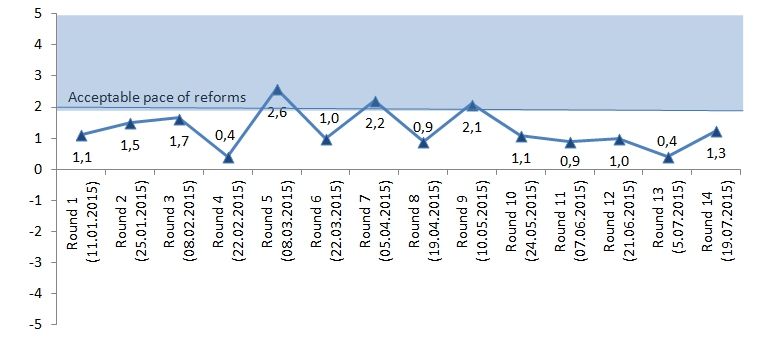

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas. Reform Index value for the 14th monitoring period (July 6th –19th, 2015) has reached +1.3 points out of a possible range from -5.0 to +5.0 points. Moderate increase in the index value was driven by adoption of two laws strengthening independence of the National Bank, amendments to the law on the prosecutor’s office and important anti-corruption initiatives.

Reform Index value for the 14th monitoring period (July 6th –19th, 2015) has reached +1.3 points out of a possible range from -5.0 to +5.0 points. Moderate increase in the index value was driven by adoption of two laws strengthening independence of the National Bank, amendments to the law on the prosecutor’s office and important anti-corruption initiatives. At the same time, experts marked no progress in public finance for two months in a row.

Chart 1. Reform Index Dynamics

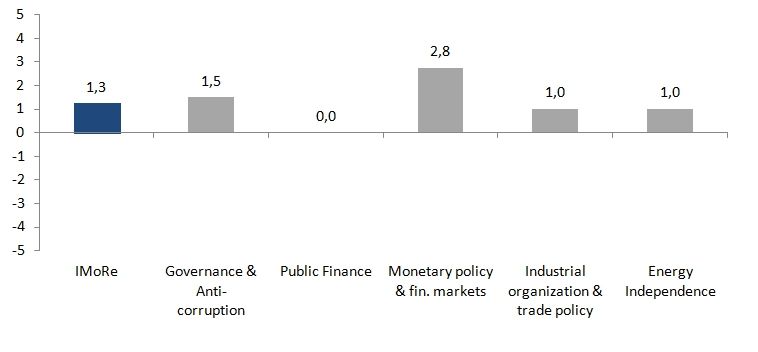

Chart 2. іMoRe and its components in the current round

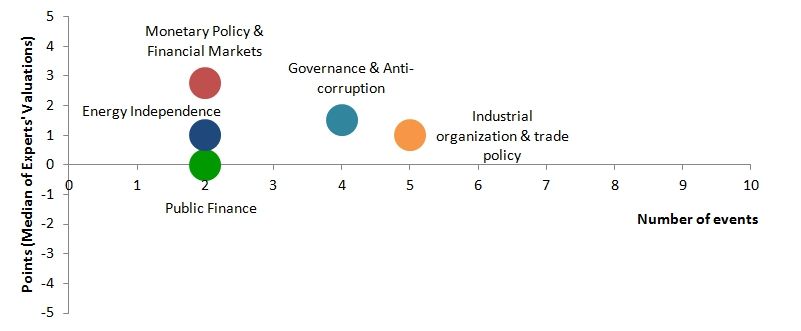

Experts assessed the highest progress in Monetary Policy and Financial Markets sector, which received +2.8 points. In particular, legislative initiatives aimed at strengthening independence of the National Bank of Ukraine (the Law #541-VIII and the Law #542-VIII) gained +3.0 points. It should be noted that this legislation was among preconditions for the second IMF tranche. Another event in the sector was the simplification of procedures for services exported through the Internet (+2.5 points). In particular, the NBU simplified the list of documents need to receive exports proceeds. However, experts noted that simplification applies only to a small number of economic agents and emphasized that it needs to be expanded to a wide range of micro business.

Another event that received relatively high +3.0 points, was the decision to involve international companies in auditing major state-owned enterprises (CMU decree #390 from 04.06.2015) due to its cumulative positive impact on anti-corruption, governance and competition policy. Experts pointed out that the decision will increase the transparency of the public sector, though expressed doubts about the quality of audits, given the large number of companies, which should be audited (183), as well as additional criteria that state-owned enterprises can add during the procurement of audit services.

Amendments to the law on the prosecutor’s office scored +2.5 points (Law # 578-VIII of 02.07.2015). Daria Kaleniuk from Anti-corruption Action Centre noted:

The Anti-Corruption Prosecutor’s Office will be in charge of all criminal proceedings of the National Anti-Corruption Bureau (NABU). That is why the efficiency and independence of investigations of high officials corruption by NABU will depend on the staff and independence of the anti-corruption prosecutor’s office. The law provides for the selection of anti-corruption prosecutor by competition commission, in which seven members are appointed by the parliament and four are appointed by Prosecutor General. At the same time, the law leaves the possibility to dismiss anti-corruption prosecutor by Prosecutor General. Moreover, the head of anti-corruption prosecutor’s office will not be able to appoint anti-corruption prosecutors independently – all senior positions will depend on the Prosecutor General. Thus, the legislation does not guarantee sufficient independence of anti-corruption prosecutor and does not meet the IMF requirements. The law will require additional amendments.

Experts also gave +2.0 points to extractive industries disclosure rules (521-VIII of 16.0 6.2015), but emphasized that this is a framework law, which requires relevant government regulations. Overall, experts rated Governance and Anti-corruption sector progress at +1.5 points.

As for Industrial Organization and Trade Policy sector, experts noted a number of small positive developments, including already mentioned audits of state enterprises, adoption of a plan to organize a joint border patrols with Poland, Slovakia, Romania and Hungary, and Moldova and others. On the other hand, experts negatively evaluated (-1.0 point), the law on the moratorium on the export of roundwood (#325-VIII of 09.04 .2015), which was signed by the President with significant delay. Though the law contributes to the development of wood processing industry, it has a negative impact on forestry and breaches the obligations of Ukraine under the DCFTA with the EU on the non-use of export restrictions. The law also creates a further incentive to invest in lobbying for the interests of the industry and the restriction of competition. Overall, the Industrial Organization and Trade Policy direction received +1.0 points.

The value of Energy Independence sub-index stood at +1.0 points. First creation of a stabilization (reserve) Energy Fund (CMU № 459 of 24.06.2015) gained +1.0 points. Second, amendments to the legislation to ensure competitive conditions for the production of electricity from alternative energy sources (law #514-VIII of 04.06.2015) received +1.0 points. In particular, experts commended the Cancellation of the “local content” requirement, which was used to limit entry of new firms into the industry. The requirement was replaced with a stimulating factor – a 5-10% premium to “green tariff” depending on the share domestic equipment. Finally, experts noted no major events in Public Finance (0.0 points).

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

Chart 3. Value of іMoRe components and number of events July 6– 19, 2015

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations