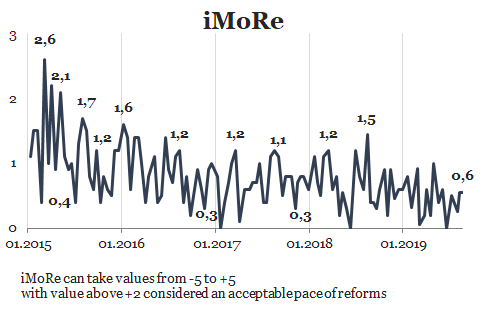

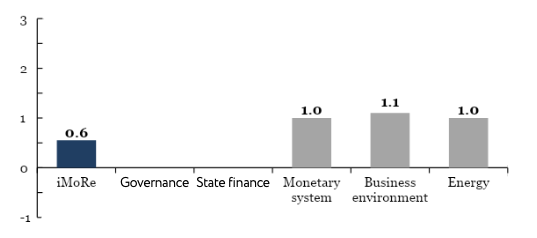

Reform Index is +0.6 points for the period from July 29 to August 11, 2019 on a scale of -5.0 to +5.0. In the previous round the index was also +0.6 points.

The events of this round:

- post offices will be able to transfer money of their customers without bank accounts;

- all types of home solar power plants will be able to sell electricity according to“green tariff”;

- the NBU will not obligate banks to comply with quick and current liquidity ratio requirements.

Chart 1. Reform Index Dynamics

Chart 2. Reform Index and its components in the current round

The events of the round

Post offices will be able to transfer money of their customers without bank accounts, +2.0 points

Postal operators can offer their clients money transfer services. However, to comply the legislation they had to register a separate financial company. It means additional documentation and staff, etc.

With the Resolution №98 from July 22, 2019 of the NBU allows postal companies to make transfers without opening a bank account.

The NBU will not obligate banks to comply with quick and current liquidity ratio requirements, +1,5 points

In 2018, the National Bank introduced new requirements to increase banks’ resilience to crises. It is called the Liquidity Coverage Ratio (LCR). LCR determines how much liquid assets a bank needs to be able to meet its liabilities during a crisis. The liquid assets of the bank include cash, certificates of deposit, government bonds and bonds of international development banks. These assets can be easily mobilized when clients massively withdraw their funds and depositors refuse to extend their deposits. These requirements are recommended by the Basel Committee (Basel III).

Banks have been implementing the LCR since June 2018, and it became obligatory in December 2018. At that time, banks also had to comply with the requirements for the quick, current and short-term liquidity ratios. However, these requirements did not take into account all the expected payments, and therefore underestimated the liquidity requirements during the crisis. The LCR takes this into account.

Now, when banks have implemented the LCR, №102 від 01.08.2010 the NBU has abolished the instant and current liquidity ratios.

All types of home solar power plants will be able to sell electricity according to“green tariff”, +1.0 point

The Law on “green auctions” was adopted in April 2019. It required that only home solar power plants, which installed solar panels on roofs or facades of houses, could sell electricity according to the “green tariffs”. The other home plants, including those, which installed solar panels on the ground, could not sell with this tariff.

A number of deputies and experts criticized these restrictions.

The Law 2755-VIII from 11.07.2019 allowed all types of home solar power plans to enjoy “green tariff” again.

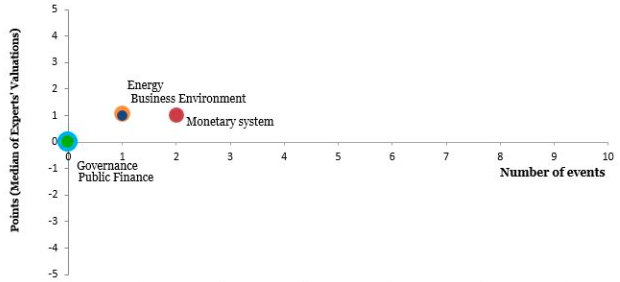

Chart 3. Value of Reform Index components and number of events

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations