StateWatch think tank analysed the financial performance of state-owned enterprises (SOEs) in 2023, identifying the 20 largest companies by assets and net income. Based on the results of the monitoring, the team recommends that the Ukrainian government, represented by the Ministry of Economy and the State Property Fund, launch an online register of SOEs, which will facilitate effective corporate reform and complete privatisation. This will ensure transparent operations of SOEs during the implementation of the EU’s Ukraine Facility programme, which is aimed at rebuilding Ukraine.

A Comprehensive Path to SOE Governance Reform

Since 2014, the Ukrainian government has been declaring a rethinking of the state-owned enterprise management system. The government wants to determine which SOEs are of strategic importance to the state and which should be privatised or liquidated. In 2017, the Ministry of Economy completed the first-ever triage of SOEs. Enterprises were categorised into those that should: (1) remain in state ownership, (2) be transferred to concession, (3) be privatised, and (4) be liquidated. Despite the clarity of the intentions, the implementation of the plans was too slow, which did not affect the overall situation in the public sector.

Despite the full-scale invasion, the government planned to carry out the triage again in July 2022, dividing the enterprises into those that should remain under state control and those that should be corporatised, and identifying candidates for privatisation. However, the triage has not yet taken place.

Consequently, there are currently several disparate lists that include both strategic enterprises and those that require reform of their corporate governance in accordance with the OECD Guidelines. For instance, the state-owned JSC “Roads of Ukraine” is included on the list of SOEs of particular economic importance, yet is not included on the list of SOEs of strategic importance to the economy and security. In contrast, according to Government Resolution No. 83 of 4 March 2015, SE “Polygraph Combine “Ukraina” is of strategic importance to the economy, yet is not included on the list of particularly important enterprises. At the same time, in 2019, the government included both companies in the TOP-15 SOEs that need to implement corporate governance in accordance with the OECD Guidelines. In order to initiate the process of enterprise reform, it is necessary to merge the aforementioned lists into a single entity.

Despite the considerable number of SOEs (over 3,400), as of May 2024, Ukraine lacks a convenient system of financial reporting for SOEs. While individual company reports can be accessed via the data.gov.ua portal, a unified system would facilitate assessment of the effectiveness of corporate governance in these enterprises by government officials, parliamentarians, civil society and international partners.

In accordance with the Law on the Management of State-Owned Property, the Ministry of Economy is tasked with monitoring the efficiency of SOE management. However, the lack of public access to the Ministry’s reports renders it impossible to independently oversee SOEs.

StateWatch think tank has received and analysed the latest reports of the Ministry of Economy on the results of monitoring the efficiency of management of SOEs as of the first half of 2023, as well as the responses of the companies on the results of their activities provided to MPs.

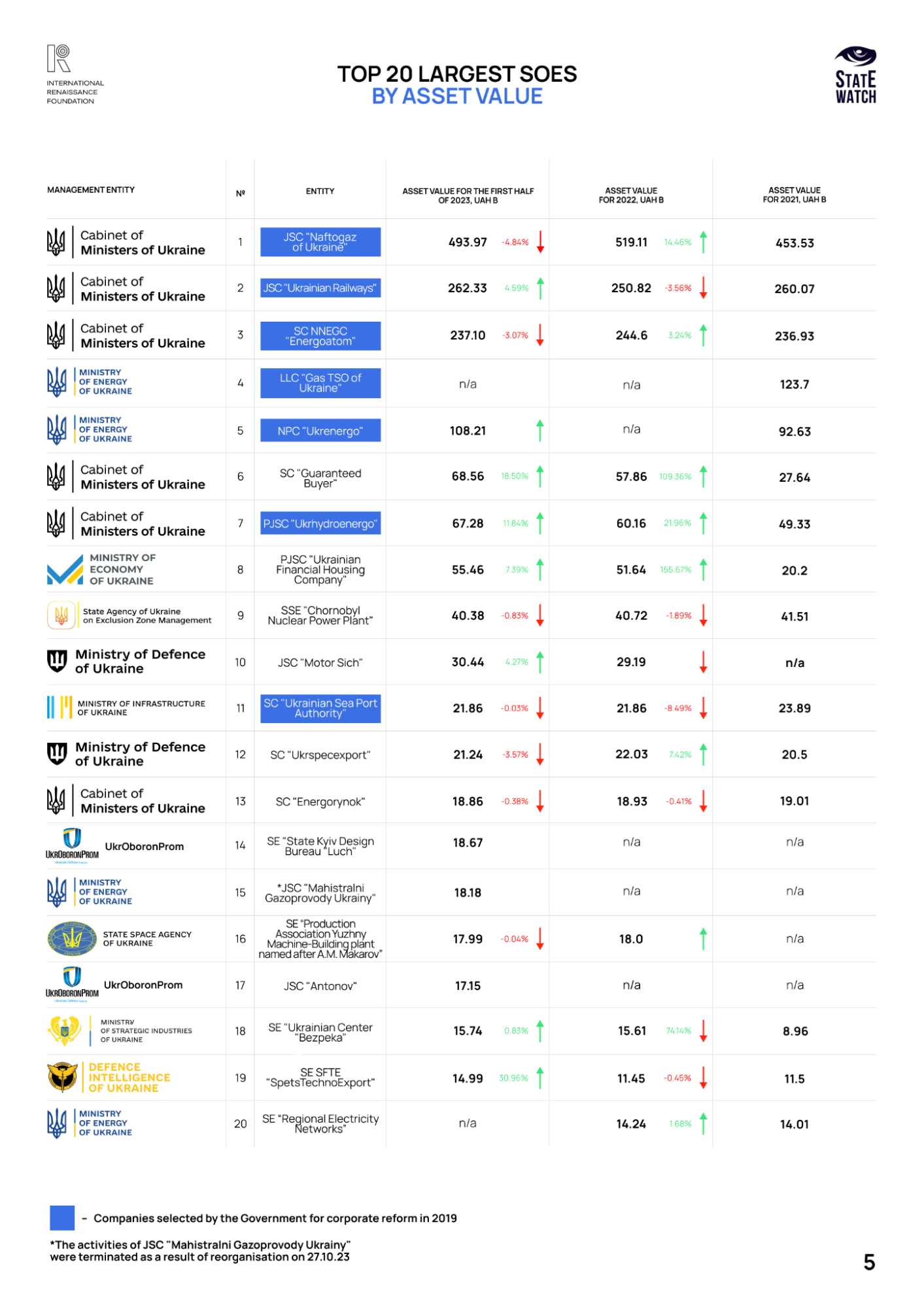

The Largest SOEs in 2023 by Asset Value

The financial statements monitoring as of 1 July 2023 revealed that JSC “Naftogaz of Ukraine”, which is managed by the Cabinet of Ministers of Ukraine, had become the largest SOE. As of that date, the company’s assets were valued at UAH 493.97 billion. This represents a 4.84% decrease from the end of 2022, when Naftogaz’s assets were valued at UAH 519.11 billion. In 2021, prior to the invasion, the company’s assets reached their lowest point in the preceding three years, with a value of UAH 453.53 billion. Naftogaz has not yet provided an official statement regarding the reasons behind the increase in the total value of its assets during the ongoing hostilities in Ukraine. Nevertheless, in November 2022, the then head of Naftogaz, Yuriy Vitrenko, provided information about the increase in the company’s assets due to the acquisition of control over the Samara-Western Direction oil pipeline and the Glusco group of petrol stations owned by Viktor Medvedchuk, a number of arrested regional gas companies of oligarch Dmytro Firtash, and district heating companies.

The smallest company in terms of assets is SE “Regional Electricity Networks”, which is managed by the Ministry of Energy. There is no data on the assets of REN for 2023. In 2022, the company’s assets amounted to UAH 14.24 billion, representing a slight increase from 2021, when they reached UAH 14.01 billion.

The largest increase in the value of assets in 2023 was recorded by JSC “Ukrainian Railways”, which ranks second in the top 20 in terms of assets and is managed by the Cabinet of Ministers of Ukraine. The value of the company’s assets was UAH 250.82 billion in 2022 and UAH 262.33 billion in 2023, representing an increase of 4.58%. The growth in assets can be attributed to investments by the Ukrainian government and international partners in the development of rail transport as an alternative to blocked sea routes in the Black Sea.

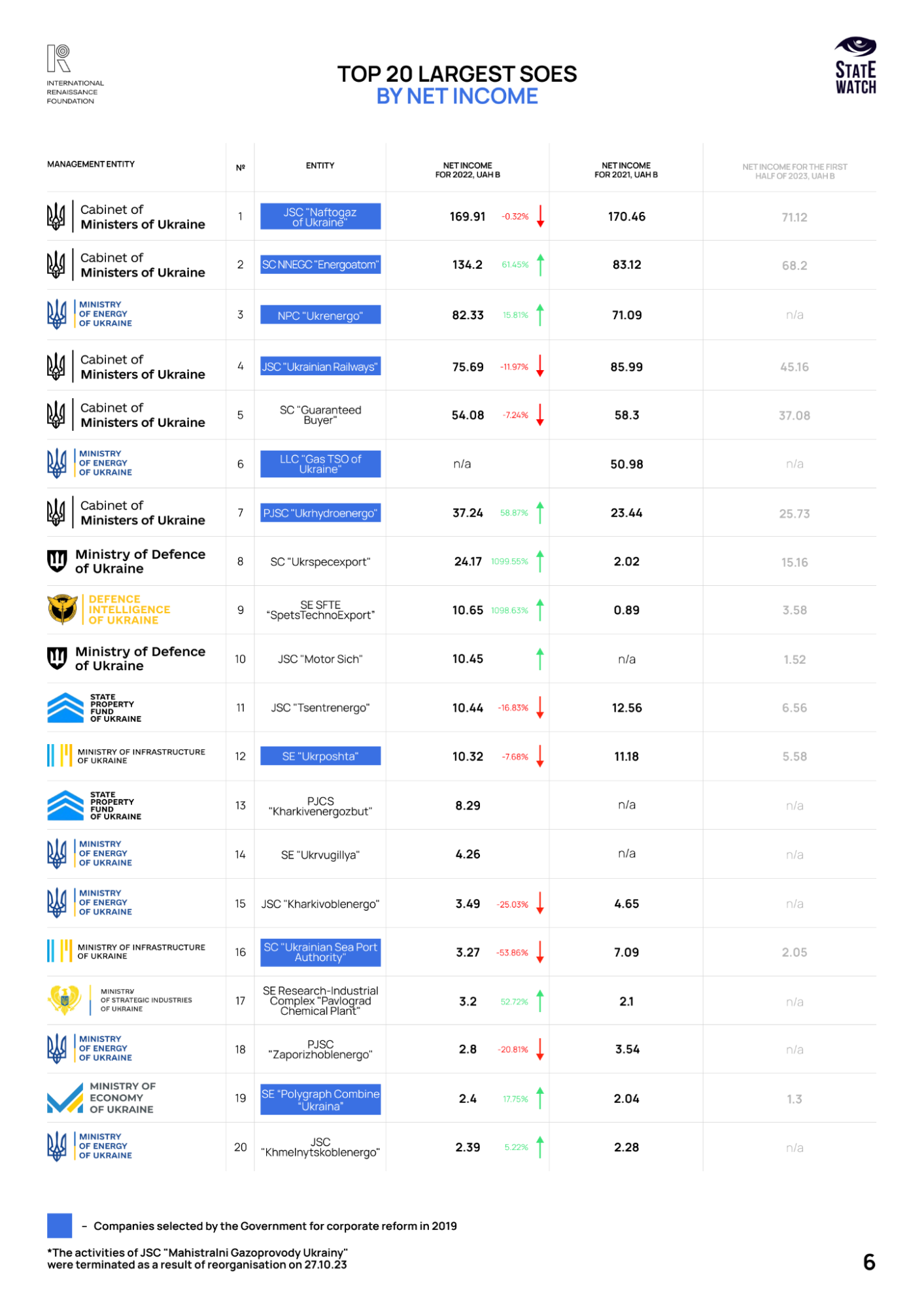

The Largest SOEs in 2023 by Net Income

The financial statements monitoring results indicate that JSC “Naftogaz of Ukraine” has received the largest net income for the first half of 2023, amounting to UAH 71.12 billion. Concurrently, the company reported a loss of UAH 9.3 billion for the period in question. The company’s net income in 2021 and 2022 was UAH 170.46 billion and UAH 169.91 billion, respectively (3.1% and 3.3% of GDP in the respective years). For comparison, the revenue of a similar Polish SOE in 2021 was 2.7% of Poland’s GDP.

The smallest company in the top 20 in terms of net income was the SE “Polygraph Combine “Ukraina”, which produces securities and forms. The company is managed by the Ministry of Economy. Its net income in the first half of 2023 was UAH 1.3 billion, and its profit was UAH 296 million. In 2021, the company’s net income was UAH 2.04 billion, and in 2022, it was UAH 2.4 billion.

The largest income growth during the full-scale invasion was demonstrated by SOEs responsible for importing military goods to Ukraine. In particular, SC “Ukrspecexport” (managed by the Ministry of Defence) increased its net income more than 12 times, from UAH 2.02 billion in 2021 to UAH 24.17 billion in 2022. The company’s profit in 2022 was UAH 46.9 million. A similar situation can be observed in the case of the SE SFTE “SpetsTechnoExport”, which is managed by the Main Directorate of Intelligence of the Ministry of Defence. Over the year, the company’s net income increased by more than 10 times, from UAH 888 million to UAH 10.65 billion, with a profit of UAH 12.33 million.

Conclusions and Recommendations

As illustrated in the accompanying infographic, the top 20 SOEs have generated considerable net income, possess substantial assets, and have even experienced an increase in income or assets despite the ongoing full-scale war. However, to ascertain this information, the team was compelled to submit inquiries to the Ministry of Economy.

It is therefore recommended that the Ministry of Economy launch an online register of SOEs. This register should include the net income/loss and the amount of assets for the previous year, as well as reflecting:

- Investment plans (annual and medium-term) for the company’s activities;

- Investment report on the results of the implementation of the company’s plans (annual and medium-term);

- Annual financial plan of the company;

- Annual financial report of the company before and after audit;

- Biographical references of members of the executive body and members of the supervisory board of the company, as well as advisers to the company’s CEO;

- The annual action plan of the company’s supervisory board.

- The annual report of the supervisory board to the company’s management body.

- The annual report on remuneration of members of the executive body and members of the supervisory board of the company.

Such a registry would facilitate the dissemination of information about the activities of SOEs to potential investors and the general public. Furthermore, it would encourage enterprises to adhere to best management practices.

It is further recommended that the Ministry of Economy and the State Property Fund should complete the triage process, which will divide the public sector economic entities (i.e. state-owned enterprises and joint-stock companies with a state share of ownership) into two groups. The first group will comprise strategic SOEs, including those engaged in centralised procurement and the provision of services of national social importance. The second group will consist of SOEs that should be privatised.

This approach allows for the consolidation of all official lists of “particularly important”, “strategic”, and “top” SOEs into a single list – strategic SOEs. This will facilitate the accurate identification of the top 15 state-owned enterprises during the implementation of the reform “Management of Public Assets”, which is outlined in the plan for the implementation of the EU Ukraine Facility programme, which is designed to facilitate Ukraine’s recovery.

By the end of 2024, the Cabinet of Ministers is anticipated to adopt a resolution that will determine which enterprises will be privatised and which will remain in state ownership. By Q3 2026, at least 15 of the latter will be required to implement corporate governance in accordance with OECD Guidelines. Concurrently, the State Property Fund must devise a unified plan for both large and small-scale privatisation. This plan must provide an understanding of the duration of privatisation processes.

Attention

The authors do not work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations