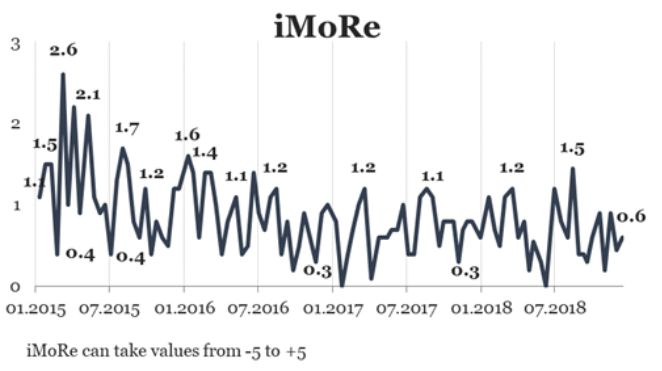

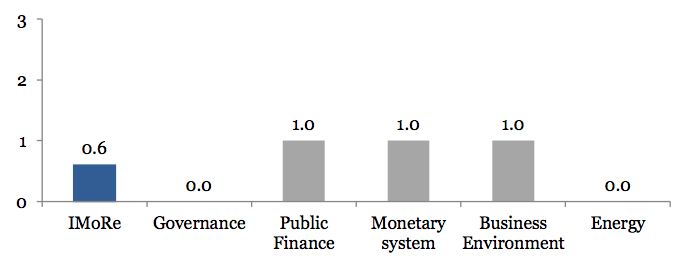

Reform Index is +0,6 points for the period from November 26 – December 9, 2018 on a scale of -5,0 to +5,0. In the previous round the index was +0,5 points.

The major event of this round is approval of methodological recommendations on the organization of corporate governance in Ukrainian banks (+2,0 points).

Chart 1. Reform Index dynamics

Chart 2. Reform Index and its components in the current round

Major event of the round

Methodology for corporate governance in banks were approved , +2.0 points

Previously, the principles of corporate governance in banks were defined in the methodological guidelines of 2007. They identified major governing bodies of the bank and their tasks. Such bodies comprise general meetings of shareholders of the bank, the board and the supervisory board.

In fact, supervisory boards were often not effective and took only formal part in managing the bank. This situation has led to the recognition that more than 100 banks were insolvent and withdrawn from the market during 2014-2018.

In order to minimize such risks in the future, the NBU has begun implementing the principles of corporate governance in banks developed by the Basel Committee on Banking Supervision.

Based on these principles, the NBU has developed new methodological recommendations, which, in particular, have changed the role of supervisory boards in the process of managing banks. In new recommendations, the NBU has defined a new concept of “collective suitability” of bank management bodies. This means that the composition of the supervisory board and the board should have competence in all major areas of activity carried out by the bank.

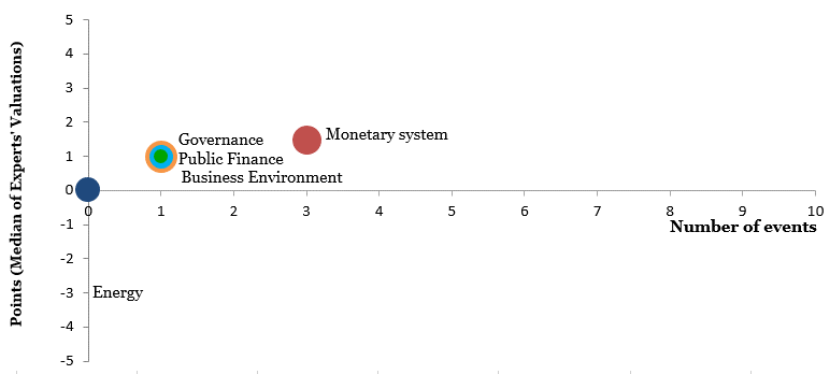

Chart 3. Value of Reform Index components and number of events

(Please see other charts on the website)

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas: Governance, Public Finance, Monetary system, Business Environment, Energy. For details please visit reforms.voxukraine.org

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations