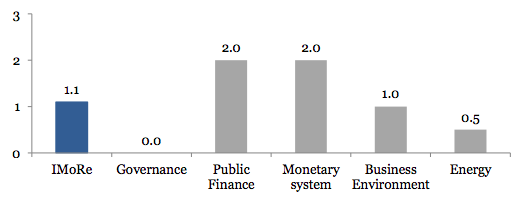

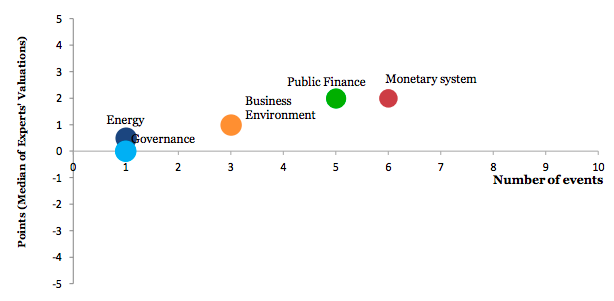

Reform Index is +1.1 points for the period from December 25 – January 14, 2018 (+0.6 in the previous round on a scale of -5.0 to +5.0). Positive developments were recorded in legislation regarding the sphere of public finance, the monetary system, business environment and the energy sector. There were no reformist legislative changes affecting governance.

The major events of the round are the medical reform and simplification of doing business in joint-stock companies.

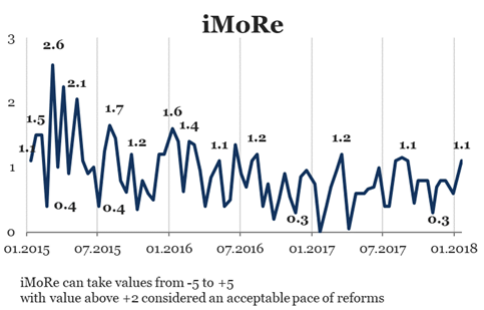

Chart 1. Reform Index dynamics*

Chart 2. Reform Index and its components in the current round

The major events of the release

Law on state financial guarantees for the provision of medical services, +3.0 points.

For years of independence, the healthcare system has not been reformed and capable to provide a satisfactory health status of the population. Life expectancy in Ukraine is significantly lower than in the EU (72 years in Ukraine versus 81 in the EU). Public funding for health care is ineffective, since funds are directed to medical institutions from the calculation of bed places, but not directly to the provision of medical aid.

Although, the Constitution guarantee free-of-charge healthcare service for Ukrainian citizens, the state funding for health care constitutes only half of the total volume of medical expenses. The rest is funded out of the patients’ pocket (often such a fee is unofficial). It is difficult for people to pay for medicines and medical services in case they or their family members have a health problems.

The program of state guarantees, stipulated by the law, will determine the list and the scope of medical services and medicines which payment will be guaranteed by the state at the expense of the state budget funds.

According to the law, the State Budget will need to allocate at least 5% of GDP to implement programs of medical guarantees. The costs of the program will be protected by the items of the budget expenditures.

Among the services that the state will pay for are primary, secondary (specialized), tertiary, palliative care, the emergency medical aid, medical rehabilitation, medical care for children under 16 years old, as well as the pregnancy monitoring and childbirth.

The law is carried into effect on 1 January, 2018 and will be implemented in phases.

According to the methodology for calculating the index, this law affects the component of “public finances”. The assessment of experts in the directions of “social protection system and labor market” (code 202) and “efficiency of public expenditures” (code 204) is +1.5 points.

Law on issuers of securities, +3.0 points

An undeveloped stock market is one of the obstacles to attracting investment by domestic companies. In particular, the procedures for placing the securities are bureaucratic, and the requirements for the disclosure of information by the joint-stock companies are not harmonized with the world standards.

Law 2210-VIII introduces European principles in the field of regulating joint–stock companies (1, 2, 3, 4, 5, 6, etc.). It implements the requirements of European corporate governance directives, changes the definition of a public joint stock company, improves the procedures for issuing securities and disclosing information on the stock market. As a result, public joint stock companies will become more transparent to investors, and the requirements for the publication of statements by companies which shares are not traded on the stock exchanges will be simplified. According to the National Commission on Securities and Stock Market (NSSMC), joint stock companies that will lose the prefix “public” will be able to reduce their annual expenses for the information disclosure by about 70%, and the total savings for companies will amount to UAH 53 million a year.

Also, a new type of activity in the stock market has been introduced – an information disclosure agent. These companies will submit information about the issuers to the NSSMC, and will be responsible for its regular disclosure and promulgation. This will make the Ukrainian stock market more transparent and create conditions for its future development.

New requirements will come into force on January 1, 2019.

According to the methodology for calculating the index, this law affects the components of the “monetary system” and “business environment”. In the direction of “capital markets” (code 302), experts rated the law with +1.0 points, while in the direction of “business regulation” (code 401) – +2.0 points.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance

- Public Finance

- Monetary system

- Business Environment

- Energy

For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations