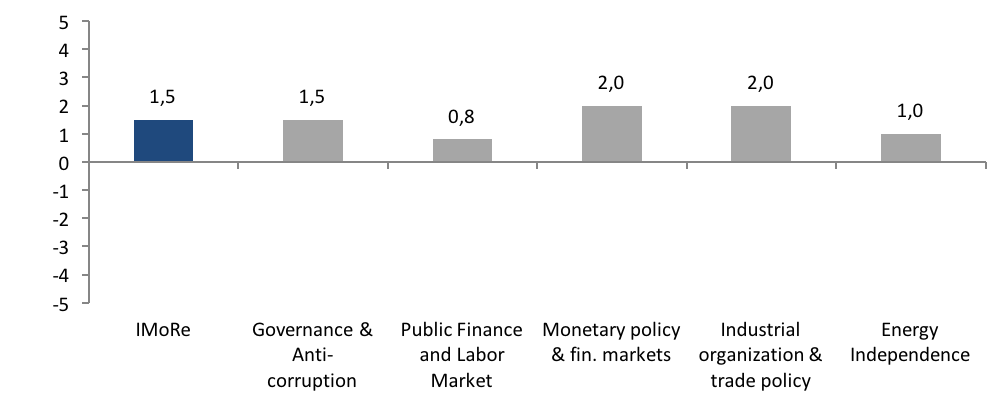

The pace of reforms accelerated notably in early June though still did not reach the desired speed of over 2: overall 1.5 points out of possible 5.0. This time the government tackled the customs service reform, while the National Bank continued to liberalize exchange controls. More good news below.

Reform Index doubled to +1.5 points on June 6 – 19 compared to the previous period. The most significant events in the issue were decisions concerning the customs service reform, permit for partial gradual dividend repatriation, simplified drug registration and others. At the same time, new method for determining the electricity wholesale market price became the most controversial issue.

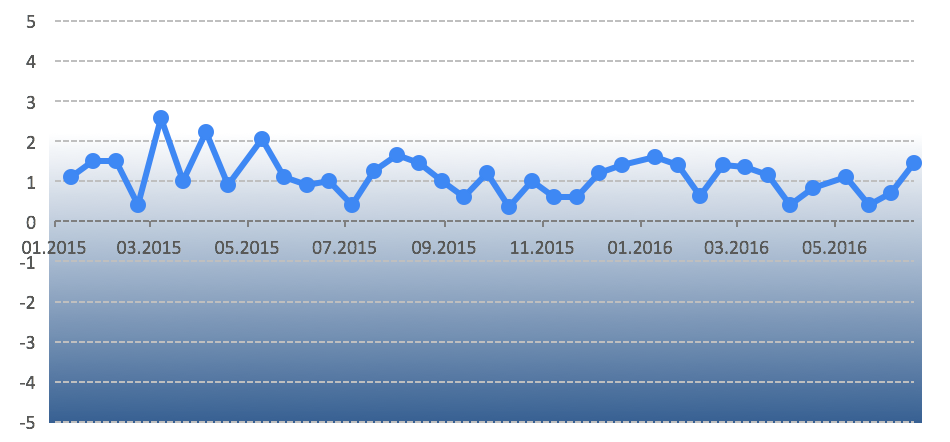

Chart 1. Reform Index dynamics

Reform Index team considers index value of at least 2 an acceptable pace of reform

Chart 2. Reform Index and its components in the current round

The most important positive developments

1) Customs service reform

Since late May, the government adopted a number of decisions concerning customs service reform. This iMoRe release included several government regulations on this matter. The start of “single window” is scheduled for August 1, 2016, but still a number of measures need to be taken, including amendments to the tax and customs codes.

The government approved the procedure of operation of customs’ “single window” system: +4.0 points

The CMU resolution 364 of 25.05.2016 adopted by government implies the introduction of electronic customs information system that combines all the controls over commodity imports and exports (customs, sanitary-epidemiological, veterinary, phytosanitary, environmental, radiological and others).

The development should simplify customs procedures and significantly reduce their timing. In particular, an enterprise will submit scanned copies of the documents through a web interface. The decisions regarding control must be taken within 4 working hours in the case of imports and 24 working hours in the case of exports. If the inspection of the goods is required, it should be conducted by all regulatory authorities simultaneously no later than 24 working hours from the time proposed by the company.

If the decision on control has not been taken in time, the principle of “tacit consent” is applied and the corresponding control is passed.

Video surveillance of customs controls and creation of flying squads to fight corruption at customs: +2.3 points

In order to combat smuggling and corruption in the customs, the government decided to set up 20 flying squads that will work 24 hour throughout Ukraine and the Interagency Target Center that will coordinate flying squads and perform analytical work to identify risky operations (CMU decree 371 of 08.06.2016). And another CMU resolution (370 of 08.06.2016) introduces photo and video surveillance of customs controls, including the inspection of goods or vehicles. Despite the high grade, a lot of experts have expressed reservations emphasizing that effectiveness of the initiative will depend on the implementation.

As part of the customs system reform the Interagency Target Center and flying squads were created to combat the illicit movement of goods across the Ukrainian border, an automated system of information exchange between customs and other regulatory authorities on the principle of” single window” was developed, and the obligatory photo and video surveillance of customs procedures introduced.

These solutions are effective tools that will help to simplify and reduce the amount of customs procedures, automate customs services and to minimize the human factor in decision-making of customs and regulatory authorities.

All this will enhance the transparency and efficiency of customs operations, promote international trade and improve the investment climate in Ukraine.

Yuri Draganchuk, the Ministry of Finance of Ukraine

Introduction of “single window” system] is a very important step, designed to simplify and speed up the procedures, which are awfully lengthy and expensive at the moment. The provision according to which the system let the goods pass automatically in case an authorized person has not taken a decision within 4 hours is especially interesting. Much will depend on the practical application of the provision.

Veronika Movchan, the Institute for Economic Research and Policy Consulting

2) Amendments to the Law “On Medicines” on simplification of state registration of medical products: +2.5 points

Law 1396-VIII of 31.05.2016 shortened the decision period on drug registration from one month to 10 working days. It also simplified registration procedure for drugs registered in the US, Switzerland, Japan, Australia, Canada and the EU.

Experts note that these changes will promote market competition leading to lower prices and diversification, and emphasize that the pharmaceutical market is one of the most difficult to reform.

3) NBU allowed the gradual repatriation of dividends for 2014-2015:+2.0 points

Taking advantage of the current favorable situation in the foreign exchange market, the National Bank extended the easing of exchange control (NBU resolution 342 of 07.06.2016). One of the most important developments was the permit for partial gradual repatriation of dividends to foreign investors. The ban to withdraw dividends had negative impact on FDI, since investors were not allowed to use the profits from their activities in Ukraine. That is why experts positively evaluated the news on the removal of the ban. The Decision will remain in force until September 14, and then the NBU plans to revise currency restrictions again depending on the market situation.

However, the procedure of dividend withdrawal has a number of limitations. Within one month it is allowed to return in total not more than USD 5 million. Moreover, the NBU has identified a large list of required documents, including the certificate of income tax payment, which will delay the process.

Permission for repatriation will allow fully paying dividends for 2014-2015 to small companies, while it discriminates large investors that within the allotted three-month “window” will receive no more than USD 20 million from their Ukrainian assets. Large investors form the Ukraine’s image in the West. Also the issue of the dividend payment out of future earnings remained unresolved- so far we have only a declaration that the restrictions will be lifted.

Alexander Paraschiy, investment company Concorde Capital

4) The National Bank allowed banks to use electronic forms of documents in the control over import/export operations: +2.0 points

The NBU Resolution 347 of 16.06.2016 amends the Instructions on the procedures of control over export and import operations.

According to the decision of the banks have been allowed to use e-documents in parallel with paper documents for information exchange, to monitor export/import operations performed electronically, to use an invoice as a document confirming the provision of services.

The development is aimed at simplifying the customer experience with banks. According to experts it will contribute to reducing administrative costs and attracting small and medium enterprises to international trade.

Some criticism

5) The National Commission for State Energy and Public Utilities Regulation approved methodology for determining electricity wholesale market price: +2.0 points

Under the new procedure, approved by the Commission’s resolution 289 of 03.03.2016, electricity wholesale market price is determined by the formula. Thus it clearly defined price components and the criteria for its review, whereas previously market price was established with no clear explanation for the choice of prices. The new methodology of calculation is transparent and the Ukrainian coal prices as a component of electricity tariff are tied to global prices.

However, the resolution received a lot of criticism regarding the coal price calculation, which influence electricity wholesale market price. It is calculated according to the formula of the coal price in the port of Amsterdam, Rotterdam and Antwerp (ARI2 index) plus the cost of transportation of the coal into Ukraine. At the same time, Ukrainian generation consumes coal of its own production and physical coal purchases from Rotterdam, as well as its transportation, does not occur. Many experts say that the coal is overpriced (especially concerning transport costs) and Ukraine will sponsor illegal coal mining in so-called DPR and LPR.

The National Commission for State Energy and Public Utilities Regulation resolution 289 of 03.03.2016 “On approval of the formation of the projected electricity wholesale market price” contains many formulas, but only one of them – a formula for thermal coal price, used by thermal power stations to produce electricity further sold on the wholesale electricity market – caused a great resonance among the public. Thermal coal, which has been supplied to Ukrainian thermal power stations for many years, has relatively low quality: high ash content, and, as a consequence, low caloric value and high content of sulfur. Ukrainian thermal coal price, which we tie to the import parity, does not meet the minimum quality level of the indicator. For this reason linking coal prices to API2 ARA CIF cannot be considered as relevant. It is likely to be regarded as an upper limit of coal price. Taking it for calculation of predictive value of electricity wholesale market price leads to unjustified overstating of the forecast.

Oleksii Khabatiuk, Green Investments Fund, NGO “Expert Platform for Energy Efficiency”

Despite the criticism of certain elements of the methodology (e.g. coal price) – the document is an important step in ensuring transparency in the electricity market. In addition, the methodology makes it possible to structure future discussions on electricity pricing.

Taras Kachka, Ukraine Reforms Communication Taskforce

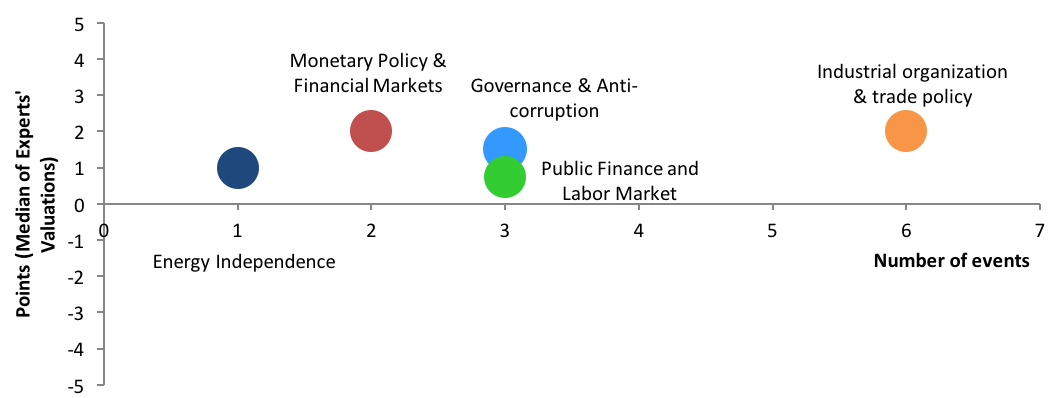

Chart 3. Value of Reform Index components and number of events June 6 – 19, 2016

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations