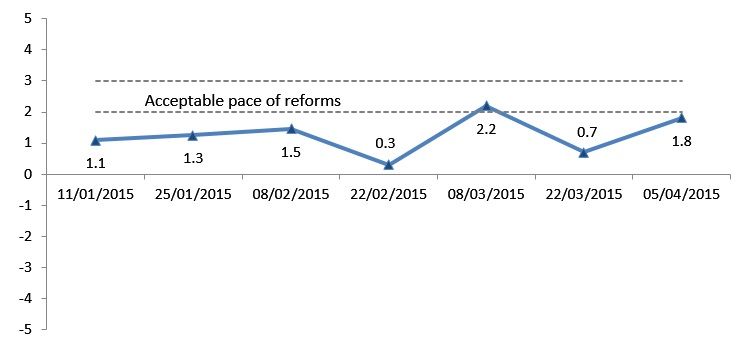

Reform Index is calculated once in two weeks based on an expert survey. Reform Index value for the seventh monitoring period (March 23rd – April 5th, 2015) totaled +1.8 points out of the possible range from -5.0 to +5.0 points.

The main driver behind accelerated index growth from +0.7 points in the previous round was the substantial progress in deregulation and anti-corruption.

Chart 1. Reform Index dynamics

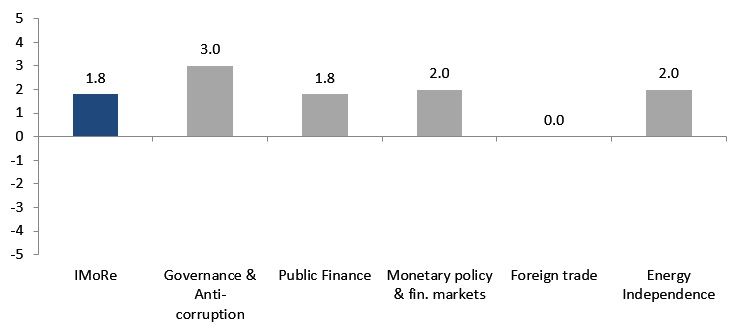

Chart 2. Reform Index and its components in the current round

Reform Index value for the seventh monitoring period (March 23rd – April 5th, 2015) totaled +1.8 points out of the possible range from -5.0 to +5.0 points. The main driver behind accelerated index growth from +0.7 points in the previous round was the substantial progress in deregulation and anti-corruption. Thanks to a number of important events in these spheres index value was almost as high as after the adoption of the “IMF package” of laws (+2.2 points).

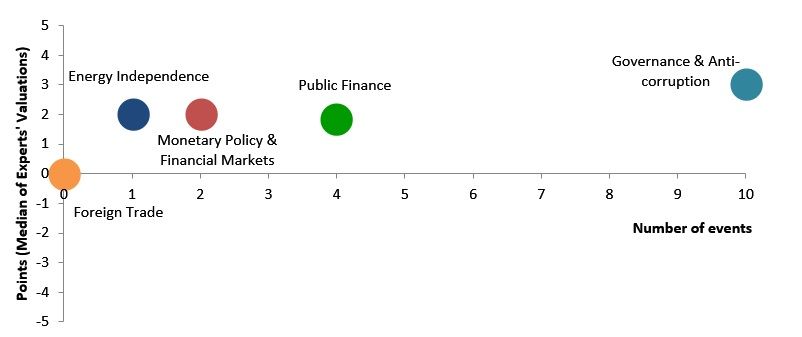

Chart 3. Value of Reform Index components and number of events March 23 – April 5, 2015

Changes to the law on joint stock companies received the highest grade in the seventh period – overall +6.0 points (remember that an event grade is the sum of grades this event receives under several sub-indices of reforms and therefore can be higher than +5.0 points). The law reduces the quorum at shareholder meetings of joint stock companies from 60% to 50%, thus depriving shareholders of large but not controlling stakes of the possibility to block meetings. In case of joint stock companies with substantial government shares, this decision will also contribute to increase in government revenues in the form of dividends. Disclosure of procurement information by companies subordinated to the Ministry of Infrastructure received slightly lower score (+5.3 points). Experts pointed out that this step will increase the transparency of public procurements, reduce opportunities for corruption, and therefore reduce budget losses caused by the fraud in this area. Experts also assigned a high grade to the launch of the National Agency for Corruption Prevention (overall +3.0 points) but noted that only the results of its future work will allow evaluating the actual importance of this agency. Cancellation of a number of licenses (+3.0 points) and the law on deregulation (3.0 points) also received high grades. According to experts, these laws improve the business climate and reduce opportunities for corruption. Liquidation of the state enterprise “Ukrekoresursy” was another positive development that destroys corruption in the sector of waste management.

As for Monetary Policy and Financial Markets direction, the establishment of the Financial Stability Council received the highest grade (+2.0 points). Experts noted that the council will coordinate the financial system supervision and identify risks. However, its overall performance will depend on timing and specificity of its recommendations and of course on their implementation. In the sector of Energy Independence, separation of gas transportation from the supply scored +2.0 points. This decision harmonizes regulation of the gas industry with the EU legislation.

Given the significant number of positive changes in deregulation, business climate improvement and corruption reduction, Governance and Anti-Corruption direction scored +3.0 points, which is the highest grade in the seventh monitoring period and the highest value since the start of observations (January 2015). Monetary Policy and Financial Markets, as well as Energy Independence, received +2.0 points, while progress in Public Finance direction was estimated at +1.8 points. On the other hand, reforms in Foreign Trade area lag behind – sector scored 0.0 points, just like in the previous round, as there were no significant events.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations