Starting January 1, 2016, when the Deep and Comprehensive Free Trade Area (DCFTA) agreement with the EU entered into force, trade between Ukraine and Germany has been demonstrating a positive trend. Currently, Ukraine’s main export groups to Germany include electric machinery, agricultural products, clothing and knitwear, ore and slag, metals and wood. At the same time, there is still room to further diversify the structure of Ukrainian export to Germany, and to take more advantage of the remaining export potential.

This research identifies the sectors of the German economy most dependent on imported goods, and in which Ukrainian manufacturers can thus find their own niche. Also, the study identifies the most promising Ukrainian products for exporting to Germany. Methodologically, the prospective goods are singled out according to two requirements: 1) identified revealed comparative advantages (RCA) in Ukraine and the absence of RCA in Germany; 2) evaluated significant potential for increasing exports to the German market, based on the assessment of the gap between the current and potential export volumes, or “undertrade”.

The estimation of the Gravity model, which links global production and consumption patterns to global trade patterns, suggests that the difference between actual and potential trade volumes between Ukraine and Germany at $500 million in 2016, or 35% of total export from Ukraine to Germany in the same year. In accordance with the structure and intensity of global export flows, Ukraine has the potential to increase the volume of trade in terms of both goods already exported to Germany as well as goods not yet supplied by the Ukrainian companies to this market.

The estimation of the Gravity model, which links global production and consumption patterns to global trade patterns, suggests that the difference between actual and potential trade volumes between Ukraine and Germany at $500 million in 2016, or 35% of total export from Ukraine to Germany in the same year. In accordance with the structure and intensity of global export flows, Ukraine has the potential to increase the volume of trade in terms of both goods already exported to Germany as well as goods not yet supplied by the Ukrainian companies to this market.

At the same time, imported intermediate goods contribute the most to the manufacture of German: motor vehicles, trailers and semi-trailers; machinery and equipment; chemicals and chemical products; coke and refined petroleum products; basic metals.

It means that Ukrainian exporters supplying inputs for these sectors have considerable potential in increasing their integration into the German and consequently – into the European and world production chains. It can already be seen that Ukrainian exporters are integrating into the above sectors, and that the DCFTA with the EU entering into force expanded existing and opened new opportunities. In particular, a number of new production facilities that manufacture electrical and other equipment (wire systems, cables, etc.) for the major international automotive companies opened in Ukraine since then. For instance, production facilities of Leoni, Elektrokontakt (producer of electrical equipment), or Bader (seat covers) currently operate in Ukraine.

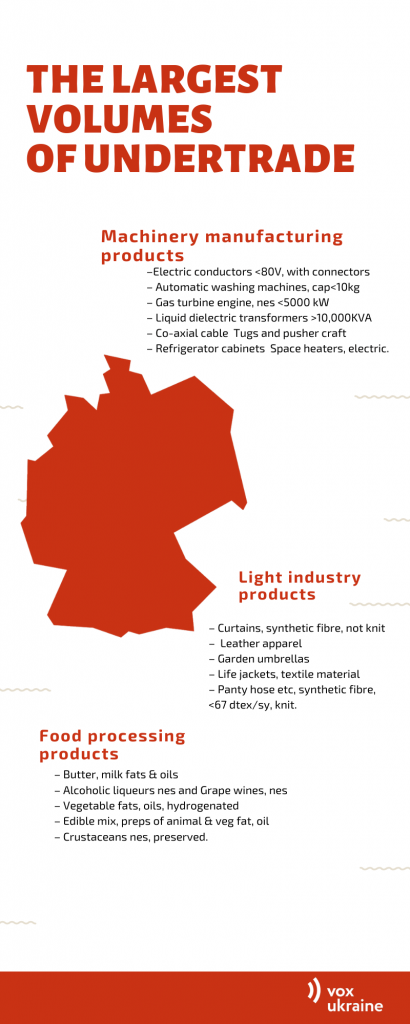

The study has also identified the list of 67 product groups, most promising for expanding Ukrainian exports to Germany. These products have been also prioritised because they fall under the ‘most promising sectors of Ukrainian economy’ according to the Export Strategy of Ukraine. For these product groups, the estimated insufficient trading volumes (undertrade) amount to USD 21.5 million, while actual exports of these goods amounted to mere USD 7.2 million in the same period (thus, the undertrade far exceeds the actual export volumes of these items).

Regardless of complicated regulations and low estimated undertrade volumes for the prospective sectors defined by Ukraine’s Export Strategy, export diversification is of paramount importance for Ukraine’s long-term economic growth, which is why facilitation of trade in these prospective sectors should be prioritised.

Following the abolition / reduction of EU import duties under the DCFTA, tariffs do not significantly restrict exports of Ukrainian goods to the EU. Instead, technical regulations, sanitary and phytosanitary measures, geographical indications, licensing, etc. create significant barriers to bilateral trade. Thus, undertrade can be explained, for instance, by the negative effects of various non-tariff barriers (both at European and national levels) or other factors, such as low competitiveness (in terms of price or quality) of Ukrainian goods compared to similar goods supplied by other countries, taste preferences of German consumers, peculiarities of importers’ associations, specific requirements of retailers, etc. Thus, harmonization of Ukrainian regulations with those of the European Union in accordance with the Association Agreement is likely to help reduce customs barriers and existing divergences in regulations, and consequently simplify the export of Ukrainian goods to the EU and Germany in particular.

Following the abolition / reduction of EU import duties under the DCFTA, tariffs do not significantly restrict exports of Ukrainian goods to the EU. Instead, technical regulations, sanitary and phytosanitary measures, geographical indications, licensing, etc. create significant barriers to bilateral trade. Thus, undertrade can be explained, for instance, by the negative effects of various non-tariff barriers (both at European and national levels) or other factors, such as low competitiveness (in terms of price or quality) of Ukrainian goods compared to similar goods supplied by other countries, taste preferences of German consumers, peculiarities of importers’ associations, specific requirements of retailers, etc. Thus, harmonization of Ukrainian regulations with those of the European Union in accordance with the Association Agreement is likely to help reduce customs barriers and existing divergences in regulations, and consequently simplify the export of Ukrainian goods to the EU and Germany in particular.

The results of the study are also important for prioritizing the process of harmonization of Ukrainian legislation with the European laws and standards aimed at reducing trade barriers faced by prospective product groups. Besides, the received estimates may help formulate Ukraine’s agenda and position when negotiating with European and German partners on reducing existing trade barriers on both the EU and bilateral levels.

Based on the results of qualitative and quantitative research, the relevant public authorities are advised to:

- Harmonise Ukrainian legislation, standards and procedures with those of the EU, in line with Ukraine’s commitments under the DCFTA within the framework of the Association Agreement with the EU. Technical barriers to trade, sanitary and phytosanitary measures, customs, protection of intellectual property rights are of particular importance.

- Prioritise harmonisation of sectoral legislation and standards in line with the prospects of increasing exports to the EU, the challenges of export diversification in accordance with Ukraine’s Export Strategy, as well as promising sectors with a high level of trade underperformance.

- Accelerate preparations for the signing of the Agreement on Conformity Assessment and Acceptance of Industrial Products (ACAA) with the EU for the first three priority sectors: low-voltage equipment, electromagnetic compatibility and machine safety that will promote growth of industrial technological exports to the EU and other countries. Further prioritise the sectors for the following stages of the ACAA signing, taking into account the results of this study.

- Conduct government-level negotiations with partners from the EU and Germany as to remove those barriers for exports of promising products to the EU / German market that will not be lifted as a result of harmonization of regulations with the European ones.

- Take advantage of the Regional Convention on Pan-Mediterranean Preferential Rules of Origin (Pan-Euro-Med Convention), which establishes identical rules of origin for goods between contracting parties within the framework of free trade agreements and promotes opening of new production facilities and attracting regional and international value chains.

- Establish effective mechanisms for the foreign direct investments protection, including export-oriented FDI.

- Ensure the rule of law and effective protection of property rights.

- Create favourable macroeconomic conditions for accessing financing by both Ukrainian and foreign business.

- Provide information and advisory support to local manufacturers and exporters in identifying the most promising destination markets for their produce, assist them in finding partners on such markets, advise on the best ways to penetrate the markets through organizing trade missions etc.

Ukrainian manufacturers and exporters are in turn advised to:

- Consider the sectors of the German economy most heavily dependent on imported inputs (Table 2. Measures of Germany’s openness to foreign trade)

- Take into account the most promising goods for the Ukrainian exports to Germany (Table 3. Promising product groups for Ukrainian exports to Germany under the Export Strategy, HS6; Annex E. Table E1. Promising goods for Ukrainian exports to Germany, HS6)

- Review pricing policies as to enhance competitiveness of the manufactured goods (Annex D. Table D1. Price analysis of the German imports)

- Take into consideration those product groups in which Ukraine displays high comparative advantages, and Germany – low ones (Annex G. Table G1. Revealed comparative advantage index, HS6),

As well as to take advantage of the following opportunities for facilitating entry to the German market:

- Programs offered in Ukraine by the German State Development Bank, KfW and the German Society for International Cooperation, GIZ

- Possibility of joining forces with the German partners in lobbying the elimination of trade barriers and / or facilitation of favorable conditions for a mutually beneficial partnership through the relevant working groups of the German Association of Eastern Business, OAOEV.

The Center was established at the Kyiv School of Economics in the framework of the project “Promotion of a Supportive Framework for Trade in Ukraine”, that is implemented by the Deutsche Gesellschaft für Internationale Zusammenarbeit (GIZ) GmbH on behalf of the German Government.