Nearly every Ukrainian has heard about large fundraisers for body armor, helmets, thermal imagers, quadcopters, scopes, vehicles, etc., organized by volunteer foundations. Both soldiers and volunteers say that drones are one of the key elements of military advantage today. However, high demand for drones may lead to an increase in their price. This article examines changes in the price of drones purchased by the largest volunteer foundations.

World market and classification of drones

The drone market size is actively growing. The global drone market is expected to reach $54 billion by 2030, compared to $27 billion in 2023. According to the most optimistic forecasts, due to the war in Ukraine, the average annual growth of the market will be 25-30% instead of the 10% predicted in 2019. Drones are used not only for defense, so an additional 15-20% market growth can be attributed specifically to the war and defense spending.

China dominates the commercial drones market: DJI company accounts for 70-80% of global sales of commercial drones. The US is more successful in the military drone and dual-use drone market, demand for which will increase due to the geopolitical situation in the world. Over 30 countries have deployed combat drones, and over ten more are developing such systems. The main countries developing military drones, besides Ukraine, are Turkey, Iran, and Israel.

Military drones can be divided into three classes. Each subsequent class is characterized by more functions and better features at the cost of increased price and weight of the UAV. The first class includes simple reconnaissance drones. Most drones from DJI, such as the Mavic 3, fall into this category. The second class includes tactical reconnaissance drones, which can carry certain armaments. Typically, these drones have better protection against electronic warfare (EW) and a wider range of optical functions for observation. Examples of drones in this category are Leleka-100, Furia, Shahed, and ZALA Lancet. The third class are attack drones aimed at the mass destruction of the enemy with heavy armament and communication systems. The Bayraktar TB-2 is one of them.

FPV drones are a separate UAV category with unique capabilities and applications. They are primarily used as kamikaze drones carrying some explosive payload. FPV drones are equipped with cameras that transmit real-time video signals to special video goggles or screens, allowing the pilot to see the surroundings through the drone’s camera lens. They enable operators to receive detailed images and feel like they are in the drone’s cockpit. These drones are indispensable for tasks requiring precision and quick reaction from the pilot.

The use of civilian drones for military purposes in Ukraine began in 2014 during Russia’s invasion of Eastern Ukraine. Currently, drones are most actively used for military tasks, mapping, and terrain imaging in the agricultural and film industries, but their application is possible in most industries.

How many aircraft does Ukraine import?

According to the State Statistics Service, the volume of imports of aircraft, spacecraft, and their parts was $355.1 million in 2021, $361.4 million in 2022, and $611.4 million for the first 11 months of 2023. 43% of total volume of these goods were imported in April, June, and July of 2023.

The State Statistics Service cannot disclose data beyond the two-digit code during martial law. Based on the description of the Ukrainian Classification of Goods for External Economic Activity (UCGEEA), we assume that the majority of drones were imported under the UCGEEA categories 8802110000 (aircraft with an empty weight up to 2,000 kg) and 8802200000 (airplanes and other aircraft with an empty weight up to 2,000 kg).

In 2021, under code 8802110000, Ukraine imported 546 units for a total value of $45 million, of which $34.8 million were from France, and $3.1 million (535 units) were from China. Under code 8802200000, Ukraine purchased 218 units from China, 91 from Poland, 65 from the Republic of Korea, 36 from the USA, and ten from France, totaling $3.9 million. $115.6 million was likely spent on two Turkish Bayraktar complexes (each with six drones and two control centers).

Purchases by charity foundations

Prior to the full-scale Russian invasion, China had no issues exporting drones directly to Ukraine. These UAVs were used either as “wedding” drones or for agricultural purposes. Obviously the demand for them was much lower than now. In 2022, the Chinese manufacturer banned exports to Ukraine and Russia, insisting that its products were “for peaceful use only,” so Ukrainians were forced to buy drones in other countries (however, according to former Minister Reznikov, the Ministry of Defense does not purchase DJI drones because the military considers them “wedding drones”). These restrictions, along with the increase in demand, were expected to raise UAV prices. At the same time, to reduce the cost of imported drones, the government canceled customs duties and VAT on them in February 2023.

So, how have drone prices changed since the start of the full-scale war? We analyzed the purchasing prices of drones by the charity foundations Come Back Alive, Prytula Foundation, and Dzyga’s Paw. We selected these organizations because their reports contain the necessary information. We also reached out to other charity foundations but they did not respond.

90% of the drones purchased by these charities are foreign. This is due to the underdevelopment of Ukrainian serial drone production, while global giants produce commercial drones in large quantities. However, reports from Come Back Alive and Prytula Foundation also show purchases of drones made in Ukraine. For example, Come Back Alive purchased Leleka-100 UAVs in 2016, 2022, and 2023, as well as the PD-2E UAVs in 2022 and 2023. Prytula Foundation purchased the Valkyrie UAV complex and other domestic drones in January and May 2023.

In the reports one can see purchases of such drone models as the DJI Mavic 2 Zoom, DJI Mavic 2 Enterprise, Autel EVO II Pro Rugged Bundle V2, Autel EVO Lite+ Premium Bundle Orange, DJI Matrice 30T, DJI Mavic Air 2S, DJI Mini 2 Fly More Combo, NEMESIS BMH UAS, BAYRAKTAR TB2 UAS, A1-MS FURIA UAS, Sich 03 UAS, Parrot Anafi USA, and other less popular drones.

For the dynamic monthly price representation (Figure 1), we chose the DJI Mavic 3 model with various modifications because the selected charity foundations purchased this drone most frequently.

Figure 1A. Dynamics of purchasing price changes for various modifications of Mavic-3, UAH

Figure 1B. Dynamics of purchasing price changes for various modifications of Mavic-3, euros at the NBU exchange rate

Source: Come Back Alive, Prytula Charity Foundation, and Dzyga's Paw. Note: The graph shows the average price for those foundations that purchased drones in the respective month. If only one charity conducted such purchases in a particular month, the price paid by that charity is indicated. Mavic 3 is the basic drone version; Mavic 3 Fly More Combo has a broader configuration, allowing for more airtime; DJI Mavic 3 Thermal has a night vision camera, and DJI Mavic 3 Enterprise is an industrial drone. It has an enhanced camera able to zoom in up to 56 times and longer flight time. In addition to demand, the price of the drone may depend on the supplier and configuration. They are not specified in the foundations' reports, but we hope that averaging the prices allows us to see the dynamics.

Figure 1 shows that these foundations consistently purchase the Mavic 3 Fly More Combo, and its price, apart from the "spike" in August 2022, remains practically stable. Meanwhile, the DJI Mavic 3 Thermal has significantly increased in price. These drones are needed on the front lines because the Russians have started to take into account the presence of drones in the Armed Forces of Ukraine and to move predominantly at night. On the other hand, over the last six months, the prices of "basic" DJI Mavic 3 have significantly decreased. We can assume that the demand for them declined as they have lost their advantages with the development of technology.

The cost of drones in the European Union

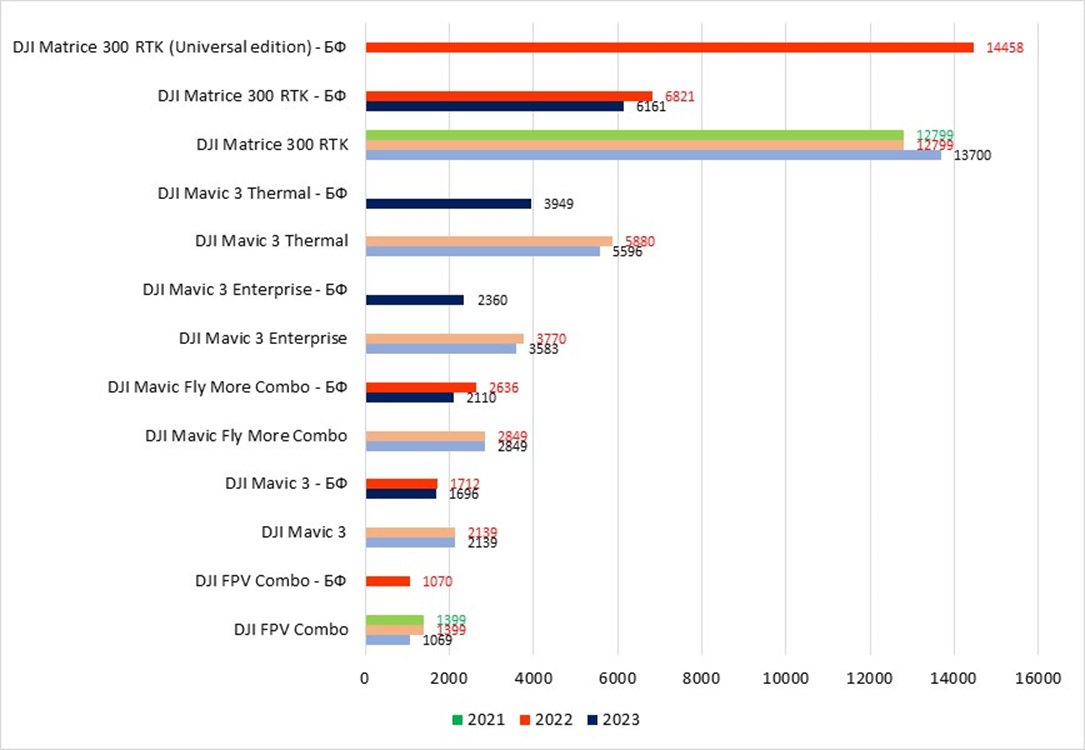

Using the web.archive service and inquiries to DJI support, we analyzed the price change on the websites of European representatives of DJI (see Figure 2) as volunteer funds purchase a portion of drones from the EU.

Figure 2. Dynamics of prices for DJI models in the European Union and comparison with procurement prices of charity foundations, EUR

Source: own calculations, store.dji.com/, megadron.pl/ via web.archive.org/

Note: The Hryvnia/Euro exchange rate was taken from the Minfin.com.ua website because the foundations purchased currency at the market rate, which differed from the official NBU rate by no more than 10%. In the figure, light colors represent prices in stores, while dark colors represent prices of charity funds. Prices in the EU (Poland) for DJI Mavic 3 Thermal, DJI Mavic 3 Enterprise, DJI FPV Combo, DJI Mavic 3, DJI Mavic 3 Fly More Combo, DJI Matrice 300 RTK Combo were obtained through inquiries to DJI. The price of the Autel EVO II Dual Rugged Bundle (640T) V2 drone was obtained through web.archive.org/ on the megadron.pl/ website.

Figure 2 shows that the charity foundations we examined purchased drones at a lower price compared to what online stores offered (likely due to wholesale purchases). However, the price may vary depending on the drone's configuration and the supplier (Ukrainian importer or foreign supplier). Unfortunately, these details are not provided in the charities' reports.

Conclusions

First, the volume of aircraft imports is noticeably increasing. For instance, in the first 11 months of 2023, Ukraine imported 70% more aircraft (by value) than in the entire 2022. Additionally, Ukrainians have begun producing drones in significantly larger quantities than before the full-scale invasion.

Since charity foundations primarily purchase drones from foreign suppliers, we compared the charities' procurement prices with those on the official DJI website in the EU. We found that Ukrainian charity foundations consistently bought drones at lower prices.

According to research by Nashi Groshi, the State Enterprise of Special Communications also purchased drones at lower than retail prices. Therefore, we can conclude that drone procurement for the military is efficient. However, it is necessary to monitor these procurements to maintain or enhance their efficiency.

Sources used

- Statista. URL: statista.com/outlook/cmo/consumer-electronics/drones/ukraine#revenue

- State Statistics Service. URL: ukrstat.gov.ua/

- Procurement report of the CF Come Back Alive. URL: savelife.in.ua/reporting/

- Procurement report of the CF Prytula Foundation. URL: prytulafoundation.org/military-reports

- Procurement report of the CF "DZYGA'S PAW." URL: dzygaspaw.com/transparency

- Internet archive. URL: web.archive.org/

- United 24. URL: u24.gov.ua/

Students of the MA program in Public Policy and Governance at Kyiv School of Economics: Volodymyr Hrebeniuk, Andrii Bobak, Taras Paslavskyi, Yevhen Kurinnyi.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations