Ukrainian Prime Minister Volodymyr Groysman surprised everyone with an initiative to double the minimum wage – up to 3200 UAH – in 2017. It is quite difficult to assess this decision because the minimum wage in Ukraine influences numerous indicators and sectors of the economy. It would be irresponsible to make any conclusions without detailed calculations. The views of modern economists on the idea of minimum wage range from enthusiastic approval to sharp criticism. VoxUkraine has studied the history of the concept of the minimum wage.

Do not take advantage of a hired worker who is poor and needy, whether that worker is a fellow Israelite or a foreigner residing in one of your towns.

Pay them their wages each day before sunset, because they are poor and are counting on it. Otherwise they may cry to the Lord against you, and you will be guilty of sin.

(The Old Testament Deuteronomy 24:14-15)

On October 26, in an unpredictable move, the government decided to double the minimum wage by lifting it from the planned 1600 UAH to 3200 UAH per month. Previously, the draft budget foresaw a much more modest increase in 2017. Since January 1, the minimum wage was expected to rise to 1600 UAH, since May 1 to 1684 UAH, and since December 1 to 1762 UAH. The draft budget was submitted to the Parliament slightly over one month ago.

The first reaction is to ask why the wage should be doubled rather than raised, e.g. by 15.2587%. It does not seem that there have been any detailed or even basic calculations behind such a profound change. Its effects can be manifold. First, a rise in the minimum wage entails the rise of the total income of households, which determines their right to public subsidies and their amount. Second, the unified social contribution paid both by self-employed and hired workers will increase, affecting the State pension fund revenues. Third, the minimum value of assets that public officials must disclose in their declarations will increase.

The discussion over the minimum wage is not unique for Ukraine. Therefore, I have decided to prepare a short overview of the situation in other countries and of the main economic theories.

History: from the Black Death to Henry Ford

The idea of imposing limits on wages has a long past. For instance, in the medieval times, guilds had strict rules that regulated all aspects of remuneration. However, guild cannot be compared with modern corporations because, e.g. they regulated almost everything and prohibited innovations that put the status quo at risk. The Black Death epidemic in the 14th century led to an attempt to cap the maximum size of wages due to the deficit of labor. At the same time, since the world remained mainly agricultural, this question concerned only a small fraction of people.

The idea of the minimum wage was raised again in the 19th century, partly in response to Marxist theories. Marxists thought that a proletarian was paid just as much as was enough for him to survive. Any attempt to ask for a raise would lead to the worker being fired and replaced by another one. Therefore, the government (controlled by the ruling class) would have to introduce the minimum wage in order to avoid a proletarian revolution. Other arguments focused on relatively low wages of women and minors (often reaching mere 1/3-1/2 of the wages of men). These groups were less protected, so the government had to assume the role of professional organizations and solve this problem. New Zealand became the first modern country to enact the minimum wage law.

However, not only states can introduce the minimum wage. Henry Fond introduced the 5-dollar daily wage (over $100 in today’s prices) at all his factories in 1914. The average wage in the US economy was much lower at the time. It was equal to mere $2.34 even in industrial Detroit. Ford argued that employees did not value their job enough when their wage was low, which led to a very high staff turnover. For instance, in 1913 the staff turnover at Ford’s factory amounted to 370%! Most of the employees (about two thirds) stopped working simply by not showing up to work. About 10% of employees did not show up every day. This had a negative impact on output since new workers lacked experience.

The raise was in no way a spontaneous decision. First, the reasons for falling efficiency were carefully studied for several months. Next, a number of changes were made based on the analysis. This included raising the wage by 15%. It was only three months later that the introduction of the five-dollar workday was announced. However, it applied only to those workers who would work for at least half a year without receiving any warnings before their wage was changed. There were other conditions as well.

Ford’s factory stood out among all other companies. Its remuneration policy allowed Ford to select the best employees on the market, which increased the company’s efficiency. This is not much different from modern jobs that are offered, e.g. by Google. At the same time, the national minimum wage has an impact on the whole market because no one can pay less than that. Therefore, workers are actually not stimulated to change the quality of their work.

The Minimum Wage Today

According to Wikipedia, currently, 80% of countries have a minimum wage. These which don’t have are not necessarily the poorest countries. For instance, six out of 28 EU countries do not have a minimum wage: Austria, Denmark, Italy, Cyprus, Finland and Sweden. Iceland, Norway and Switzerland do not have a minimum wage as well. However, this is not the outcome of any specific opposition to introducing the minimum wage. Alternatives exist, in particular, sectoral agreements between workers and employers. For instance, in Switzerland, collective labor agreements guarantee a minimum remuneration for both unqualified and qualified employees. In 2014, the Swiss held a referendum on whether to introduce a minimum hourly wage, yet the overwhelming majority (75%) voted against this measure.

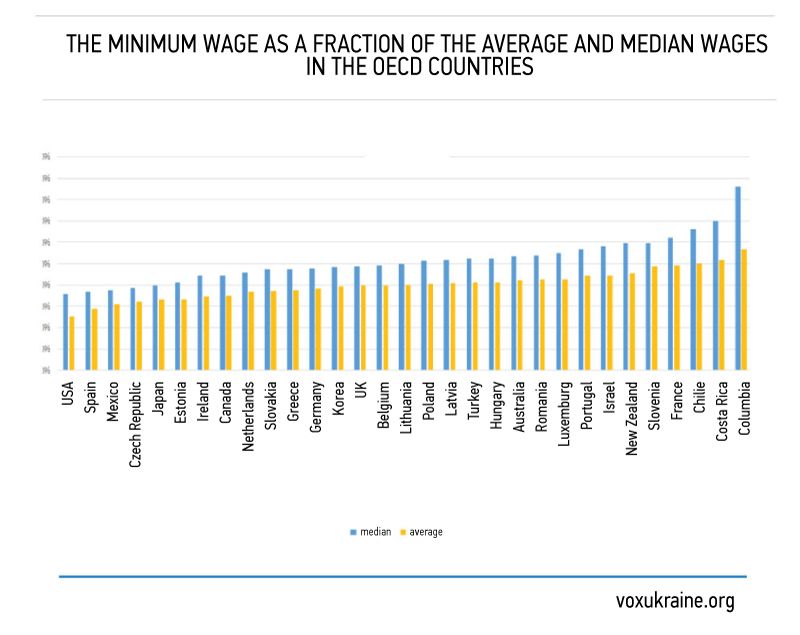

It is also interesting to look at the ratio between the minimum wage and the average and median wages. Economists often prefer to consider the median, not the average wage, because the median wage is seen as more representative. The median wage is the boundary between what the highest 50% of earners are paid and what the lowest 50% of earners are paid. For instance, if we have five employees with wages 1, 2, 3, 4, 10, the average wage is equal to 4, while the median wage equals 3.

For the OECD countries, in 2015, the ratio of the minimum wage to the median wage ranged from 35.8% (USA) to 85.9% (Columbia). In Ukraine, as of mid-2016, this ratio was equal to about 39%, while the ratio of the minimum wage to the average wage was equal to 30%. Therefore, Ukraine had one of the lowest minimum wages.

As the Figure 1 shows, the USA has the lowest relative minimum wage among those developed countries that have a minimum wage. However, some US states set a higher minimum wage than the federal government does. Moreover, cities and counties can set their own minimum wages. Currently, the federal minimum wage equals $7.25. Columbia District has the highest minimum wage – $11.50, while a number of states approved a gradual raise up to $15 by 2021-2023.

Theory

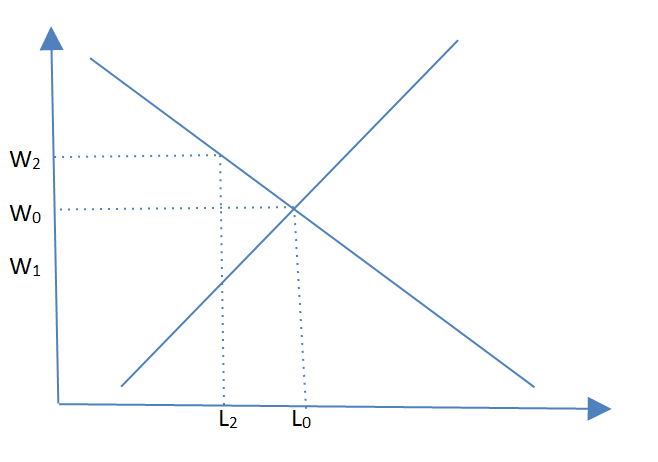

According to the basic theory, raising the minimum wage has a negative impact on employment. Let us suppose that labor is a good just like any other. Let us then consider a partial equilibrium model in competitive market (i. e. there are many buyers and sellers). The demand curve is downward. The more expensive labor becomes, the fewer employers can afford to buy it. The supply curve is upward. The higher the wage, the more people are ready to work. The equilibrium occurs when wage is equal to w0 and labor is equal to L0. If the minimum wage is lower than the equilibrium level, no changes in the equilibrium level w1 occur. If the minimum wage is higher than the equilibrium – w2, employment falls down to L2.

Figure 2. The basic model of the relation between the minimum wage and employment

However, complications arise when one tries to test this model in practice. For example, we assume that no other changes occur, that is why we can establish a clear connection between the changes in wage and employment. In practice, other factors can influence both indicators, e.g. a shift in external demand, changes in technology, changes in tastes, alternative sources of income etc.

Interesting Facts

Are there any empirical findings that support this theory? Yes. For instance, a study analyzed the changes in the structure of employment in the South of the USA (a depressed region with low wages) after the federal minimum wage was introduced in 1938. In order to obtain clearer results, the data were taken from two industries that used low-skilled labor, the seamless hosiery and lumber industries. It turned out that the introduction of the minimum wage led to a fall in employment in the production of socks in the south (and to a rise in the north), especially at those firms that paid lower than the minimum wage. In addition, a more active mechanization of the production occurred (the replacement of labor with capital), and imports of the hosiery increased as well. In lumber, employment hardly changed, which can be linked to the increased demand from the military industry at that time. At the same time, the output grew much higher in the north, where wages were higher than the minimum, than in the south, where most wages were either equal to or lower than the minimum wage.

This theory serves as the basis for other theories that can be built by adding or relaxing some assumptions. For instance, alternative employment opportunities may be considered, where no legislative limits on wages are valid. This concerns the informal sector of the economy, the self-employed, those who get the main part of their income as tips etc. If wages increase in the formal sector, some of the newly unemployed can find work in the alternative sector, which will lower wages for all those who are employed there. Instead of raising income for all those employees who get lower than the minimum wages, this decision helps one group and hurts another. This prediction was tested in a number of developing countries that usually have a much larger informal sector than developed countries. While some studies supported the theory, other studies detected the reverse outcome, namely the rise of wages in the informal sector after the minimum wage was introduced. The latter is usually explained by “the lighthouse effect”. If the minimum wage is known, it helps workers in the informal sectors to determine what wage to demand.

Another proposed modification is not to view the labor market as perfectly competitive. This idea gained popularity at the end of 20th century (though it is based on the after-war articles by Stigler (1946) and Lester (1947). The number of employers is usually much lower than the number of available employees. The fast-food industry and teenage workers is a classic example, sometimes referred to as Mcjob (derived from “McDonalds” and “job”). Perfect monopoly or, in this case, monopsony is the antipode of the perfect competition. Technical details can be found in the aforementioned articles. The main idea is that while the monopoly maximizes profits by selling less goods at a higher price than under perfect competition, monopsony buys goods (labor in this case) at a lower price than the competitive conditions would allow. In this case, the introduction of the minimum wage would actually increase employment (within a certain range. A very high wage increase decreases employment even in the monopsony market).

Perfect monopsony markets with one employer hardly exist. However, this variant of the model can be closer to reality than the perfect competition model, if there is a direct or hidden collusion among employers, high job search expenses, problems with creating new jobs etc.

This model was used in the recent attempt to push through a significant increase of the minimum wage in the USA. In 2014, more than 600 economists, including several Nobel Prize laureates, signed the letter in support of lifting the federal minimum wage in the USA up to $10.1. Here is a short video-interview with Paul Krugman on the subject.

In contrast to Groysman’s initiative, this raise was expected to occur gradually over a couple of years. Afer to increase to $10.1, the minimum wage would increase annually at the inflation rate. However, Republicans hold the majority in both the Senate and the Congress. This party traditionally opposes any limits on business as well as the policies suggested by the Democratic president, who supported this idea. Therefore, the federal minimum wage was left intact.

Others point out that the basic model is a partial equilibrium model. This means that it considers only one market in isolation without looking at how changes in this market are going to influence the rest of the economy. The alternative approach stresses that labor is unlike any other good. It is used in all spheres of creating added value. Therefore, any decision on how much and at what wage to work helps determine the total output that this very wage is used to buy. Therefore, much more complicated models of the general equilibrium should be used to analyze the labor market. Opponents of this approach note that the share of the labor market that is influenced by the minimum wage is too small in order to have any significant effect on the economy.

Uncertain Conclusions

The debate on the minimum wage concept has been going on quite for some time. Currently, most countries have a national minimum wage or alternative ways of determining it.

Relative minimum wage (as a share of the average or median wage) varies greatly across countries. In Ukraine, it is one of the lowest in comparison to the OECD countries.

The basic theory foresees a decrease in employment after the minimum wage is introduced if it is higher than the market equilibrium level. However, if some assumptions are relaxed, some models predict that the minimum wage will have no impact on employment or can even increase it.

Empirical studies provide contradictory results on the impact of the minimum wage on employment.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations