What are the problems communities are faced with in their financial activity, do they comply with legislation and, most important, do they have the capacity to perform the undertaken functions – these are the questions we tried to find the answer to through comprehensive assessment of financial management in 50 communities participating in DOBRE (USAID) program. A team of experts analyzed documents and conducted interviews with officials for the purposes of assessing the following aspects of financial management: fund management, procurement, revenue collection, tax and duty administration, accounting, budget execution, asset management, budgeting including the use of data and citizen engagement in the budgeting process. The main outcomes are presented in this publication.

Decentralization has enabled to increase the budgets of those villages, settlement, towns that decided to merge into ATCs (amalgamated territorial communities). Executive bodies of the communities were provided with a rather wide mandate for exerting influence on fund management, including the mandate in revenue administration. According to the information provided by the Vice Prime Minister – Minister for Regional Development, Construction, Housing Servicing and Utilities of Ukraine, the revenues of all local budgets in Ukraine for the first half of 2018 increased by 23.8%, or by 20.7 bln. UAH as compared to the same period of 2017. However, many of the established amalgamated territorial communities, if not all, are insufficiently capable of successful performance of their new duties and keep being highly dependant on the funding allocated from the State Budget. Poor financial management system as well as absence of the strategic vision of community development lead to inefficient management of available resources, as well as create opportunities for non-transparent activity giving rise to the risks of corruption.

Assessment of budget performance of 50 communities [1] – partners of DOBRE (USAID) program – testifies to high level of dependence of their budget revenues on state transfers, since the share of transfers in the aggregate amount of revenues on average makes up 60-80%. The second block of overall income in terms of shares consists of tax revenues (which is on average 15-30%). While own nontaxable income makes up, as a rule, only some 5% of the overall amount of the community’s budget revenues. There are almost no revenues from the operations with capital. Let us consider all the components of income in a more detailed way.

Tax revenues

In all analyzed ATCs the risks of fluctuations in the size of own budget revenues in case norms of tax legislation change are high. The structure of own budget revenues is characteristic of the majority of ATCs: some 95% are tax revenues, income from non-tax revenues and income from operations with capital are almost non-available. As a rule, two largest taxes – personal income tax and single tax (or excise duty in some communities) – make up 65-80% of the revenue part of the budget, with no account of transfers. Communities in the territory of which there are large companies with a large number of hired employees constitute an exception here (the share of income from personal income tax payment exceeds 80%, but there are only 6 per cent of such communities in our selection), since 60% of personal income tax from salaries go to the community budget. Revenues from environmental tax and rental payments made up less than 1% in most ATCs.

Almost in all communities the rates of local taxes and duties were set not at the maximum level [2] (only 4 communities out of 50 set the maximum rates). While determining them, deputies of local councils took into account social and economic status of the community as well as the possibility that increased tax rate would lead to increased social tension and growth of debt in payments. However, in essence, such decisions were motivated by the fact that in most communities deputies are representatives of business or are closely connected with it – hence, for them increased tax rates are not beneficial. Public hearings dedicated to establishment of local taxes and duties do not take place in most communities, though that could be a tool for working with deputies and business representatives on rate increase.

Almost in all communities the rates of local taxes and duties were set not at the maximum level (only 4 communities out of 50 set the maximum rates). While determining them, deputies of local councils took into account social and economic status of the community as well as the possibility that increased tax rate would lead to increased social tension and growth of debt in payments.

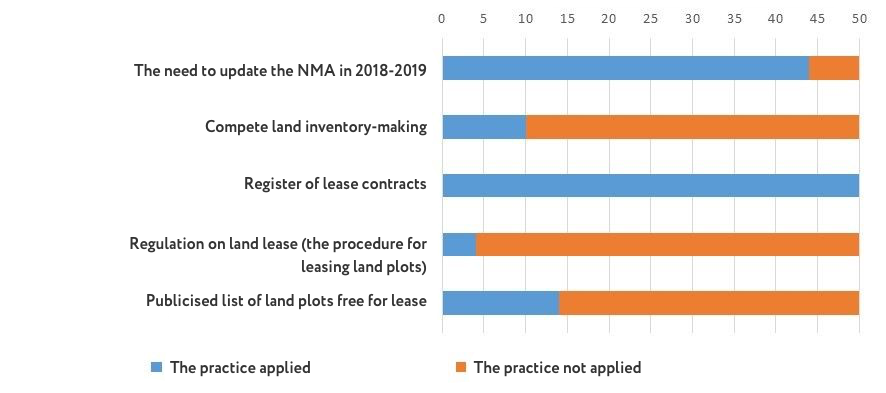

The amount of revenues from land tax and land rent depends on the reliability of information on the amount of lands leased and lands owned by legal entities and natural persons in the territory of ATCs. During the assessment we traced that in most cases ATCs are not provided with adequate plan-cartographic materials, respective land surveying and town planning documents, there are no master plans, technical documents on the land boundaries. The process of complete land inventory-making by the communities is only starting, while normative and monetary assessment (NMA) of ATC lands requires updating in the mid-term prospect (mainly in 2018-2019) in the territory of most communities (fig.1). Land documents were produced in different years and are of different quality and physical condition, they are mainly preserved on paper carriers in raion land resources administrations. However, executive bodies of all ATCs keep the registers of land plot lease contracts. The main reason for the above problems is that considerable amounts of land surveying works require respective funding, while due to limited financial resources the communities cannot perform them.

Fig.1 Works related to land issues, conducted in ATCs; number of ATCs

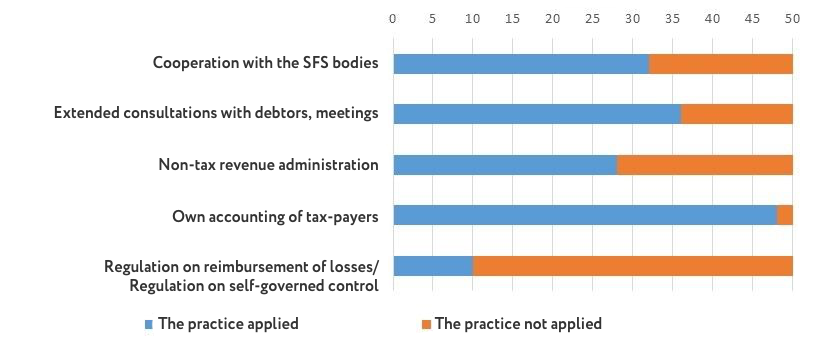

Executive bodies of ATCs have been granted a rather wide mandate for exerting influence on the community fund management, including the revenue administration part. However, in practice there may often be traced the situation when the responsible persons in ATCs either do not have complete information about their own mandate, or the legislation does not envisage enough tools for actual exercising of their rights in the field of ATC fund management (fig. 2).

Fig.2. Administration of taxes and duties in 50 ATCs; number of ATCs

As far as administration of tax revenues of ATC budgets is concerned, all the competences related to control over completeness of tax accrual and payment, compliance with other norms of applicable tax legislation are exclusively within the competence of the bodies of the State Fiscal Service of Ukraine. Under art. 41.4 of the TCU, other state bodies are not entitled to conduct inspections of timeliness, reliability, completeness of tax and duty accrual and payment, including upon the request of law-enforcement bodies. Hence, in fact, executive authorities of ATCs only get information from the bodies of the Treasury on the amounts of paid taxes that are enrolled in the budget of the respective ATC, having no opportunity for conducting the inspection of completeness of tax payments made. Even when the representatives of local authorities possess information on the violations made in tax accrual and payment, without involving the State Fiscal Service bodies local government bodies cannot bring dishonest tax-payers to account. While the State Audit Service may bring the ATC administration to account for underpaid taxes.

According to the evidence provided by financial experts and heads of communities, the representatives of the SFS quite often cooperate with communities informally, information is provided upon oral requests of community administrations. However, such practice is not consistent, and cooperation is mainly in the field of real estate tax administration.

Non-tax revenues

Though as far as own non-tax revenues are concerned, communities have sufficient mandate, in most communities they are within 5-7% of the total revenue. The main reason for that is inability to efficiently dispose of the community property and absence of facilities that are of interest for prospective investors in most analyzed communities.

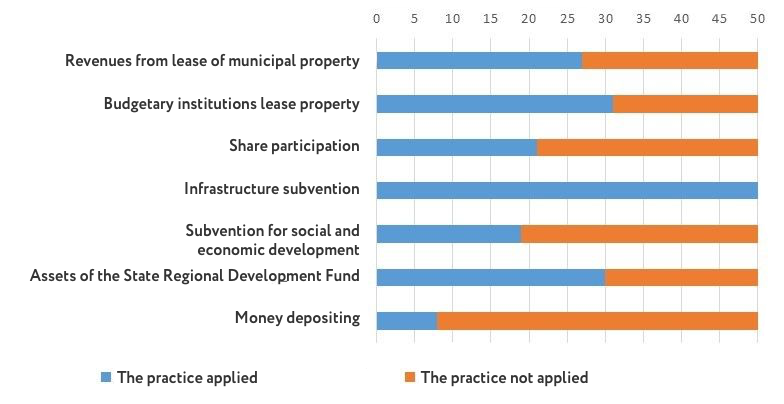

Fig.3. The use of some sources of income in 50 ATCs; number of ATCs

Administrative duties and payments in most communities make up the main part of non-tax revenues, and they are best administered in ATCs where ASCs (Administrative Service Provision Centres) have been established.

Income from share participation in the development of the inhabited settlement’s infrastructure was available in less than a half of ATCs under analysis. The main reason for that is either absence of projects that would enable to pay this duty, or the fear of the ATCs administration ‘to scare off’ prospective investors with additional payments (fig. 3).

The possibility of getting money from the State Regional Development Fund (SRDF) has been used only by 30 communities (6 town ones, 15 urban village ones, and 9 village ones). One of the main reasons is poor quality of submitted projects and preference given by the tendering commission to projects having a larger part of co-funding. Besides that, on July 18 the Cabinet of Ministers introduced changes to the current procedure of the SRDF asset allocation and increased the threshold for projects – now only projects where the overall budgeted value of the construction projects (new construction, reconstruction, restoration, capital repairs) makes up at least 5,000 thousand UAH, and for other projects — exceeds 1,000 thousand UAH may apply for tenders. Such situation is problematic for village ATCs, since their financial capacity is lower than that of town and urban village ATCs, while the need for additional resources and dependence on interbudget transfers is higher.

Revenues from money depositing come to only 8 out of 50 ATCs. These are communities with considerable revenues from environmental tax [3] or high level of own income.

Most of the analyzed communities do not lease whole property complexes and other municipally-owned property, and in case such practice is applied, the amounts of money received are insignificant. During amalgamation the property of merging territorial communities was transferred under handover acts, however, no complete inventory of the community property was actually made. Works related to identification, registration of unowned property in the territories of ATCs are not consistent even in the 18 communities trying to perform them. Registers of municipal property, land plots that may be leased or sold on competitive grounds are normally not developed and not publicised on the official website. However, works related to development of such registers are started only in some communities – for instance, among communities-partners of DOBRE program 14 communities have registers of free land plots, and 12 have registers of municipal property. That all leads to the situation when communities cannot dispose of their property and even don’t know what they own.

Most of the analyzed communities do not lease whole property complexes and other municipally-owned property, and in case such practice is applied, the amounts of money received are insignificant. During amalgamation the property of merging territorial communities was transferred under handover acts, however, no complete inventory of the community property was actually made.

Almost all ATCs have functioning municipal enterprises [4] (or decision has been passed to establish such enterprises), part of profit from the activity of which is supposed to go to the community budget. In the overwhelming majority of communities under analysis such enterprises are unprofitable [5] and get current transfers from the budget for carrying out their economic activity. Since municipal enterprises are fully subordinated and accountable to local authorities, the community administration has sufficient mandate to administer that type of income, hence, it may influence the increase in its own revenues to the ATC’s budget due to the set part of such profit of the municipal enterprise. However, in practice, heads of ATCs and management of municipal enterprises treat them not as business: overstaffed, with non-transparent decision-making, absence of control over financial transactions, slow upgrading of the material and technical base – this is just a short list of bottlenecks identified through our monitoring.

Interbudget transfers

Interbudget transfers constitute the largest share of income in most ATCs. Almost all analyzed ATCs received basic subsidy, a considerable part of them – additional subsidy from the state budget to local budgets for expenditure related to maintenance of educational institutions and health care institutions transferred from the state budget.

Educational and medical subventions

Since 2017 the salary of educators has increased by 50-70%, therefore communities started having problems with funding of employees of educational institutions, and to solve it they needed to look for additional resources. One more problem in the educational field of communities is development of budget estimates for meeting the needs of educational institutions. In practice, local financial bodies do not make any analysis of budget requests, and expenditure is budgeted depending on the income that may be directed to finance education in the community. As the result of that, in budget estimates for education the expenditure remains ungroundedly inflated, its size could be reduced after a real analysis of the situation in educational establishments in terms of the number of employees registered there, after an energy audit aimed at identifying the possibility of reducing energy costs, and, finally, analysis of the expediency of merger of schools with small number of students in grades, development of the support school.

In 2017 medical subvention was directed to local budgets for payment of current expenses of health care institutions. However, starting with 2017, the funds of medical subvention may not be directed to payment of utilities and energy carriers – such payments must be made out of local budgets. Unclear plan of the medical reform at the local level (absence of procedures of establishment of hospital circuits, transfer of raion institutions to towns or ATCs) constitutes an additional barrier for communities in overtaking medical institutions from raion level to their administration.

In 2017 medical subvention was directed to local budgets for payment of current expenses of health care institutions. However, starting with 2017, the funds of medical subvention may not be directed to payment of utilities and energy carriers – such payments must be made out of local budgets.

Subvention for infrastructure development, subvention for social and economic development

Subvention for infrastructure development has been used by all the 50 analyzed communities. The most substantial problem for the majority of communities was a complicated and long-lasting procedure of approving projects funded out of this source, as well as delays in subvention distribution, due to which ATCs had little time to use the funding. The overwhelming majority of the projects under implementation were related to construction or repairing works, for which autumn and winter period was not the best one, that is why work performance efficiency could be substantially lower.

Subvention for territory social and economic development activities in 2017 was used by less than a half of the analyzed communities. The main reason for that was political influence on the process of its allocation – in the opinion of administration in most communities, it is received by communities which are lobbied by people’s deputies and deputies of regional councils.

Conclusions and recommendations

Analysis of financial management assessment results in 50 ATCs-partners of DOBRE program has enabled to identify the faults available in the majority of the amalgamated communities. All communities require further work in the following main directions:

- improvement of planning and strategic documents of communities, local programs – though most communities have their strategic documents developed, quite often the correlation between the goals set in them and the directions of local budget expenditure is rather poor. Of importance is strategic vision in community administration, reflected in long-term documents and enabling to find additional sources of budget revenues, optimize the expenses and efficiently use community assets.

- work of local authorities at transparency improvement and enhancement of resident involvement in community administration – most analyzed ATCs so far do not involve residents and public activists in the decision-making process in the community. Analysis shows that the main reasons for that ares closedness of ATC administration due to the fear of political risks and low level of interest of the public in the analysis of community administration efficiency. Also, not in all ATCs information that is valuable for residents, including budget information, is made public. The survey of households, made by GFK to the order of DOBRE program, has shown that communities-partners of DOBRE program manifest higher level of awareness of the services local authorities are responsible for, and it is related to higher level of confidence of the fact that the ATC administration uses the community assets in the best way possible. Along with that, less than 10% of community residents have participated in any types of public hearings or discussions of draft budget over the last 12 months. ATC authorities need to intensify their work at informing residents of their activity and looking for the opportunities for establishing the maximum local tax rates. Besides increased trust in the activity of ATC authorities, such work may also lead to increased revenues to local budget since business will more readily pay taxes realizing what goals they are spent on.

- administration of tax and non-tax revenues – one of the most serious problems of ATCs is absence of legislatively enshrined mandate for administering tax revenues, while cooperation with the SFS bodies is not regulated. Until the legislation envisages interaction of communities with the SFS, ATCs may set up task forces with the representatives of the STS for joint work on the issues of complete payment of taxes and duties to the ATC budget. An important direction is the search of additional sources of funding and the use of all possible sources of tax and non-tax revenues;

- optimization of budget expenditure – the problem of ATCs is high share of current expenses as compared to capital ones, in particular, for education and medicine. Heads of ATCs have to continue working at optimization of expenses – to review the structure of ATC expenses, to make analysis of the possibility of reducing current expenses, re-allocate the budget in favour of capital costs and development costs since such expenses may bring some economy of budget assets in future;

- regulation of procurement activity – some ATCs violate procurement legislation, some have a conflict of interests. Besides removal of such faults, communities need to increase the number of competitive subthreshold procedure, since that will yield, according to different estimates[6], economy at the average rate of 10-15% as compared to direct agreement conclusion;

- intensification of work at community asset management – inventory-making of land resources and municipal property, updating of the normative and monetary assessment as well as development of property administration system, etc;

- construction of internal control system – to ensure efficient control over the ATC budget revenues and expenses, it is recommended to apply public audit mechanisms, that would check rational use of the budget money, financial and economic activity of legal entities and local executive self-government bodies – money holders. Many community heads have already started making steps in this direction – since they want to be re-elected. Besides that, the ATCs that have undergone the inspection conducted by the State Audit Service were provided recommendations on the establishment of internal control system, which most frequently constitutes the main motivation factor for community government bodies.

The content is the responsibility of Global Communities and does not necessarily reflect the views of USAID or the Government of the United States.

Notes

[1] There are partner communities of DOBRE Program in 7 regions: Ternopil, Ivano-Frankivsk, Dnipropetrovsk, Mykolayiv, Kharkiv, Kherson, and Kirovohrad regions. it is hard to say how representative this selection is. But we analyzed different types of ATCs (village/urban village/town) with different population size in different regions and different parts of the country. We presented the results to different stakeholders and projects and they said that the main problems we are describing are characteristic of most ATCs of Ukraine

[2] For example, under art. 269-287 of the Tax Code, land tax rates may constitute from 1% to 12% of the normative plot assessment. However, most considered ATCs have set tax rates below 1% for most lands and 3-5% for some small number of lands used by business entities (though tax rates up to 12% may be set for such land plots).

[3] Environmental tax has a target designation, and communities have to direct revenues from it to finance nature protection activities, implementation of which used to be a problem for some ATCs due to absence of interesting ‘green’ ideas.

[4] In most ATCs municipal enterprises perform the functions of provision of amenities, water supply and water sewerage

[5] Municipal enterprises, in particular, the ones dealing with provision of amenities are profitable if they provide services at high tariffs, are not overstaffed and offer support services – for instance, production and sales of fuel briquettes, tourist services, advertising.

[6] For instance, according to assessment, Bashtanka ATC in Mykolayiv region, that makes subthreshold procurement, the economy made up some 1 mln. UAH (from January 01, 2018 to June 12, 2018 35 procurements for the total amount of 64.3 mln. UAH were made), and in 2017 – 2.2 mln. UAH – Source: the speech of the ATC head at the press-conference