, we suggest recommendations for Program improvement to enhance the positive effects of future implementation of the state loan support strategy.

- Focus the Program on supporting new SMEs, as initially intended. In other words, the Program should only involve companies that could not have obtained loans without it. To achieve this, the Government, in collaboration with banks, should develop clear criteria for distinguishing between large and small/medium-sized businesses to restrict access to credit for large companies structured as an SME group.

- Formulate clear effectiveness criteria for each loan purpose, focusing the Program on supporting investment loans by gradually phasing out refinancing of old loans and working capital under the Program. Record information on whether companies that received loans under the Program have achieved the business goals outlined in their loan applications or business plans and regularly publish this information in an aggregated format.

- Conduct a comprehensive asset quality review and detect tangible socio-economic effects of the old credit portfolio under the "5-7-9%" program (e.g., job creation, implementation of innovations, contribution to food and energy security, etc.), which, despite the narrowing of the Program's objectives, will remain in the Fund.

- Avoid "distortion" of program funding in favor of a particular group of banks, given the currently dominant role of state-owned banks in the Program (see Figure 12). There should be fair competition between banks to attract clients under the Program.

- Preemptively establish safeguards against abuses by businesses in de-occupied territories, including fictitious re-registrations, by conducting thorough review of credit applications by banks’ risk management and financial monitoring departments.

- Implement a mechanism for insuring against war risks, which will increase the share of investment lending in the Program structure and reduce the credit risks of borrowers.

While aspects of sustainable development are beyond the scope of this study, considering the NBU's announced increasing attention to ESG risks, we believe it is worth developing safeguards against a purely formal approach to controlling the sustainability risks of "5-7-9%" loan recipients. At the same time, excessive restriction of potential borrowers and lowering levels of financial inclusion due to complexity of including ESG components into loan applications should be avoided.

Overall, we advise to base the new Program strategy on the principles of avoiding accumulation of additional credit risk on the balance sheets of state-owned banks due to moral hazard risk. For example, accumulating non-performing loans in the segment of state-owned banks increases the likelihood of their recapitalization. Implementing clear KPIs separately for "emergency" crisis response funding and financing of investment projects will enhance the operational design of the Program. This will ensure more effective allocation of public funds to stimulate economic growth, given critically constrained public funds.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations