Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas. Reform Index value for the 17th monitoring period (August 17th –30th, 2015) constituted +1.0 point out of a possible range from -5.0 to +5.0 points. Achievement of long-awaited agreement on restructuring of external government and government-guaranteed debt had a positive impact on the on the Public Finance sector grade and index value as a whole.

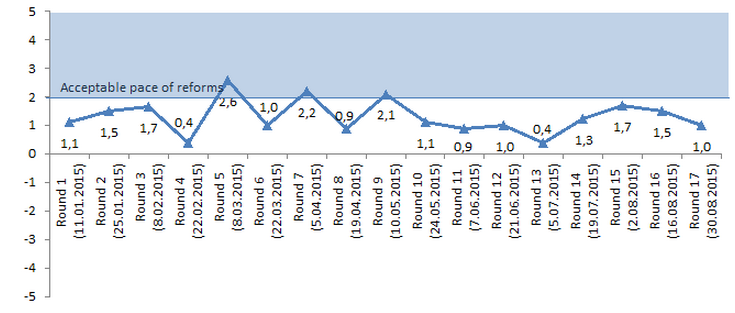

Chart 1. Reform Index dynamics

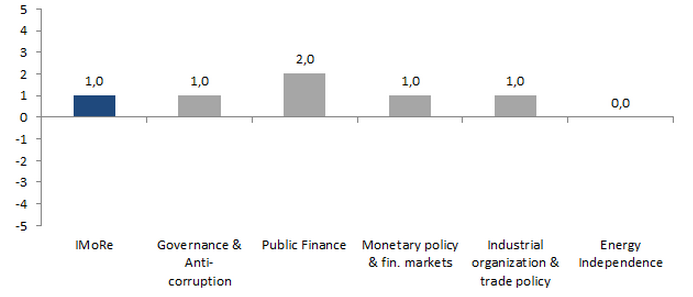

Chart 2. Reform Index and its components in the current round

Experts assigned to Ukraine’s agreement with foreign creditors the highest grade in this period: +3.0 points. Even though the agreement is not formally a reform, experts considered it important for public finance stability. According to Olena Bilan from Dragon Capital, VoxUkraine Editor,

It’s a good thing that agreement on restructuring was reached without the moratorium. Also, 20% haircut will have a positive impact on the dynamics and stability of the public debt. Caveats are a relatively short maturity extension (four years) and a possible increase of debt burden for the state budget in the long run due to the payments on warrants.

The stability of the debt to GDP ratio in the medium and long run will depend on the pace of implementation of economic reforms, the level of political predictability and fiscal consolidation policies.

Slightly lower grade (+2.5 points) was assigned to government resolution (609 of 05.08.2015) on the list of licensing authorities as a positive step in deregulation and a public administration improvement. Clarification of some issues regarding the procurement of medical drugs through international organizations (CMU resolution 622 from 22.07.2015), including the definition of criteria for selecting such organizations, received +2.0 points as a sum of points in Public Finance and Anticorruption areas. Government resolution (588 from 17.07.2015) on pre-privatization review of enterprises received +2.0 points. In experts’ opinion, the development will contribute to greater transparency of privatization provided proper accomplishment of such reviews.

Experts assigned +1.5 points to the CMU decision to simplify procedure for obtaining permits for dredging at seaports (Decree 574 from 30.07.2015). From now on, the permission will be issued once and will be valid indefinitely in case technical specifications of a seaport water area and conditions of dredging do not change. Previously the permission had to be obtained every time it was necessary to maintain water depths at the proper level.

In “Monetary Policy and Financial Markets” sub-index, experts assessed two events in the area of currency regulation. Expanding the opportunities to transfer foreign currency abroad for enterprises gained +1.0 points (NBU Resolution 544 of 20.08.2015) – a slight easing of administrative restrictions on capital movement. However, the NBU ban (Resolution 551 of 20.08.2015) to re-register loans in foreign currency from non-residents gained 0.0 points. Despite the positive short-term effect of prevention of capital flight, experts noted the negative strengthening of administrative pressure and repressiveness of the event. In particular, Vladimir Kotenko from Ernst & Young Ukraine noted,

On the one hand, this is a positive move as it targets fraudsters. On the other hand, the central bank is stubbornly avoiding a meaningful comprehensive discussion of the currency regulations reform. In light of such an obstinacy of the regulator, adding more “don’ts” sucks out any optimism about the future of foreign exchange controls.

Among the sectors, Public Finance scored the highest in the 17th monitoring period with +2.0 points. Governance and Anti-Corruption, Monetary Policy and Financial Markets, as well as Industrial Organization and Trade Policy areas received +1.0 points each. Energy Independence received 0.0 points.

Reform Index aims to provide a comprehensive assessment of reform efforts by Ukraine’s authorities. The Index is based on expert assessments of changes in the regulatory environment in five areas:

- Governance and Anti-Corruption

- Public Finance and Labor Market

- Monetary Policy and Financial Markets

- Industrial Organization and Foreign Trade

- Energy Independence

For details please visit reforms.voxukraine.org

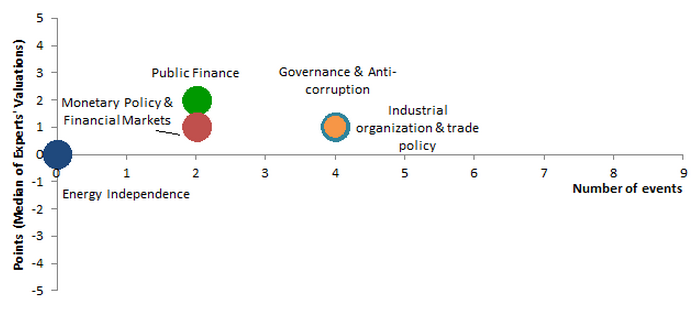

Chart 3. Value of іMoRe components and number of events August 17– 30, 2015

Main media partner Project partners

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations