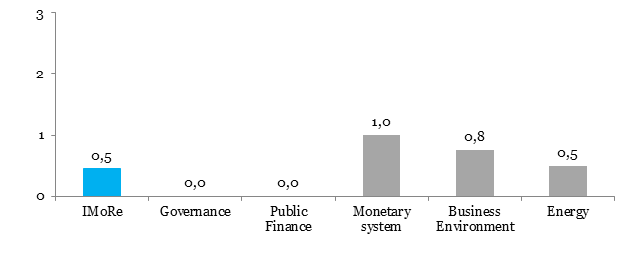

Reform Index is +0.5 points on a scale of -5.0 to +5.0 for the period from September 4, 2017 (+1.1 in the previous round). Certain positive developments were recorded in legislation regarding the monetary system, the business environment and the energy sector. There were no reformist legislative changes affecting governance and public finance.

Among the major events that occurred during this round are the NBU decree that allows banks to select agents for identification and verification of individuals and simplifies the conditions for attracting loans from international financial institutions, as well as the government’s decree regarding the procedure and rules for the compulsory civil aviation insurance.

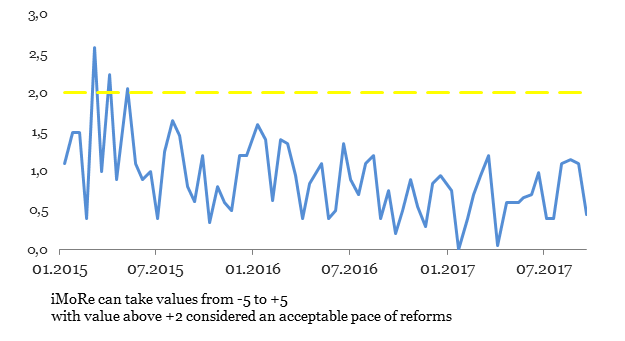

Chart 1. Reform Index dynamics*

Chart 2. Reform Index and its components in the current round

Events of the release

- The NBU decree that allows banks to select agents for identification and verification of individuals, +1.0 point

According to the current legislation on counteraction to money laundering, obtained by criminal means and on consumer loans, when issuing more than 150 thousand UAH, the bank is required to identify and verify clients.

Banks often use intermediaries (credit agents) to provide consumer loans. This is a good opportunity for consumers to issue loans directly in the retail chain and not to visit the bank. However, if the amount of the contract exceeded 150 thousand UAH, it was necessary to apply to the bank for passing the procedure of identification and verification.

With the decree # 90 dated September 12, 2017, the NBU has given banks the opportunity to delegate to agents the procedures for identification and verification of clients when issuing consumer loans. Now it can be completely arranged with the agent and there is no need to apply to the bank’s institution for the procedures.

- CMU decree on the procedure and rules for the compulsory civil aviation insurance,+1.0 point

The current rules of compulsory insurance of civil liability provide insurance of aircraft from the risk of death or damage, liability for damage to life or health of passengers, crew members and airline personnel, third parties, and insurance for damage to baggage, mail, cargo, etc.

These rules did not fully comply with international standards, in particular, the Montreal Convention on the unification of certain rules for international carriage by air, as well as EU regulations 785/2004 of 21/01/2004 and 285/210 from April 6,2010 concerning requirements for the insurance of operators of aircraft carriers and planes. According to them, the rules should also provide for compulsory liability insurance to third parties of air operators, ground handling companies and air navigation services.

Decree # 676 dated September 6, 2017 approximates the rules of compulsory insurance of civil aviation to international standards. In particular, it provides for an increase in the minimum insurance amounts for liability insurance under existing types of insurance and introduces fundamentally new ones. They oblige to insure liability to third parties of air operators (aerodrome, heliport, permanent runway) and certified terrestrial operators, as well as organizations providing air navigation services.

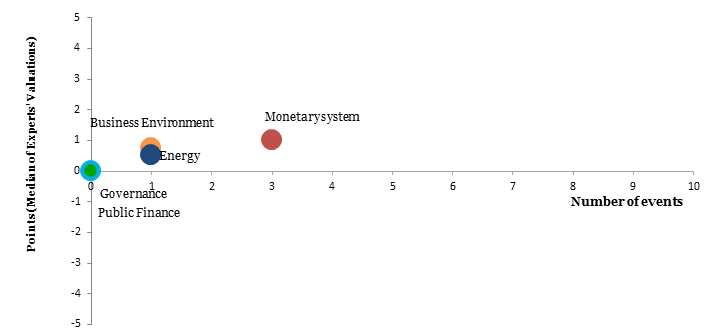

Chart 3. Value of Reform Index components and number of events

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations