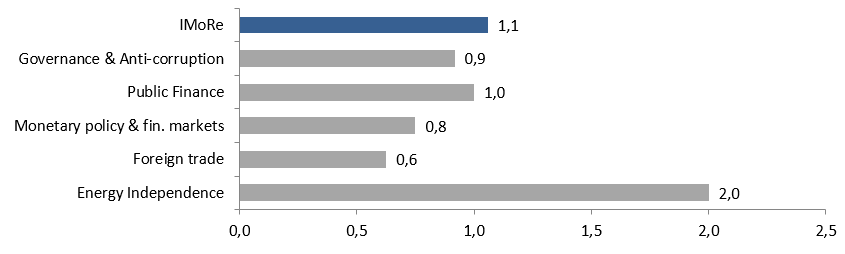

Reform Index is based on expert assessment of changes in regulatory environment along five directions. The value of the Reform Index over the first monitoring period (December 28, 2014 – January 11, 2015) is +1.1 points out of “-5 +5 maximum possible.

It is below the range of 2-3 points which we consider an acceptable pace of reforms, but still indicates that reforms are taking place.

Chart 1. Reform Index value of reform monitoring and its components over the period December 28, 2014 – January, 11, 2015

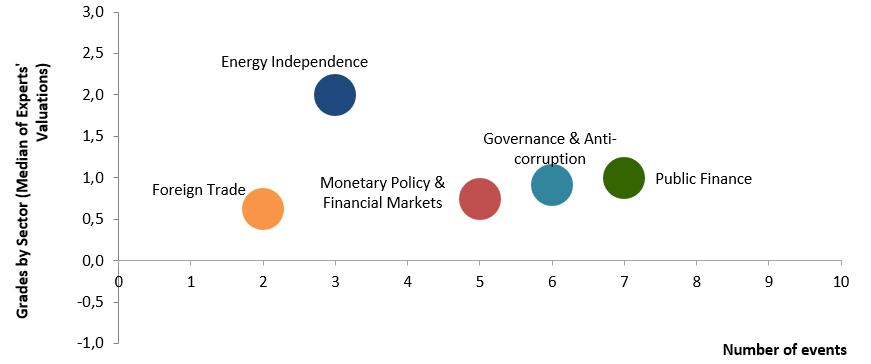

The key event in the first monitoring period was the adoption of the “budget package”, namely of the Law on the State Budget for 2015, the changes in the tax system and the Budget Code and related regulations. The experts rated positively the abolishment of a number of privileges (Law of Ukraine dated 28.12.2014 № 76-VIII «On amendments and cancelling of some legislative acts of Ukraine”), the Law on Transfer Pricing and Changes to the Budget Code. However, the Law on the State Budget for 2015 was assessed negatively due to overestimated parameters of fiscal revenues and hidden deficit. The Law on the Reduction of the Single Social Payment Rate received 0 points. The experts noted that despite positive intention to reduce the tax burden, the law discriminates honest taxpayers and will have only limited impact on legalization of salaries given the possible tax rate revision. The overall progress in the Public Finance direction got +1.0 point.

The experts notified the progress in development of competitive environment mainly through the adoption of the improved Law on Transfer Pricing. However, there have not been any noticeable changes in the fight against corruption. As a result, the Governance and Anti-Corruption direction was rated with +0.9 points.

Chart 2. Value of some Index components and the number of events over the period of December 28, 2014 – January 11, 2015

The most notable progress was observed in the Energy Independence direction that got +2.0 points. The experts positively assessed the government and parliament initiatives on the cancelation of a number of preferential tariffs on electricity and the assignments given by Verkhovna Rada to the National Commission for State Energy and Public Utilities Regulation to increase gas prices.

The +0.8 points in Monetary Policy and Financial Markets direction reflect the multidirectional impact of two laws: the positive assessment of the Law on the Simplification of the State Capitalization of Banks was largely offset by the Law on the State Budget which many experts consider as largely limiting the monetary policy independence of the National Bank of Ukraine.

The positive but low estimate at +0.6 points in the Foreign Trade direction was caused by two events: the abolition of exemptions for imported energy-saving materials and the elimination of preferential prices for electricity exports. The possible introduction of additional import duties was not included in this round of assessment since the decision is yet to be made.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations