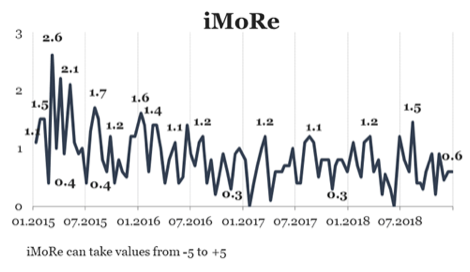

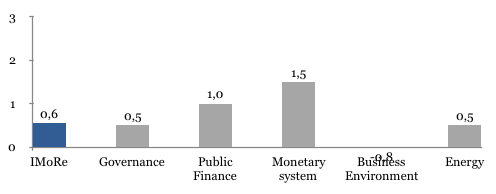

Reform Index is +0,6 points for the period from December 10-23, 2018 on a scale of -5,0 to +5,0. In the previous round the index was the same +0,6 points.

The major events of this round are changes to the Tax and Budget codes from “budget package-2019”. Experts pointed on serious reservations about particular provisions of these laws.

Chart 1. Reform Index dynamics

Chart 2. Reform Index and its components in the current round

Major event of the round

Changes to the Tax Code from “budget package-2019”, 0 points

As in previous years, along with the law on the state budget, the Verkhovna Rada amended the tax legislation (Law 2628-VIII of 23.11.2018).

The law consists of a number of provisions that affect different spheres of the economy, and, respectively, on different directions of Reform Index. The provisions of the law that affect the tax system were assessed by the experts positively (+1.0 points). At the same time, experts gave negative assessments of changes that create barriers for entry of new players into the market for information exchange services between the single base of real estate valuation reports, appraisers and notaries (-1.0 points).

Among main changes:

- increase of excise taxes and environmental tax; they gradually approach the EU level in accordance with our obligations under the Association Agreement,

- increase of rent for the extraction of minerals and the use of forest resources,

- decrease of the non-taxable cost of international parcels (from 150 to 100 euros), etc.

The Tax Code was also amended in the rules for the activity of authorized electronic platforms, through which the appraisers transmit information on the assessment of the value of the property to a single database. These platforms also provide services for obtaining information from this database by notaries at the time of certification of transactions. Now these rules create even more barriers for the entry of new players to this market.

Revenues from any purchase or sale of property are taxed. The size of the tax depends on the estimated value of the property. In Ukraine, there is a single database, which contains information on the evaluation of the real estate. In order for the appraiser to enter the information in such a database, he must apply for the service to a specialized electronic platform. Similarly, notaries, who conclude agreements, should receive information on the estimated value of the property from the database.

Thus, the services of such platforms are obligatory for the realization of purchase and sale of the real estate. At the same time, the state does not set any upper limit on the price of these services. This market has significant economic barriers for the entry of new players, as specialized software is required to create a new platform.

Today there are 4 such platforms. However, according to the Bihus-Info investigations (1, 2), all 4 platforms are probably interconnected, as they operate on the same program code. In this regard, the Antimonopoly Committee has opened the case.

By adopting the changes to the Tax Code, lawmakers decided to further strengthen barriers for the entry to this market. Now the launch of a new platform requires the consent of existing ones. Thereby, in fact, no company can work on this market until its competitors agree.

Changes to the Budget Code from “budget package-2019”, +0,5 points

The Law 2621-VIII of 22.11.2018 amended the Budget Code with regard to the use of state support by agricultural producers.

Previously, agricultural producers could use state support for the purchase of domestic producers of agricultural machinery and equipment. Now the list of technic equipment, in the purchase of which agricultural producers can receive compensation, is expanded. The updated list included special wagons for transportation of grain, equipment for the production of bioethanol and electricity from biomass.

The expert opinions on this law were divided – there were positive and negative assessments, their median is +0,5 points.

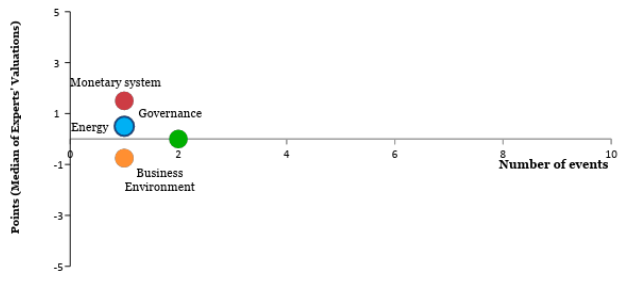

Chart 3. Value of Reform Index components and number of events

(Please see other charts on the website)

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations