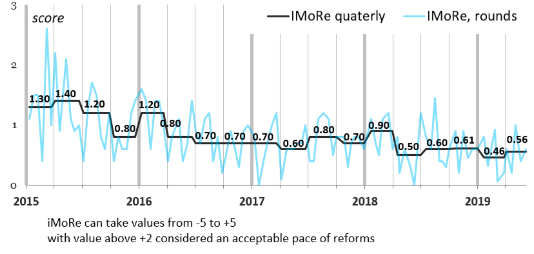

The pace of reforms has been slow for the fifth quarter in a row. Perhaps policy makers were focused on the presidential and parliamentary elections, while reforms were not their priority.

Key legislative changes

(1) New Bankruptcy Code (Reform Index #108) – it introduced the procedures for personal bankruptcy and streamlined corporate bankruptcy procedures

(2) Deadlines for export/import payments were abolished (Reform Index #110) – now payments on export/import contracts can be made at any time while previously contracts had to be cleared within a year.

(3) New regulation on educational districts (Reform Index #112) – local communities are provided with a mechanism to cooperate and create one overarching school that will provide education to children from these communities. Larger schools to which children from different villages are bussed will help both to save money and to provide better education as compared to smaller village schools.

(4) New legislation on “green auctions” (Reform Index #110) – high “green tariffs” established for energy produced from renewable sources some time ago have led to quick growth of wind and solar production capacities and even quicker growth of cost of this energy for consumers. Although ‘green’ energy is just 2% of total electricity generation in Ukraine, its producers get 9% of energy market turnover. Thus, since 2020 the right to construct a renewable energy station will be won at an auction by a producer who proposes the lowest energy price. This price then will be fixed for 20 years. Existing producers will get current ‘green’ tariffs until 2030.

The new Bankruptcy Code, +4.0 points

What was the problem?

Bankruptcy procedures for individuals (persons) were not regulated by Ukrainian legislation. Individuals who could not repay their debt to creditors got into a dead-end. Creditors and collection agencies put pressure on debtors, but it rarely helped satisfy creditor claims and restore the debtor financial solvency.

Bankruptcy procedures for companies were not efficient either. They lasted long and creditors were able to get back only a small portion of its funds. Thus, according to Doing Business-2019, the bankruptcy procedure lasted on average 2.9 years, cost 40.5 percent of estate, and only 9.6 cents per dollar were recovered.

What changed?

(1) The code introduced bankruptcy procedure for individuals.

The bankruptcy case can only be initiated by the debtor. After the start of the bankruptcy proceedings creditors can submit their claims only as a part of the case, penalties and sanctions are not accumulated.

Individual bankruptcy case can be resolved in two ways:

- debt restructuring to restore the financial solvency of the debtor (debt rescheduling, write-off etc),

- debt repayment through the sale of a debtor’s assets.

An individual who declared a bankruptcy is considered as a person who does not have a “perfect business reputation” for the next 3 years. When s/he is making a credit, loan or suretyship agreements, s/he has to inform the counterpart about this fact. Additionally, the individual may not initiate new bankruptcy proceedings within the next 5 years.

(2) Corporate bankruptcy procedures were improved to strengthen creditor protection.

It will be possible to sell assets of a bankrupt only via electronic system. Compared to the previous procedures, this one will be more transparent and competitive. It will thus help to sell assets at the highest possible price and satisfy the maximum of creditor’s claims.

The procedure for initiating the bankruptcy case was simplified.

The hardening period was extended from 1 to 3 years. It means that during 3 years before the bankruptcy initiation creditors or insolvency managers may challenge debtor’s transactions. This should help prevent fraud.

In addition, if a collateral sale does not cover creditor’s claim, the claim can be extended to other assets of a debtor (while previously a creditor was eligible only to the collateral itself).

Deadlines for export/import payments were abolished, +2.0 points

What was the problem?

Ukrainian exporters and importers had to pay for goods/services or receive payments within 365 days after the goods/services were delivered. Earlier this limit was 90 days, then 180 days. To meet this requirement and avoid sanctions companies had to resign contracts every 90 days (180 days, 365 days).

What changed?

The requirement was abolished. Exporters/importers can make and receive payments from their contractors at any time.

New regulation on educational districts, +2.0 points

What was the problem?

Organization of educational networks within one territorial unit (amalgamated community or rayon) is not always efficient in terms of teachers’ capacities, distances to school, costs.

What changed?

The local authorities of communities or rayons will be able to jointly create an educational district, establish schools or other education centers and co-finance them.

This regulation provides local authorities with instruments for improvement of access to education for their citizens. Children who do not have an opportunity to attend some educational center in their hromada or rayon will be able to attend it in the neighboring community within their educational district.

New legislation on “green auctions” (+1.0 points)

What was the problem?

Ukraine introduced “green tariffs” to provide incentives to business and households to invest in production of electricity from renewable energy sources. The rate of return on these investments has been growing since the “green tariff” was the highest in Europe and the production cost, including the price of solar panels, decreased.

Average green tariffs rates in Ukraine and the EU, 2016

| Country | €ct, average, range |

| Austria | 11.37 (3.23 – 19.5) |

| Belgium | 13.9 (4.6 – 23.2) |

| Greece | 15.5 (8 – 23) |

| Ireland | 11.33 (6.95 – 15.7) |

| Lithuania | 12.75 (5.5 – 20) |

| Luxembourg | 17.8 (9.2-26.4) |

| Malta | 15.25 (15 -15.5) |

| Germany | 15.62 (3.5 – 27.73) |

| Slovakia | 11.27 (7.03 – 15.51) |

| Slovenia | 15.9 (6.6 – 25.21) |

| France | 13.04 (6.07 – 20) |

| Average price in the euro area countries | 14.76 |

| Average price in Ukraine | 18.2 |

Source: res-legal.eu

This incentive system stimulated fast growth of electricity production, especially with solar panels. At the same time, it created risks for uncontrolled increase of electricity prices for final consumers. In 2018, about 2% of the electricity was produced from renewable sources, and its value was closed to 9% of the wholesale market turnover (16 bln UAH or about $0.6 billion). In 2021, the value of electricity produced by existing and planned renewable capacities will grow by 2.5 times (to 40 bln UAH).

What changed?

“Green” tariff was replaced by “green auctions” for wind farms with the capacity of more than 5 MW and solar plants with the capacity of over 1 MW. An investor who proposes the lowest tariff at an auction will be able to install the production capacity, and the government will guaranty payment of this tariff for the next 20 years.

Current “green” tariff will continue to be applied to the wind farms and solar plants, which

- have installed their capacities before 2020,

- have signed the contract for electricity supply before 2020 and have installed capacities during the next 2 years for solar energy and 3 years for wind energy,

- wind farms and solar power plants with the capacity of less than 5 and 1 MW respectively.

“Green” tariff will be reduced

- for solar plants by 25% in 2020 and by 2.5% annually in 2021-2023,

- for wind farms with the capacity of more than 2 MW by 10% in 2020.

New rules were introduced for households. “Green” tariff will be reduced by 10% from 2020. For solar energy, the “green” tariff was to be applied only if the panels were installed on roofs or facades of buildings. However, in August 2019 these restrictions on the panels installation for households were abolished.

The tariff for energy generated from biomass and biogas will remain at the current level.

Q3 of 2019 will provide the last opportunity for the current Parliament and the government to push through reforms. They will have about three months for making unpopular but important decisions before the new government is installed. Whether they have used this opportunity, we’ll tell in our next quarterly report.

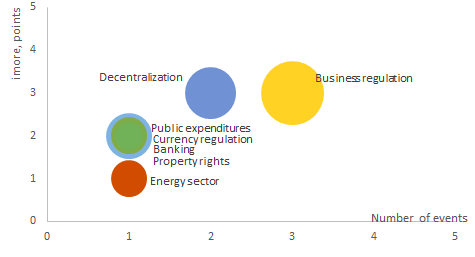

Key areas of reforms, according to Reform Index surveys, were business environment, decentralization and energy sector.

Reform Index average for the second quarter of 2019 was +0.56 points driven by 9 reformist changes to legislation. The Cabinet of Ministers initiated 6 regulations, the Parliament – 2, the President – 1, and the NBU – 1. In the previous quarter Reform Index average was +0.46 points, the Cabinet initiated 11 regulations, the Parliament – 2, and the NBU – 2.

Chart 2. Reform Index index and the number of events by directions

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations