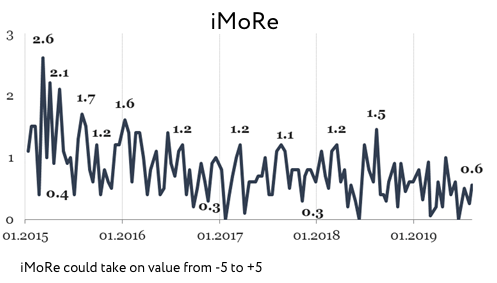

Reform Index is +0,6 points for the period from July, 15 to July, 28 out of possible values from -5,0 to +5,0. The index for the previous round was +0,3 points.

The events of this round are the removal of double declaration at the customs for products from the EU and EFTA and introduction of new demands for the bad assets management at the banks.

Graph 1. Reform Index dynamics

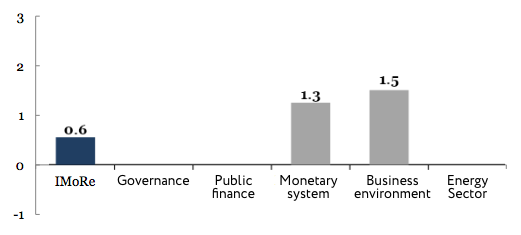

Graph 2. Value of Reform Index and its components in the current evaluation round

Events of the round

The removal of double declaration at the customs for the goods from EU and EFTA, +2,0 points

Importers who deliver goods to Ukraine from EU and EFTA have to declare them twice: first, in order to ship their products from the territory of EU or EFTA, and then in order to bring them to Ukraine.

Resolution of the Cabinet of Ministers from 17th of July 2019 № 619 changes this policy for a range of non-excisable products.

Expert commentary:

“The new resolution removes the need for double declaration. It will allow the use of declarations filled out during the shipments of products from the EU/EFTA in Ukraine, too.

The resolution will allow to use the same declaration filled during the shipping the products out of the EU (EFTA) for importing these products to Ukraine.

Not only does this resolution make physical transportation of the goods between Ukraine and other European countries easier, it also helps fight corruption at the customs”.

– Taras Kachka, the advisor at the International Renaissance Foundation

This decision is another step in the implementation of the Association Agreement between Ukraine and the EU, especially when it comes to Ukraine’s participation in the common transit system according to the Convention on common transit.

New demands for the bad assets management, +1,5 points

The resolution № 97 from July 18th, 2019 National bank introduces demands for the bad assets management.

Banks will have to introduce an early response system for the potentially problematic debtors. The document also determines the instruments to be used for the bad assets management (restructuring, out-of-court and court settlement) and recoveries management.

Each bank will have to develop a bad asset management strategy with realistic indicators of the reduction of the level and amount of bad assets and recoveries.

Banks have to meet these demands by September 2020.

Expert commentary:

“The resolution on the bad assets management process in Ukrainian banks is an important step in directing banks to reduce the level of nonperforming loans, which will be controlled by the bank’s Board. The banks are tasked to organize the work with the nonperforming and potentially problematic assets through:

Early response system implementation means exposing the potentially problematic assets at the early stage and their subsequent management

Implementation of the special procedures and management instruments, including the restructuring, out-of-court and court settlement

Implementation of the recoveries management processes: the recoveries sale plan, internal procedures of its upkeep, usage, protection and insurance.

Structural aspects will have particular attention: creation of the separate NPL management department, its status and accountability, etc. Banks will have 14 months to gradually implement the demands of the Resolution (until the fall 2020), which will allow each bank to build the most fitting (both for the bank and for the cooperating debtor). The part of NPL in the bank portfolios is still above 50% and is decreasing too slowly. According to the data of the NBU, as 1st of July the grand total of the nonperforming loans is 581,3 billion UAH.”

– Olena Korobkova, The Independent association of the Banks of Ukraine

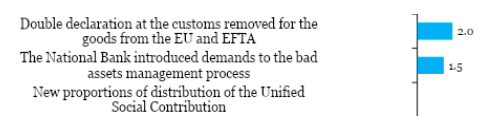

Graph 3. Events that determine the Index value; the evaluation of the event is the sum of the evaluations of each dimension, so it can be less than -5 or more than +5

Table 1. Evaluation of the events and the reform progress by

| Governance | 0.0 |

| State finances | 0.0 |

| New proportions of distribution of the Unified Social Contribution | 0.0 |

| Monetary system | +1.3 |

| The National Bank introduced new demands to the bad assets management process | +1.5 |

| Business environment | +1.5 |

| Double declaration at the customs removed for the goods from the EU and EFTA | +2.0 |

| Energy | 0.0 |

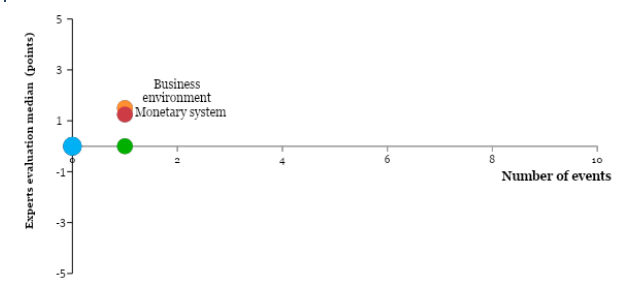

Graph 4. Meaning of the separate Index components and the number of events

(See graphs and tables on the website http://imorevox.in.ua/?page_id=577, http://imorevox.in.ua/list_rounds.php)

Reform Index is to give a complex evaluation to the Ukrainian government’s efforts in economic reforms implementation. The index consists of expert evaluations of changes in a regulatory environment, taking into account five dimensions:

- Governance

- State finances

- Monetary system

- Business environment

- Energy

You can learn more about the Index and the calculation methodology here: reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations