Both national and international sources have talked about an allegedly massive increase of labour migration of Ukrainian citizens to Poland and other EU countries. After the political upheaval and the economic crisis since 2014, major changes in migration and migration patterns of Ukrainians indeed appear likely. However, the debate so far has often been driven by assertions and anecdotes rather than facts and analysis. Based on recent research of the German Advisory Group Ukraine, we provide a facts-based analysis of recent developments in labour migration of Ukrainians as well as their causes and effects.

The following piece is based on Policy Study 02/2019 “Labour migration from Ukraine: Changing destinations, growing macroeconomic impact“ of the German Advisory Group Ukraine.

Drawing on our recent research, we first present findings about recent developments in labour migration from Ukraine, concentrating on whether a substantial and ongoing increase in labour (e)migration is under way and whether migrant destinations have shifted from East to West. We then look at the risks and benefits of these developments for Ukraine before giving an outlook of the likely future developments in labour migration and implications for policymakers.

An overall increase of labour migration

In order to estimate a total figure for the stock of Ukrainian labour migrants, we draw on two statistical sources as no single statistical method can cover all migrants: The special modules on migration for 2012 and 2017 of the Ukrainian Labour Force Survey (LFS) cover those migrants that are still members of a household in Ukraine – hence, mainly temporary migration (regular and irregular). By contrast, administrative data from partner countries, especially as harmonized by Eurostat, relate to all Ukrainian citizens officially present, but exclude irregular migrants.

Table 1. Ukrainian migrants’ destinations by data source, thousands

| Labour Force Survey | Partner country data** | |||

| 2012 | 2017 | 2012 | 2017 | |

| Former Soviet Union | ||||

| Belarus | 21 | 22 | n.a. | n.a. |

| Kazakhstan | n.a. | n.a. | n.a. | n.a. |

| Russian Federation | 510 | 343 | n.a. | 346** |

| EU member states | ||||

| Czech Republic | 152 | 123 | 103 | 116 |

| Germany | 28 | 10 | 112 | 118 |

| Italy | 156 | 147 | 225 | 235 |

| Poland | 169 | 507 | 122 | 451 |

| Portugal | 21 | 21 | 44 | 32 |

| Spain | 53 | n.a. | 78 | 89 |

| Total EU (Eurostat) | 779 | 1.177 | ||

| Other | ||||

| Israel | n.a. | 14 | n.a. | n.a. |

| United States | n.a. | 23 | n.a. | n.a. |

| Countries not listed* | 70 | 93 | ||

| TOTAL | 1.182 | 1.303 | ||

*Difference between totals and countries listed; Labour Force Survey data include US, Israel in 2012; Spain in 2017

** All EU data from Eurostat, RUS data from Rosstat

Source: World Bank; Ukrstat, LFS 2012 and 2017; Eurostat; Rosstat

We arrive at our estimate for 2017 by taking partner country data as the starting point and adding approximately one third of LFS migrants to account for irregular temporary migrants. Our estimate for 2012 is done in the same way. For Russia, where no administrative data about registered Ukrainian migrants in 2012 exists, we assume that the reduction in the number of labour migrants in Russia in the LFS data applies to the administrative data for Russia as well.

On this basis, we estimate the total extent of labour migration from Ukraine as follows:

- 2012: At least 1.6 m people

- 2017: At least 2 m people.

These estimates are conservative and hence a lower bound. They count the average number of labour migrants during these years, not the total number of people involved in labour migration, which will be higher as many individuals only spend a part of the year abroad for temporary or seasonal work.

Our figures confirm an increase of labour migration between 2012 and 2017, although perhaps less drastic than that suggested by some commentators or articles. Nevertheless, the estimate for 2017 implies a substantial migration prevalence of 7% (labour migrants divided by the working-age population of Ukraine). Our estimates are also broadly compatible with recent research by the CES, which estimated the corresponding average number of labour migrants during 2017 at 2.6 m people.

Shift from East to West

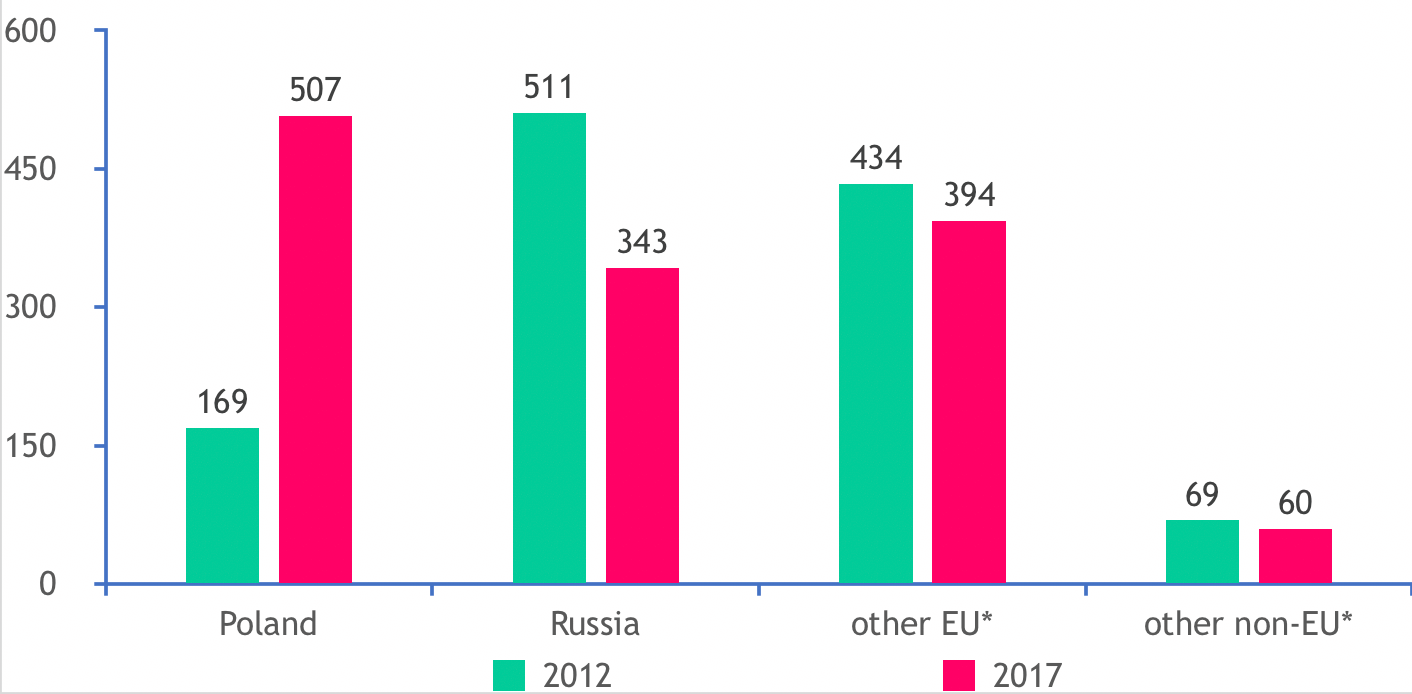

An East-West shift among the destination countries of Ukrainian labour migrants has occurred: Between the last available waves of the LFS migration module (the best single data source) in 2012 and 2017, migration to Russia declined by at least one third, whereas the number of migrants in Poland tripled to half a million. With large numbers of Ukrainian migrants also in Italy and the Czech Republic, the EU is now by far the largest region of destination for migrants from Ukraine. 3 out of 4 Ukrainian labour migrants in 2017 were now working in EU countries.

Fig. 1 Distribution of migrants among destinations, thousand

*Finland is included in non-EU in 2012, but in EU in 2017 (approx. 13 thsd.). Source: Ukrstat, LFS 2012 & 2017

Recent research from Poland helps to identify trends in labour migration after 2017. A 2019 paper by economists at the National Bank of Poland indicates that an additional 200,000 Ukrainian labour migrants per year arrived in Poland in 2017 and 2018 (again, these estimates refer to the average number of migrants present in Poland over the year on a full-time-equivalent basis, not the number of individuals involved in migration movements which is probably higher). We expect that a majority of these people did not have prior migration experience and have not relocated from another destination country. Overall, this is consistent with the general perception that total labour migration from Ukraine has been rising continuously and strongly in the past years. There is evidence that interest in labour migration from Ukraine slowed down in 2019, but it is unclear whether this translates into an overall slowdown of migration – perhaps due to a reduction of wage differentials – or reflects transient phenomena during an election year.

Migrants are mainly from the West of Ukraine, male and overqualified for their jobs

A more detailed analysis of the characteristics of migrants reveals some clear trends:

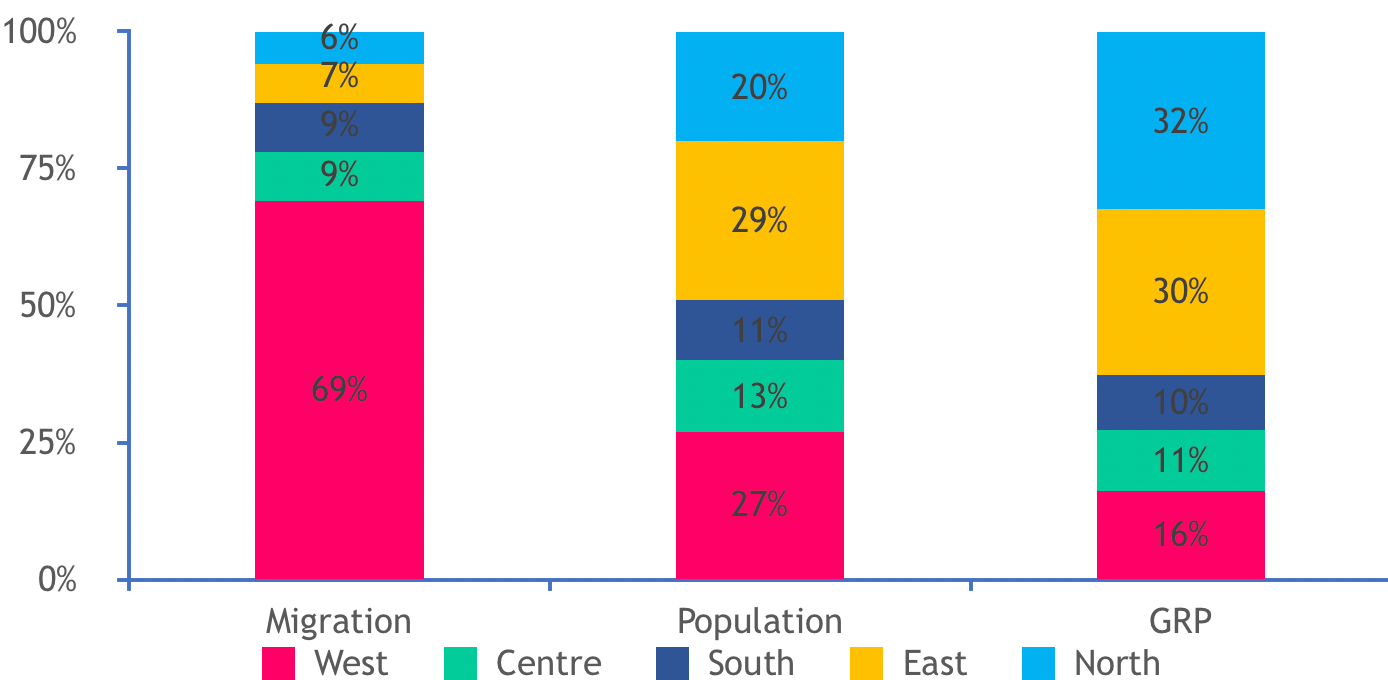

Fig. 2: Migrants, population, and gross regional product (GRP) by economic region

Source: Ukrstat, LFS 2017

Note: GRP denotes Gross Regional Product

- Migrants are overwhelmingly from the rural West of Ukraine: 69% of labour migrants in the 2017 migration module of the Labour Force Survey were from the West of Ukraine, although this region only is home to 27% of the population of the country. The much larger migration propensity in this region is not a new phenomenon. The West remains a relatively poor region, producing only 16% of the GDP of Ukraine.

- Labour migrants are mainly male: 70% of labour migrants in 2017 were male. Within the destination countries, the one major exception from this trend is Italy, where 71% of labour migrants are female, probably mostly providing care services in Italian families, whereas manual work in agriculture, construction and industry predominates in Russia and Poland.

- Younger persons and persons from rural areas are overrepresented among labour migrants: 41% of labour migrants are under 35 years of age, compared to 34% in the general population. This is even more pronounced in Poland, where 47% of Ukrainian labour migrants are under 35. Furthermore, Ukrainian migrants are almost equally likely to come from urban or rural areas. As less than one third of Ukrainians live in rural areas, the migration prevalence there is twice as high as in urban areas

- Persons with higher education are less likely to migrate, whereas vocational education backgrounds are overrepresented among labour migrants: the share of migrants with higher education is lower (33%) than among the working-age population (45%). Conversely, individuals with vocational training make up 34% of migrants (46% in Poland) but only 24% of the working-age population. This may help explain anecdotal evidence of firms in labour-intensive light industries recently reporting growing labour shortages.

- Migrants are at risk from de-skilling: More than half of migrants in EU countries such as Poland or Italy are working in elementary occupations, much more than in Russia or at home. However, 67% of labour migrants have a vocational or higher education. 46% of migrants in Poland and 56% in Italy, but only 21% in Russia migrants report in the 2017 LFS that they are overqualified for their jobs. Apparently, the wage differential with Western Europe is large enough to make migration worthwhile even if the jobs are substantially below migrants’ qualifications.

Risks and benefits for Ukraine

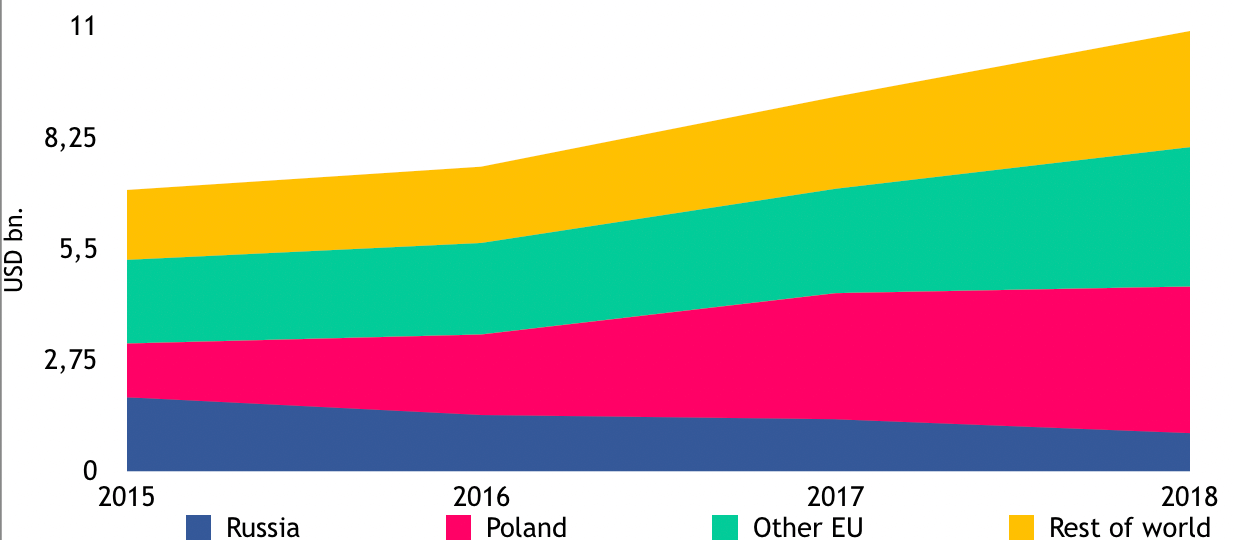

Labour migration clearly has had positive effects on Ukraine: Remittance have been rising in monetary terms from USD 7 bn per year in 2015 to USD 10 bn in 2018, around 8% of GDP. At this magnitude, remittances are a significant contribution to household incomes (and hence domestic demand) and to limiting the current account deficit.

Fig.3: Net personal remittances by source countries, Ukraine, 2015-2018

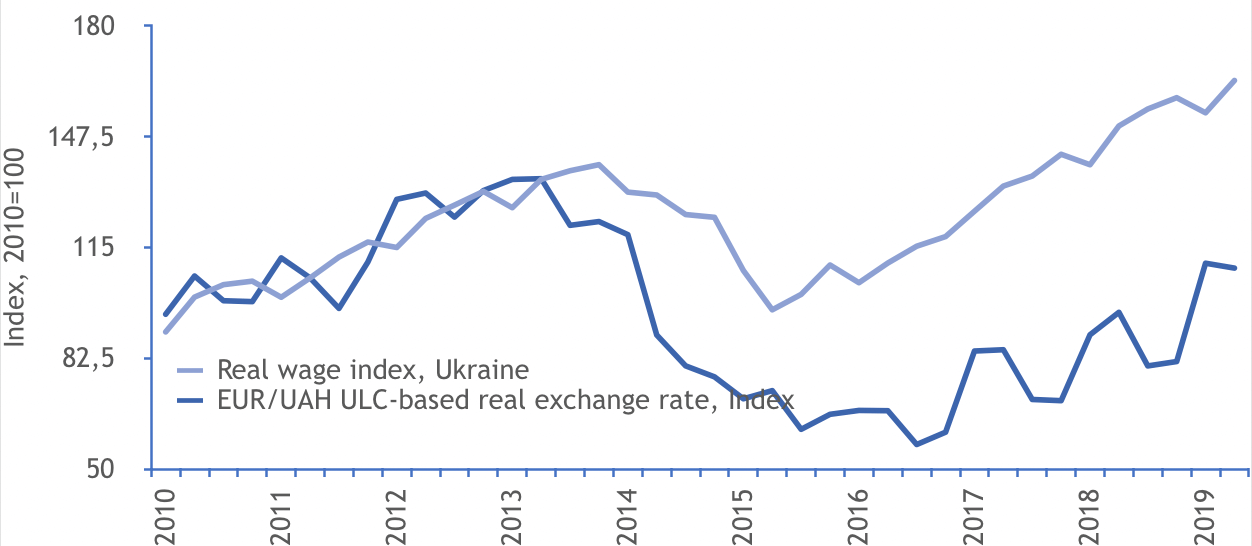

Furthermore, labour migration appears to have supported the recovery of real wages in Ukraine through the channels of labour supply and domestic demand/labour demand. Real wages in Ukraine have been on an upward trajectory since 2015 and are now clearly above the level in 2013. Such an increase of wages is of course good for workers, especially in Ukraine, which currently has one of the lowest GDP per capita in Europe (second to Moldova in PPP terms).

Figure 4: Real wages and real exchange rate based on unit labour cost, 2010-2018

Source: Ukrstat, LFS 2017, Eurostat, own calculations

Note: Real wage index is based on wages in UAH deflated by CPI. ULC based EUR/UAH exchange rate index is based on the ratio of Ukrainian (UAH) to Eurozone (EUR) unit labour cost (ULC) multiplied with EUR/UAH exchange rate

However, the sharp increase in wages, coupled with reports from individual companies about wage increases or difficulties in finding workers, has sparked concerns: Has labour migration led to a loss of competitiveness of Ukraine due to rising wages and the upward pressure on the exchange rate through remittances? Has labour migration led to Ukraine suffering from “Dutch disease”?

At present, this is not the case: The real exchange rate based on Unit Labour Cost, which measures the relative labour costs in Ukraine in comparison to the Eurozone, has only recovered to its 2010 level so far. Employment in Ukraine has also been rising lately in line with GDP growth. This shows that no general problem exists with competitiveness. Of course, companies seeking to employ people at the bottom end of the wage distribution in migration-prone regions (e.g. near the Polish border) may indeed struggle to find employees if working abroad offers significantly higher incomes. But overall, Ukraine has not become uncompetitive.

The effects of migration on Ukraine have so far been positive, but if a significant net outflow of migrants persists, Ukraine will eventually experience negative effects. As the labour force would shrink and real wages grow faster than labour productivity, rising labour costs and low availability of workers would eventually deter investment. Furthermore, financing national expenditures such as pensions and infrastructure would become difficult in the long run if more and more Ukrainians work and pay taxes abroad rather than at home. For a country that has an ageing population (increasing median age due to increasing life expectancy and low fertility), sustained net emigration of working-age people will create problems in the long run.

Outlook: Migration may slow down, but will probably continue

An important question is hence whether labour migration is likely to continue as a net outflow of workers from Ukraine. This depends, first, on how wages and living conditions differ between Ukraine and possible destination countries and, second, on how open these countries are towards Ukrainian workers.

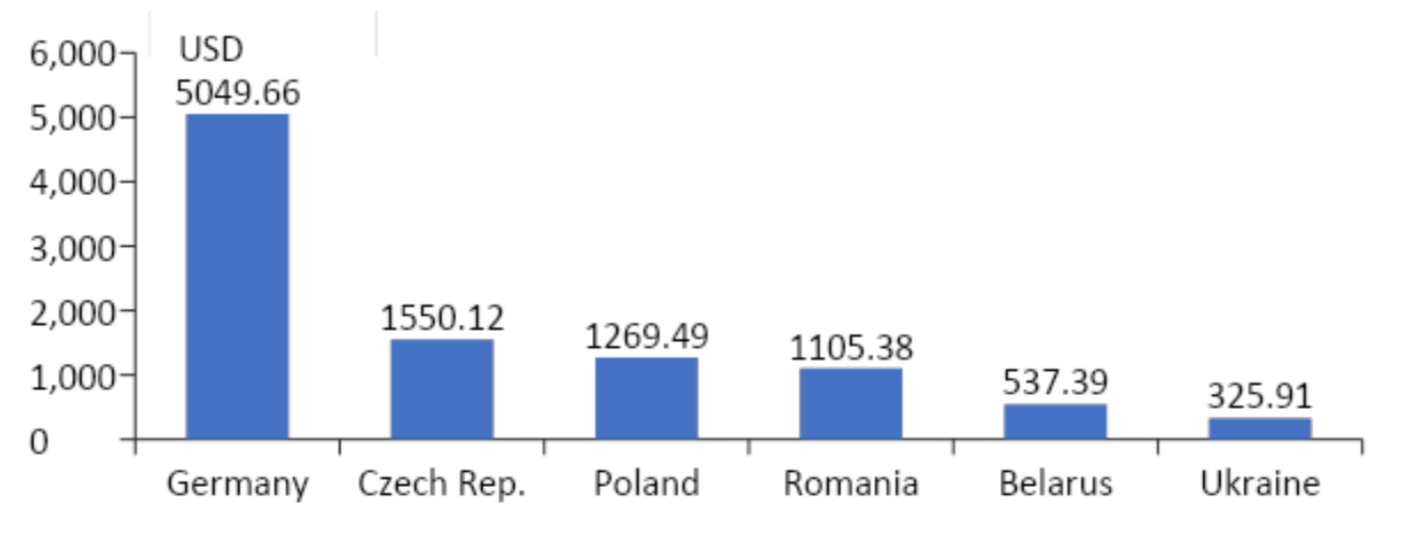

Fig. 5 Average monthly wages in USD, 2018

Wage differentials between Ukraine and other European countries remain large. Although average monthly wages in Ukraine have recovered substantially from USD 192 in 2015, their lowest point during the economic crisis, to USD 326 in 2018, this is only about a quarter of average wages in current destination countries such as Poland or the Czech Republic and less than one tenth of wages in western or northern EU countries. Even considering the significance of informal wages in Ukraine, lower costs of living and future growth, wage differentials are likely to remain an incentive for migration for years to come.

On top of this, the openness of EU countries to labour migrants from Ukraine may increase further. Due to demographic change and their ageing populations, many countries including the old member states such as Germany or France will increasingly face shortages of workers and may adjust their immigration policies accordingly.

Therefore, labour migration from Ukraine is likely to persist, although the annual outflow may become smaller. The imminent pressure of the economic crisis that started in 2014 and has unquestionably created hardship for many people is no longer present. But differentials persist in wages and living conditions whilst networks of Ukrainians abroad and increasing demographic pressures in Ukraine’s neighbours to the West will make labour migration easier in coming years.

Implications for Ukraine

Labour migration will be an important factor for Ukraine in years to come. Although its effects so far have been mainly beneficial for migrants, their families, and the Ukrainian economy as a whole, this may change in the long run if emigration begins to hurt cost competitiveness, the investment climate, and public finances in Ukraine. But the policy implications are not trivial: Clearly, no government can (or should even attempt to) prevent its citizens from moving abroad freely. What then should the government do with regard to migration?

In our view, the answer is threefold:

- More and more frequent statistical data is necessary to have up-to-date and comprehensive information on this important issue. This may include questions on migration experiences of past and present household members in the forthcoming census, annual LFS modules on migration (currently implemented only every five years), and questions on the migration status of household members in the regular LFS.

- Migration should be mainstreamed into the strategic policy planning of Ukraine. As no short-run fix is available or desirable to stop the current outflow, Ukraine should attempt to adapt to net emigration and to harness its benefits whilst mitigating its negative effects. This may include policies to reduce regional divergence, assisting Ukrainian abroad through consular and employment services and legal advice, introducing Diaspora policies to encourage the involvement of Ukrainians abroad in the economy and society at home, equipping students with the right skills for work in Ukraine as well as abroad and encouraging the use of formal transfer channels for remittances (and the associated financial development) by lowering the cost of sending remittances from the EU to Ukraine through official channels.

- Above all, economic growth and a positive economic perspective for Ukraine are necessary in order to induce people to stay and invest in a future in Ukraine. By implementing comprehensive economic reforms now, Ukraine has the opportunity to create favourable conditions for economic growth and social development that will improve people’s expectations for their lives in Ukraine compared to potential countries of destination.

Whether labour migration will remain a positive factor for Ukraine and Ukrainians or whether it turns into a negative spiral of depopulation and slowing growth depends on the success of comprehensive policy reforms that need to be implemented as soon as possible. Along with the macroeconomic stabilisation of Ukraine, which is a prerequisite for economic growth, there are now encouraging signs that the government of Ukraine has understood this challenge. Before any verdict on the success of current reform can be reached, labour migration will remain important for Ukraine in the medium term – for individual citizens, for policy makers, and for the economy as a whole.

Attention

The author doesn`t work for, consult to, own shares in or receive funding from any company or organization that would benefit from this article, and have no relevant affiliations