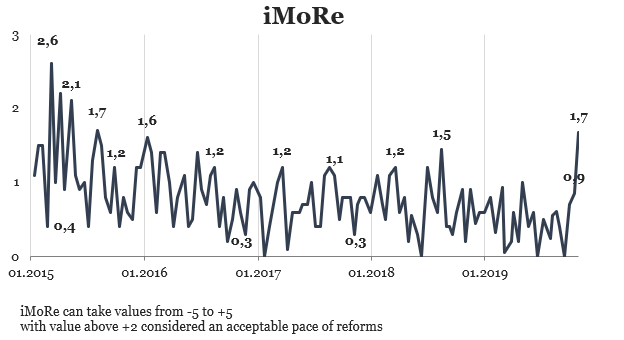

The latest index value is one of the highest in its history. Only four times before had iMoRe managed to reach the same of higher level. The last time index reached that high was in August 2015, after the VIII convocation of Verkhovna Rada came into power, having consecutively appointed the Cabinet of Ministers.

Among the main events of the round are the reforms of the financial sector, namely split law, law on consumer of financial services rights protection, laws to strengthen the institutional capacity of NABU and NAPC, abolish the monopoly of state institutions at expertise, the ProZorro threshold reduction law, the concession law, the law on cancellation of the list of objects that are not subject to privatization and the law on compulsory notarization of corporate rights dispossession.

Experts are divided on two of laws that introduce the use of electronic PPOs and checks; strengthening of sanctions for violations in the use of cash registers, compensation for customers who reported violations when issuing a check (cashback), expanding the list of FOPs obliged to use PPO.

The index for the previous round was +0,9 points.

Chart 1. Reform Index Dynamics

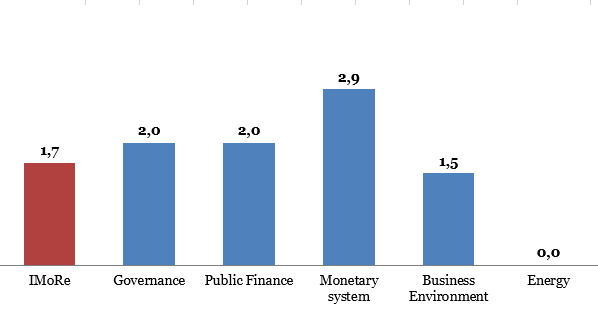

Chart 2. Reform Index and its components in the current round

The main events of the round

Financial sector reform

Split law, +3.0 points

The so-called split law #79-IX from 12.09.2019 changes the state regulation of financial services markets. It liquidates the National Financial Services Market Regulation Commission and distributes its powers between the National Bank of Ukraine (NBU) and the National Securities and Stock Market Commission (NCSSM).

Currently, the NBU oversees the banking services market, funds transfer and foreign exchange operations. The NCSSM oversees the securities markets and derivatives. The National Commission for the State Regulation of Financial Services Markets (National Financial Services Commission) oversees insurance and leasing companies, credit unions, credit bureaus, pawnshops, non-governmental pension funds, construction financing funds etc.

Some of the companies regulated by National Commission, like banks, work with the money of the population. In particular, this is done by insurance companies, credit unions, pension funds. However, the state regulates their activity significantly less, compared to banks. They don’t need to comply with the transparency requirements of the business structure, corporate governance, etc. as required from banks.

This situation poses risks for both clients and the financial stability of the country as a whole. One striking example is the bankruptcy of Mykhailivsky Bank. With the involvement of the credit union, the bank has robbed about 14,000 people for a total of UAH 1.5 billion. In its premises, the bank raised funds from people for a non-banking institution. To resolve the crisis, the Deposit Guarantee Fund had to commit itself to compensating people for lost money.

In order to prevent such situations in the future, approaches to regulating non-banking financial institutions need to be substantially revised.

The parliament decided to delegate the regulatory functions over the non-bank financial institutions to NBU and NCSSM. In the future, this will allow both institutions to formulate common approaches to regulate the markets they are responsible for.

One of the main arguments in favor of such changes is better opportunities to ensure financial stability. Modern technologies contribute to the integration of financial markets and their separation becomes rather conditional. Banks sell insurance policies and use non-banking institutions as agents to sell their services. Payment systems work with individuals’ accounts opened with banks. Crediting companies issue limits on cards issued by banks [from K. Rozhkova’s interview for New Time — edt]. All these companies, not just banks, influence the financial system and work with people’s money.

Therefore, it is advisable for all financial sector companies to be governed by similar rules. The requirements that the NBU now imposes on banks to ensure financial stability makes sense to extend to other financial institutions. These requirements are sufficient equity, compliance with financial monitoring legislation, and a transparent ownership structure.

This decision was also influenced by the fact that the NBU and the NCSSM have significantly greater institutional capacity than the National Financial Services Commission.

Law 79-IX of 09/12/2019:

- transfers the regulation of insurance, leasing, financial companies, credit unions, pawnshops and credit bureaus to the NBU;

- transfers the regulation and supervision of the funded pension system, as well as the financing and property management of housing and real estate operations to the NCSSM;

- eliminates the National Financial Services Commission.

The law establishes a transition period until July 1, 2020. Until June 30 inclusive market regulation will continue to be dealt with by the National Financial Services Commission, and from 1 July 2020 the functions of the National Financial Services Commission will be taken over by the NBU and the NCSSM.

The NBU outlined its vision for licensing, prudential supervision, reporting, audits, corporate governance and consumer protection for non-banking financial institutions following the split in the White Book (2018).

The split law was one of the requirements of the IMF loan program in 2018-19.

Financial Services Consumer Protection Act, + 2.5 points

People who take out loans from banks or other financial institutions often do not have complete information about all the terms at the time of the contract. The contract may also refer to other documents that affect the credit conditions. Because of this, people cannot estimate the real value of a consumer loan, which in particular includes costs related to insurance, appraisal, notary services and more. Financial institutions have the necessary information about the cost of such services, but often do not provide it when calculating the estimated cost of the loan.

These issues were to be addressed by the Law of Ukraine “On consumer lending” (2016). However, it did not fully work.

First, it did not clearly identify the public authorities responsible for protecting the rights of consumers of financial services and having the appropriate powers. Second, it did not define the mechanisms for holding companies to account for violations of the rights of consumers. Third, it differentially defined the requirements for banks and other financial institutions for similar lending services.

Law #122-IX from 09/20/2019 solves these problems. It gives the NBU and NCSSM powers to protect the rights of consumers of financial services. They will be able to influence banks and financial companies in case of violation of such rights. The requirements for all lending companies will be the same — both for banks and other financial companies.

Changes in the legislation on cash registers and electronic checks

Legislative package 128-IX from 09/20/2019 and 129-IX from 09/20/2019 introduced a number of changes related to the introduction of software cash registers, electronic checks, the requirement for іndividual entrepreneurs to use cash registers, and the remuneration to buyers who reported breaches of issuing a check (cashback).

Reform Index experts’ opinions on both laws diverged.

Law on the Use of Electronic Cash Registers and Checks; increased sanctions for violations in the use of cash registers, +2.5 points

Businesses use cash registers to account for the purchase and sale of goods. The Fiscal Office monitors these records to know if the company or private entrepreneur is paying the taxes correctly.

The legislation used a list of devices that can be used to record cash payments that are long overdue. In particular, it did not allow the use of electronic (software) cash registers, which the seller can, for example, install on a smartphone.

The current legislation also created opportunities for abuse by individual taxpayers who did not register all of their settlement transactions or register them only partially in order to pay less taxes.

Law 128-IX of 09/20/2019, as intended by its initiators, should address these issues.

The current legislation sets out an exhaustive list of devices that a business can use to register cash payments. In order to control the records, such devices must be sealed. Following the transactions, they print the fiscal checks that the seller is required to provide to the buyer.

Now, in addition to these devices, businesses can use cash register software, and instead of paper checks, provide the buyer with electronic ones. For example, a seller may install the necessary program on his smartphone that will record transactions on the fiscal service server, record transactions using this program, and provide electronic checks.

The law also increases sanctions for violations of cash register rules.

In the case of cash payments without cash register or with it, but not for the full value of the goods, the seller must pay a fine. If this violation was committed for the first time, the fine is 100% of this value (1 UAH previously). The penalty for each subsequent violation is 150% of the cost (100% previously).

Penalties for violations when using electronic cash registers will be from 5 to 300 tax-free minimums of citizens (there were 5-100 minimums). The harshest penalty of 300 minimums (100 minimums) would be applied when using cash registers that intentionally distort data. The law specifies that this is a cash register whose design or software has been modified and not provided by the manufacturer’s design and technological documentation.

Reform Index experts believe that this law has a positive effect on the efficiency of the tax system (+2.0 points). Experts have disagreed on the impact on business conditions. Some believe that the positive effects outweigh the negatives, and some consider the opposite (median scores are +0.5 points).

Remuneration Law for Buyers Reporting Cash (Cashback) Violations, Expanded List of PEs Required to Use Cash Registers, +0 Points

Current legislation on the use of cash registers has gaps. Individual taxpayers who did not register their settlement transactions or only partially register them due to a misstatement of the reporting to reduce the amount of taxes paid.

There are also various schemes that are used by large companies to reduce the tax burden, using PEs. They conduct transactions through PEs that have a simplified tax regime and are not required to use cash registers. That is why large companies are actually enjoying the benefits that the state intended for small businesses.

According to MPs, Law #129-IX from 20.09.2019 will solve this problem.

It introduces a fee to buyers who have reported irregularities when issuing a check (cashback). The developers of the law believe that such a reward will encourage buyers to keep track of whether the sellers correctly make cash payments. This, in turn, should reduce the magnitude of such abuse.

The law also extends the scope of PEs that must use cash registers. These changes will take effect gradually.

Until October 1, 2020 cash registers will not apply for the PEs from Groups 2-4 with income up to UAH 1 million. The only exceptions are those who sell warranted products, medicines, medical devices and health care services.

From October 1, 2020, the cash register will become mandatory for PEs who sell second-hand goods, sell goods or services over the Internet, travel agencies and tour operators, hotels, and more.

As of January 1, 2021, PEs will apply all single tax payers of Group 2-4.

Software for the operation of cash register software will be available for free download on the Fiscal Service website.

The law also expands the range of businesses that can use a simplified tax system. Starting January 1, 2021, it will be able to be used by PEs (Group 2) with income up to 2.5 million UAH (now – 1.5 million).

This law has provoked protests from small businesses demanding it to be repealed.

Most Reform Index experts believe that this law will have a positive effect on the state’s ability to collect taxes (+2.0 points in the tax system) and reflect negatively on business (-2.0 points).

Strengthening the institutional capacity of National Anti-Corruption Bureau of Ukraine (NACB) and NAPC (National Agency on Corruption Prevention) in the fight against corruption

Law on “wiretapping” the NACB and abolition of state institutions’ monopoly on examination, +2.0 points

In order to listen to the suspects, NACB and the State Bureau of Investigations (SBI) must have the appropriate court order and familiarize themselves with the SSU (The Security Service of Ukraine). Due to this, there were cases of information leakage in the investigation of anti-corruption crimes and the operations of NACB were disrupted.

Law #187-IX from 04/10/2019 solves this problem and gives these authorities the right to listen autonomously.

In order for this rule to work, a number of by-laws must be adopted and technical facilities should be created for such listening.

The law contains a number of rules that will allow courts and investigative bodies to be more effective.

Law on rebooting the NAPC and canceling state funding for parties, +1.0 points

Although the NAPC has broad powers to control and monitor the way of life of officials and to access detailed declarations of their income and assets, the performance of this body has been poor.

One of the reasons for the low efficiency could be a collegial decision-making system by agency members (5 people).

Law 140-IX of 02/10/2019 attempts to solve this problem by introducing sole authority over this body.

Another problem the law solves is the abolition of state funding for parties that did not get into parliament.

It should be noted that state funding for parties voted for by more than 3% of voters was introduced by the law of 2015. The move was seen as very progressive because it was expected that such a rule would free parties of dependence on oligarchs (Reform Index #24 – +3.0 points). Funding was to start after the election 9th convocation of the Verkhovna Rada. However, a consensus has emerged among the newly elected deputies that this issue can wait for now.

Amendments to the Public Procurement Law, +2.0 points

Law on concession, +1.8 points

Formally, concession legislation has been in place in Ukraine since 1999. At that time, a concession mechanism was introduced for road construction, which has not yet worked. Less than 2 years ago, Parliament made another attempt to launch a concession legislature and introduced a number of changes to legislation that were again ineffective.

Law 155-IX from 03.10.2019 is another attempt to launch concessions.

Law on Compulsory Notarization of Corporate Rights Dispossession, +1,5 points

The existing system of state registration of real estate and corporate rights has many gaps. Therefore, owners can lose their assets when attackers want to acquire these assets by taking advantage of such loopholes.

Law 159-IX from 03/10/2019 solves this problem. It improves the registration system for real estate and corporate rights.

Law abolishing the list of objects not subject to privatization +1.5 points

In Ukraine, the state owns 3444 enterprises total. Attempts to launch large-scale privatization were also made by reformers in the previous government.

In 2017, the Ministry of Economic Development made the so-called “triage” and determined which state-owned enterprises should remain state-owned or be concessioned, privatized or liquidated in the long term. Parliament made another attempt in early 2018 (Law 2269-VIII), but it did not work.

In the last 4 years, privatization revenues have been budgeted at the level of UAH 17-19 billion, but this plan has never been fulfilled by more than 5% by far.

Law 145-IX from 02.10.2019 is another attempt to start privatization. He abolished the list of enterprises that are not subject to privatization and instructed the government to form a new list. It should include enterprises in which the state’s share should not be less than 50 percent + 1 share.

Law on Improvement of the Procedure of Licensing of Business Activities, +1,0 point

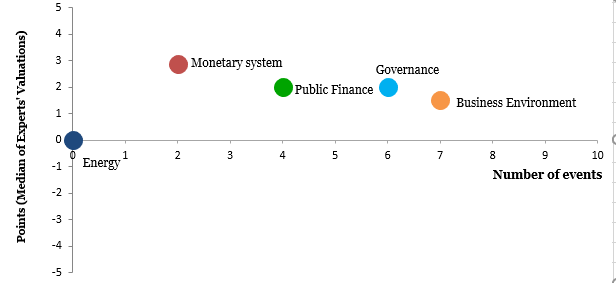

Chart 3. Value of Reform Index components and number of events

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations