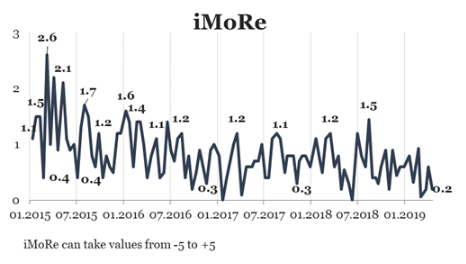

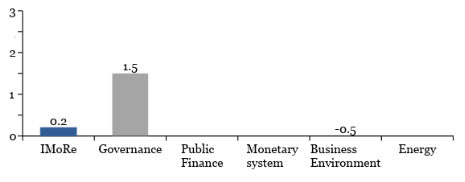

Reform Index is +0.2 points for the period from March 25 to April 7, 2019 on a scale of -5.0 to +5.0. In the previous round the index was +0.6 points.

The major event of this round is the launch of the tax and customs services separation procedure. Also, experts have recorded anti-reform – an increase in the export duty on scrap.

Chart 1. Reform Index dynamics

Chart 2. Reform Index and its components in the current round

Major events of the round

Law on increasing the export duty on scrap metal, +0.1 points

Law 2700-VIII of 02/28/2019 increases the export duty on scrap metal from EUR 42 to EUR 58 per ton for 2 years. This makes the export of scrap metal less profitable and encourages sellers to look for opportunities to sell products in Ukraine.

The decision is supported by representatives of the metallurgical industry, who complain about shortage of scrap metal in the domestic market. Metal scrap sellers are struggling to resist: although foreigners are ready to buy raw materials at a higher price than Ukrainian companies, increased duties can make export unprofitable. In particular, according to UaVtormet, in February 2019 average world prices for scrap increased to $ 306.5 per ton, while domestic purchasing prices dropped to $ 219 per ton from 240-270 per ton.

Provision on the division of the tax and customs services, +1.5 points

According to the latest reports of the Ombudsman’s Board, over 60% of business complaints relate to abuse of state bodies in the tax area. Firms that deal with the customs often find themselves in a situation where the agency encourages them to use illegal corruption levers to quickly resolve the issue.

There are constant attempts to reform this sphere. In particular, in 2016 the government decided to introduce a “single window” at the customs. Experience proved that in order to fully simplify customs procedures the changes to the legislation had to be introduced. In 2018, the law that simplified the use of the “single window” was adopted.

Another attempt to reform this area is to separate the State Fiscal Service and set up Tax and Customs Services. This reform was foreseen in the program of cooperation of Ukraine with the IMF.

The mechanism of tax and customs services separation was adopted by the Government with provision of March 6, 2019 # 227.

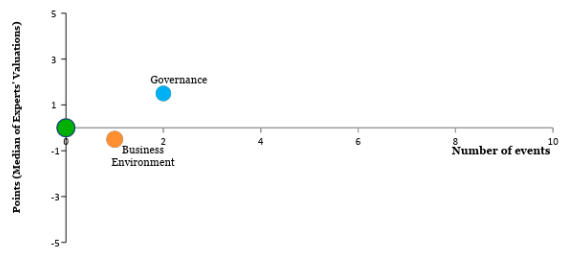

Chart 3. Value of Reform Index components and number of events

(Please see other charts on the website)

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations